NASDAQ

Profit Surges, Led by Market Services

Nasdaq Inc. said first-quarter profit surged as revenue

increased across all segments, led by the market-services

division.

The bottom line beat Wall Street expectations.

Nasdaq has transformed itself from a U.S.-focused exchange

operator to a global business-services company that includes

markets in the U.S., Canada and the Nordic region, as well as

investor, public-relations, technology and data services. In the

quarter it closed deals to buy Chi-X Canada, an alternative trading

system for the Toronto Stock Exchange, and news-release distributor

Marketwired. The financial terms of those deals weren't

disclosed.

Nasdaq reported profit of $132 million, or 78 cents a share, for

the quarter, up from $9 million, or five cents a share, a year

earlier. Excluding restructuring- and acquisition-related charges

and other items, per-share earnings rose to 91 cents.

Revenue increased 5.3% to $534 million. Analysts polled by

Thomson Reuters expected a per-share profit of 89 cents on revenue

of $535 million.

Chris Allen, an analyst at UBS AG, said in a research note that

he expected the "solid results" would positively impact Nasdaq

share price today.

Market-services revenue, which contributed 38% of the exchange's

top line, increased 6.9% to $201 million on higher trading volumes.

Exchanges benefit more from periods of heightened trading and

volatility because the more people trade, the more fees they

collect on transactions.

The company's information-services segment, which represented

25% of the top line, reported revenue increased 6.4% to $133

million, on higher revenue from index data and proprietary data,

and from an acquisition.

One area of weakness was the company's technology solutions,

which saw operating margins decline to 12% from 21%, according to

Daniel Fannon, an analyst at Jefferies Group LLC. Technology

solutions, including exchange technology for operators around the

world and compliance surveillance software, accounts for about a

quarter of Nasdaq's revenues.

The Marketwired acquisition and growth in surveillance products

drove a 3.1% revenue increase to $134 million in the technology

solutions segment.

Despite a moribund market for initial public offerings in the

quarter, Nasdaq said all 10 U.S. IPOs listed on its exchange. The

period was the slowest since the first quarter of 2009, both in

terms of number of deals and total money raised, according to data

provider Dealogic.

Listing services revenue increased 3.1% to $66 million.

--Austen Hufford

STATE STREET

Drop in Fee Income Spurs Earnings Fall

State Street Corp. reported a decline in earnings and revenue

for the first quarter as weaker global markets dented the fees

generated by the trust bank.

Boston-based State Street reported earnings of $319 million, or

79 cents a share, down from $373 million, or 89 cents a share, a

year earlier. Excluding certain items, per-share profit fell to 98

cents from $1.16. Revenue declined 4.5% to $2.48 billion. Analysts

projected 90 cents in per-share earnings on $2.56 billion in

revenue, according to Thomson Reuters.

Chief Executive Joseph Hooley said fee revenue was hurt by a

challenging market environment, especially at the beginning of the

year, but added he was encouraged by signs of stability in

March.

Assets under custody and administration declined 5.4% to $26.94

trillion, and assets under management dropped 6% to $2.3 trillion

from a year before.

Lower assets, the market decline and the stronger dollar also

cut into fee revenue, with servicing fees declining 2.1% and

management fees falling 10%. Fees, which represent most of the

bank's top line, slipped 4.1% to $1.97 billion 4.1% from a year

earlier and 3.6% sequentially.

In recent quarters State Street has focused on managing

expenses. Late last year, the bank said it was accelerating its

cost-cutting plan as it grappled with a challenging environment. It

said Wednesday that layoffs and other measures announced in the

third quarter are on track to result in about $100 million in cost

savings this year. Total expenses in the first quarter fell 2.2%

from a year earlier to $2.05 billion.

--Austen Hufford

(END) Dow Jones Newswires

April 28, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

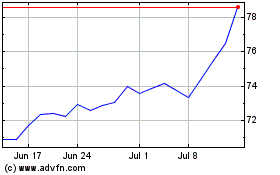

State Street (NYSE:STT)

Historical Stock Chart

From Mar 2024 to Apr 2024

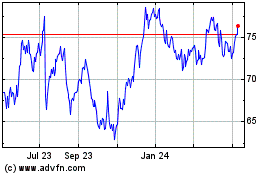

State Street (NYSE:STT)

Historical Stock Chart

From Apr 2023 to Apr 2024