TIDMDNLM

RNS Number : 6587L

Dunelm Group plc

13 January 2016

13(th) January 2016

Dunelm Group plc

TRADING UPDATE

26 weeks to 2(nd) January 2016

Dunelm Group plc ("Dunelm" or "the Group"), the UK's leading

homewares retailer, reports the following trading update for the 26

week period to 2(nd) January 2016.

Commenting on Dunelm's performance in the period, John Browett,

Chief Executive, said:

"These trading numbers are a reasonable outcome given the

unseasonably warm weather. We have had a very strong sale after

Christmas and we expect further good progress in the second

half.

"I am really pleased to have joined Dunelm. Clearly our

proposition remains popular with customers and I look forward to

working with the team here in fully delivering the potential of the

business over the coming years."

Highlights

Revenue

13 weeks to 2(nd) January 26 weeks to 2(nd) January

2016 2016

----------------- ---------------------------------- ----------------------------------

Sales YoY Growth YoY Growth Sales YoY Growth YoY Growth

(GBPm) (GBPm) (%) (GBPm) (GBPm) (%)

----------------- -------- ----------- ----------- -------- ----------- -----------

LFL stores 205.0 5.2 2.6% 376.8 12.4 3.4%

----------------- -------- ----------- ----------- -------- ----------- -----------

Home Delivery 16.5 3.1 23.4% 28.0 5.5 24.4%

----------------- -------- ----------- ----------- -------- ----------- -----------

Total LFL* 221.5 8.3 3.9% 404.9 17.9 4.6%

----------------- -------- ----------- ----------- -------- ----------- -----------

Non-LFL stores 24.2 11.7 43.2 23.8

----------------- -------- ----------- ----------- -------- ----------- -----------

Total 245.7 20.0 8.8% 448.1 41.7 10.3%

----------------- -------- ----------- ----------- -------- ----------- -----------

* Calendar impact

Due to the 53(rd) week included in the last financial year, the

above figures include eight days of our Winter Sale, compared to

two days of Winter Sale included in the comparative period. This

has boosted LFL growth by approximately GBP10.0m (equivalent to

4.7% in the quarter and 2.6% over the half year). These impacts

will reverse in the next quarter. Therefore, adjusting for this

calendar impact, underlying LFL performance was -0.8% for the 13

weeks to 2(nd) January and +2.0% for the 26 week period.

Underlying performance

Having adjusted for the beneficial calendar impact, sales

performance in the quarter reflected:

- Reduced footfall in LFL stores which we attribute to the

particularly mild weather, partially compensated by improved

conversion and growing transaction values;

- Ongoing store portfolio expansion, with three new superstores

opened and one major refit completed;

- Continuing growth in on-line business, including a +23.4% increase in home delivery sales.

Gross Margin

Gross margin percentage growth for the half year is estimated to

be +30bps compared with the first half of last financial year. This

included the impact of Winter Sale as described above, which is

estimated to have depressed margin growth by -20bps in the quarter,

and by -10bps over the half year.

Store Portfolio

The total number of superstores trading at the period end was

151. There are seven new stores committed, as at the period end,

including two relocations. We expect three of these new stores to

open in the remainder of this financial year, taking our total

anticipated openings for the financial year to six including the

two relocations. This will bring the year-end superstore count to

152. Our medium term target remains to operate from around 200

superstores across the UK.

Financial Position

The Group remains strongly cash generative with closing net debt

of GBP48.1m (H1 15: net cash GBP61.4m), reflecting the cash

returned to shareholders in H2 15. Daily average net debt across

the half year amounted to GBP47.5m.

Ends

For further information please contact:

Dunelm Group plc 0116 2644 356

John Browett, Chief Executive

Keith Down, Chief Financial Officer

MHP Communications 020 3128 8100

John Olsen / Tom Horsman

Forthcoming Newsflow:

Dunelm will release its interim results on 10(th) February 2016.

There will be a presentation for analysts at 9.30am at the offices

of UBS, 1 Finsbury Avenue, London EC2M 2PP. Those analysts who wish

to attend are requested to contact Isabelle Grainger of MHP on the

above number or at isabelle.grainger@mhpc.com. A copy of the

presentation will be made available on the Dunelm website.

