Euro Falls On Risk Aversion

December 17 2014 - 6:23AM

RTTF2

The euro drifted lower against most major rivals in European

deals on Wednesday, as European markets fell amid continued

sell-off in oil prices, and traders await the outcome of the

Federal Reserve's meeting, due later in the day.

Most market participants expect the Fed to change its

forward-looking policy statement by removing language that it

expects to keep interest rates low "for a considerable period."

Crude oil is trading at $55 per barrel, as worries over

oversupply continues.

Eurozone inflation came in line with flash estimate in November,

final data from Eurostat showed.

Eurozone annual inflation came in at 0.3 percent in November,

down from 0.4 percent in October. A year ago, the rate was at 0.9

percent. The November inflation matched flash estimate released on

November 28.

The euro retreated to 1.2007 against the franc during European

morning deals. The euro is thus edging closer to violate its peg

rate of 1.20.

The KOF Swiss Economic Institute upgraded its 2015 growth

outlook for the Swiss economy citing improved global conditions and

private consumption. The institute also reduced its inflation

forecast due to the collapse of oil prices.

In its Winter Forecast, the think tank said the gross domestic

product will grow 1.9 percent in 2015 and by 2.1 percent in 2016.

The outlook for 2015 was raised from 1.7 percent.

The single currency dropped to 1.2453 against the greenback,

lower by 0.4 percent from yesterday's New York session close of

1.2508. Continuation of the euro's downtrend may lead it to a

support around the 1.24 zone.

The euro hit a 2-day low of 0.7922 against the pound, after

having advanced to a multi-week high of 0.8005 on Tuesday. If the

euro-pound pair extends decline, 0.78 is seen as its next support

level.

Bank of England policymakers decided to leave its key rate at a

historic low of 0.50 percent in a split vote for the fifth straight

time at the meeting held on December 3 and 4.

The Monetary Policy Committee voted 7-2 to retain its key rate

at 0.50 percent. Ian McCafferty and Martin Weale sought a 25

basis-point hike for the fifth straight meeting.

On the flip side, the European unit held steady against the yen,

after recovering to 146.46 in early deals. At yesterday's close,

the pair was valued at 145.55.

Japan had a merchandise trade deficit of 891.859 billion yen in

November, according to data from the Ministry of Finance.

That beat forecasts for a shortfall of 992.0 billion following

the downwardly revised 736.9 billion yen deficit in October.

Looking ahead, U.S. CPI for November and Canada wholesale sales

for October are due in the New York session.

At 2:00 pm ET, the Fed will announce its monetary policy

decision. Interest rates are seen keeping on hold at 0.25

percent.

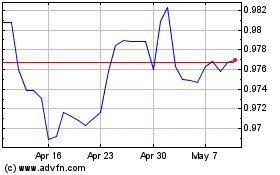

Euro vs CHF (FX:EURCHF)

Forex Chart

From Mar 2024 to Apr 2024

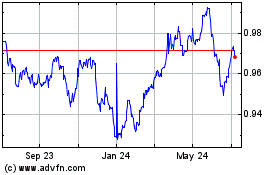

Euro vs CHF (FX:EURCHF)

Forex Chart

From Apr 2023 to Apr 2024