Issuer Free Writing Prospectus

Filed Pursuant to Rule 433

Registration Statement No. 333-215627

July 14, 2017

BITCOIN INVESTMENT TRUST

On July 7, 2017, representatives of Grayscale Investments, LLC, sponsor of the Bitcoin Investment Trust, and others met with staff

members of the Securities and Exchange Commission (the “SEC”) to discuss matters relating to NYSE Arca, Inc.’s pending filing with the SEC of a proposed rule change relating to the listing and trading of shares of the Bitcoin

Investment Trust. At the meetings, the sponsor delivered the presentation attached hereto, which the SEC subsequently publicly posted to its website under the NYSE Arca, Inc. rulemaking file

(

https://www.sec.gov/comments/sr-nysearca-2017-06/nysearca201706.htm

).

The issuer has filed a

registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC

for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the sponsor will arrange to send you the prospectus (when available) if you

request it by calling collect

1-212-668-3911.

The Bitcoin Investment Trust Sponsored by

Grayscale Investments, LLC Meeting with U.S. Securities and Exchange Commission July 7, 2017

Meeting Agenda GRAYSCALE | 02 Overview of

the Bitcoin Investment Trust The Importance of an ETP Structure for Investor Protection Bitcoin Investment Trust Features Designed to Mitigate Manipulation NYSE Arca Rule 19b-4 Application for the Bitcoin Investment Trust

Overview of the Bitcoin Investment

Trust

Grayscale’s Bitcoin Investment Trust

GRAYSCALE | 04 Sponsored by Grayscale Investments, the Bitcoin Investment Trust™ is an open-ended trust that provides titled, auditable and secure bitcoin exposure through a traditional investment vehicle. Modeled after the popular SPDR®

Gold Shares ETF, the Trust was created for investors looking for bitcoin exposure. The Bitcoin Investment Trust’s shares are the first publicly-quoted securities solely invested in, and deriving value from, the price of bitcoin. The Bitcoin

Investment Trust’s assets under management as of June 30, 2017 were $437.88 million.

GRAYSCALE | 05 Bitcoin Investment Trust A

Network of Trusted Service Providers 1 Calculated by Bitcoin Holdings per Share of the Trust as of June 30, 2017 2 The Trust will not generate any income and regularly sells/distributes bitcoin to pay for its ongoing expenses. Therefore, the amount

of bitcoin represented by each share will gradually decline over time. Track bitcoin market price as represented by the Index, less expenses Investment Objective 2% annually Management Fee $437.88 Million1 Assets Under Management Both cash and

in-kind on business days Proposed Creations/Redemptions (Subject to Reg M Relief) Calculated and published daily at 4:00pm (New York Time) Bitcoin Holdings per Share Each share represented ownership of 0.1 bitcoins at inception2 Ownership Sponsor

Custodian Listing Exchange Auditor Legal Counsel to Sponsor Administrator & Transfer Agent Distribution & Marketing Agent Grayscale Investments, LLC Xapo, Inc. New York Stock Exchange Friedman LLP Davis Polk & Wardwell LLP Bank of New

York Mellon ALPS Fund Services, Inc. Authorized Participants KCG Americas LLC, Wedbush Securities, Credit Suisse Securities (USA) LLC Benchmark Index Liquidity Provider Genesis Global Trading 24-hour VWAP of the TradeBlock XBX Index

Key Milestones GRAYSCALE | 06 Grayscale

launched the Bitcoin Investment Trust as a 506(c) private placement in September 2013. The Bitcoin Investment Trust was approved for public quotation on OTCQX® under the symbol GBTC in February 2015. GBTC first began trading on OTCQX® in

May 2015. Grayscale filed a Confidential Draft Form S-1 Registration Statement for the Bitcoin Investment Trust with the SEC in March 2016. Subsequently, Grayscale filed a total of 6 Amendments to the Draft Form S-1 Registration Statement between

March 2016 and May 2017. During May 2017, GBTC was among the top 5 most actively traded securities on OTCQX® on 19 of the 22 trading days of the month, based on dollar-denominated volume. It was the most actively traded security on 5 of those

days. The Bitcoin Investment Trust is owned by large, prominent, and regulated institutional investors that are responsible for managing billions of dollars in investment assets for their clients. Sell-side firms including Wedbush Securities,

Needham & Company, and Canaccord Genuity have initiated research coverage on GBTC.

