Estée Lauder Beats Estimates but Lowers Forecast -- 2nd Update

February 05 2016 - 12:41PM

Dow Jones News

By Austen Hufford

Estée Lauder Cos. reported better-than-expected growth in profit

and revenue but said the strong dollar will continue to hurt its

results.

Shares rose 2.2% to $88.89 in midday trading.

The cosmetics company--whose brands include Clinique, MAC and

Bobbi Brown--said it plans to increase investment to fuel growth.

Chief Executive Fabrizio Freda told The Wall Street Journal in an

interview that the company is launching new products and

corresponding marketing campaigns, including some aimed directly at

millennials.

"This quarter, we are investing first of all in new innovations

for our key brands," he said.

For the current quarter, Estée Lauder expects revenue to

increase between 2% and 3%, but sees the stronger dollar hurting

sales by about 4%. Analysts surveyed by Thomson Reuters were

projecting growth of 3%, on average. The company expects adjusted

per-share earnings of between 53 cents and 58 cents, below analyst

estimates of 76 cents.

For the year, sales are expected to grow between 4% and 5%. On a

constant-currency basis, the company expects revenue to increase

between 9% and 10%, upping the lower end of its forecast by 1

percentage point. The company lowered its forecast of per-share

earnings to between $3.07 and $3.12, compared with $3.10 to $3.17

earlier. Analysts had expected $3.18 a share on revenue growth of

9%.

Sales to travelers boosted results in the quarter, and Mr. Freda

said the company will expand into new airports and aim more brands

at them.

Estée Lauder said volatility and economic challenges are slowing

growth in Hong Kong, China and other emerging markets. Sales in the

Asia-Pacific regions fell 0.3%

As previously announced, Estée Lauder said it was overhauling

its global technology infrastructure, transitioning to a primarily

vendor-owned model. The company record a charge of $18.5 million in

the second quarter.

Over all, Estée Lauder reported a profit of $446.2 million, or

$1.19 a share, compared with $435.7 million, or $1.13 a share, a

year earlier. Excluding the technology charges, earnings were $1.22

a share.

Total sales grew 2.6% to $3.12 billion.

Analysts polled by Thomson Reuters had expected earnings of

$1.11 a share on sales of $3.08 billion.

Gross margin remained 81.2%.

Skin care sales fell 3.3% because of currency fluctuations that

were partially offset by increases in sales of its La Mer brand.

Makeup sales increased 6.4% on expanded distribution and from

lipsticks and foundations. Skin care and makeup segments

contributed about 40% of revenue each.

Sales in the Americas increased 2.1% as sales in the Europe,

Middle East and Africa regions grew 4.7%.

The stock, which increased 0.3% in the past three months, was

inactive premarket.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

February 05, 2016 12:26 ET (17:26 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

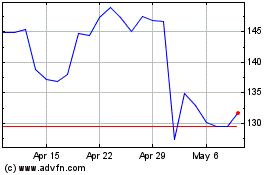

Estee Lauder Companies (NYSE:EL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Estee Lauder Companies (NYSE:EL)

Historical Stock Chart

From Apr 2023 to Apr 2024