Notes

1. Like-for-like (LFL) sales represents revenues from stores

trading for at least one full financial year prior to 5(th) July

2015 and excludes stores with significant change of space in the

current or previous financial year.

2. Quarterly sales and margin analysis:

52 weeks to 2(nd) July 2016

---------------------- ------------------------------------------------------

Q1 Q2 H1 Q3 Q4 H2 FY

---------------------- ---------- ---------- ---------- --- --- --- ---

Total sales GBP202.3m GBP245.7m GBP448.1m

---------------------- ---------- ---------- ---------- --- --- --- ---

Total sales growth +12.0% +8.8% +10.3%

---------------------- ---------- ---------- ---------- --- --- --- ---

LFL sales growth +5.5% +3.9% +4.6%

---------------------- ---------- ---------- ---------- --- --- --- ---

Gross margin growth* +20bps +30bps +30bps

---------------------- ---------- ---------- ---------- --- --- --- ---

*estimated

52 weeks to 27(th) June 2015

----------------------------- ----------------------------------------------------------------------------------

Q1 Q2 H1 Q3 Q4 H2 FY

----------------------------- ---------- ---------- ---------- ---------- ---------- ---------- ----------

Total sales GBP180.6m GBP225.8m GBP406.4m GBP216.2m GBP200.1m GBP416.4m GBP822.7m

----------------------------- ---------- ---------- ---------- ---------- ---------- ---------- ----------

Total sales growth +17.0% +11.8% +14.0% +10.7% +12.1% +11.4% +12.7%

----------------------------- ---------- ---------- ---------- ---------- ---------- ---------- ----------

LFL sales growth +8.9% +4.2% +6.2% +4.9% +5.8% +5.4% +5.8%

----------------------------- ---------- ---------- ---------- ---------- ---------- ---------- ----------

Gross margin growth/decline +40bps -30bps Level -10bps -100bps -60bps -30bps

----------------------------- ---------- ---------- ---------- ---------- ---------- ---------- ----------

3. Please note that the prior financial year comprised a 53 week

period running to 4(th) July 2015. Our audited financial statements

covered this 53 week period but we use figures for the 52 weeks

ending 27(th) June 2015 for comparative purposes in the above

table.

Notes to Editors

Dunelm is market leader in the GBP11bn UK Homewares market. The

Group currently operates 157 stores, of which 151 are out-of-town

superstores and 6 are located on high streets, and an on-line

store, to be found at www.dunelm.com.

Dunelm's "Simply Value for Money" customer proposition offers

industry-leading choice of quality products at keen prices, with

high levels of availability and supported by friendly service. Core

ranges include many exclusive designs and premium brands such as

Dorma, and are supported by a frequently changing series of special

buys. The superstore format provides an average of 30,000 sq. ft.

of selling space with over 20,000 products across a broad spectrum

of categories, extending from the Group's home textiles heritage

(bedding, curtains, cushions, quilts and pillows) to a complete

Homewares offer including kitchenware and dining, lighting, wall

art, furniture and rugs. Dunelm is one of the few national

retailers to offer an authoritative selection of curtain fabrics on

the roll, and owns a specialist UK facility dedicated to producing

made-to-measure curtains.

Dunelm was founded in 1979 as a market stall business, selling

ready-made curtains. The first shop was opened in Leicester in 1984

and over the following years the business developed into a

successful chain of high street shops before expanding into broader

homewares categories following the opening of the first Dunelm

superstore in 1991.

Dunelm has been listed on the London Stock Exchange since

October 2006 (DNLM.L) and has a current market capitalisation of

approximately GBP1.8bn.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTBTMRTMBJBBTF

(END) Dow Jones Newswires

January 13, 2016 02:00 ET (07:00 GMT)

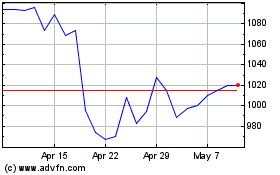

Dunelm (LSE:DNLM)

Historical Stock Chart

From Aug 2024 to Sep 2024

Dunelm (LSE:DNLM)

Historical Stock Chart

From Sep 2023 to Sep 2024