EP GLOBAL OPPORTUNITIES TRUST PLC - Portfolio Holdings as at 28 February 2015

March 17 2015 - 12:15PM

PR Newswire (US)

EP GLOBAL OPPORTUNITIES TRUST PLC

PORTFOLIO HOLDINGS AS AT 28 FEBRUARY 2015

% of Net

Rank Company Sector Country Assets

1 Novartis Health Care Switzerland 3.3

2 Swire Pacific Industrials Hong Kong 3.2

3 Screen Technology Japan 3.2

4 Sumitomo Mitsui Trust Financials Japan 2.9

5 East Japan Railway Consumer Services Japan 2.9

6 Fresenius Medical Care Health Care Germany 2.9

7 PostNL Industrials Netherlands 2.8

8 Panasonic Consumer Goods Japan 2.8

9 Toyota Consumer Goods Japan 2.8

10 AstraZeneca Health Care United Kingdom 2.7

11 Microsoft Technology United States 2.7

12 Japan Tobacco Consumer Goods Japan 2.7

13 KDDI Telecommunications Japan 2.6

14 Mitsubishi Industrials Japan 2.6

15 Toshiba Industrials Japan 2.6

16 Sumitomo Mitsui

Financial Financials Japan 2.5

17 DBS Financials Singapore 2.5

18 Hutchison Whampoa Industrials Hong Kong 2.5

19 Vodafone Telecommunications United Kingdom 2.5

20 Google Technology United States 2.4

21 Qualcomm Technology United States 2.3

22 Roche * Health Care Switzerland 2.3

23 Yamaha Motor Consumer Goods Japan 2.3

24 BNP Paribas Financials France 2.3

25 Bangkok Bank ** Financials Thailand 2.3

26 Intesa Sanpaolo Financials Italy 2.2

27 HSBC Financials United Kingdom 2.2

28 Terex Industrials United States 2.2

29 BG Oil & Gas United Kingdom 2.2

30 Royal Dutch Shell *** Oil & Gas Netherlands 2.1

31 Nomura Financials Japan 2.1

32 Bank Mandiri Financials Indonesia 2.1

33 Whirlpool Consumer Goods United States 2.0

34 Sanofi Health Care France 1.9

35 ABB Industrials Switzerland 1.9

36 Galaxy Entertainment Consumer Services Hong Kong 1.7

37 Bayer Basic Materials Germany 1.7

38 Misawa Homes Consumer Goods Japan 1.6

39 Edinburgh Partners Financials United Kingdom 1.2

40 Bridgestone Consumer Goods Japan 0.8

Total equity investments 94.5

Cash and net assets 5.5

100.0

* The investment is in non-voting shares

** The investment is in non-voting depositary receipts

*** The investment is in Class A ordinary shares

GEOGRAPHICAL DISTRIBUTION

28 February 2015 % of Investments

Japan 36.4

Europe 24.8

Asia Pacific 15.1

United States 12.3

United Kingdom 11.4

100.0

SECTOR DISTRIBUTION

28 February 2015 % of Investments

Financials 23.6

Industrials 18.8

Consumer Goods 15.9

Health Care 13.9

Technology 11.2

Telecommunications 5.4

Consumer Services 4.9

Oil & Gas 4.5

Basic Materials 1.8

100.0

As at 28 February 2015, the net assets of the Company were £120,366,000.

17 March 2015

Enquiries:

Kenneth Greig

Edinburgh Partners AIFM Limited

Tel: 0131 270 3800

The Company's registered office address is:

27-31 Melville Street

Edinburgh

EH3 7JF

Copyright h 17 PR Newswire

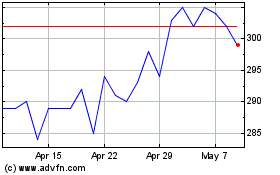

Global Opportunities (LSE:GOT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Global Opportunities (LSE:GOT)

Historical Stock Chart

From Apr 2023 to Apr 2024