TIDMFPO

RNS Number : 8390P

First Property Group PLC

11 June 2015

Date: 11 June 2015

On Behalf of: First Property Group plc ("First Property", "the Company" or "the Group")

Embargoed: 0700hrs

First Property Group plc

Preliminary Results for the twelve months to 31 March 2015

First Property Group plc (AIM: FPO), the property fund manager

and investor, today announces its preliminary results for the

twelve months ended 31 March 2015.

Financial highlights:

Unaudited Audited Percentage

Year to Year to change

31 March 31 March

2015 2014

------------------------------------- ----------- ---------- -----------

Profit before tax GBP8.08m GBP6.60m +22.4%

===================================== =========== ========== ===========

Diluted earnings per share 6.93p 4.53p +53.0%

===================================== =========== ========== ===========

Total dividend per share 1.35p 1.12p +20.5%

===================================== =========== ========== ===========

Profit before unallocated central

overheads and tax by segment:

------------------------------------- ----------- ---------- -----------

Property fund management (FPAM) GBP4.44m GBP2.63m +68.8%

===================================== =========== ========== ===========

Group Properties* GBP6.57m GBP6.32m +4.0%

------------------------------------- ----------- ---------- -----------

Average EUR/GBP rate used 1.285 1.188 -8.2%

===================================== =========== ========== ===========

Net assets GBP31.02m GBP23.46m +32.2%

===================================== =========== ========== ===========

Cash Balances GBP12.24m GBP11.28m +8.5%

===================================== =========== ========== ===========

Group Properties* at market value GBP142.04m GBP69.08m

===================================== =========== ========== ===========

Group Properties*at book value GBP126.90m GBP61.06m

===================================== =========== ========== ===========

Gross Debt secured against Group

Properties GBP107.78m GBP49.33m

===================================== =========== ========== ===========

LTV % 75.89% 71.41%

===================================== =========== ========== ===========

Net assets per share 26.30p 20.00p +31.5%

===================================== =========== ========== ===========

Adjusted net assets per share** 35.75p 24.80p +44.2%

===================================== =========== ========== ===========

Year-end EUR/GBP rate used 1.382 1.210 -14.2%

===================================== =========== ========== ===========

Assets under management (including

Group Properties) GBP327m GBP357m -8.4%

===================================== =========== ========== ===========

Poland 65% 69%

===================================== =========== ========== ===========

UK 33% 28%

===================================== =========== ========== ===========

Romania 2% 3%

------------------------------------- ----------- ---------- -----------

* Excludes the Group's non-controlling interests in four other FPAM managed funds.

** Calculated according to EPRA triple net valuation

methodology, which includes fair values of i) financial instruments

ii) debt and iii) deferred taxes.

Operational Highlights (and explanatory notes):

-- The increase in profit before tax to GBP8.08 million (2014:

GBP6.60 million) was largely attributable to the contribution made

to earnings by:

o Fund Management - The performance fee earned by the Group of

GBP3.2 million (2014: nil) on profits realised by Fprop PDR.

o Group Properties:

i. The purchase by the Group and FOP of six properties in Poland

and Romania during the year which made a contribution to the

Group's profit before unallocated overheads and tax of GBP2.27

million (2014: nil). These acquisitions also resulted in GBP1.84

million of negative goodwill, a non-cash item which has been

credited to the Income Statement; and

ii. The full year contribution to profit before unallocated

overheads and tax from the additional properties purchased by the

Group and FOP in the previous year of GBP1.83 million (2014:

GBP676,000).

-- Final dividend increased to 1 penny per share (2014: 0.79

pence per share), an increase of 27%, which together with the

interim dividend of 0.35 pence (2014: 0.33 pence) equates to a

dividend for the year of 1.35 pence per share (2014: 1.12 pence per

share).

-- New fund established in January 2015 on behalf of

Shipbuilding Industry Pension Scheme (SIPS) with a commitment of

GBP125 million for an initial term of ten years targeting

investments in the United Kingdom. The Group's UK efforts are now

concentrated on investing this.

-- Funds under management in Central and Eastern Europe (CEE)

once again rated by Investment Property Databank (IPD) as the best

performing versus the IPD CEE universe, now for the annualised

periods from 2005 to the end of each of the years between

31December 2008 and 31 December 2014.

-- The impact of a weaker Euro versus Sterling during the year

resulted in profit before tax being some GBP258,000 lower than it

would otherwise have been.

Commenting on the results, Ben Habib, Chief Executive of First

Property Group, said:

"The financial year just ended has been transformational for the

Group principally because of the six investments made by it and FOP

in Poland and Romania, which should yield recurring profit before

unallocated overheads and tax of just over GBP6 million per annum.

These earnings will more than replace the fee income we used to

earn from the USS fund which expires in August 2015 and which at

its peak amounted to some GBP3 million per annum.

"The Group's future earnings are substantially underpinned, its

balance sheet is strong, the economies in which we operate are

growing, we have investment mandates which will result in the

Group's earnings growing and we are working on new interesting

transactions. I therefore look to the future with excitement and

confidence."

A briefing for analysts will be held at 10.00hrs today at the

Group's headquarters, 35 Old Queen Street, London, SW1H 9JA. A

conference call facility will also be available on +44 (20) 7984

7578, passcode: 540877. A copy of the accompanying investor

presentation can be accessed simultaneously at

http://www.fprop.com/plc-results/81/88/. A recorded copy of the

call will subsequently be posted on the Company website,

www.fprop.com.

For further information please contact:

First Property Group plc Tel: +44 (20) 7340

0270

Ben Habib (Chief Executive www.fprop.com

Officer) investor.relations@fprop.com

George Digby (Group Finance

Director)

Jeremy Barkes (Director,

Business Development)

Arden Partners (NOMAD & Tel: + 44 (20) 7614

Broker) 5900

Chris Hardie (Director,

Corporate Finance)

Michael McNeilly (Corporate

Finance)

Redleaf Polhill (PR) Tel:+ 44 (20) 382

4734

Richard Gotla / Henry Columbine firstproperty@redleafpr.com

Notes to investors and editors:

First Property Group plc is a property fund manager and investor

with operations in the United Kingdom and Central Europe. Its

earnings are derived from:

-- Fund management - via its FCA regulated and AIFMD approved

subsidiary, First Property Asset Management Ltd (FPAM), which earns

fees from investing for third parties in property in the UK and

Central Europe;

-- Group Properties - principal investments by the Group, currently comprising:

o Six directly owned properties in Poland and Romania;

o Five properties in Poland held by Fprop Opportunities plc

(FOP), an FPAM managed fund in which the Group is a 76.2%

shareholder;

o Non-controlling interests in four other funds managed by

FPAM.

