TIDMGEMD

RNS Number : 6013H

Gem Diamonds Limited

17 March 2015

17 March 2015

GEM DIAMONDS FULL YEAR 2014 RESULTS

Gem Diamonds Limited (the Company) is pleased to announce its

Full Year results for the period ending 31 December 2014.

During 2014, Gem Diamonds demonstrated a strong operational

performance, delivering on a number of strategic objectives,

resulting in a robust financial position and maiden dividend. The

Company continued to focus on enhancing operational efficiencies

and investing in innovative technologies at both Letšeng and

Ghaghoo, delivering improved earnings and positioning Gem Diamonds

for long term sustainable growth.

FINANCIAL RESULTS

-- Revenue US$271 million, up 27 %

-- Underlying EBITDA US$104 million, up 35 %

-- Attributable net profit US$33 million, up 57 %

-- Basic EPS 24 US cents, up 57 %

-- Cash on hand US$111 million as at 31 December 2014 (net after

debt); (US$99.4 million attributable to Gem Diamonds)

OPERATIONAL HIGHLIGHTS

LET ENG:

-- Carats recovered of 108 569

-- Average of US$2 540 per carat

-- Tonnes treated of 6.4 million

-- Waste tonnes moved of 19.8 million

GHAGHOO:

-- The Phase 1 capital project has been completed on time and on budget

-- Final commissioning and optimisation of the plant is in progress

-- A total of 10 167 carats recovered during commissioning,

(including a 20 carat white diamond, a 17 carat white diamond and a

three carat orange diamond)

DIVIDEND

-- 5 US cents per share

-- Total dividend of US$6.9 million

-- Record date: 8 May 2015

-- Payment date: 9 June 2015

Commenting on the results today, Clifford Elphick, Chief

Executive Officer of Gem Diamonds, said:

"2014 was a solid year both financially and operationally for

Gem Diamonds. We successfully delivered on a number of key growth

objectives including bringing Ghaghoo into production,

significantly enhancing operational efficiencies at Letšeng and

delivering a maiden dividend. With a continued focus on cost

control, the Company is in a very strong position financially with

cash balance of US$111 million, supported by the high average price

per carat of US$2 540 achieved for the year. As we expand from a

single producing mine to two producing mines, with the ramp up of

production at Ghaghoo, we will start to see a significant shift in

production figures.

Whilst there have been a number of challenges in the diamond

market recently, the medium to long term fundamentals look

positive. This, combined with the resilience of Letšeng diamonds to

pricing constraints, leaves Gem Diamonds well placed to take

advantage of the favourable supply/demand dynamics in the market in

order to continue its growth in 2015 and beyond".

The Company will be hosting a webcast presentation on its full

year results at 9.30am today. A copy of the full Annual Report 2014

and a live audio webcast of the presentation will be available on

the Company's website: www.gemdiamonds.com

For further information:

Gem Diamonds Limited

Sherryn Tedder, Investor Relations

Tel: +44 (0) 20 3043 0280

Bell Pottinger

Daniel Thole / Joanna Boon

Tel :+44 (0) 20 3772 2500

ABOUT GEM DIAMONDS

Gem Diamonds is a leading global diamond producer of high value

diamonds. The company owns 70% of the Letšeng mine in Lesotho and

100% of the Ghaghoo mine in Botswana. The Letšeng mine is famous

for the production of large, top colour, exceptional white

diamonds, making it the highest dollar per carat kimberlite diamond

mine in the world. Since Gem Diamonds' acquisition of Letšeng in

2006, the mine has produced four of the twenty largest white gem

quality diamonds ever recorded.

Gem Diamonds has a growth strategy based on the expansion of the

Letšeng mine and bringing the Ghaghoo mine into production, while

maintaining its strong balance sheet. The Company seeks to maximise

revenue and margin from its rough diamond production by pursuing

cutting, polishing and sales and marketing initiatives further

along the diamond value chain. With favourable supply/demand

dynamics expected to benefit the industry over the medium to long

term, particularly at the high end of the market supplied by Gem

Diamonds, this strategy positions the Company well to generate

attractive returns for shareholders in the coming years.

Chairman's statement

2014 was characterised by the delivery of a robust financial

performance and the recommendation of our first dividend. The focus

on maximising the revenue from our core assets through enhancing

operating efficiencies and investing in innovative technologies has

delivered improved earnings and has positioned Gem Diamonds for

sustainable growth.

Our investment proposition

-- Diamond market fundamentals

-- Strategic and structural clarity

-- Dividend paying policy

-- Letšeng: value enhancing opportunities

-- Ghaghoo: near term asset valuation upside

-- Robust corporate governance

Dear shareholder,

It gives me great pleasure to present Gem Diamonds' 2014 Annual

Report.

Strategic review

In 2011, Gem Diamonds mapped out a clear strategy built on three

pillars, namely value creation, growth and sustainability. This

broad-based approach has allowed the Group to adapt to short-term

opportunities and challenges while moving towards its long-term

goal of sustainable shareholder returns. During 2014, the Group

made great strides in achieving its stated objectives:

Maintaining a robust financial position and cash flows

The continued enhancement of the Group's cash position and

balance sheet strength allows it to react proactively to market and

operational conditions in order to meet its medium and longer-term

objectives.

Group revenue rose by 27% over the prior year, with cash on hand

at the end of the year of US$110.7 million. The Group achieved a

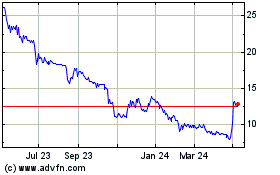

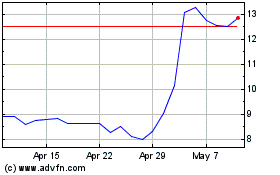

total shareholder return of 23% in 2014.

Dividend

Based on the positive results achieved since the implementation

of the above strategy, the Board is pleased to recommend maiden

cash dividend of 5 US cents per share. The Board has adopted a

policy that will determine the appropriate dividend each year based

on consideration of the Company's cash resources, the level of free

cash flow and earnings generated during the year, and the expected

funding commitments for capital projects relating to our growth

strategy and will aim to pay a total dividend at an approximately

consistent proportion of sustaining net earnings. Dividends are

expected to be declared by the Board annually with the full-year

results. This policy demonstrates our commitment to returning value

to shareholders.

Improving the revenue line at Letšeng through innovation

The Letšeng mine in Lesotho is synonymous with exceptional

diamonds. It is, therefore, imperative that the Group continually

invests in innovative ways of identifying, recovering and

preserving these high-value diamonds. During 2014, the mine

continued to reap the benefits of the technological investments

made in the previous years. In addition, further focused projects,

including the installation of the new Coarse Recovery Plant, which

will further improve diamond recovery, and the Plant 2 Phase 1

upgrade, which will increase throughput, reduce breakage and

improve diamond liberation, are set to advance Gem Diamonds'

strategic objective of increasing revenues at Letšeng. These

projects represent relatively low capital investments in keeping

with the Group's focus of maintaining capital discipline in all of

its operations.

While the political unrest that occurred in Lesotho during 2014

posed a possible challenge, the mine, situated four hours from the

capital, Maseru, remained unaffected. The state of affairs in the

country has since stabilised, with elections having taken place on

28 February 2015 under the watchful eye of the South African

Development Community (SADC) representatives headed by South

Africa's Deputy President, Cyril Ramaphosa.