The Importance of an ETP Structure for

Investor Protection

GBTC Trades at a Persistent Premium to its

Bitcoin Holdings per Share GRAYSCALE | 08 Source: OTCQX Marketplace Since the Bitcoin Investment Trust first began trading on the OTCQX® marketplace, the top tier of three marketplaces for trading over-the-counter securities, it has traded on

average at a 41.5% premium to its Bitcoin Holdings per Share. More recently, the market price of GBTC reached greater than a 130% premium to its Bitcoin Holdings per Share. In June 2017, GBTC closed at a premium in excess of 100% on 5 of the 22

trading days of the month. Currently, GBTC is the only publicly-quoted investment vehicle that seeks to provide passive exposure to bitcoin; however, investors are forced to substantially overpay for the assets that they hold in its current form.

An ETP Structure Facilitates Arbitrage

GRAYSCALE | 09 Source: Matthew Tucker, CFA, BlackRock® Blog, January 27, 2016. New year, new investing strategy: exploring ETFs. Approval of the proposed Rule Change along with Regulation M Relief will allow the Bitcoin Investment Trust to

convert to an ETP structure on the NYSE Arca. As an ETP, Authorized Participants will be able to create and redeem shares to arbitrage any inefficiencies or dislocations between the price of the underlying asset (bitcoin) and the price of the

Bitcoin Investment Trust shares on the NYSE. In an ETP format, investors will be able to passively gain exposure to bitcoin at readily observable market prices, through a reliable and secure investment vehicle.

Bitcoin Market Capitalization & User

Growth GRAYSCALE | 10 Source: blockchain.info; bitcoincharts.com Bitcoin Market Capitalization (USD) Cumulative # of User Wallets Growth in the market capitalization of bitcoin is fundamentally supported by an increase in network users, as measured

by unique wallets. Cumulative # of User Wallets Market Capitalization (USD) Cumulative # of User Wallets Bitcoin Market Capitalization (USD)

Bitcoin Investment Trust Features

Designed to Mitigate Manipulation

A Benchmark Index that Mitigates Market

Manipulation GRAYSCALE | 12 By utilizing a trailing 24-hour VWAP of the TradeBlock XBX Index, Grayscale has demonstrated high benchmarking standards that are designed to protect investors from market manipulation and ensure a fair, orderly, and

efficient market. The TradeBlock XBX Index was designed to serve as a reference rate to track a liquid bitcoin market price while also adjusting for deviations caused by anomalies and manipulation attempts. The XBX Index incorporates a: VOLUME

WEIGHTING: Exchanges with greater liquidity receive a higher weighting in the index, increasing the ability to execute against the index in the underlying spot markets. Liquidity weighting also mitigates the impact of volume spikes during off-peak

trading hours. PRICE VARIANCE WEIGHTING: The index price reflects data points that are discretely weighted in proportion to their variance from the rest of the cohort. As the price at a particular exchange diverges from the rest of the data points,

its influence on the index consequently decreases. INACTIVITY ADJUSTMENT: The XBX algorithm penalizes stale ticks on any given constituent exchanges. If an exchange does not have recent trading data, its weighting is gradually reduced, until it is

de-weighted entirely. Similarly, once activity resumes, the corresponding weighting for that constituent is gradually increased until it reaches the appropriate level. Furthermore, TradeBlock has published empirical evidence identifying a number of

cases in which the aforementioned index methodology has successfully shielded the XBX Index from anomalistic or manipulative pricing. See Appendix for more details.

Pragmatic Creation & Redemption

Procedures GRAYSCALE | 13 Grayscale has developed thorough creation and redemption procedures for shares of the Bitcoin Investment Trust that: Mitigate the potential for market manipulation Allow for efficient management of risk exposure Facilitate

transparency for Authorized Participants The Trust’s procedures were modeled after existing ETPs that have a proven track record of enabling arbitrage for both cash and in-kind orders. Since cash creation and redemption orders are placed by

Authorized Participants on T-1, the Trust’s Liquidity Provider(s) have ample time to buy/sell (as the case may be) the underlying bitcoin, minimizing their impact on the bitcoin spot market and diminishing the potential for front running or

manipulation during a constrained or predetermined timeframe.

