TIDMDNE

RNS Number : 3783X

Dunedin Enterprise Inv Trust PLC

28 August 2015

For release 28 August 2015

Dunedin Enterprise Investment Trust PLC

Half year ended 30 June 2015

Dunedin Enterprise Investment Trust PLC, the private equity

investment trust which specialises in investing in UK mid-market

buyouts, announces its results for the half year ended 30 June

2015.

Financial Highlights:

-- Net asset value total return of -0.1% in the six months to 30 June 2015

-- Realisations of GBP3.0m in the half year

-- New investments of GBP10.6m in the half year

-- GBP0.7m returned to shareholders by way of share buyback

-- Final dividend for 2014 paid of 4.7p per share

Comparative Total Return Performance (%)

FTSE

Small

Cap

(ex Inv

Periods to 30 Net asset Share Cos)

June 2015 value price Index

--------------- ---------- ------- ---------

Six months -0.1 -9.1 11.9

One year 1.0 -24.2 8.4

Three years -5.9 4.6 88.3

Five years 28.8 39.0 119.5

Ten years 45.6(*1) 15.8 95.2

(*1) - taken from 31 July for ten years

For further information please contact:

Graeme Murray Corinna Osbourne

Dunedin LLP Equity Dynamics Limited

0131 225 6699 07825 326 440

0131 718 2310 corinna@equitydynamics.co.uk

07813 138367

Chairman's Statement

Between your Company's half year end and the time of writing

this statement, market conditions have been turbulent following

negative economic news mainly from China. As a consequence, the

share price has declined from a recent high of 354.5p at 31 July

2015 to 316.9p at the time of writing.

The market for unquoted businesses is generally not directly

correlated with global stock markets. A continuation of this

turbulence could help to lower the multiple required to be paid for

new investments, but correspondingly may have a negative impact on

the IPO market and potential exit valuations achieved.

Performance

The Board is acutely aware of the extent of your Company's

underperformance and in particular of the lack of profitable

realisations from Dunedin Buyout Fund II LP. The portfolio of

investments in this fund is now relatively mature and offers the

prospect of good realisations in the near future; advisers have

been appointed to assist in the sale of several portfolio companies

in order to maximise value and capitalise on the positive exit

environment for private businesses. Historically, performance has

been partly linked to realisations from the portfolio. The Board

has emphasised to the Manager the importance of delivering value

for shareholders.

Following the change in strategy in November 2011 to invest

primarily in Dunedin funds, the Company committed GBP60m to Dunedin

Buyout Fund III LP ("DBF III") in 2012/2013. As DBF III still has

two and a half years left of its five year investment period and is

only 38% invested, it is too early to judge the performance of

DBFIII.

Board Changes

I am pleased to welcome Angela Lane to our Board from 1 June

this year. Angela has worked as an independent director and adviser

to private companies and private equity firms. She spent 18 years

working in private equity at 3i and has extensive experience of

business and financial services, healthcare, travel and aviation,

media, consumer goods and infrastructure. I am sure that her

experience will prove invaluable

Duncan Budge

27 August 2015

Manager's Review

Results for the six months to 30 June 2015

The results for the six months to 30 June 2015 show strong

contributions from CitySprint, Hawksford and Kee Safety as a result

of earnings growth and an increase in valuation multiples. This has

been offset by the underperformance of Premier Hytemp and EV as a

result of trading conditions in the oil and gas sector.

In the six months to 30 June 2015, Dunedin Enterprise's net

asset total return per share was -0.1%, after taking account of

dividends paid. The unaudited net asset value per share decreased

by 1.0% from 510.6p to 505.4p, while the FTSE Small Cap Index (ex

Inv. Cos) increased by 9.5%.