FPAM funds have ranked No.1 versus the Investment Property

Databank (IPD) Central & Eastern Europe (CEE) universe for the

annualised periods from the commencement of its operations in

Poland in 2005 to the end of each of the years between 31 December

2008 and 31 December 2014.

First Property Asset Management Limited is authorised and

regulated by the Financial Conduct Authority. Further information

about the Company and its products can be found at:

www.fprop.com.

CHIEF EXECUTIVE'S STATEMENT

Financial results

I am pleased to report final results for the twelve months ended

31 March 2015.

Revenue earned by the Group increased to GBP18.52 million (2014:

GBP18.05 million) yielding a profit before tax of GBP8.08 million

(2014: GBP6.60 million). The increase in profit before tax is

principally attributable to the contribution to earnings made

by:

-- Fund Management - the performance fee earned by the Group of

GBP3.2 million (2014: nil) on profits realised by Fprop PDR.

-- Group Properties:

i. The purchase by the Group and FOP of six properties in Poland

and Romania during the year which made a contribution to the

Group's profit before unallocated overheads and tax of GBP2.27

million (2014: nil). These acquisitions also resulted in GBP1.84

million of negative goodwill, a non-cash item which has been

credited to the Income Statement; and

ii. The full year contribution to profit before unallocated

overheads and tax from the additional properties purchased by the

Group and FOP in the previous year of GBP1.83 million (2014:

GBP676,000).

Diluted earnings per share were 6.93 pence (2014: 4.53

pence).

The Group ended the period with net assets of GBP31.02 million

(2014: GBP23.46 million).

Its cash balances increased to GBP12.24 million (2014: GBP11.28

million) despite having made some GBP80 million of new, leveraged

property investments. Of this cash, GBP3.26 million (2014: GBP4.14

million) was held by Fprop Opportunities plc (FOP), which is 76.2%

owned by the Group and GBP573,000 (2014: GBP528,000) was held by

Corp SA (90% owned by the Group), the property management company

for Blue Tower in Warsaw.

Dividend

The Directors have resolved to recommend increasing the final

dividend to 1 penny per share (2014: 0.79 pence per share), an

increase of 27%, which together with the interim dividend of 0.35

pence per share (2014: 0.33 pence per share) equates to a dividend

for the year of 1.35 pence per share (2014: 1.12 pence per share).

The substantial increase in the final dividend results from the

material increase in the Group's underlying recurring earnings and

the Directors' confidence in the sustainability of these.

The proposed final dividend will be paid on 30 September 2015 to

shareholders on the register at 21 August 2015, and is subject to

shareholder approval at the forth coming annual general

meeting.

REVIEW OF OPERATIONS

Key Points

The annualised earnings before unallocated overheads and tax of

just over GBP6 million which the Group expects to earn from the six

properties acquired by it and FOP during the year, more than

replaces the fee income we used to earn from the USS fund which

expires in August 2015 and which, at its peak, amounted to some

GBP3 million per annum.

When the earnings from the six new property investments are

combined with the Group and FOP's existing investments, the

annualised recurring contribution to the Group's profit before

unallocated overheads and tax will amount to some GBP9.5

million.

Our development activity in the United Kingdom, via Fprop PDR,

made a contribution to the Group of GBP3.86 million and yielded

investors in that fund a total return of GBP16.6 million on equity

deployed of GBP30.35 million, translating into a net return on

equity of 53% and an IRR of 98% per annum. Fprop PDR is likely to

make a further contribution to profit before unallocated central

overheads and tax of some GBP1 million for the year to 31 March

2016, resulting from transactions concluded last year. However, the

Permitted Development Rights legislation is due to expire in May

2016 and we do not therefore expect any further transactions to be

undertaken by Fprop PDR, unless the legislation is extended in some

way.

The Group's UK efforts are now concentrated on investing the

GBP125 million fund management mandate awarded to us by SIPS.

PROPERTY FUND MANAGEMENT (First Property Asset Management Ltd or

FPAM)

As at 31 March 2015 aggregate assets under management,

calculated by reference to independent third party valuations,

stood at GBP327 million (2014: GBP357 million), including some

GBP142 million (2014: GBP69 million) of properties held by the

Group. Of these, 33% were located in the UK, 65% in Poland and 2%

in Romania. With the exception of Fprop PDR, fees are levied by

FPAM by reference to funds under management excluding cash and cash

commitments.

Revenue earned by this division amounted to GBP6.14 million

(2014: GBP4.27 million), resulting in a profit before unallocated

central overheads and tax of GBP4.44 million (2014: GBP2.63

million) and representing 40% (2014: 29%) of Group profit before

unallocated central overheads and tax.

Revenue from the USS fund reduced to GBP1.54 million (2014:

GBP2.5 million) as a result of disposals by the fund. Following the

expiry of the USS fund management contract FPAM's fund management

fee income, excluding performance fees, will amount to some GBP1.35

million per annum.

First Property Asset Management Ltd (FPAM) now manages eight

closed-end funds, having established one new fund during the year

under review. A brief synopsis of the value of assets and maturity

of each of these funds is set out below:

Fund Country Established Fund Assets % of total

of investment Expiry under assets

management under

at market management

value

--------------------- ---------------- ------------- ---------- ----------------- ------------

SAM Property UK Aug-2004 Rolling * *

Company

Ltd (SAM)

--------------------- ---------------- ------------- ---------- ----------------- ------------

Regional

Property

Trading

Ltd (RPT) Poland Aug-2004 Aug-2020 GBP6.21m 1.9%

--------------------- ---------------- ------------- ---------- ----------------- ------------

5(th) Property

Trading

Ltd (5PT) Poland Dec-2004 Dec-2017 GBP7.68m 2.4%

--------------------- ---------------- ------------- ---------- ----------------- ------------

USS Fprop

Managed

Property

Portfolio

LP Poland Aug-2005 Aug-2015 GBP62.91m 19.2%

--------------------- ---------------- ------------- ---------- ----------------- ------------

UK Pension

Property

Portfolio

LP (UK

PPP) UK Feb-2010 Feb-2017 GBP94.35m 28.8%

--------------------- ---------------- ------------- ---------- ----------------- ------------