NYSE Arca Rule 19b-4 Application for the

Bitcoin Investment Trust

SolidX and Winklevoss Denials GRAYSCALE

| 15 The Commission, acting through delegated authority, denied Rule 19b-4 applications filed by NYSE Arca and BATS BZX, for the SolidX and Winklevoss Bitcoin Trusts in March 2017, as being inconsistent with the requirements of the Exchange Act

Section 6(b)(5) – “the rules of a national securities exchange must be designed to prevent fraudulent and manipulative acts and practices and to protect investors and the public interest.” The denials laid out a test that was

originally crafted for physical commodities that no digital currency can satisfy – First, the exchange must have surveillance-sharing agreements with significant markets for trading the underlying commodity or derivatives on that commodity

Second, underlying markets must be regulated. The denials shift the focus to the markets for the underlying asset rather than to the market for the listed security. Since significant underlying markets are not regulated, this conclusively determines

that the security cannot be listed. As a result, the SEC deems digital currency ETPs to be too risky for U.S. investors, regardless of the level of disclosure provided.

A Physical Commodity Test is Not

Appropriate for Digital Currency GRAYSCALE | 16 A physical commodity ETP test may be justified where the underlying asset is traded in regulated markets, but because the test acts as a categorical bar if the underlying asset is not traded in

regulated markets, the test is not appropriate for digital currencies. A Section 6(b)(5) test usually focuses on whether the listing exchange has rules to deter fraudulent and manipulative acts and practices in the securities markets, not all

markets that a security offers exposure to – E.g., investment in securities of health insurers exposes investors to the risk of insurance fraud, but the SEC does not require exchange rules to deter insurance fraud. Because a test designed for

physical commodity ETPs was applied, previous 19b-4 analyses discount – Exchange’s surveillance procedures that are designed to detect and deter manipulation in the securities themselves. Prof. Craig Lewis’ white paper explaining

why the bitcoin market is inherently difficult to manipulate.

Digital Currency Test GRAYSCALE | 17

Approval of the Bitcoin Investment Trust 19b-4 application is consistent with Section 6(b)(5). NYSE Arca’s rules are designed to detect and deter fraud in the market for Bitcoin Investment Trust securities. Approving the application would

protect investors and be in the public interest – Denying the application will not prevent investors from investing in the Bitcoin Investment Trust on the OTCQX®, or prevent investors from investing in bitcoin directly. On the other hand,

denying the application would harm investors by preventing them from obtaining protections offered by Securities Act registration, including protection against false or misleading disclosures, as well as protections against manipulative trading

offered by an exchange listing.

Appendix

Bitcoin ETP Comparison Matrix GRAYSCALE

| 19 Grayscale Bitcoin Investment Trust SolidX Bitcoin Trust Winklevoss Bitcoin Trust Why Grayscale is Superior Exchange NYSE Arca NYSE Arca BATS Grayscale is using the top exchange for ETP listings in the US (over 90% of US ETP listing

choose NYSE). Operating History ~4 Years None None Grayscale has nearly a 4 year operational history and track record of success working with world-class service providers. AUM $437.88M1 $0 $0 Grayscale has a strong base of global investors who have

selected the Bitcoin Investment Trust as their method for gaining trusted and secure exposure to the bitcoin market. Basket Size 100 shares 100,000 Shares 100,000 shares Grayscale is offering granular basket sizes to allow Authorized Participants to

more efficiently manage their position sizes and risk exposures. Benchmark Index 24hr VWAP of TradeBlock's XBX Index 4pm Spot of TradeBlock's XBX Index (susceptible to manipulation at a single point in time) 4pm Gemini Exchange Auction (easily

manipulated and volume fluctuates from as little as $100K to a few million dollars) Grayscale utilizes a 24-hour VWAP of the TradeBlock XBX Index as the benchmark for the Bitcoin Investment Trust. This substantially mitigates the impact of

manipulation attempts at individual exchanges, and across exchanges, at a single point in time. Custodian Xapo Inc. Self Self Grayscale is using the leading global bitcoin custodian, which employs intense physical, cryptographic, and jurisdictional

security layers. Authorized Participants KCG Wedbush Credit Suisse None KCG Virtu Convergex Grayscale is partnering with some of the most experienced and respected Authorized Participants in the ETF business. Order Type(s) Cash In-Kind Cash