Bringing the Ghaghoo mine into production

Gem Diamonds' technical skills have come to the fore in the

development of the Ghaghoo mine in Botswana, delivering the capital

project on time and within budget. It is also pleasing to report

that the first diamonds produced during commissioning have been of

a better quality and average size than those recovered during the

exploration phase. It has also been noteworthy that the presence of

rare coloured diamonds in the resource has been confirmed.

The mine development showcases Gem Diamonds' commitment to best

practice in relation to its project affected communities and the

environment. The communities affected by the Ghaghoo mine have been

involved and consulted from the outset with the aim of achieving

broader stakeholder value. In addition, numerous ecological and

archaeological surveys; visual and socio-economic impact

assessments; as well as an extensive public participation process

have been conducted. Information gathered during this process

underpinned the Group's approach to minimising Ghaghoo's ecological

footprint and maximising the benefit for all stakeholders. A

Ghaghoo Community Trust has been established and local community

representatives sit in Trust meetings. The Trust has made a number

of material interventions in community projects, long before the

first diamond was sold and will continue to do so as the mine

enters the next phase of development.

Continued excellence in sales, marketing and manufacturing

initiatives

Positioned at the very top end of the diamond market, Gem

Diamonds' Letšeng mine consistently produces some of the world's

most remarkable diamonds, making it the highest average dollar per

carat kimberlite diamond producer in the world and achieved an

average of US$2 540* per carat in 2014. Letšeng's tenders attract

the world's top diamantaires who continue to pay the highest prices

for these exceptional diamonds, allowing Letšeng's rough production

to remain relatively resilient to market fluctuations.

Of note, during the year Letšeng recovered its highest number of

diamonds greater than 20 carats in a single year, since acquisition

in 2006. This included seven +100 carat diamonds, five of which

together achieved a total of US$37.4 million The largest diamond

recovered during the year, a 299.3 carat yellow diamond, was sold

into a partnership arrangement at the beginning of 2015, which will

see Letšeng further benefiting from 50% of the resulting polished

uplift.

Committed to the highest health and safety standards

Safeguarding the well-being of employees is both a moral and

business imperative. Despite a strong overall safety performance

during the year, the loss of life of one of our employees, Mr

Segolame Mashumba, in January 2014, is a tragedy that has sharpened

our focus on safeguarding the health and safety of our employees.

On behalf of the Board and the Group, we once again send our

heartfelt condolences to the family. I wish to reaffirm the Group's

commitment to eliminating fatalities at work and reducing

incidences of injury in line with our all-encompassing goal of

achieving zero harm.

Gem Diamonds is deeply aware of its responsibility towards the

areas in which it operates, both in terms of environmental

stewardship and socio-economic development. The Group recognises

that its long-term viability is closely linked to the success and

well-being of the communities in which it operates and strives to

contribute positively to these communities. A comprehensive

sustainable development programme is in place at each operation,

supported in terms of strategic guidance by the HSSE Committee, at

Board level. (Refer to the full 2014 Sustainable Development Report

on the Gem Diamonds website.)

Corporate governance

The Group's commitment to robust corporate governance supports

its ability to create sustainable returns for all stakeholders.

During September 2014, the UK Corporate Governance Code was

amended. The Board agrees with and supports the Code, and the Gem

Diamonds' governance framework was amended accordingly. The Group

is thus well positioned to introduce the necessary changes as

required.

During the year, the Group's Board of Directors submitted

themselves to a Board evaluation process aimed at enhancing Board

governance. I am pleased to report that no major issues were

identified and the feedback received will be incorporated into the

Group's governance framework.

After eight years of service as Company Secretary, André

Confavreux retired at age 70 on 11 January 2015. The Board would

like to express its appreciation to André for his significant

contribution to the Group over the years. Following André's

retirement, Glenn Turner has added the role of Company Secretary to

his current duties as Executive Director.

Outlook

The long-term outlook for the diamond market remains strong.

Despite a weakening of prices in the fourth quarter of 2014, partly

due to concerns over bank lending and liquidity, the Group expects

some firming in the market as banks in Dubai and elsewhere take

steps to fill the funding gap that triggered these concerns. The

medium to long-term outlook for diamond demand, therefore, is

expected to remain favourable, with diamond prices beginning to

trend upward in the second half of 2015.

The strategic focus for the year ahead will remain on creating

value by focusing on mining and selling diamonds efficiently and

responsibly. We remain confident in our ability to continue

delivering returns to our shareholders through this focused

execution of strategy as is demonstrated by the Group's dividend

policy.

The 2014 results are a testimony to the calibre of people

employed at Gem Diamonds and I would like to thank my fellow Board

members for their wisdom and contribution during the year. On

behalf of the Board, I would like to thank our employees for their

tireless efforts and commitment to Gem Diamonds as well as our

shareholders for their support as we continue to deliver on our

strategy and build long-term value.

Roger Davis

Non-Executive Chairman

16 March 2015

Chief executive officer's overview

Letšeng continues to drive strong operational performance and

exceptional financial results during 2014. Prices of both rough and

polished diamonds firmed over the first three quarters before

declining moderately in the final quarter. Despite this softer

trend, the final Letšeng tender of 2014 saw very strong prices

achieved and demonstrates the Group's commitment to implementing

the strategy adopted in 2011 to create sustainable growth and

production despite the market conditions. As our second mine,

Ghaghoo, ramps up, we look forward to the contribution Botswana's

first underground diamond mine will make.

2014 achievements

-- Maintained robust financial position and cash flows

-- Operations expanded from a single producing mine to two

-- Maiden dividend

-- Improved Letšeng revenue line and plant optimisation

-- Completed Ghaghoo capital project on time and on budget

-- Continued excellence in sales, marketing and manufacturing initiatives

Operational performance

Letšeng

At Letšeng, a year of solid operational performance saw an

improvement over the prior year's production results, with costs

well controlled. Plant enhancements and improved blasting

techniques, as well as greater access to ore from the higher grade,

higher value Satellite orebody over the prior year, resulted in an

improvement in the grade, size and quality of the diamonds

produced.

During the year, Letšeng issued a revised resource statement to

reflect a significant increase in the Letšeng indicated resource

category which had been extended in depth to approximately 350

metres below the current mine pits on both Satellite and Main pipe

orebodies. This extension has resulted in a significant increase in

the indicated resource tonnage and contained carats but has also

allowed for a significant increase in the Letšeng probable

reserves, with the entire 22 year life of mine plan now classified

as reserve.

The growth focus at the Letšeng mine during 2014 remained on

relatively low capex expansion projects with near-term returns. Two

such projects were advanced significantly during the year:

The new Coarse Recovery Plant remains on track for completion at

the end of the second quarter of 2015. This plant will optimise the

treatment of the high-value, coarse fraction of ore using X-ray

transmissive (XRT) technology that will improve the recovery of the

high-value Type II diamonds. Significant improvements to security

measures and advanced diamond accounting processes will also result

from the construction of the new Coarse Recovery Plant.

Implementation of the Plant 2 Phase 1 upgrade project commenced

in the third quarter of 2014 and is on track to be completed in

early 2015. The project is expected to result in an increased

treatment capacity of 250 000 tonnes per annum and further reduce

diamond damage and improve diamond liberation. Subsequent upgrades

to the plant will be considered once the current projects are

completed, and plant performance has been fully evaluated.

The operational improvements undertaken this year, together with

the projects that are currently under way and those considered for

the future, position Letšeng as a long life open pit operation.

Optimisation of the life of mine plans, which take these

improvements into account, will deliver on the longer-term plan for

Letšeng going forward.