GBP3.61

Fprop PDR m* (commitment

LP UK Oct-2013 May-2018 of GBP42m) 1.1%

--------------------- ---------------- ------------- ---------- ----------------- ------------

SIPS Property GBP10.33m

Nominee (commitment

Ltd UK Jan-2015 Jan-2025 of GBP125m) 3.2%

--------------------- ---------------- ------------- ---------- ----------------- ------------

Sub total GBP185.09m 56.6%

------------------------------------------------------------------ ----------------- ------------

Fprop Opportunities

plc (FOP) Poland Oct-2010 Oct-2020 GBP54.44m 16.6%

--------------------- ---------------- ------------- ---------- ----------------- ------------

Group Properties

(excluding Poland

FOP) & Romania n/a n/a GBP87.60m 26.8%

--------------------- ---------------- ------------- ---------- ----------------- ------------

Sub total GBP142.04m 43.4%

------------------------------------------------------------------ ----------------- ------------

Total GBP327.13m 100%

================================================================== ================= ============

*Not subject to recent revaluation

Independent fund performance analysis:

Our investments in Central and Eastern Europe (CEE) have once

again been ranked No.1 by Investment Property Databank (IPD)

against the IPD CEE universe, now for the annualised periods from

the commencement of FPAM's operations in Poland in 2005 to the end

of each of the years between 31 December 2008 and 31 December

2014.

New business:

Poland - we are in preliminary discussions with potential

investors to establish a new fund targeting minimum rates of return

on equity invested of 15% per annum.

TOTAL GROUP PROPERTIES

The Group increased its property holdings (including those held

by FOP) from five to eleven during the year under review, as set

out below:

Property No. of Book value Market Contribution

properties value to Group

profit

before

tax and

overheads

---------------- ------------ ----------- ----------- ----------------

Continuing

---------------- ------------ ----------- ----------- ----------------

Blue Tower 1 GBP12.64m GBP14.18m GBP1,461,000

---------------- ------------ ----------- ----------- ----------------

FOP 4 GBP42.76m GBP45.76m GBP1,135,000

---------------- ------------ ----------- ----------- ----------------

Sub total 5 GBP55.40m GBP59.94m GBP2,596,000

---------------- ------------ ----------- ----------- ----------------

New investments

during the

year

---------------- ------------ ----------- ----------- ----------------

Poland 2 GBP58.00m GBP66.19m GBP1,263,000(1)

---------------- ------------ ----------- ----------- ----------------

Romania 3 GBP5.08m GBP7.23m GBP634,000(2)

---------------- ------------ ----------- ----------- ----------------

FOP 1 GBP8.42m GBP8.68m GBP369,000(3)

---------------- ------------ ----------- ----------- ----------------

Sub total 6 GBP71.50m GBP82.10m GBP2,266,000

---------------- ------------ ----------- ----------- ----------------

Total 11 GBP126.90m GBP142.04m GBP4,862,000

================ ============ =========== =========== ================

(1) The contribution to Group profit from its two new property

investments in Poland was for the period from 15 December 2014 to

31 March 2015.

(2) The contribution to Group profit from its three new property

investments in Romania was for the period from 27 July 2014 to 31

March 2015.

(3) The contribution to FOP's profit (which is consolidated into

the accounts of the Group) from its one new property investment in

Poland was for the period from 19 September 2014 to 31 March

2015.

It is the Group's policy to carry its investments at the lower

of cost or market value for accounting purposes.

Other Property Interests:

Group Properties also comprises non-controlling interests in

four other funds managed by FPAM, as set out in the table

below.

Non controlling interest in funds managed by FPAM at 31 March

2015:

Fund % owned Book value Current Group's

by of First market share

First Property's value of pre-tax

Property share of holdings profit

Group in earned

fund by fund

FY2015

-------------------- ---------- ------------- ------------- ------------

Investments

-------------------- ---------- ------------- ------------- ------------

UK Pension 0.9% GBP893,000 GBP893,000 GBP64,000

Property Portfolio

LP (UK PPP)

-------------------- ---------- ------------- ------------- ------------

Fprop PDR LP 4.9% GBP638,000 GBP638,000 GBP630,000

-------------------- ---------- ------------- ------------- ------------

Interest in

associates

-------------------- ---------- ------------- ------------- ------------

5(th) Property 37.8% GBP519,000 GBP998,000 GBP153,000

Trading Ltd

(5PT)

-------------------- ---------- ------------- ------------- ------------

Regional Property 25.8% GBP152,000 GBP177,000 GBP32,000

Trading Ltd

(RPT)

-------------------- ---------- ------------- ------------- ------------

Share of results GBP671,000 GBP1,175,000 GBP185,000

in associates

-------------------- ---------- ------------- ------------- ------------

Total GBP2,202,000 GBP2,706,000 GBP879,000

==================== ========== ============= ============= ============

Revenue from Group Properties, including FOP, amounted to

GBP12.38 million (2014: GBP13.78 million), generating a profit

before unallocated central overheads and tax of GBP6.57 million

(2014: GBP6.32 million) and representing 60% (2014: 71%) of Group

profit before unallocated central overheads and tax.

The reduction in revenue was attributable to the Group ceasing

its development activities in the UK, which were instead carried

out by Fprop PDR.

The increase in profit before unallocated central overheads and

tax was attributable to:

i. The purchase by the Group and FOP of six properties in Poland

and Romania during the year which made a contribution to the

Group's profit before unallocated overheads and tax of GBP2.27

million (2014: nil). These acquisitions also resulted in GBP1.84

million of negative goodwill, a non-cash item which has been

credited to the Income Statement; and

ii. The full year contribution to profit before unallocated

overheads and tax from the additional properties purchased by the

Group and FOP in the previous year of GBP1.83 million (2014:

GBP676,000).

Commercial property markets outlook

Poland:

GDP growth in Poland, Europe's sixth largest economy,

accelerated to 3.4% in 2014 and is forecast to grow by the same

amount in 2015 and 2016. Rent levels for commercial property are

generally sustainable, subject to location. Capital values remain

largely unchanged from their credit crunch lows and yield some 2-3%

more than equivalent property in Western Europe. In addition,

Poland's banking sector is well capitalised and keen to lend

against property at record low interest rates.