During the six months to 30 June 2015 the share price decreased

by 10.3% from 352.4p to 316.0p, which equates to a discount of

37.5% to net asset value. This compared with a discount of 31.0% at

31 December 2014.

During June 2015 Dunedin Enterprise no longer qualified for

inclusion in the FTSE All-Share Index due to a reduction in the

market capitalisation of the Company. This resulted in a number of

tracker funds which held shares being required to dispose of their

shareholding within a short period of time, resulting in downward

pressure on the share price. The majority of these shares were

placed with the assistance of the Company's brokers. The balance of

shares remaining (GBP0.7m) were bought back by the Company at a

price of 309.8p, a discount of 39% to the net asset value as at 31

December 2014. The removal of these sellers led to a recovery in

the share price after the half year end. However, following recent

market declines, the share price now stands at 316.9p.

In the six months to 30 June 2015 Dunedin Enterprise invested a

total of GBP10.6m and realised GBP3.0m from investments.

The Company had outstanding commitments to limited partnership

funds of GBP56.2m at 30 June 2015. This consists of GBP49.2m to

Dunedin managed funds and GBP7.0m to European funds. It is expected

that approximately GBP34m of this total commitment will be drawn

over the next two and a half years. The GBP20m revolving credit

facility is available to the Company until 27 February 2017 and is

undrawn at 30 June 2015. The Board and the Manager remain satisfied

with the balance between cash resources and outstanding commitments

given the expected rate of new investment and potential

realisations of existing investments. The Company therefore

continues to adopt a going concern basis in preparing the half year

report and accounts.

Net asset and cash movements in the half year to 30 June

2015

The movement in net asset value is summarised in the table

below:-

GBP'm

-------------------------------- --------------------------------------------------

Net asset value at 31 December

2014 106.6

Unrealised value increases 6.5

Unrealised value decreases (5.1)

Realised loss over opening

valuation (1.2)

Dividends paid to shareholders (1.0)

Share buyback (including

costs) (0.7)

Other movements (0.8)

-------------------------------- --------------------------------------------------

Net asset value at 30 June

2015 104.3

-------------------------------- --------------------------------------------------

Cash movements in the half year to 30 June 2014 can be

summarised as follows:

GBP'm

-------------------------------- -----------------

Cash and near cash balances

at 31 December 2014 9.9

Investments made (10.6)

Investments realised 3.0

Dividends paid to shareholders (1.0)

Share buyback (including

costs) (0.7)

Operating activities (0.1)

-------------------------------- -----------------

Cash and near cash balances

at 30 June 2015 0.5

-------------------------------- -----------------

Portfolio Composition

Dunedin Enterprise holds investments in unquoted companies

through:

-- Dunedin managed funds (including direct investments), and

-- Third party managed funds.

The investment portfolio can be analysed as shown in the table

below.

Valuation Additions Disposals Realised Unrealised Valuation

at 31-12-14 in half in half movement movement at 30-06-15

year year

GBP'm GBP'm GBP'm GBP'm GBP'm GBP'm

--------------------- ------------ ---------- ---------- --------- ----------- ------------

Dunedin managed 84.0 7.8 (1.7) (1.2) 1.6 90.5

Third party managed 13.2 2.8 (1.3) - (0.2) 14.5

--------------------- ------------ ---------- ---------- --------- ----------- ------------

97.2 10.6 (3.0) (1.2) 1.4 105.0

--------------------- ------------ ---------- ---------- --------- ----------- ------------

New investment activity

(MORE TO FOLLOW) Dow Jones Newswires

August 28, 2015 02:01 ET (06:01 GMT)

In March 2015 an investment of GBP4.9m was made in Blackrock

Programme Management ("Blackrock PM"). Blackrock PM is a

professional services firm that provides independent expert witness

and construction consulting services for large, international

construction projects. The company is headquartered in London and

is widely recognised as a market leader, employing individual

directors who are experts in their field. Blackrock PM has worked

on an extensive range of projects around the globe, including

airports, roads, railways, power stations, process plants,

manufacturing facilities, health and educational facilities and

commercial buildings.