Ghaghoo

As Botswana's first underground diamond mine, the Ghaghoo mine

has showcased Gem Diamonds' ability to add value to existing assets

through technical innovation. By pursuing an underground mining

option, the Group achieved significant cost savings, reduced its

potential environmental impact and has served to pave the way for a

new era of mining in challenging mining conditions (including

deposits covered with significant overburden). This point was

reinforced by the President of Botswana when he officiated the

opening of the Ghaghoo mine in September 2014.

Gem Diamonds is developing Ghaghoo in a phased approach. The

first phase is aimed at confirming diamond grades and prices, as

well as testing different mining and processing techniques. In

subsequent phases, production will be increased as appropriate in a

cost effective manner.

The mine is currently in Phase 1 with the capital project

complete and commissioning progressing well. As at 31 December

2014,

48 023 tonnes of ore had been treated, with 10 167 carats

recovered, including a 20 carat white diamond, a 17 carat white

diamond, and a three carat orange diamond (the recovery of which

confirms the presence of valuable coloured diamonds in the

orebody). After year end, a 35 carat diamond was recovered, which

is the largest diamond recovered at Ghaghoo to date. The first

tender of 10 167 carats was held in February of 2015, following

viewings held in Gaborone and Antwerp and achieved US$210 per

carat. As is usual in the development of the marketing of a new

mine's production, it will take at least six months of tender sales

and the subsequent sale of the polished diamonds by clients, in

order for a reliable average price to emerge. As part of the mine's

Phase 1 plan, a production rate of approximately 60 000 tonnes per

month is expected to be achieved by mid-2015.

During the year, a significant ingress of water was encountered

at Ghaghoo following the intersection of a fissure in the basalt

country rock. This challenge has been overcome through swift and

efficient technical response, allowing the development of the

tunnels to proceed with minimal disruption to mine development.

Sales, marketing and manufacturing

The Group continues to invest in its marketing and manufacturing

operations to ensure the highest returns on its production.

During the year Letšeng recovered seven +100 carat diamonds,

five of these exceptional diamonds (a 197.6 carat, a 162.02 carat,

a 161.31 carat, a 132.55 carat and a 112.6 carat) together achieved

a total sales value of US$37.4 million, representing 14% of

Letšeng's total revenue. The largest diamond recovered in 2014 was

a 299.3 carat yellow diamond, which was extracted and sold into a

partnership arrangement in early 2015, where Letšeng will further

share in 50% of the uplift from the eventual polished sales

value.

For the full year Letšeng sold 108 963 carats (2013: 97 294),

achieving an average price of US$2 540* per carat, up 24% from US$2

043* per carat in the prior year.

Health, safety, social and environment (HSSE)

The sustainability of the Group is strongly dependent on

maintaining its social licence to operate. As a result, the health

and safety of employees and contractors, environmental

responsibility, legal compliance and social relevance remain key

enablers of the Group's continued success.

The Group manages its environmental footprint with great care.

Across all operations there is a continual focus on improving

energy efficiency, reducing direct impact and enhancing

biodiversity. It is pleasing to report that for the sixth

consecutive year no major environmental incidents occurred across

the Group.

Gem Diamonds works in close collaboration with its project

affected communities to ensure that the social projects implemented

make a meaningful contribution to these communities. With the

opening of the Ghaghoo mine, the Group's involvement in the

surrounding community has intensified. The Ghaghoo Community Trust

has been funded as part of the development of the mine and these

funds allocated to support community projects during 2014. In

addition, employment opportunities have been taken up by many in

the project affected communities and the medical facilities on the

mine have been made available to treat emergencies in the

surrounding communities. Moreover, Ghaghoo continues to equip and

maintain the boreholes, which are used by the communities within

the Central Kalahari region.

Outlook

As the Group's operations expand from a single producing mine to

two producing mines, with the ramp up of production at Ghaghoo, the

Group will start seeing a significant shift in production figures

going forward. The Group will continue to focus on improving

operational efficiencies and pursuing innovative technologies.

Taking these steps, I am confident that the Group is well placed to

take advantage of the favourable supply/demand dynamics in the

market in order to produce continued growth in 2015 and beyond.

I wish to express my sincere appreciation to our employees. Your

continued pursuit of excellence has made the success of Gem

Diamonds possible. I would also like to thank the Board for their

guidance during the year, as well as our shareholders for their

continued support.

Clifford Elphick

Chief Executive Officer

16 March 2015

GROUP FINANCIAL PERFORMANCE

Capital and cash management discipline has placed the Group in a

well-funded position to recommend the payment of its maiden

dividend of 5 US cents per share, which enforces its strategy of

delivering additional value to its shareholders.

Financial highlights

-- Revenue of US$271 million - up 27%

-- Underlying EBITDA of US$104 million - up 35%

-- Attributable profit of US$33 million - up 57%

-- Basic EPS of 24 US cents - up 57%

-- Cash on hand of US$111 million

-- Maiden dividend of 5 US cents per share

2014 2013

US$ million US$ million

Total Total

------------------------------------------- ------------ ------------

Revenue 270.9 212.8

Royalties and selling costs (24.7) (18.5)

Cost of sales (129.6) (103.1)

Corporate expenses (12.4) (13.8)

------------------------------------------- ------------ ------------

Underlying EBITDA 104.2 77.4

Depreciation and mining asset amortisation (15.2) (17.3)

Share-based payments (1.7) (0.9)

Other income 0.2 0.7

Foreign exchange gain 5.2 0.6

Finance income/(cost) 0.2 (1.6)

Reversal of impairment of assets - 0.1

------------------------------------------- ------------ ------------

Profit before tax 92.9 59.0

Income tax expense (35.0) (20.8)

------------------------------------------- ------------ ------------

Profit for the year 57.9 38.2

Non-controlling interests (24.7) (17.0)

------------------------------------------- ------------ ------------

Attributable profit for the year 33.2 21.2

Earnings per share (US cents) 24.0 15.3

------------------------------------------- ------------ ------------

Revenue

The Group's revenue is primarily derived from its two business

activities, namely its mining operations at Letšeng and its rough

diamond manufacturing operation in Antwerp. Revenue does not

include any contribution from the mining operation at Ghaghoo, as

the mine had not reached full commercial production during the

year. The first sale of carats recovered during commissioning

concluded after year end. Overall, the Group revenue increased by

27%, driven by 12% higher volume of rough carat sales from Letšeng

and 24% higher diamond prices achieved. Management interventions

initiated during 2013, effective mining plans and favourable

external market conditions for the majority of 2014 have all

resulted in a positive impact on revenue.

Mining operations

The demand for rough diamonds remained strong during 2014, with

high prices achieved for Letšeng's production, particularly the

high-quality, large diamonds for which the mine is renowned. The

benefit of the additional investment in waste stripping in the

Satellite pipe at Letšeng in 2013 was realised in 2014, as

increased volumes of the higher-value, higher-grade Satellite pipe

ore was mined during the year. The Satellite to Main pipe ore ratio

was 31:69 during the year, compared to 16:84 in the prior year. The

increased contribution of the higher-grade Satellite pipe ore,

together with the higher than expected performance of the reserve

grade during the year resulted in Letšeng recovering 108 569

carats, a 14% increase from the prior year.