In-Kind or Partial In-Kind (Involes the use of Non-Deliverable Forward/Swaps) In-Kind Grayscale is offering optionality for both cash and in-kind orders without introducing significant liquidity and counterparty risks. The creation and redemption

procedures were explicitly designed to mitigate the potential for market manipulation and are modeled after existing ETPs. Cash Creations For cash creations, the Trust's Liquidity Provider shows a firm quote on behalf of the APs order, so there is

no price or time discretion taken by the Liquidity Provider AND the AP knows their cost at the time they collateralize their creation order For cash creations, the Sponsor takes on the role of buying bitcoin for the Trust at an unknown price on

behalf of an AP during a short window from 3pm to 4pm N/A Grayscale is partnering with Genesis, the largest OTC bitcoin trading desk in the world. Genesis is an SEC and FINRA registered broker-dealer with a strong track-record. Cash

Redemptions For cash redemptions, the Trust's liquidity provider shows a firm quote on behalf of the APs order, so there is no price or time discretion taken by the liquidity provider AND that the AP knows their cash proceeds at the time they have

an accepted redemption order For cash redemption, the Sponsor is agreeing to provide the cash proceeds of the basket's NAV on the order date, a price that will be difficult/impossible for them to meet or beat in selling bitcoins to pay out the cash

proceeds for the redemption order N/A Grayscale is partnering with Genesis, the largest OTC bitcoin trading desk in the world. Genesis is an SEC and FINRA registered broker-dealer with a strong track-record. 1 Calculated by Bitcoin Holdings

per Share of the Trust as of June 30, 2017

GRAYSCALE | 20 Grayscale’s Parent

Company: Digital Currency Group NEW VENTURES CORPORATE NETWORK SUBSIDIARIES Digital asset broker-dealer Asset management business Media, events, and research platform Strategically build or acquire new businesses DCG has 36 employees and over 1,000

portfolio company employees INVESTMENT PORTFOLIO (100+ companies across 27 countries)

Management of the Sponsor GRAYSCALE | 21

Barry E. Silbert, Chief Executive Officer Barry E. Silbert is the Chief Executive Officer of the Sponsor and the founder of Digital Currency Group, Inc. (“DCG”) which builds and supports bitcoin and blockchain companies through its

insights, network and access to capital. Starting in 2012, Mr. Silbert became one of the first and most active investors in the bitcoin space, providing seed funding for Coinbase, Ripple, BitPay and a number of other companies who have defined the

bitcoin industry. Prior to founding DCG, Mr. Silbert founded SecondMarket, an online platform and registered broker-dealer that enabled private companies to customize, control and execute secondary transactions for the benefit of their employees and

investors. SecondMarket was acquired by NASDAQ in 2015. Before becoming an entrepreneur, Mr. Silbert was an investment banker at Houlihan Lokey and graduated with honors from the Goizueta Business School of Emory University. Mr. Silbert has received

several honors including being named Entrepreneur of the Year by Ernst & Young and Crain’s and being selected to Fortune’s prestigious “40 under 40” list. Simcha Wurtzel, Vice President, Finance and Controller Simcha

Wurtzel is Vice President, Finance and Controller of the Sponsor and the Vice President of Finance and Controller of the Digital Currency Group, Inc. From 2007 to 2015, Mr. Wurtzel served as the Financial and Operations Principal for SecondMarket.

Prior to working at SecondMarket, Mr. Wurtzel was a Senior Accountant at Liberty Media’s Starz! Entertainment division where he held specific responsibilities for studios producing series television and theatrical feature films. Mr. Wurtzel

holds a B.S. degree in accounting from Touro College, New York. Michael Sonnenshein, Director, Sales & Business Development Michael Sonnenshein is the Director of Sales and Business Development for the Sponsor. Since 2014, Michael has led the

sales effort for the Bitcoin Investment Trust, managed senior relationships with institutional clients, and established strategic partnerships with the Trust’s service providers. Prior to joining Grayscale, Mr. Sonnenshein was a financial

advisor at JPMorgan Securities, covering high net worth individuals and institutions. Mr. Sonnenshein also worked in a similar capacity at Barclays Wealth. Mr. Sonneshein earned his Bachelors of Business Administration from the Goizueta Business

School of Emory University and a Masters in Business Administration from the Leonard N. Stern School of Business of New York University.