Poland is a tangential beneficiary of the quantitative easing

taking place in the euro zone, which has boosted economic activity

in Germany and by association Poland; some 40% of Poland's trade is

with Germany. QE has also, amongst other things, suppressed euro

interest rates and the value of the euro (the currency in which

most Polish commercial property transacts and in which rents are

paid), translating into reduced capital values for non-euro based

investors. Given this confluence of circumstances, we believe the

business case for property investment in Poland to be highly

compelling.

United Kingdom:

The UK was the fastest growing major advanced economy in 2014,

growing at 2.8%, and is forecast by the OBR to grow by 2.5% in

2015. Consumer confidence is at a twelve year high and occupier

demand for commercial property is growing across the board. This is

slowly manifesting itself in increasing property values and rising

rents. Investment demand, including from international investors,

continues to spread into the regions.

We expect the newly elected Government to continue its efforts

to loosen the planning system to enable higher rates of new

development. We shall be looking out in particular for any news of

its intention to extend Permitted Development Rights (PDR) beyond

its current scheduled expiry in May 2016.

Current Trading and Prospects

The financial year just ended has been transformational for the

Group principally because of the six investments made by it and FOP

in Poland and Romania, which should yield recurring profit before

unallocated overheads and tax of just over GBP6 million per annum.

These earnings will more than replace the fee income we used to

earn from the USS fund which expires in August 2015 and which at

its peak amounted to some GBP3 million per annum.

The Group's future earnings are substantially underpinned, its

balance sheet is strong, the economies in which we operate are

growing, we have investment mandates which will result in the

Group's earnings growing and we are working on new interesting

transactions. I therefore look to the future with excitement and

confidence.

Ben Habib

Chief Executive

11 June 2015

CONSOLIDATED INCOME STATEMENT

for the year ended 31 March 2015

Notes Year ended Year ended

31 March 31 March

2015 (unaudited) 2014

Total (audited)

results

Total

results

GBP'000 GBP'000

-------------------------------- ------ ------------------- ---------------------

Revenue - existing operations 14,325 17,004

- business acquisitions 4,198 1,041

-------------------------------- ------ ------------------- ---------------------

18,523 18,045

-------------------------------- ------ ------------------- ---------------------

Cost of sales (3,156) (5,800)

-------------------------------- ------ ------------------- ---------------------

Gross profit 15,367 12,245

Recognition of negative 1,123 -

goodwill on refinancing

of subsidiary

Recognition of negative 716 -

goodwill on acquisition

of subsidiaries

Fair value adjustment (876) -

to investment properties

Operating expenses (6,925) (5,019)

-------------------------------- ------ ------------------- ---------------------

Operating profit 9,405 7,226

-------------------------------- ------ ------------------- ---------------------

Share of results in associates 185 190

Distribution income 694 63

Re-classification of

profit - 35

Loss on disposal of asset

held for resale - (7)

Interest income 145 148

Interest expense (2,346) (1,057)

-------------------------------- ------ ------------------- ---------------------

Profit before tax 8,083 6,598

Tax credit/(charge) 5 328 (962)

-------------------------------- ------ ------------------- ---------------------

Profit for the year 8,411 5,636

-------------------------------- ------ ------------------- ---------------------

Attributable to:

Owners of the parent 8,172 5,281

Non-controlling interest 239 355

8,411 5,636

Earnings per share:

Basic 6 7.21p 4.75p

Diluted 6 6.93p 4.53p

-------------------------------- ------ ------------------- ---------------------

All operations are continuing.

CONSOLIDATED SEPARATE STATEMENT

OF OTHER COMPREHENSIVE INCOME

for the year ended 31 March 2015

Year ended Year ended

31 March 31 March

2015 2014

(unaudited) (audited)

Total Total

results results

GBP'000 GBP'000

----------------------------------- --- ------------- -----------

Profit for the year 8,411 5,636

---------------------------------------- ------------- -----------

Other comprehensive income

Exchange differences

on retranslation of foreign

subsidiaries 272 (128)

Re-classification of

profit - (35)

Revaluation of available-for-sale 37 -

financial assets

Taxation - -

----------------------------------- --- ------------- -----------

Total comprehensive income

for the year 8,720 5,473

Total comprehensive income

for the year attributable

to:

Owners of the parent 8,505 5,327

Non-controlling interest 215 146

8,720 5,473

--------------------------------------- ------------- -----------

CONSOLIDATED BALANCE SHEETS

As at 31 March 2015

Notes As at As at

31 March 31 March

2015 2014

(unaudited) (audited)

GBP'000 GBP'000

Non-current assets

Goodwill 7 153 153

Investment properties 8 114,262 48,759

Property, plant and equipment 43 65

9

Interest in associates (a) 671 675

9

Other financial assets (b) 1,531 1,706

Other receivables 11 283 400

Deferred tax assets 3,803 839

------------------------------- ------ ------------- -----------

Total non-current assets 120,746 52,597

------------------------------- ------ ------------- -----------

Current assets

Inventories - land and

buildings 10 12,639 12,304

Current tax assets 236 76

Trade and other receivables 11 5,744 4,135

Cash and cash equivalents 12,240 11,279

------------------------------- ------ ------------- -----------

Total current assets 30,859 27,794

------------------------------- ------ ------------- -----------

Current liabilities

Trade and other payables 12 (8,134) (4,224)

Financial liabilities 13 (11,788) (4,349)

Current tax liabilities (108) (247)

------------------------------- ------ ------------- -----------

Total current liabilities (20,030) (8,820)

------------------------------- ------ ------------- -----------

Net current assets 10,829 18,974

------------------------------- ------ ------------- -----------

Total assets less current

liabilities 131,575 71,571

------------------------------- ------ ------------- -----------

Non-current liabilities:

Deferred tax liabilities (2,631) (897)

Financial liabilities 13 (97,925) (47,212)

Net assets 31,019 23,462

------------------------------- ------ ------------- -----------

Equity

Called up share capital 1,149 1,149

Share premium 5,505 5,498

Foreign exchange translation

reserve (618) (914)

Revaluation reserve (49) (86)

Share-based payment reserve 203 203

Retained earnings 23,735 16,717

------------------------------- ------ ------------- -----------

Equity attributable to

the owners of the parent 29,925 22,567

Non-controlling interest 1,094 895

------------------------------- ------ ------------- -----------

Total equity 31,019 23,462

------------------------------- ------ ------------- -----------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the year ended 31 March 2015