2014 2013

------------------------------------------------- --------------------- ------

Average price per carat (US$)(1) 2 540 2 043

------------------------------------------------- --------------------- ------

Carats sold(1) 108 963 97 294

------------------------------------------------- --------------------- ------

Group revenue summary (US$ million)

Sales - rough 276.8 198.8

------------------------------------------------- --------------------- ------

Sales - polished margin 5.8 6.3

------------------------------------------------- --------------------- ------

Sales - other 0.4 0.3

------------------------------------------------- --------------------- ------

Impact of movement in own manufactured inventory (12.1) 7.4

------------------------------------------------- --------------------- ------

Group revenue 270.9 212.8

------------------------------------------------- --------------------- ------

(1) Includes carats extracted for polishing at rough valuation.

The combination of increased mining in the higher-value

Satellite pipe, the positive impact of the new crushers installed

during 2013 and favourable market conditions, resulted in a higher

average value obtained for Letšeng's rough diamond exports. US$2

540* per carat was achieved in 2014 from the sale of 108 963

carats, compared to the average price of US$2 043* per carat

achieved in 2013 from 97 294 carats. This resulted in an overall

increase of 39% in Letšeng's rough revenue compared to the prior

year and an EBITDA margin of 46% (2013: 42%).

Diamond manufacturing operation

The diamond manufacturing operation in Antwerp contributed

US$5.8 million to Group revenue (through additional polished margin

generated) and US$3.9 million to EBITDA. During the year, 1 232

carats valued at a rough market value of US$17.2 million were

extracted from the Letšeng exports for manufacturing. In total,

polished diamonds with an initial rough value of US$5.1 million

were sold during the year and US$15.0 million remained in inventory

at the end of the current year, compared to US$2.9 million at the

end of the prior year. The year-on-year polished inventory movement

decreased the Group revenue by US$12.1 million.

Royalties and selling costs

Royalties and selling costs in the Group of US$24.7 million

mainly comprise mineral extraction costs paid to the Lesotho

Revenue Authority of 8% on the sale of diamonds and diamond

marketing-related expenses.

Cost of sales

The focus for 2014 remained on continued operational excellence

through cost reductions and enhancing production efficiencies. Cost

of sales for the period was US$129.6 million, the majority of which

was incurred at Letšeng, and includes waste stripping costs

amortised of US$49.3 million (2013: US$34.8 million). The benefits

of the newly negotiated mining contract, procuring a larger mining

fleet and improved production throughput contributed to improved

unit costs. Cost of sales does not include any operational costs

incurred at Ghaghoo, as the mine did not reach its intended

sustaining operational levels, and therefore all costs were

recognised as part of the asset's carrying value during 2014.

The LSL (pegged to the South African rand) and the Botswana pula

(BWP) were weaker than the prior year, positively impacting US

dollar reported costs during the year. Conversely, the British

pound (GBP) strengthened against the US dollar during the year,

negatively impacting GBP corporate costs.

Exchange rates 2014 2013 % change

----------------------------------- ----- ----- --------

LSL per US$1.00

Average exchange rate for the year 10.85 9.65 12

Year end exchange rate 11.57 10.47 11

----------------------------------- ----- ----- --------

BWP per US$1.00

Average exchange rate for the year 8.98 8.40 7

Year end exchange rate 9.51 8.78 8

----------------------------------- ----- ----- --------

US$1.00 per GBP

Average exchange rate for the year 1.65 1.56 6

Year end exchange rate 1.56 1.66 (6)

----------------------------------- ----- ----- --------

Year ended Year ended

31 December 31 December

Letšeng costs 2014 2013

----------------------------------------------------- ------------ ------------

US$ (per unit)

Direct cash cost (before waste) per tonne treated(1) 12.70 13.34

Operating cost per tonne treated(2) 19.64 15.85

Waste cash cost per waste tonne mined 2.22 2.71

----------------------------------------------------- ------------ ------------

Local currency (per unit) LSL

Direct cash cost (before waste) per tonne treated(1) 137.75 128.68

Operating cost per tonne treated(2) 213.08 152.92

Waste cash cost per waste tonne mined 24.07 26.12

----------------------------------------------------- ------------ ------------

(1) Direct cash costs represent all operating cash costs, excluding royalty

and selling costs.

(2) Operating costs include waste stripping cost amortised, inventory and

ore stockpile adjustments, and excludes depreciation.

Total direct cash costs (before waste) at Letšeng, in local

currency, were LSL884.6 million compared to LSL801.1 million in

2013. This resulted in unit costs per tonne treated for the year of

LSL137.75 (2013: LSL128.68). This increase of 7% is primarily

attributable to general inflation increases of approximately 6%;

above inflationary fuel and power increases; additional costs

relating to back up power facilities and diamond reduction

initiatives, offset by savings achieved through the new mining

contract arrangements.

Operating costs per tonne treated increased to LSL213.08 per

tonne from LSL152.92 per tonne, mainly due to increased waste

stripping cost amortised, driven by the different waste to ore

strip ratios for the particular ore processed. Letšeng

significantly increased mining ore from the Satellite pipe during

the year, which carries a higher amortisation charge than the Main

pipe. As a result, the amortisation charge attributable to the

Satellite pipe ore accounted for 64% of the total waste stripping

amortisation charge in 2014 (2013: 48%).

Year ended Year ended

31 December 31 December

Other operating information (US$ million) 2014 2013

-------------------------------------------------- -------------- -------------

Waste cost capitalised 51.5 59.3

Waste stripping costs amortised 49.3 34.9

Depreciation and mining asset amortisation 15.2 16.0

Capital expenditure(1) 11.3 9.9

-------------------------------------------------- -------------- -------------

(1) Capital expenditure excludes movements in rehabilitation assets relating

to changes in rehabilitation estimates.

Local currency waste cash cost per waste tonne mined decreased

by 8% as a result of the newly negotiated mining contract and the

use of larger equipment improving overall efficiencies. Following

the estimation change in respect of the waste mined out of the

surveying review, which was disclosed in 2012, waste costs will be

recovered from the mining contractor over the eight year term of

the new contract and this has been raised as a prepayment in the

Statement of Financial Position. The impact on the waste stripping

cost amortised in the current year due to the change in estimate is

a credit of US$0.9 million.

Corporate expenses

As a result of the streamlining of the corporate structure

initiated in 2013, corporate expenses have further decreased,

notwithstanding inflation, from US$13.8 million in 2013 to US$12.4

million in 2014, which now represents the full impact of the

restructuring initiatives. Corporate expenses relate to central

costs incurred by the Group and are incurred in both South African

rand and British pounds.

Share-based payments

Share-based payment costs for the year amounted to US$1.7

million compared to US$0.9 million in 2013. There were two

Long-term Incentive Plan (LTIP) options granted during March and

June of 2014. In March, 625 000 nil-cost options were granted to

certain key employees. The vesting of these options will be subject

to the satisfaction of certain performance and service conditions

classified as non-market conditions. In June, 609 000 nil-cost

options were granted to the Executive Directors. The vesting of

these options will be subject to the satisfaction of certain

performance conditions over a three-year period. The share-based

payment cost associated with the new awards had a US$0.6 million

impact on the current year charge.

Net finance income

Net finance income mainly comprises interest received from

surplus cash from the Letšeng operation and the finance income

adjustment relating to the impact of raising the non-current

prepayment at fair value relating to the waste estimation change.

This income was partially offset by the unwinding of the current

environmental provisions and interest on interest-bearing

liabilities.

Income tax expense

The Group's effective tax rate was 37.6%, above the UK statutory

tax rate of 21.5%. This tax rate is driven by tax of 25% on profits

generated by Letšeng, withholding tax of 10% on dividends from

Letšeng and deferred tax assets not recognised on losses incurred

in non-trading operations.

