Fresenius Medical Care Raises 2016 Net Profit Guidance, Confirms 2015 Targets

October 29 2015 - 3:10AM

Dow Jones News

By Ulrike Dauer

FRANKFURT--German health care group Fresenius SE & Co. KGaA

(FRE.XE) on Thursday said a good third quarter and continuing

strong results at its Fresenius Kabi unit in North America allowed

it to raise its net profit guidance for the third time this

year.

Fresenius now expects net profit to be some 20% to 22% higher

than the year-earlier figure of 1.086 billion euros ($1.20

billion). Under its last guidance raised in July--for the second

time this year after April--it had forecast an 18% to 21% profit

increase.

Fresenius also targets 2015 sales growth of 8% to 10% over the

2014 figure of EUR23.2 billion, unchanged from its previous

guidance.

The Kabi unit, the group's clinical technology provider, also

raised its guidance. It now forecasts an 8% rise in sales, at the

upper end of its previous 6% to 8% guidance, and EBIT growth of 19%

to 22%, up from the previously targeted 18% to 21% . All company

forecasts are in constant currency.

In the quarter from July to September, net profit rose 31% to

EUR367 million, helped by a tailwind from the positive foreign

exchange translation effects of the weak euro, beating a forecast

EUR348 million. Sales rose 16% to EUR6.94 billion from EUR5.98

billion in the same quarter a year ago, below the forecast EUR6.95

billion

As a result of the weakening of the euro against the U.S. dollar

and other major currencies, group sales and profit benefited

strongly after translating dollar-denominated sales into euros.

Fresenius has four business units--Fresenius Medical Care AG

& Co. KGaA (FMS), the world's largest provider of dialysis

products and services; Fresenius Kabi; hospital group Fresenius

Helios; and health care facilities manager Fresenius Vamed. It

generates some 40% of sales each in North America and in

Europe.

Three of the four business operations contributed to the

improvements. Fresenius Kabi booked a 42% rise in net profit and a

16% sales increase in the third quarter, following an already

strong performance in the first two quarters, which had caused both

lifts in the guidance.

Fresenius' biggest unit FMC confirmed its full-year guidance

after revenue rose 3% in the quarter to $4.23 billion and net

profit fell 3% to $262 million. For 2016, FMC also maintained the

profit and revenue targets

Write to Ulrike Dauer at Ulrike.Dauer@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 29, 2015 02:55 ET (06:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

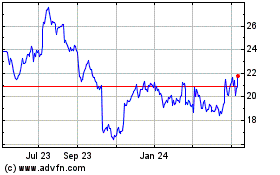

Fresenius Medical Care (NYSE:FMS)

Historical Stock Chart

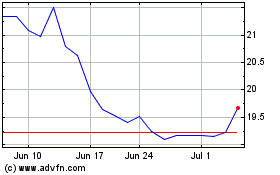

From Mar 2024 to Apr 2024

Fresenius Medical Care (NYSE:FMS)

Historical Stock Chart

From Apr 2023 to Apr 2024