Energy Shares Rise as Crude Gains

December 12 2017 - 4:27AM

Dow Jones News

By David Hodari and Gregor Stuart Hunter

-- Brent crude hits 2 1/2 -year high

-- Europe tech sector bucks Asian negativity

-- Investors await Draghi speech

European stocks edged down Tuesday, despite buoyancy among the

technology and oil-and-gas sectors.

The Stoxx Europe 600 fell 0.1% in morning trading, while the

euro rose 0.2% to $1.1787. A stronger euro tends to weaken shares

of European multinationals which translate earnings from

abroad.

The European tech sector received a boost, with Atos shares up

5.6% on its bid for Dutch software firm Gemalto, which itself rose

32.4%. The Stoxx Europe 600 technology sector rose 0.7%.

The Stoxx Europe 600's oil-and-gas sector also gained, rising

0.6%, with Statoil up 2.1% and Tullow Oil up 1.1%.

Rising oil prices helped Australia's commodities-heavy

S&P/ASX 200 index buck the negativity of the broader Asian

region and finish 0.2% higher.

Asian stocks mostly pulled back, with regional tech shares

reversing gains made Monday.

Hong Kong's Hang Seng Index fell 0.6%, led by a 2.9% drop in

heavyweight Tencent Holdings. Tencent's fall came after it

disclosed that one of its units is in talks to acquire a minority

stake in supermarket operator Yonghui.

Camera-maker Sunny Optical, a Hang Seng newcomer, slid another

7.5% after it said that Chinese mobile-phone shipments in November

fell 21% from a year earlier.

Taiwan's tech-heavy Taiex fell 0.3% and Korea's Kospi slipped

0.4%, despite a 0.6% gain for index heavyweight Samsung

Electronics.

That tech weakness, and a 0.1% rebound for the yen versus the

dollar to Yen113.4860, helped push the Nikkei down 0.3% in late

trading.

Regional selling also stung Chinese stocks, with the Shanghai

Composite down 1.3% and the Shenzhen Composite down 1%.

That Chinese equity weakness came despite credit data released

late Monday revealed resilient bank lending in November, with some

money leaving the shadow-banking sector.

Investors were awaiting cues from global central banks. The

Federal Open Market Committee's two-day meeting was set to begin

Tuesday, with its interest rate decision due Wednesday. Data from

CME Group revealed that investors were betting on a 100%

probability that the Fed will announce a rate increase.

U.S. 10-year Treasury yields ticked down to 2.382% from 2.387%

late Monday.

The European, British, Swiss and Norwegian central banks were

also scheduled to meet this week, with European Central Bank

President Mario Draghi due to give a speech Tuesday.

"The main focus from Draghi is that we'll get new economic

forecasts and we'll get 2020 [forecasts] for the first time... he

may also give more detail on how [the ECB] plans to scale back

purchases to EUR30 billion from EUR60 billion. Will they halve all

purchases or take a more nuanced approach?" said James Knightley,

chief international economist at ING.

Bitcoin prices slipped after Securities and Exchange Commission

Chairman Jay Clayton warned about the risks to retail investors in

the red-hot cryptocurrency. Coindesk's Bitcoin USD Price Index was

recently up 0.6% at around $16,979.60 after nearing $17,400 in late

New York trading.

Write to David Hodari at David.Hodari@dowjones.com and Gregor

Stuart Hunter at gregor.hunter@wsj.com

(END) Dow Jones Newswires

December 12, 2017 04:12 ET (09:12 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

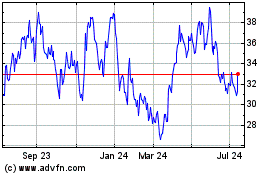

Tullow Oil (LSE:TLW)

Historical Stock Chart

From Mar 2024 to Apr 2024

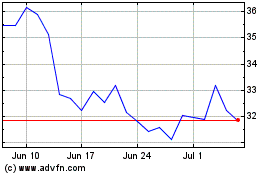

Tullow Oil (LSE:TLW)

Historical Stock Chart

From Apr 2023 to Apr 2024