EBITDA and attributable profit

The impact of the positive trading activities for the year has

resulted in underlying EBITDA of US$104.2 million, up by US$26.8

million (35%) from the prior year. The profit attributable to

shareholders for the year was US$33.2 million (up 57% from US$21.2

million in 2013) equating to 24.0 US cents per share (up 57% from

15.3 US cents in 2013) on a weighted average number of shares in

issue of 138 million.

Financial position and funding review

The Group's robust cash position was maintained, with US$110.7

million cash on hand at year end, of which US$99.4 million was

attributable to Gem Diamonds and US$0.2 million restricted. The

Group generated cash flow from operating activities of US$133.7

million before the investment in waste mining and capital

expenditure.

Enhancing the Group's funding strategy of incorporating

appropriate debt levels into the capital structure, additional debt

funding of LSL140.0 million (US$12.1 million) for the funding of

the Coarse Recovery Plant, and US$25.0 million to fund the

remaining Phase 1 development spend at Ghaghoo was raised during

the year. Both these facilities were fully drawn down by year end,

resulting in a net cash position of US$73.6 million, with undrawn

facilities of US$41.6 million still available as at 31 December

2014.

Investments in property, plant and equipment amounted to

US$101.3 million, the largest component of which was US$54.0

million incurred in waste stripping costs at Letšeng. The Group

also invested US$11.3 million at Letšeng, in connection with the

Coarse Recovery Plant, Plant 2 Phase 1 upgrade, additional resource

extension drilling and other sustaining capital costs. US$35.1

million was invested in Ghaghoo, representing the remaining Phase 1

capital project costs (US$26.2 million) together with six months'

operational costs during the commissioning phase (US$8.9 million).

These costs continued to be recognised as part of the carrying

value of the asset until such time as the mine is capable of

operating at sustainable levels.

During the year, Letšeng declared dividends of US$92.0 million

of which US$57.9 million flowed to Gem Diamonds and US$34.1 million

flowed outside of the Group representing withholding taxes of

US$6.5 million and payment to the Government of Lesotho of US$27.6

million for its minority portion.

Outlook

Capital and cash management discipline has placed the Group in a

well-funded position to recommend the payment of its maiden

dividend of 5 US cents per share, which enforces its strategy of

delivering additional value to its shareholders. This dividend is

subject to shareholder approval at the scheduled AGM to be held on

2 June 2015, and would be anticipated to be paid on 9 June 2015.

The total dividend would be US$6.9 million, equating to 21% of 2014

net earnings.

Focus will be on converting the Ghaghoo mine from a development

project into sustaining operational activities and achieving steady

state production by the end of the first half of 2015. Optimising

steady state production costs will be of high priority with the aim

of generating a positive contribution to EBITDA.

Letšeng is operationally geared to mine a more consistent mix of

Satellite and Main pipe ore. In addition, the potential added value

benefits following the completion of the Coarse Recovery Plant and

the Plant 2 Phase 1 project in the first half of 2015 provides a

strong platform from which to build during 2015 and beyond.

The Group will continue to pursue cost control, operational

efficiencies and growth opportunities on an ongoing basis to

achieve its objectives of delivering shareholder return over the

short, medium and long term.

Michael Michael

Chief Financial Officer

16 March 2015

Operating review - Letšeng

At Letšeng, plant improvements and improved blasting techniques,

as well as greater access to ore from the higher-grade satellite

orebody resulted in an improvement in the grade, size and quality

of the diamonds produced, exceeding all prior year production

levels.

Letšeng

Operational highlights

-- Highest number of +20 carat diamonds recovered

-- The recovered grade outperformed the 2014 reserve estimate by 7%

-- Five +100 carat diamonds sold achieved US$37.4 million in

total, representing 14% of total sales

-- Early introduction of the new mining contract resulted in

improved efficiencies and cost savings

Large diamond recoveries

Frequency of recoveries of large diamonds at Letšeng

Number of diamonds* 2008 2009 2010 2011 2012 2013 2014

-------------------------- ----- ----- ----- ----- ----- ----- -----

>100 carats 7 5 6 5 3 7 7

-------------------------- ----- ----- ----- ----- ----- ----- -----

60 - 100 carats 16 10 10 19 13 16 21

-------------------------- ----- ----- ----- ----- ----- ----- -----

30 - 60 carats 74 76 61 59 61 50 69

-------------------------- ----- ----- ----- ----- ----- ----- -----

20 - 30 carats 88 98 89 91 110 71 101

-------------------------- ----- ----- ----- ----- ----- ----- -----

Total diamonds

>20 carats 185 189 166 174 187 144 198

-------------------------- ----- ----- ----- ----- ----- ----- -----

* Letšeng's treatment plants only. (Excludes Contractor

Plant production.)

Year Year

ended ended

Letšeng operational 31 December 31 December

performance 2014 2013 % change

------------------------- ------------ ------------ --------

Tonnes treated 6 421 704 6 225 821 3

Waste tonnes mined 19 884 721 19 072 657 4

Carats recovered 108 569 95 053 14

------------------------- ------------ ------------ --------

Operational performance

Letšeng reported a year of robust operational performance,

exceeding all prior year production levels. For the year Letšeng

treated a total of 6.4 million tonnes of ore compared to the 6.2

million tonnes in 2013. Of the total ore treated for the year, 69%

was sourced from the Main pipe and 31% from the Satellite pipe,

compared to 84% Main and 16% Satellite ore in 2013. The recovered

grade has outperformed the 2014 reserve estimate by 7% and this can

be attributed to a concerted effort to improve mining, treatment

and geological controls, as well as the increased recovery of fine

diamonds through improved liberation and dilution control. The

higher recovered grade and increased Satellite pipe contribution to

the mining mix resulted in 108 569 carats being recovered in 2014,

a 14% increase from the prior year.

Waste stripping at Letšeng increased in line with the mine plan

and the requirement to access the higher-grade Satellite ore in

higher proportions. Waste moved was 19.9 million tonnes, up 4% from

2013. During the first half of 2014, the mining contractor

delivered larger mining equipment that included five new 100 tonne

dump trucks and two new 300 tonne hydraulic excavators, thereby

improving the waste mining efficiency in line with the current and

medium-term increase in waste mining.

Significant improvements to sidewall control and blasting of the

pit slopes have allowed the slope angles of the mine to be

increased safely. This will result in lower stripping ratios,

thereby significantly reducing the total cost of mining over

the life of the mine. Optimisation of the long-term mine plan,

taking into account the steeper slope angles, commenced toward the

end of the year and will be ready for review early in 2015.

New mining contract

Letšeng successfully renegotiated its contract with the mining

contractor a year ahead of the expiry of the previous contract.

This has resulted in improved unit costs for eight years, effective

from 1 January 2014. The introduction of the new larger mining

equipment has resulted in improved loading and hauling

efficiencies, contributing to reduced mining costs.

Focus on diamond damage

With diamond damage remaining a key focus area, a number of

initiatives in both mining and processing were embarked upon during

the past year to reduce diamond damage even further. Changes to

mine blasting practices and operations have resulted in improved

fragmentation of the ore for the treatment plants, which

contributes to reducing diamond damage. These efforts, in

conjunction with the installation of the secondary and tertiary

crushers in 2013; the lining of the cyclone underflow boxes; and

the optimisation of crusher gaps and crusher operations have

resulted in a reduced breakage trend in the valuable Type II

diamonds.