Group Share Share Share-based Foreign Purchase Investment Retained Non-controlling Total

capital premium payment exchange of own revaluation earnings interest

reserve translation shares reserve

reserve

GBP'000 GBP'000

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- -------- -------- ------------ ------------ --------- ------------ --------- ---------------- --------

At 1

April

2014 1,149 5,498 203 (914) (310) (86) 17,027 895 23,462

Profit

for the

period - - - - - - 8,411 - 8,411

Net change

in available

for sale

financial

assets - - - - - 37 - - 37

Movement

on foreign

exchange - - - 296 - - - (24) 272

Sale

of treasury

shares - 7 - - 137 - - - 144

Non-controlling

interest - - - - - - (239) 239 -

Dividends

paid - - - - - - (1,291) (16) (1,307)

----------------- -------- -------- ------------ ------------ --------- ------------ --------- ---------------- --------

At 31

March

2015 1,149 5,505 203 (618) (173) (49) 23,908 1,094 31,019

----------------- -------- -------- ------------ ------------ --------- ------------ --------- ---------------- --------

At 1

April

2013 1,149 5,492 203 (995) (603) (51) 12,947 401 18,543

Profit

for the

period - - - - - - 5,636 - 5,636

Net change

in available

for sale

financial

assets - - - - - (35) - - (35)

Movement

on foreign

exchange - - - 81 - - - (209) (128)

Sale

of treasury

shares - 6 - - 293 - - - 299

Non-controlling

interest - - - - - - (355) 355 -

Decrease

in

non-controlling

interest

(acquisition

of CORP) - - - - - - - (63) (63)

Increase

in

non-controlling

interest

(FOP) - - - - - - - 507 507

Dividends

paid - - - - - - (1,201) (96) (1,297)

----------------- -------- -------- ------------ ------------ --------- ------------ --------- ---------------- --------

At 31

March

2014 1,149 5,498 203 (914) (310) (86) 17,027 895 23,462

----------------- -------- -------- ------------ ------------ --------- ------------ --------- ---------------- --------

CONSOLIDATED CASH FLOW STATEMENTS

for the year ended 31 March 2015

2015 2014

Notes Group Group

GBP'000 GBP'000

----------------------------------- ------ --------- ---------

Cash flows from operating

activities

----------------------------------- ------ --------- ---------

Operating profit 9,405 7,226

Adjustments for:

Depreciation of investment

property, plant & equipment 387 31

Fair value adjustment 876 -

on investment properties

Negative goodwill (1,839) -

Share based payments - -

(Increase)/decrease in

inventories (258) (4,474)

(Increase)/decrease in

trade and other receivables (486) (2,604)

Increase/(decrease) in

trade and other payables 577 1,547

Other non-cash adjustments 81 203

----------------------------------- ------ --------- ---------

Cash generated from operations 8,743 1,929

Taxes paid (826) (552)

----------------------------------- ------ --------- ---------

Net cash flow from operating

activities 7,917 1,377

----------------------------------- ------ --------- ---------

Cash flow from/(used

in) investing activities

----------------------------------- ------ --------- ---------

Purchase of investments (353) (849)

Proceeds from investments 565 -

Proceeds from sale of

financial assets - 28

Capital expenditure investment

properties (383) (46)

Proceeds from sale of

shares in associates - 23

Cash paid on acquisitions

of new subsidiaries 4 (4,638) (4,415)

Cash and cash equivalents

received on acquisitions

of new subsidiaries 4 3,055 786

Purchase of non-controlling

interest - (126)

Purchase of investment

property - (555)

Purchase of property,

plant & equipment (14) (60)

Interest received 145 148

Dividends from associates 189 107

Distributions received 694 63

----------------------------------- ------ --------- ---------

Net cash flow from investing

activities (740) (4,896)

----------------------------------- ------ --------- ---------

Cash flow (used in)/from

financing activities

Proceeds from issue of

shares to non-controlling

interest - 507

Proceeds from non-controlling

interest shareholder

loan in subsidiary - 1,206

Repayment of shareholder

loan in subsidiary (293) (107)

Proceeds from bank loan 3,547 3,136

Repayment of bank loan (4,574) (387)

Repayment of finance

lease (1,202) (463)

Sale of shares held in

Treasury 144 299

Interest paid (2,266) (1,029)

Dividends paid (1,291) (1,201)

Dividends paid to non-controlling

interest (16) (96)

----------------------------------- ------ --------- ---------

Net cash flow (used in)/from

financing activities (5,951) 1,865

----------------------------------- ------ --------- ---------

Net increase in cash

and cash equivalents 1,226 (1,654)

----------------------------------- ------ --------- ---------

Cash and cash equivalents

at the beginning of the

year 11,279 12,979

----------------------------------- ------ --------- ---------

Currency translation

gains/(losses) on cash

and cash equivalents (265) (46)

----------------------------------- ------ --------- ---------

Cash and cash equivalents

at the year-end 12,240 11,279

----------------------------------- ------ --------- ---------

1. Basis of preparation

-- These preliminary financial statements have not been audited

and are derived from the statutory accounts within the meaning of

section 434 of the Companies Act 2006. They have been prepared in

accordance with the Group's accounting policies that will be

applied in the Group's annual financial statements for the year

ended 31 March 2015. These are consistent with the policies applied

for the year ended 31 March 2014. These accounting policies are

drawn up in accordance with International Accounting Standards

(IAS) and International Financial Reporting Standards (IFRS) as

issued by the International Accounting Standards Board and as

adopted by the European Union (EU). Whilst the financial

information included in this preliminary statement has been

prepared in accordance with IFRS, this announcement does not itself

contain sufficient information to fully comply with IFRS. The

comparative figures for the financial year ended 31 March 2014 are

not the statutory accounts for the financial year but are derived

from those accounts prepared under IFRS which have been reported on

by the Group's auditors and delivered to the Registrar of

Companies. The report of the auditors was unqualified, did not

include references to any matter to which the auditors drew

attention by way of emphasis without qualifying their report and

did not contain a statement under section 498 (2) or (3) of the

Companies Act 2006.

-- These preliminary financial statements were approved by the

Board of Directors on 10 June 2015.

2. Revenue

Revenue from continuing operations consists of revenue arising

in the United Kingdom 20% (2014: 53%), Poland 74% (2014: 47%) and

Romania 6% (2014: nil). All revenue relates solely to the Group's

principal activities.

