EUROPE MARKETS: European Stocks Slide The Most In 5 Months As Britain Heads Toward Snap Election

April 18 2017 - 12:22PM

Dow Jones News

By Carla Mozee and Sara Sjolin, MarketWatch

Pound leaps on perceived clarity offered by election plan;

First-round French vote comes Sunday

European stocks moved sharply lower on Tuesday, with U.K. stocks

leading the charge south after U.K. Prime Minister Theresa May

unexpectedly called an early general election.

A slump in commodity shares and nerves ahead of the first round

of voting in France's presidential election on Sunday also added

selling pressure on European equity benchmarks

The Stoxx Europe 600 index slid 1.1% to close at 376.35, marking

its biggest one-day percentage drop since Nov. 2, according to

FactSet data.

Trading was closed Monday for the Easter holiday. Last week,

which was shortened by the Good Friday holiday, the regional

benchmark fell 0.2%, its first pullback in three weeks.

British surprise: The U.K.'s FTSE 100 posted its biggest one-day

percentage drop since June last year, down 2.5% to end at 7,147.50,

after May said she wants Britain to hold a general election on June

8.

The election is aimed at strengthening the Conservative

government's position as it prepares to negotiate Britain's exit

from the European Union. The pound jumped above $1.27, trading

around its highest level since early December.

Read:Why the snap U.K. election is a 'game-changer' for the

pound

(http://www.marketwatch.com/story/heres-why-the-pound-surged-to-10-week-high-after-may-called-snap-uk-election-2017-04-18)

A strong sterling tends to weigh on the London-listed

multinationals.

"Opinion polls suggest that May can win an election now given

the weakness of the opposition and given that the country still

hasn't felt much of a downside effect as a consequence of Brexit,"

wrote Jane Foley, senior FX strategist at Rabobank, in a note.

"If polls continue to suggest that May will be handed a strong

mandate this is likely to lessen scope for uncertainty and

volatility for the pound," she wrote.

See:Risk of 'a reversal in the entire Brexit process'--analysts

react to U.K. election surprise

(http://www.marketwatch.com/story/uk-adds-another-layer-of-complexity-analysts-react-to-surprise-snap-election-call-2017-04-18)

France: May's call for a general election came less than a week

before the first round of voting in France's presidential election

on Sunday.

In Paris, the CAC 40 was knocked down 1.6% to 4,990.25, its

worst session since September.

"While the latest odds still give independent Emmanuel Macron a

healthy chance of winning in May, his odds have fallen as those of

[conservative François] Fillon and far-left candidate [Jean-Luc]

Mélenchon have surged," wrote Kathleen Brooks, research director at

City Index.

"If we get a Macron/Fillon second-round runoff, this is likely

to be considered 'market friendly,' triggering a rally in the euro,

the CAC, but also in the German DAX and Eurostoxx index, which have

had decent correlations with the French bond yield this year," she

said.

Read: Raucous French election could be won by dark horse

François Fillon

(http://www.marketwatch.com/story/raucous-french-election-could-be-won-by-dark-horse-francois-fillon-2017-04-13)

Both Melenchon and the far-right Front National's Marine Le Pen

want a shake-up of the European Union and to put France's EU

membership to a vote. A so-called Frexit could spark turmoil as

France is seen as an integral part of the both the eurozone and the

EU.

The euro was buying $1.0705, compared with $1.0644 late Monday

in New York.

In Frankfurt, the DAX 30 fell 0.9% to 12,000.44.

Miners: Tuesday's session saw European mining shares shoved

lower as iron ore prices slumped to their lowest in five months on

concerns stemming from China after weaker housing data there. That

conflicted with weekend news that the world's second-largest

economy posted first-quarter gross domestic product of 6.9%

(http://www.marketwatch.com/story/china-gdp-grows-at-fastest-pace-since-2015-2017-04-16),

the fastest rate of growth since 2015.

"Though headline activity was robust, we see signs that growth

may be peaking," said UBS economist Donna Kwok in a research note.

"Despite property activity's rally in Q1, real property investment

was not as strong and has in fact been losing momentum since the

start of 2017."

Investors in mining shares watch developments in the Chinese

property market as the country is a major buyer of precious and

industrial metals. The Stoxx Europe 600 Basic Resources index

stumbled 3.1% on Tuesday.

Among miners, steel producer ArcelorMittal (MT) sank 6.2%,

Tenaris SA (TEN.MI) fell 3.4%, Antofagasta PLC (ANTO.LN) fell 3.4%

and Glencore PLC (GLEN.LN) moved down 5.6%.

(END) Dow Jones Newswires

April 18, 2017 12:07 ET (16:07 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

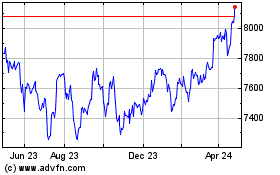

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

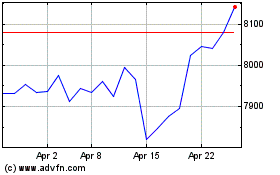

FTSE 100

Index Chart

From Apr 2023 to Apr 2024