Building on the successful installation of the crushers in 2913,

further enhancements were made to the plants, which had a positive

impact on the diamond breakage trend. New liner configurations for

the Plant 1 and Plant 2 secondary crushers were finalised and

adopted, resulting in improved throughputs, as well as better

fragmentation.

Expansion and improvement programme

Following several studies it was decided that the Plant 2 Phase

1 upgrade would be implemented and that the Plant 2 Phase 2 upgrade

project would be examined further after the implementation of Phase

1. The Plant 2 Phase 1 project was approved by the Board in June

2014 at a capital cost of US$4.7 million and will be completed in

Q1 2015. The Plant 2 Phase 1 upgrade project will increase

Letšeng's production capacity by 250 000 tonnes per annum and is

also expected to further reduce diamond damage.

Construction on the new Coarse Recovery Plant started in Q3 of

2014. Construction and commissioning is expected to be completed by

the end of Q2 2015. This new plant will create a single access,

secure facility, and will use XRT sorters to process all of the

+5mm diamond concentrate to ensure improved diamond recovery of the

high-value Type II diamonds, which typically have a low

fluorescence and are not easily recovered using regular

fluorescence-based X-ray technology.

State of the art security systems have been designed for the new

Coarse Recovery Plant, which will include X-ray scanning of all

personnel exiting the recovery plant.

Skills

The issue of skills attraction and retention remains a material

risk to the Letšeng operation. Aside from the normal factors

ascribed to working in remote areas and remunerating skilled

employees in a globally weak currency, localisation challenges,

difficulties experienced in obtaining work permits for expatriates

and increasing competition from other diamond companies in Lesotho

for skilled personnel have exacerbated the risk.

An exercise focusing on a global search for qualified and

experienced Lesotho citizens who were willing to work in Lesotho

indicated that there is a limited pool of available skills.

Extensive engagements with Lesotho Government officials on this

matter have commenced. Indications are that the stakeholders will

adopt a collaborative approach to addressing the skills challenge.

Furthermore, an intensified effort is being made to invest in the

development of existing employees.

HSSE

Letšeng was awarded, for the second consecutive year, the

highest possible rating for HSSE management according to the IRCA

global system. The 2014 external HSSE audit resulted in a five star

rating which reflects the continued focus on the effective

management of risks to the health and safety of the mine's

employees and project affected communities, as well as Letšeng's

approach to safeguarding the natural environment in which it

operates.

On 23 October 2014 Letšeng reached a significant milestone of

365 days without an LTI. Unfortunately, immediately following this

milestone Letšeng experienced an LTI. The incident was

comprehensively investigated, the root causes determined and

appropriate corrective actions taken to prevent recurrences.

No major or significant environmental incidents were recorded at

Letšeng during 2014.

To improve the lives and social well-being of the communities

affected by mining activities, Letšeng continues to work closely

with the project affected communities and relevant community and

governmental forums. During 2014, Letšeng invested approximately

US$0.3 million towards community investment projects, the amount of

which is anticipated to increase in 2015 in line with the maturity

of the corporate social investment (CSI) plan and as more projects

are implemented. The majority of Letšeng's investment spend went

towards infrastructure development, small and medium enterprise and

education. To this end, Letšeng's invested US$59 587 towards

educational scholarships and initiatives. Letšeng undertook a herd

boys training campaign which was focused on outdoor survival skills

to aid surviving harsh winter conditions in the Lesotho mountains.

The operation also built and equipped three health posts in Lesotho

during 2014. These health posts were handed over to the department

of health as they continue

to expand access to medical services in Lesotho.

At the end of 2014, 92% of Letšeng's workforce comprised Lesotho

citizens with 18% originating from project affected

communities.

Sustainable development in action

Indigenous plant nursery

Letšeng assisted the local community members in the neighbouring

Khubelu valley with the establishment of an indigenous plant

nursery. The project aims is to have the communities sell

indigenous plants to local projects and businesses, thereby

generating an income for the community and furthering

self-sustainability.

The mine provided training to community members which

included:

- conservation of endangered plant species;

- propagation of indigenous plants;

- establishing an environment conducive to plant growth; and

- nursery management.

The community is in the process of securing the correct

infrastructure for the nursery and the project is well under

way.

Focus for 2015

-- Complete the Plant 2 Phase 1 upgrade

-- Complete the construction and commissioning of the Coarse

Recovery Plant

-- Complete mine planning studies incorporating steeper slope

angles, reducing and delaying the peak

of waste stripping and the optimal mining rates from both pits

to derive optimal returns

-- Re-review the optimal timing for commencement of underground

mining

-- Undertake further studies into the next phase(s) of the

expansion programme

-- Improving efficiencies through continuous improvement

programmes

-- Continuation of test work with new waste sorting

techniques

-- Continuation of the drive to reduce diamond damage

Operating review - Ghaghoo

The Ghaghoo diamond mine was officially opened by His Excellency

the President of Botswana, Seretse Khama Ian Khama, on 5 September

2014. The mine reached an important milestone with the completion

of the Phase 1 capital project which entailed developing an access

decline through 80 metres of sand overburden and three production

tunnels in the first level of mining.

Ghaghoo

Operational highlights

-- The Phase 1 development of the Ghaghoo mine has been completed on time and on budget

-- Final commissioning and optimisation of the plant to achieve

nameplate production output is in progress

-- A total of 10 167 carats recovered during commissioning, (including a 20 carat white diamond,

a 17 carat white diamond and a three carat orange diamond)

Total resource

20.5 million carats (as at 1 January 2014)

In-situ value

US$4.9 billion (as at 1 January 2014)

Operational performance

The Ghaghoo diamond mine was officially opened by His Excellency

the President of Botswana, Seretse Khama Ian Khama, on 5 September

2014.

The mine reached an important milestone with the completion of

the Phase 1 capital project, which entailed developing an access

decline through 80 metres of sand overburden and three production

tunnels in the first level of mining.

The tunnels in the old sampling level (140 metres below surface)

were intersected in August 2014. These tunnels were dewatered and

inspected and found to be stable and free of harmful gases.

To facilitate production, two 1 200mm diameter ventilation holes

were drilled and one has been equipped as an emergency escape

route.

The planned ramp up to approximately 60 000 tonnes per month and

final commissioning by December 2014 were delayed due to an

unforeseen intersection of a major water fissure along the basalt

rim tunnel of the first production level. The water fissure was

successfully sealed and measures were taken to rehabilitate the

underground workings, including the reinforcing of underground

tunnels, installing additional pumping and water handling

capacities, drilling of dewatering boreholes around the kimberlite

pipe and sealing of the water fissure.

During the year, production was drawn from the trial stope on

Level 0, 134 metres below surface, and from the development tunnels

in Level 1. The ore drawn from these was used in the commissioning

of the processing plant. The processing plant is in the final

stages of commissioning and further optimisation work is in

progress. 48 023 tonnes of ore was treated, resulting in the

recovery of 10 167 carats during the year. The recovered grade

during the commissioning period has averaged just above 21 carats

per hundred tonnes (cpht) compared to an expectation of

approximately 27cpht, but was negatively impacted by highly diluted

ore from the margins of the pipe and plant inefficiencies during

early commissioning. During the latter part of the year, following

an optimisation process at the treatment plant, the grade showed

improvement and it is expected that reserve grades will be achieved

as both the plant and mining operations reach steady state

production levels.

