MILAN—Eni SpA said Sunday that it made a massive natural-gas

discovery off the coast of Egypt, in what the Italian oil-and-gas

company is calling the largest-ever find in the Mediterranean

Sea.

The gas, estimated at about 30 trillion cubic feet or 5.5

billion barrels of oil equivalent, is in a field about 80 miles off

the Egyptian coast, and is enough to supply the North African

country for decades.

Most of the gas will be used by Egypt, with any excess exported,

perhaps using a liquefied natural gas plant that Eni has not far

from the field.

If the discovery proves to be as big as thought, it will likely

lead to Eni boosting its production targets for the coming years.

The company had been forecasting that it would find 2 billion

barrels of oil equivalent over the next four years, and in the

seven years to 2014 had found 10 billion barrels, less than double

the Egyptian discovery.

Eni has been prospecting for oil and gas in Egypt for over 60

years and is the biggest Western producer in both the country and

all of Africa. The company will use existing facilities, including

offshore platforms, near the new find to keep the development costs

relatively low, Eni Chief Executive Claudio Descalzi said in an

interview. A subsea well also will be used to limit costs.

"This is a confirmation of our strategy of developing

conventional assets in mature areas where we have strong geological

knowledge and where we have synergies," said Mr. Descalzi. "We have

done that very successfully in the past 3 to 4 years."

It will take several months to sort out the development and

production leases, and drilling is expected to begin early next

year, said Mr. Descalzi, who wouldn't say when production might

begin. If drilling starts in early 2016, production would likely

kick off about a year later, based on similar projects.

"We will fast track this project and production will begin as

soon as possible," Mr. Descalzi said. "This discovery is

transformational for Eni and especially for Egypt."

The Leviathan natural gas field off the coast of Israel was the

largest discovery in the Mediterranean before the just-announced

Egyptian find.

While Eni in recent years has generally sold stakes in its big

finds to share the development costs, that is unlikely to happen

with the new Egyptian field because of the relatively low

development costs, said Mr. Descalzi.

Though natural gas is trading near a 2½ -year low, he said that

would have no effect on the decision on when to start pumping the

gas from the Egyptian field.

Eni, through an Egyptian subsidiary, has complete control of the

exploration and will have a 50% stake in the production, with the

rest held by the Egyptian state oil and gas company.

The Egyptian find is one of Eni's largest-ever, though it is

smaller than a natural gas field being developed off the coast of

Mozambique.

After years of turmoil following former President Hosni

Mubarak's ouster, Egypt, which was once a gas exporter to markets

from Asia to South America, was pushed to become an importer over

the past few years after failing to keep pace with its domestic

demand growth.

Such a large gas find could help Egypt, which is dealing with

its worst energy crisis in decades, meet most of its gas demand for

years. It may also have implications for neighboring Israel, which

is looking to export its own deposits to Egypt and Jordan.

"The field is said by ENI to be capable of producing 2.5 to 3

billion cubic feet per day, which would cover most, though not all,

of Egypt's energy gap," said Robin Mills, a nonresident fellow for

energy at the Brookings Doha Center.

"This find probably rules out Israeli gas exports to Egypt, but

won't restore Egypt as a significant exporter unless more is

discovered," he said.

Noble Energy Inc. and Delek Group Ltd., which are developing two

sizable fields in Israeli waters, have been negotiating long-term

contracts to sell gas to companies in Egypt, but the deals have

been delayed by bureaucratic and regulatory hurdles in Israel.

Egypt, one of a handful of Arab countries with normalized

relations with Israel, initially rejected the idea of importing gas

from the country, in fear of protests and violence. But Oil

Minister Sherif told The Wall Street Journal in March that the

country is open to approving the two pending deals to receive gas

from Israel if the price were right and if one of the gas companies

involved dropped legal action against the Egyptian government.

Israel Energy Minister Minister Yuval Steinitz said Sunday in a

statement that the gas find in Egypt "is a painful reminder that

while Israel sleepwalks and dallies with the final approval for the

gas road map, and delays further prospecting, the world is changing

in front of us, including ramifications for export options."

Summer Said contributed to this article.

Write to Eric Sylvers at eric.sylvers@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 30, 2015 20:55 ET (00:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

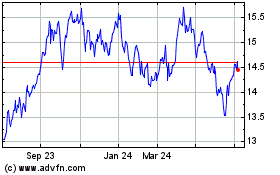

Eni (BIT:ENI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eni (BIT:ENI)

Historical Stock Chart

From Apr 2023 to Apr 2024