3. Segment reporting 2015

Property Group Group Unallocated Total

fund properties fund central

management and other properties overheads

co-investments "FOP"

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------- ------------ ---------------- ------------ ------------ ----------

External revenue

- Existing

operations

- Sale of

inventory 6,140 2,968 5,217 - 14,325

- Business - - - - -

acquisitions - 3,479 719 - 4,198

-------------------- ------------ ---------------- ------------ ------------ ----------

Total 6,140 6,447 5,936 - 18,523

-------------------- ------------ ---------------- ------------ ------------ ----------

Depreciation

and amortisation 18 363 6 - 387

-------------------- ------------ ---------------- ------------ ------------ ----------

Operating

Profit 4,435 5,454 2,454 (2,938) 9,405

-------------------- ------------ ---------------- ------------ ------------ ----------

Share of results

in associates - 185 - - 185

-------------------- ------------ ---------------- ------------ ------------ ----------

Distribution

income - 694 - - 694

-------------------- ------------ ---------------- ------------ ------------ ----------

Interest income - 36 89 20 145

-------------------- ------------ ---------------- ------------ ------------ ----------

Interest payable - (730) (1,616) - (2,346)

-------------------- ------------ ---------------- ------------ ------------ ----------

Profit/(loss)

before tax 4,435 5,639 927 (2,918) 8,083

-------------------- ------------ ---------------- ------------ ------------ ----------

Analysed as:

-------------------- ------------ ---------------- ------------ ------------ ----------

Before performance

fees and related

items 1,605 4,489 2,272 (963) 7,403

-------------------- ------------ ---------------- ------------ ------------ ----------

Negative goodwill

Felix - 1,123 - - 1,123

-------------------- ------------ ---------------- ------------ ------------ ----------

Negative goodwill

Gdynia Podolska

and Corktree - 716 - - 716

-------------------- ------------ ---------------- ------------ ------------ ----------

Fair value

adjustment - - (876) - (876)

-------------------- ------------ ---------------- ------------ ------------ ----------

Depreciation - (357) - - (357)

-------------------- ------------ ---------------- ------------ ------------ ----------

Performance

fees 3,365 - - - 3,365

-------------------- ------------ ---------------- ------------ ------------ ----------

Staff incentives (535) (194) (184) (1,955) (2,868)

-------------------- ------------ ---------------- ------------ ------------ ----------

Realised foreign

currency gain - (138) (285) - (423)

-------------------- ------------ ---------------- ------------ ------------ ----------

Total 4,435 5,639 927 (2,918) 8,083

-------------------- ------------ ---------------- ------------ ------------ ----------

Assets - Group 1,633 84,478 58,522 6,301 150,934

-------------------- ------------ ---------------- ------------ ------------ ----------

Assets- associates - 979 - (308) 671

-------------------- ------------ ---------------- ------------ ------------ ----------

Liabilities (289) (72,437) (45,666) (2,194) (120,586)

-------------------- ------------ ---------------- ------------ ------------ ----------

Net assets 1,344 13,020 12,856 3,799 31,019

-------------------- ------------ ---------------- ------------ ------------ ----------

Additions

to

non-current

assets

-------------------- ------------ ---------------- ------------ ------------ ----------

Property,

plant and

equipment 14 - - - 14

-------------------- ------------ ---------------- ------------ ------------ ----------

Investment

properties - 66,909 8,864 - 75,773

-------------------- ------------ ---------------- ------------ ------------ ----------

Investments - 353 - - 353

-------------------- ------------ ---------------- ------------ ------------ ----------

Interest in - - - - -

associates

-------------------- ------------ ---------------- ------------ ------------ ----------

Segment reporting 2014

Property Group Group Unallocated Total

fund properties fund central

management and other properties overheads

co-investments "FOP"

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------- ------------ ---------------- ------------ ------------ ---------

External revenue

- Existing

operations 4,268 2,440 2,246 - 8,954

- Sale of

inventory - 8,050 - - 8,050

- Business

acquisitions - - 1,041 - 1,041

-------------------- ------------ ---------------- ------------ ------------ ---------

Total 4,268 10,490 3,287 - 18,045

-------------------- ------------ ---------------- ------------ ------------ ---------

Depreciation

and amortisation (21) (7) (3) - (31)

-------------------- ------------ ---------------- ------------ ------------ ---------

Operating

Profit

- Existing

operations 2,630 5,010 1,388 (2,413) 6,615

- Business

acquisitions - - 611 - 611

-------------------- ------------ ---------------- ------------ ------------ ---------

Total 2,630 5,010 1,999 (2,413) 7,226

-------------------- ------------ ---------------- ------------ ------------ ---------

Share of results

in associates - 190 - - 190

-------------------- ------------ ---------------- ------------ ------------ ---------

Profit on

disposal of

asset held

for resale - - - 28 28

-------------------- ------------ ---------------- ------------ ------------ ---------

Dividend income - 63 - - 63

-------------------- ------------ ---------------- ------------ ------------ ---------

Interest income - 76 40 32 148

-------------------- ------------ ---------------- ------------ ------------ ---------

Interest payable - (251) (806) - (1,057)

-------------------- ------------ ---------------- ------------ ------------ ---------

Profit/(loss)

before tax 2,630 5,088 1,233 (2,353) 6,598

-------------------- ------------ ---------------- ------------ ------------ ---------

Analysed as:

-------------------- ------------ ---------------- ------------ ------------ ---------

Before performance

fees and related

items 2,592 5,157 1,288 (830) 8,207

-------------------- ------------ ---------------- ------------ ------------ ---------

Performance

fees 451 - - - 451

-------------------- ------------ ---------------- ------------ ------------ ---------

Staff incentives (413) (69) (55) (1,523) (2,060)

-------------------- ------------ ---------------- ------------ ------------ ---------

Realised foreign - - - - -

currency gain

-------------------- ------------ ---------------- ------------ ------------ ---------

Total 2,630 5,088 1,233 (2,353) 6,598

-------------------- ------------ ---------------- ------------ ------------ ---------

Assets - Group 1,241 16,983 54,890 6,602 79,716

-------------------- ------------ ---------------- ------------ ------------ ---------

Assets- associates - 983 - (308) 675

-------------------- ------------ ---------------- ------------ ------------ ---------

Liabilities (884) (10,935) (43,587) (1,523) (56,929)

-------------------- ------------ ---------------- ------------ ------------ ---------

Net assets 357 7,031 11,303 4,771 23,462

-------------------- ------------ ---------------- ------------ ------------ ---------

Additions

to

non-current

assets

-------------------- ------------ ---------------- ------------ ------------ ---------

Property,

plant and

equipment 41 19 - - 60

-------------------- ------------ ---------------- ------------ ------------ ---------

Investment

properties - - 28,717 - 28,717

-------------------- ------------ ---------------- ------------ ------------ ---------

Investments - 849 - - 849

-------------------- ------------ ---------------- ------------ ------------ ---------

Interest in - - - - -

associates

-------------------- ------------ ---------------- ------------ ------------ ---------

Interest income from the cash that is 100% controlled is not

allocated to a separate segment, because cash is managed centrally,

and is netted off against unallocated central overheads. Head

office costs and overheads that are common to all segments are

shown separately under unallocated central overheads. Assets,

liabilities and costs which relate to Group central activities have

not been allocated to business segments.