Two follow-on investments were made in the half year. A further

investment of GBP1.5m was made in Red, the IT staffing business, to

assist with working capital and a re-setting of bank covenants. An

investment of GBP0.3m was made in Steeper, the provider of

prosthetic, orthotic and assistive technology products and

services, to assist with a factory improvement programme. There

were drawdowns totalling GBP1.1m made during the half year by

Dunedin managed funds for management fees.

Within the European funds a total of GBP2.6m was drawn down by

Realza for two new investments. It invested GBP1.4m in Litalsa, a

provider of packaging finishes. Realza invested a further GBP1.2m

in Cualin Quality, a leading producer of premium tomatoes and a

further GBP0.2m was drawn by the two European funds to meet

management fees and operating expenses.

Realisations

In the six months to 30 June 2015 a total of GBP3.0m was

realised from investments. GBP1.7m was received from Enrich

following the successful outcome of the court case against the

vendor of the business. A total of GBP1.0m was returned from

Innova/5. This was primarily the result of a successful IPO of the

internet portal service provider Wirtualna Polska on the Polish

stock exchange and a partial realisation of the stock on flotation.

A further distribution of GBP0.3m was made by Realza as a result of

strong cash generation by GTT, the provider of management services

to local public entities in Spain.

Unrealised movements in valuation

Unrealised movements in portfolio company valuations in the half

year amounted to GBP1.4m. The largest increases within this total

were in the valuation of CitySprint (GBP3.3m), Hawksford (GBP1.6m)

and Kee Safety (GBP0.8m). There were reductions in value at the two

oil and gas related investments, EV (GBP2.6m) and Premier Hytemp

(GBP1.0m).

CitySprint continues to grow both organically and through an

ongoing programme of bolt-on acquisitions. Organic growth has been

generated from services to the healthcare industry and retail

sector. In July 2015 the company completed its 20(th) acquisition

whilst under Dunedin's ownership. The earnings multiple applied to

the investment has been increased from 8.0x to 9.0x, reflecting the

increasing scale of the business. Hawksford has benefited from a

reduced level of net external debt and an increase in the multiple

applied from 7.0x to 8.0x, to reflect recent transactions in the

sector, where multiples of 9x to 10x and above have been paid. The

valuation of Kee Safety has benefited from strong earnings growth

of 10% in the half year. This is the result of both organic growth

and bolt-on acquisitions. The company continues to invest in

product development to generate future growth. Since Dunedin's

investment the company has completed six acquisitions, expanding

the global foot-print of the business.

The maintainable profits of both Premier Hytemp and EV have been

impacted by the reduced oil price and the consequent reduced level

of demand and lower margins. Premier Hytemp supplies the oil

exploration sector and has been significantly impacted since the

price of oil fell in late 2014. EV primarily supplies the

production side of the oil industry where the market has been

impacted to a lesser extent.

The average earnings multiple applied to the valuation of the

Dunedin managed portfolio was 7.9x EBITDA (31 December 2014: 7.6x)

or 9.9x EBITA (31 December 2014: 9.3x). These multiples are applied

to the maintainable earnings of portfolio companies. Within the

Dunedin managed portfolio, the weighted average gearing of the

companies was 2.1x EBITDA (31 December 2014: 2.2x) or 2.6x EBITA

(31 December 2014: 2.7x).

The portfolio continues to be valued in accordance with the

International Private Equity Venture Capital valuation guidelines

(www.privateequityvaluation.com).