HSSE

Ghaghoo is a maturing organisation that is improving its

management systems, including the HSSE management system. The

operation was recognised for its improvement of HSSE management

when it was awarded a four star rating for its external HSSE audit

for a second consecutive year in 2014. Regrettably a fall of ground

incident occurred on 11 January and resulted in the death of Mr

Segolame Mashumba. A comprehensive and thorough accident

investigation found that the incident was a result of a series of

consecutive actions that combined to weaken the rock mass to such

an extent that a very small amount of force was required to cause

failure. Work practices have been revised and an extensive training

programme has been implemented.

On 4 November 2014 a further fall of ground occurred, resulting

in three LTIs. This incident was investigated and appropriate

actions were taken to address the root causes to prevent recurrence

of the incident.

Ghaghoo established a community trust in 2014. This trust is

made up of representatives from the mine as well as representatives

from the project affected communities as well as representatives

from the mine.

No major or significant environmental incidents occurred during

2014.

Ghaghoo established a community trust in 2014. This trust is

made up of representatives from the mine as well as representatives

from the project affected communities as well as representatives

from the mine. Ghaghoo has increased its CSI activity in local

communities during the year, with a focus on education. The mine

has adopted the Kaudwane Primary School as part of its social

investment strategy and appointed a number of Kaudwane residents as

part of its short-term labour project. The project is aimed at

building capacity and providing local community members with work

experience and skills. Other programmes have been identified as

part of the CSI plan for implementation in 2015.

At year end, 93% of the Ghaghoo workforce were Batswana

citizens, 19% of which originated from project affected

communities.

Sustainable development in action

Adoption of the Kaudwane Primary School

Ghaghoo officially adopted the Kaudwane Primary School on 24

June 2014. An official adoption ceremony was held to mark this

event and to facilitate good relations between the Ghaghoo diamond

mine and the Kaudwane community. The school identified various

projects that they required assistance with, including

infrastructure and maintenance upgrades.

Extensive maintenance has been undertaken to improve the

ablution facilities of the school, and the classrooms have been

provided with electricity after the generator was serviced. More

projects are planned for implementation during 2015.

Focus for 2015

-- Continue the transition of processes and systems from the project phase to operations phase

-- Continue ramping-up mining and production to nameplate

capacity and maintain a focus on sustaining those levels.

(Production is expected to ramp-up to reach steady state during the

first half of 2015).

-- Optimise the processing plant

-- Advance the decline to open up Level 2 in 2015

-- Increase the number carats for sale and the frequency of tenders held

(An initial sale of 10 096 carats took place in Gaborone and

Antwerp during February 2015.

Operating review - Sales, marketing and manufacturing

The Group continues to invest in and grow the intellectual

property in its sales, marketing and manufacturing operations, with

the objective of ensuring that the highest returns are achieved for

its rough and polished diamonds.

Sales, marketing and manufacturing

Operational highlights

-- US$276.8 million* with an average price of US$2 540* per

carat was achieved for Letšeng's high-value production

-- 59* rough diamonds for greater than US$1.0 million each

-- Polished sales through the manufacturing division contributed

US$5.8 million in additional revenue to the Group

*Includes carats extracted for polishing at rough valuation.

Sales and marketing

The Group's rough diamond production is marketed by Gem Diamonds

Marketing Services and sold through an electronic tender platform.

The tender platform is designed to enhance engagement with

customers by allowing continuous access, flexibility and

communication, as well as ensuring transparency during the tender

process. Although tender viewings of the Group's diamonds take

place in Antwerp, the electronic tender platform allows customers

the flexibility to participate in each tender from anywhere in the

world. This flexibility together with the professional and

transparent manner in which the tender is managed, as well as the

high-calibre clients who participate in the tenders, contributes to

the achievement of the highest market-driven prices for the Group's

rough diamond production. In addition to the Letšeng production,

Gem Diamonds Marketing Services will also be tendering the Ghaghoo

rough diamond production in 2015, with viewings scheduled to take

place in Gaborone and Antwerp.

Rough diamonds selected for polishing are manufactured at

Baobab, and the resulting polished diamonds are sold by Gem

Diamonds Marketing Services through direct selling channels to

prominent high-end clients.

Focus for 2015

Sales and marketing - Gem Diamonds Marketing Services

-- Continue to achieve highest prices for the Group's rough and

polished diamonds through optimised sales and marketing

activities

-- Develop and implement the market strategy and sales channels

for the Ghaghoo rough production to achieve highest prices

-- Identify diamond sales and marketing opportunities in other strategic jurisdictions

Analysis and manufacturing

Baobab Technologies' advanced mapping and analysis of Letšeng's

exceptional rough diamonds assists the Group in assessing

appropriate true values of its rough diamonds that are presented

for sale on tender or sold through any other sales channel. This

ensures that robust reserve prices are set for its diamonds at each

tender and assists in the making of strategic selling, partnering

or manufacturing decisions.

In order to access the highest value for its top-quality

diamonds, the Group also selectively manufactures some of its own

high-value rough diamonds through Baobab and places other

exceptional diamonds into strategic partnership arrangements with

select clients.

During 2014, Baobab Technologies received 933 carats of

high-value diamonds for processing, with a rough market value of

US$12.9 million from Letšeng and continued to cut and polish third

party goods. Included in this amount was the manufacture of two

high-value diamonds a 124 carat diamond, which resulted in 12

exceptional polished diamonds with a total weight of 40.63 carats

(including a 10 carat, D Flawless, Emerald cut), and a 95 carat

diamond, which resulted in four exceptional polished diamonds with

a total weight of 34.53 carats (including a 18 carat, D Flawless,

Round and a 10 carat, D Flawless, Round). All of the polished

stones from these two diamonds achieved Excellent grading for cut

grade, polish and symmetry by the GIA.

Focus for 2015

Analysis and manufacturing - Baobab

-- Continue to analyse Letšeng's large, high-value diamonds to

ensure deep understanding of product value on each

Letšeng tender

-- Obtain best possible polished results for Letšeng's rough

diamonds extracted for manufacturing

-- Increase business activities by polishing more high-value

diamonds for customers outside the Group

Principal risks and uncertainties

The Group is exposed to a number of risks and uncertainties that

could have a material impact on its performance and long-term

development. The effective identification, management and

mitigation of these risks and uncertainties are a core focus of the

Group, as they are key to the Company's objectives and strategy

being achieved. Central to Gem's approach to risk management is

having the right Board and Senior Management team in place, with

such members combining extensive experience of diamond mining,

corporate governance, risk management and the local operating

conditions in Lesotho and Botswana.

Risk management is the overall responsibility of the Board,

assisted primarily by the Audit and HSSE Committees, who together

identify and assess any change in risk exposure, together with the

potential financial and non-financial impacts and likelihood of

occurrence.

Given the long-term nature of the Group's mining operations, the

Group's risks are unlikely to alter significantly on a yearly

basis. However, inevitably the level of risk can change, as could

the Group's risk appetite. The Board and its Committees have

identified the following key risks. This is not an exhaustive list,

but rather a list of the most material risks facing the Group. The

impact of these risks individually or collectively could

potentially affect the ability of the Group to operate profitably

and generate positive cash flows in the medium to long term. As a

result, these risks are actively monitored and managed, as detailed

below in no order of priority.