The geographic location of physical non-current assets is UK

GBP2,229,000 (2014: GBP2,424,000), Poland GBP109,568,000 (2014:

GBP48,934,000) and Romania GBP5,080,000 (2014: GBPNil).

4. Business acquisitions

The Group directly made three acquisitions:

- On 27 July 2014 the Group took control of Felix Development

SRL. Felix owns three properties located in Romania; and

- On 15 December 2014 the Group acquired a beneficial interest

in the entire issued share capital in Corktree Sp z.o.o and Gdynia

Podolska Sp. z.o.o. for EUR2.65m and EUR2.25m respectively. Both

Corktree's and Gdynia Podolska's main assets are office buildings

in Poland.

The Group's subsidiary Fprop Opportunities plc (FOP) made one

further acquisition during the year. On 19 September 2014 it

acquired all the share capital in Zinga Poland Sp. z.o.o for

EUR378,000. Zinga's main asset is an office block in Warsaw,

Central Poland.

Following all four purchases a total of GBP1.84m of negative

goodwill was generated.

Felix Zinga Gydnia Corktree 31 March

Podolska 2015

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- --------- --------- ---------- --------- ---------

Acquisitions of

net assets acquired

at fair value

Cash 437 310 1,501 807 3,055

Trade and other

receivables 102 438 1,029 1,048 2,617

Share in subsidiary - - - 19 19

Investment property 5,547 8,846 33,137 27,860 75,390

Trade and other

payables (369) (204) (389) (972) (1,934)

Tax liabilities (53) (52) (52) 99 (58)

Financial liabilities (3,566) (9,013) (32,204) (26,401) (71,184)

Tenant deposits (440) (29) (885) (74) (1,428)

Fair value of goodwill (1,123) (2) (392) (322) (1,839)

Foreign exchange - - - - -

reserve

Total purchase price

paid in cash 535 294 1,745 2,064 4,638

---------------------------- --------- --------- ---------- --------- ---------

(4,638)

Cash paid on acquisitions (535) (294) (1,745) (2,064) 3,055

Cash and cash equivalents

acquired on purchases 437 310 1,501 807

---------------------------- --------- --------- ---------- --------- ---------

Acquisitions net

of cash and cash

equivalents acquired (98) 16 (244) (1,257) (1,583)

---------------------------- --------- --------- ---------- --------- ---------

5. Tax expense

2015 2014

GBP'000 GBP'000

---------------------------- --------- ---------

Analysis of tax charge for

the year

Current tax (525) (761)

Deferred tax 853 (201)

Total tax charge for the

year 328 (962)

---------------------------- --------- ---------

The tax charge includes actual current and deferred tax for

continuing operations.

Brought forward tax losses, have been utilised and partially

offset against profits arising in the UK. These tax losses were not

previously recognised as a deferred tax asset due to insufficient

foreseeable taxable income being earned in the UK.

As a result of the above the effective tax rate for the Group is

-4.1% (2014:15%).

The deferred tax credit is largely attributable to the

acquisitions of Corktree and Gdynia Podolska during the year. This

has been created as a result of the nil value paid for the deferred

tax asset on acquisition. The deferred tax asset has been

restricted to two years worth of profits.

6. Earnings/NAV per share

2015 2014

---------------------------- -------- --------

Basic earnings per share 7.21p 4.75p

Diluted earnings per share 6.93p 4.53p

GBP'000 GBP'000

---------------------------- -------- --------

Basic earnings 8,172 5,281

Diluted earnings assuming

full dilution 8,187 5,298

The following numbers of shares have been used to calculate both

the basic and diluted earnings per share:

2015 2014

Number Number

--------------------------------- ------------ ------------

Weighted average number

of Ordinary shares in issue

(used for basic earnings

per share calculation) 113,348,847 111,265,093

--------------------------------- ------------ ------------

Number of share options

assumed to be exercised 4,850,000 5,750,000

--------------------------------- ------------ ------------

Total number of ordinary

shares used in the diluted

earnings per share calculation 118,198,847 117,015,093

--------------------------------- ------------ ------------

The following earnings have been used to calculate both the

basic and diluted earnings per share:

2015 2014

GBP'000 GBP'000

---------------------------------- --------- ---------

Basic earnings per share

Basic earnings 8,172 5,281

---------------------------------- --------- ---------

Diluted earnings per share

Basic earnings 8,172 5,281

Notional interest on share

options assumed to be exercised 15 17

---------------------------------- --------- ---------

Diluted earnings 8,187 5,298

---------------------------------- --------- ---------

2015 2014

--------------------------------- ------------ ------------

Net assets per share 26.30p 20.00p

Adjusted Net assets per share 35.75p 24.80p

The following numbers have been used to calculate

both the net assets and adjusted net assets

per share:

Net assets per share Number Number

--------------------------------- ------------ ------------

Number of shares in issue

at year end 113,792,541 112,952,158

GBP'000 GBP'000

--------------------------------- ------------ ------------

Net assets excluding non

controlling interest 29,925 22,567

Adjusted net assets per share Number Number

Number of shares in issue

at year end 113,792,541 112,952,158

Number of share options assumed

to be exercised 4,850,000 5,750,000

Total 118,642,541 118,702,158

Adjusted net assets per share GBP'000 GBP'000

Net assets excluding non

controlling interest 29,925 22,567

Adjustments for market value

of assets and debt 12,488 6,869

Total 42,413 29,436

7. Goodwill

2015 2014

Group Group

GBP'000 GBP'000

------------- --------- ---------

At 1 April 153 114

Additions - 39

At 31 March 153 153

------------- --------- ---------

8. Investment properties

Investment properties owned by the Group, and indirectly via FOP

are stated at cost less depreciation and accumulated impairment

losses. The properties were valued by CBRE, Polish Properties and

BNP Paribas at the Group's financial year-end at EUR176.73 million

(2014: EUR63.96 million), the Sterling equivalent at closing

foreign exchange rates being GBP127.86 million (2014: GBP52.88

million). On acquisition of the Gdynia Podolska property during the

year the Directors took the decision to depreciate the property

over the lease term. In the Director's opinion the property's

estimated residual value at the end of the period of ownership will

be lower than the carrying value. No other property has been

depreciated as the estimated residual value is expected to be

higher than the carrying value.