Digital Currency Group’s Board

Members & Advisors GRAYSCALE | 22 Glenn Hutchins, Co-Founder, Silver Lake Partners Board Member Glenn Hutchins is a co-founder of Silver Lake, the global leader in technology investing. He serves on the board of AT&T, Nasdaq, the Federal

Reserve Bank of New York, the Brookings Institution, the Economic Club of New York and the Center for American Progress. He is a member of the Executive Committee of the New York Presbyterian Hospital, an owner and member of the Executive Committee

of the Boston Celtics and a Fellow of the American Academy of Arts and Sciences. Previously, he was a special advisor to President Clinton. With his wife, he founded the Hutchins Family Foundation to support healthcare, education and public policy

initiatives. Lawrence Lenihan, Co-CEO and Co-Founder, Resonance Board Member Lawrence Lenihan is the Co-Founder and Co-CEO of Resonance, a venture operating company that partners with talented creators to transform the fashion industry by uniquely

combining venture investing experience, fashion industry insight and expertise, manufacturing knowledge and capability and technology vision. Prior to Resonance, Lawrence founded FirstMark Capital in New York City which has backed some of the most

successful commerce companies in the market today including Tommy John, Pinterest and Shopify. Lawrence is an Adjunct Professor at NYU’s Stern School where he teaches Next Generation Retail. Lawrence H. Summers, Charles W. Eliot University

Professor and President Emeritus at Harvard University Advisor Lawrence H. Summers is the Charles W. Eliot University Professor and President Emeritus at Harvard University. He served as the 71st Secretary of the Treasury for President Clinton and

the Director of the National Economic Council for President Obama.

GRAYSCALE | 23 Digital Currency

Group’s Investors

XBX Index Case Studies GRAYSCALE | 24

XBX Index Update: Removing OKCoin (February 17, 2017) https://tradeblock.com/blog/xbx-index-update-removing-okcoin Bitfinex Flash Crash Analysis (August 20, 2015) https://tradeblock.com/blog/bitfinex-flash-crash-analysis Analysis of Bitfinex

Anomalies and XBX Index Performance (May 8, 2015) https://tradeblock.com/blog/analysis-of-bitfinex-anomalies-and-xbx-performance XBX Index Update: Adding Coinbase, Removing Kraken (May 1, 2015)

https://tradeblock.com/blog/xbx-update-adding-coinbase-removing-kraken XBX Update: Adding OKCoin, Removing BTC-e and BTCChina (February 23, 2015) https://tradeblock.com/blog/xbx-update-adding-okcoin-removing-btc-e-and-btcchina

Recent Government & Regulatory News

GRAYSCALE | 25 South Korea Prepares Bill to Provide Legal Framework for Cryptocurrencies (July 3, 2017) https://news.bitcoin.com/south-korea-prepares-bill-to-provide-legal-framework-for-cryptocurrencies/ Indian Government Mulling Legalising Bitcoin

Cryptocurrency In India (June 26, 2017) https://inc42.com/buzz/bitcoin-cryptocurrency-india-government/ Consortium Launched to Prevent Criminal Uses of Cryptocurrencies (June 12, 2017)

https://cointelegraph.com/news/consortium-launched-to-prevent-criminal-uses-of-cryptocurrencies Australia Will Recognize Bitcoin as Money and Protect Bitcoin Businesses, No Taxes (May 11, 2017)

https://cointelegraph.com/news/australia-will-recognize-bitcoin-as-money-and-protect-bitcoin-businesses-no-taxes Bitcoin value rises over $1 billion as Japan, Russia move to legitimize cryptocurrency (April 12, 2017)

http://www.cnbc.com/2017/04/12/bitcoin-price-rises-japan-russia-regulation.html Japan Officially Recognizes Bitcoin as Currency Starting April 2017 (April 2, 2017)

http://www.newsbtc.com/2017/04/02/japan-officially-recognises-bitcoin-currency-starting-april-2017/ PBOC Lists New Rules for Chines Bitcoin Exchanges (March 9, 2017) https://news.bitcoin.com/pboc-rules-bitcoin-exchanges/ Governments Around the World

Are Warming Up to Bitcoin and the Blockchain (March 01, 2017) http://www.nasdaq.com/article/governments-around-the-world-are-warming-up-to-bitcoin-and-the-blockchain-cm586766

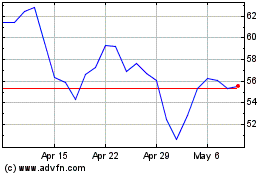

Grayscale Bitcoin Trust ... (AMEX:GBTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

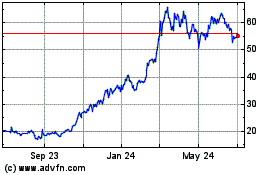

Grayscale Bitcoin Trust ... (AMEX:GBTC)

Historical Stock Chart

From Apr 2023 to Apr 2024