Description and impact Mitigation 2014 actions and outcomes

------------------------------ ---------------------------------- ---------------------------------

Market risks

Rough diamond prices

-----------------------------------------------------------------------------------------------------

Numerous factors beyond Market conditions are The market for rough

the control of the Group continually monitored and polished diamonds

may affect the price to identify current trends firmed over the first

and demand of diamonds. that will pose a threat three quarters in 2014

These factors include or create an opportunity before softening in the

international economic for the Group. The Group final quarter as a result

and political trends, has flexibility in its of recent concerns over

as well as consumer trends. sales processes and the bank lending and liquidity.

The funding of growth ability to reassess its Despite this, diamond

plans could also be adversely capital projects and prices achieved outperformed

affected by constrained operational strategies the mineral reserve prices,

cash flows impacted by in light of current market improving Group revenues.

negative market conditions. conditions to preserve Operational efficiency

cash balances. initiatives and current

Strict treasury management projects in the form

procedures are also in of the new Coarse Recovery

place to monitor cash Plant and Plant 2 Phase

and capital projects 1 upgrade are geared

expenditure. to providing increased

revenue and margin.

The Group has a strong

balance sheet with cash

reserves of US$110* million

plus existing undrawn

facilities of US$42*

million.

* As at 31 December 2014.

------------------------------ ---------------------------------- ---------------------------------

Operational risks

Mineral resource risk

-----------------------------------------------------------------------------------------------------

The Group's mineral resources Various bulk sampling Letšeng resource

influence the operational programmes combined with drilling and bulk sampling

mine plans and affect geological mapping and programmes were successfully

the generation of sufficient modelling methods significantly completed during the

margins. Under-performance improve the Group's understanding year. The results of

of its mineral resources of and confidence in these programmes together

could affect the Group's the mineral resources with other geological

ability to operate profitably and assist in optimising work have resulted in

in the medium to long the mining thereof. a significant increase

term. in the indicated resource

category and probable

reserves. The entire

open pit life of mine

plan is now classified

as reserve.

------------------------------ ---------------------------------- ---------------------------------

Operational risks continued

A major production interruption

-----------------------------------------------------------------------------------------------------

The Group may experience The Group continually Letšeng sources

material mine and/or reviews the likelihood its power through the

plant shutdowns or periods and consequence of possible Lesotho Electricity Corporation,

of decreased production different events and which in turn is sourced

due to a number of different ensures that the appropriate from the South African

events. Any such event management controls, electricity provider,

could negatively affect processes and business Eskom, who have had challenges

the Group's operations continuity plans are in providing consistent

and impact both profitability in place to mitigate power in South Africa

and cash flows. this risk. and neighbouring dependent

states. In light of this,

improvements in power

monitoring and the provision

of backup power supply

were undertaken at Letšeng,

reducing the impact of

lengthy outages.

In addition, a review

of critical spares for

the treatment plants;

improved sidewall control;

and geotechnical monitoring

during the year were

undertaken, which further

mitigate possible production

down time.

Following significant

water ingress at Ghaghoo

in July, improved water

handling and management

systems have been introduced.

------------------------------ ---------------------------------- ---------------------------------

Diamond theft

-----------------------------------------------------------------------------------------------------

Theft is an inherent Security measures are The new Coarse Recovery

risk factor in the diamond constantly reviewed and Plant, which incorporates

industry. implemented in order enhanced security features

to minimise this risk. is well underway and

on target to be completed

by the end of the second

quarter of 2015. Upgrades

to the existing security

systems and facilities

continued at Letšeng

throughout the year.

The Phase 1 capital project

at Ghaghoo was completed

and included appropriate

diamond security systems

and facilities.

------------------------------ ---------------------------------- ---------------------------------

Diamond damage

-----------------------------------------------------------------------------------------------------

Letšeng's valuable Diamond damage is regularly Building on the success

Type II diamonds are monitored and analysed. of the new crushers installed

highly susceptible to Continuous studies are in the prior year, numerous

damage during the mining conducted to further further initiatives continue

and recovery process implement modifications to be implemented with

and the opportunity to and identify opportunities the aim of reducing diamond

reduce such damage creates to reduce such damage. damage, with improved

potential upside for blasting practices having

the Group. had a significant impact.

The Plant 2 Phase 1 upgrade,

which was approved during

the year and on track

to be completed by the

end of the first quarter

of 2015, is further aimed

at reducing the impact

of diamond damage.

------------------------------ ---------------------------------- ---------------------------------

Expansion and project delivery

-----------------------------------------------------------------------------------------------------

The Group's growth strategy Project governance structures Studies on the Letšeng

is based on delivery have been implemented expansion projects continued

of expansion projects, to ensure that the projects to advance during the

premised on various studies, are monitored and risks year. The new Coarse

cost indications and managed at an appropriate Recovery Plant and Plant

future market assumptions. level. 2 Phase 1 upgrade projects

In assessing the viability, Flexibility in the execution were approved and completion

costs and implementation of projects allows the thereof is anticipated

of these projects, risks Group to react quickly on time and within budget

concerning cost overruns to changes in market by the end of the second

and/or delays may affect and operational conditions. quarter of 2015.

the effective implementation The Phase 1 development

and execution thereof. of Ghaghoo was completed

within budget. The initial

ramp up was delayed due

to significant water

ingress, however, improved

water handling and management

systems, which were quickly

introduced, have reduced

the impact of the delay

and as a result, the

mine is on track for

delivery by the end of

the first half of 2015.

------------------------------ ---------------------------------- ---------------------------------

HSSE-related risks

----------------------------------------------------------------------------------------------------

The risk that a major The Group has reviewed While the Group's overall

health, safety, social and published policies safety performance remains

or environmental incident in this regard and significant satisfactory, a fatality

may occur within the resources have been allocated was recorded at the Ghaghoo

Group is inherent in to continuously improve, underground mine.

mining operations. review, recommend, implement Letšeng and Ghaghoo

and monitor compliance maintained their five-star

throughout the various and four-star ratings

operations within the respectively for their

Group. This is overseen external HSSE audits.

by the HSSE Committee Corporate social investment

of the Board. into the Group's project

Further to this, the affected communities

Group engages independent continued throughout

third parties to review the year.

and provide assurance

on processes currently

in place.

The Group actively participates

and invests in corporate

social initiatives and

the involvement of members

of the communities who

sit on the respective

corporate social responsibility

committees is critical

to the success thereof.

------------------------------ -------------------------------- ----------------------------------

Strategic risks

Political risks

----------------------------------------------------------------------------------------------------

The political environments Changes to the political Political unrest was

of the various jurisdictions environment and regulatory experienced during the

that the Group operates developments are closely year in Lesotho; however

within may adversely monitored. Where necessary, no disruptions were experienced

impact the ability to the Group engages in at the Letšeng Mine.

operate effectively and dialogue with relevant The Group took part in

profitably. Emerging government representatives its ongoing dialogues

market economies are in order to remain well with representative stakeholders,

generally subject to informed of all legal gaining insight into

greater risks, including and regulatory developments the progress and status

regulatory and political impacting its operations of the political developments

risk, and are potentially and to build relationships. leading up to the elections

subject to rapid change. in February 2015. The

Group further implemented

specific procedures to

mitigate the impact of

any unrest. There were

no strikes or lockouts

during the year at either

operation.

------------------------------ -------------------------------- ----------------------------------

Retention of key personnel and skills shortages

----------------------------------------------------------------------------------------------------

The successful achievement The Group's human resources An intensified effort

of the Group's objectives practices, which are is being made to invest

and sustainable growth regularly reviewed, are in the development of

depends on its ability designed to identify existing identified key