Ericsson Profit Rises on Dollar, Apple Pact

January 27 2016 - 6:35AM

Dow Jones News

By Jens Hansegard

STOCKHOLM--Sweden's Ericsson AB on Wednesday reported earnings

that undershot expectations, sending shares some 5.1% lower in

morning trade.

The communications technology company reported a 67% increase in

fourth-quarter net profit, helped by a stronger dollar and higher

licensing revenue from a new global license deal with Apple Inc.

but analysts had hoped for a profit jump of about 74%. Ericsson

sells a lot of services and equipment in dollars but reports in

kronor.

Net profit rose to 7.06 billion Swedish kronor ($825.3 million)

in the three months to end-December from 4.22 billion kronor in the

same period a year earlier, the company said on Wednesday. The

consensus view was that Ericsson would report a net profit of 7.34

billion kronor.

Ericsson's full-year revenue from intellectual property rights

rose to 14.4 billion kronor from 9.9 billion kronor a year earlier,

with the Apple global licensing agreement serving as a driver,

Ericsson said.

Ericsson and Apple Inc. in December reached a global license

agreement that ended an almost-year long patent dispute between the

companies.

The dispute was an example of the tricky relationships in

telecoms, where standardization of technologies and increased

penetration of smartphones rely on sharing research and development

globally. Sharing such standards has led to many complaints and

legal squabbles between network manufacturers and smartphone makers

over the fair use of some technologies.

Details of Ericsson's contract with Apple remain confidential,

but analysts estimated the deal would add close to 3 billion kronor

to Ericsson's adjusted fourth-quarter operating profit.

Net sales in the quarter increased to 73.6 billion kronor,

higher than 68.0 billion kronor a year earlier, but below analysts'

forecast for 74.07 billion kronor. Adjusted for comparable units

and currency, sales fell 1%. The company's closely watched gross

margin, which has been under pressure over past years, remained

stable at 36.3%.

Ericsson's improved but disappointing performance follows its

agreement announced last November with Cisco Systems Inc. designed

to combine Cisco's strength in Internet technology with the Swedish

company's expertise in equipment used by wireless operators.

The pact, which comes as the companies face heightened

competition from companies such as Huawei Technologies and Nokia,

entails that the companies will collaborate in areas that include

making existing products work better together, while Ericsson will

resell Cisco gear.

Ericsson said that the partnership, which stops short of a

full-blown merger, means that the companies may jointly develop

entirely new hardware and services.

"Ericsson and Cisco will continue to explore further joint

business opportunities as the partnership progresses," Chief

Executive Hans Vestberg said at a news conference Wednesday.

Ericsson said that the pact will start to improve operating

income this year and that it will generate $1 billion or more in

additional sales by 2018.

The company declared a 8.8% higher full-year dividend of 3.70

kronor a share, up from 3.40 kronor in 2014.

Write to Jens Hansegard at jens.hansegard@wsj.com

Corrections & Amplifications

Ericsson reported net profit for the three months to

end-December. An earlier version of this article misstated the

period as the three months to end-September. Ericsson's full-year

revenue from Intellectual property rights rose to 14.4 billion

kronor from 9.9 billion kronor a year earlier. An earlier version

of this article incorrectly stated the reporting period for revenue

from intellectual property rights was for the quarter. (Jan,27,

2016)

(END) Dow Jones Newswires

January 27, 2016 06:20 ET (11:20 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

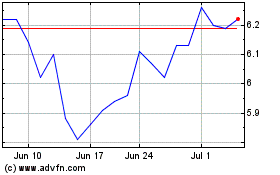

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

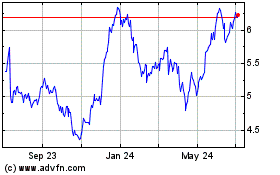

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Apr 2023 to Apr 2024