Fossil's Sales, Earnings Slump

August 09 2016 - 5:30PM

Dow Jones News

Fossil Group Inc. said profit tumbled in the second quarter as

the watchmaker's global sales dropped, paced by declines in the

traditional watches it makes for brands including Emporio Armani,

Michael Kors and Skagen.

The company also gave downbeat guidance for the current quarter,

though shares jumped 7.4% as second-quarter results weren't as bad

as investors feared.

The Texas company has been trying to revamp its assortment as

high-tech rivals such as Apple Inc. and Samsung Electronics Co.

launch smartwatches. In March, Fossil said it would fast-track more

than 100 new products across several brands this year as it fights

to compete and grab a share of the growing market for smartwatches

and wearable devices, launches it says will allow it to raise

prices and lift its profit margin.

On Tuesday, Chief Executive Kosta Kartsotis said sales trends

remain challenging but were "relatively stable" during the quarter

"considering the disruptive environment." He highlighted strength

in other areas of the business—jewelry sales, for example, rose

2%—that "were being masked by continued weakness in the traditional

watch category, particularly among our licensed brands." Total

sales fell 7.4% from a year earlier.

Fossil signaled that sales would remain soft in the current

quarter, falling 2% to 6% from the year-ago quarter. The company

projected 15 cents to 40 cents in per-share profit, far short of

the 68 cents analysts have expected.

For the year, Fossil backed its sales view after slashing it in

May, still forecasting a decline of 1.5% to 5% this year. The

company pulled in the high end of its earnings guidance, now

predicting $1.80 to $2.65 a share versus a previous range of $1.80

to $2.80. Analysts predict $2.06 in profit per share this year.

Over all for June quarter, Fossil reported a profit of $6

million, or 12 cents a share, down from $54.6 million, or $1.12 a

share, a year earlier.

Revenue declined to $685.4 million from $740 million. Analysts

projected 9 cents in adjusted earnings per share on $671.9 million

in sales, according to Thomson Reuters. The company said adverse

foreign-exchange rates knocked 4 cents off its bottom line and

shaved $6.8 million off sales.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

August 09, 2016 17:15 ET (21:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

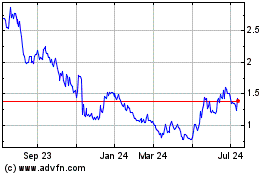

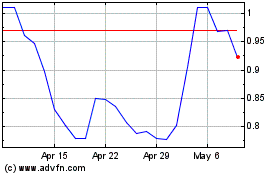

Fossil (NASDAQ:FOSL)

Historical Stock Chart

From Aug 2024 to Sep 2024

Fossil (NASDAQ:FOSL)

Historical Stock Chart

From Sep 2023 to Sep 2024