2015 2014

Group Group

GBP'000 GBP'000

------------------------------ --------- ---------

Investment properties

At 1 April 48,759 20,349

Business acquisitions 75,390 28,116

Capital expenditure 383 46

Purchase additions - 555

Depreciation (357) -

Fair value adjustment (876) -

Foreign exchange translation (9,037) (307)

------------------------------ --------- ---------

At 31 March 114,262 48,759

------------------------------ --------- ---------

9. Investment in associates and other financial assets

The Group has the following investments:

2015 2014

Group Group

GBP'000 GBP'000

---------------------------- --------- ---------

a) Associates

At 1 April 675 615

Disposals - (23)

Share of associates profit

after tax 185 190

Dividends received (189) (107)

---------------------------- --------- ---------

At 31 March 671 675

---------------------------- --------- ---------

The Group's investments in associated companies is held at cost

plus its share of post-acquisition profits assuming the adoption of

the cost model for accounting for investment properties under IAS40

and comprises the following:

2015 2014

Group Group

GBP'000 GBP'000

----------------------------------- --------- ---------

Investments in associates

5(th) Property Trading Ltd 827 863

Regional Property Trading

Ltd 152 120

----------------------------------- --------- ---------

979 983

----------------------------------- --------- ---------

Less: Share of profit after

tax withheld on sale of property

to 5(th) Property Trading

Ltd in 2007 (308) (308)

----------------------------------- --------- ---------

671 675

----------------------------------- --------- ---------

If the Group had adopted the alternative fair value model for

accounting for investment properties, the carrying value of the

investment in associates would have increased by GBP504,000 (2014:

GBP775,000) to GBP1,175,000 (2014: GBP1,450,000).

2015 2014

Group Group

GBP'000 GBP'000

------------------------------- --------- ---------

b) Other financial assets

and investments

At 1 April 1,706 892

Additions 353 849

Disposals (565) (35)

Increase in fair value during 37 -

the year

------------------------------- --------- ---------

At 31 March 1,531 1,706

------------------------------- --------- ---------

The Group holds two unlisted investments in funds managed by it.

Both are held at fair value. All of the assets have been classified

as available for sale. In the Directors' view the fair value has

been estimated to be not materially different from their carrying

value. Fair value has been arrived at by applying the Group's

percentage holding in the investments of the fair value of their

net assets.

10. Inventories - land and buildings

2015 2014

Group Group

GBP'000 GBP'000

------------------------------- --------- ---------

Group properties for resale

at cost

At 1 April 12,304 8,591

Purchases - 4,428

Capital expenditure 258 46

Disposals - -

Foreign exchange translation 77 (761)

------------------------------- --------- ---------

At 31 March 12,639 12,304

------------------------------- --------- ---------

11. Trade and other receivables

2015 2014

Group Group

GBP'000 GBP'000

-------------------------------- --------- ---------

Current assets

Trade receivables 1,655 3,305

Other receivables 3,147 502

Prepayments and accrued income 942 328

-------------------------------- --------- ---------

5,744 4,135

-------------------------------- --------- ---------

Non-current assets

-------------------------------- --------- ---------

Other receivables 283 400

-------------------------------- --------- ---------

12. Trade and other payables

2015 2014

Group Group

GBP'000 GBP'000

----------------------------- --------- ---------

Current liabilities

Trade payables 2,605 1,139

Other taxation and social

security 580 289

Other payables and accruals 4,938 2,780

Deferred income 11 16

----------------------------- --------- ---------

8,134 4,224

----------------------------- --------- ---------

13. Financial liabilities

2015 2014

GBP'000 GBP'000

------------------------------------ --------- ---------

Current liabilities

Bank loan 9,382 3,840

Finance leases 2,406 509

------------------------------------ --------- ---------

11,788 4,349

------------------------------------ --------- ---------

Non-current liabilities

Loans repayable by subsidiary

(FOP) to third party shareholders 1,936 2,229

Bank loans 50,610 32,322

Finance leases 45,379 12,661

------------------------------------ --------- ---------

97,925 47,212

------------------------------------ --------- ---------

2015 2014

GBP'000 GBP'000

------------------------------- --------- ---------

Total obligations under bank

loans and finance leases

Repayable within one year 11,788 4,349

Repayable within one and five

years 57,928 35,106

Repayable after five years 39,997 12,106

------------------------------- --------- ---------

109,713 51,561

------------------------------- --------- ---------

Loans repayable by FOP to third party shareholders are repayable

in October 2020.

Seven bank loans and three finance leases (all denominated in

foreign currencies) totalling GBP107,777,000 (2014: GBP49,332,000)

included within financial liabilities are secured against

investment properties owned by the Group and Fprop Opportunities

plc (FOP) and the property owned by the Group shown under

inventories. These bank loans and finance leases are otherwise

non-recourse to the Group's assets.

The preliminary results are being circulated to all shareholders

and can be downloaded from the Company's web-site (www.fprop.com).

Further copies can be obtained from the registered office at 35 Old

Queen Street, London, SW1H 9JA.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SFIESSFISELM

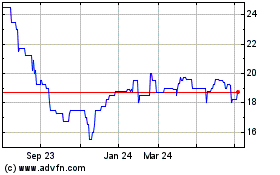

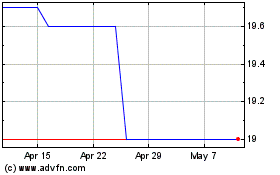

First Property (LSE:FPO)

Historical Stock Chart

From Mar 2024 to Apr 2024

First Property (LSE:FPO)

Historical Stock Chart

From Apr 2023 to Apr 2024