Dunedin LLP

27 August 2015

Ten Largest Investments

(both held directly and via Dunedin managed funds) by value at

30 June 2015

Approx. Percentage

percentage Cost of Directors' of net

of equity investment valuation assets

Company name % GBP'000 GBP'000 %

--------------------------------- ------------ ----------- ----------- -----------

CitySprint (UK) Group Limited 11.9 9,838 22,256 21.3

Hawksford International Limited 17.8 5,637 10,428 10.0

Weldex (International) Offshore

Holdings Limited 15.1 9,505 9,885 9.5

Realza Capital FCR 8.9 8,788 9,008 8.6

CGI Group Holdings Limited

(Pyroguard) 41.7 9,450 8,252 7.9

Kee Safety Group Limited 7.2 6,275 8,169 7.8

Formaplex Group Limited 17.7 1,732 6,467 6.2

EV Offshore Limited 10.6 7,078 5,818 5.6

U-POL Group Limited 5.2 5,657 5,106 4.9

Innova/5 LP 3.9 5,758 5,011 4.8

69,718 90,400 86.6

---------------------------------- ----------- ----------- ----------- --------------

Top ten investments (held via funds and direct investments)

CitySprint (UK) Group Limited

Percentage of equity held 11.9%

Cost of Investment GBP9.8m

Directors' valuation GBP22.3m

Percentage of net assets 21.3%

CitySprint is the UK's largest national time critical and same

day distribution network. It benefits from an asset light business

model with almost 3,000 self-employed couriers, making the business

both highly flexible and scalable. It operates from 40 service

centres in the UK and can deliver to over 87% of the mainland UK

population within 60 minutes. It handles over ten million critical

same day deliveries a year, providing flexible, reliable and

cost-effective solutions.

CitySprint offers a range of services including SameDay Courier,

UK Overnight and International courier services, as well as more

complex logistics services. It services a number of different

sectors, including healthcare, online retail fulfilment and parts

fulfilment such as outsourced supply chain services for engineering

and servicing companies. CitySprint now has the UK's largest

SameDay healthcare courier network.

Hawksford International Limited

Percentage of equity held 17.8%

Cost of Investment GBP5.6m

Directors' valuation GBP10.4m

Percentage of net assets 10.0%

Hawksford is one of the largest independent fiduciary services

businesses in the Channel Islands, serving high net worth private

clients and small and large corporates. It also provides a

dedicated range of services for multi-generational families through

its family office business and administers specialist investment

funds.

In the last four years the business has completed the

acquisitions of Key Trust Company Limited, Trustcorp Jersey

Limited, L-S&S GmbH, a Swiss boutique private wealth law firm,

the funds business of Standard Bank Dubai and Janus Corporate

Solutions. These acquisitions have further enhanced Hawksford's

market-leading position through additional high quality people and

clients. The focus of the business remains on providing excellent

service and increasing client choice by growing the international

footprint.

Weldex (International) Offshore Holdings Limited

Percentage of equity held 15.1%

Cost of Investment GBP9.5m

Directors' valuation GBP9.9m

Percentage of net assets 9.5%

(MORE TO FOLLOW) Dow Jones Newswires

August 28, 2015 02:01 ET (06:01 GMT)

Weldex is a market-leading crawler crane hire business in the

UK, with a strong European presence. It serves the offshore wind,

oil and gas and commercial construction markets. Its cranes,

including two of the largest in the UK, have been used in a number

of significant construction projects including the 2012 Olympic

site, Crossrail and the new Queensferry crossing over the Firth of

Forth.

Weldex was established in 1979 and has grown into the UK's

largest crawler crane hire company. The company employs 102 staff

and operates nationwide and overseas from its headquarters in

Inverness, its depot at Alfreton and its base at Nigg Energy Park

which undertakes oil and gas decommissioning work. The company

provides its customers with an established team of fully accredited

operators, site managers and service engineers and also supplies

associated lifting equipment including wheeled cranes, forklifts,

lorry loaders and trailers.

Realza Capital FCR

Percentage of equity held 8.9%

Cost of Investment GBP8.8m

Directors' valuation GBP9.0m

Percentage of net assets 8.6%

Realza Capital FCR is a Spanish private equity fund making

investments in Spain and Portugal. The fund is limited to investing

15% of commitments in Portugal. Dunedin Enterprise's investment is

held via Dunedin Fund of Funds LP.

The fund invests in companies with leading market positions and

attractive growth prospects either through organic growth or

through subsequent merger & acquisition activity. Realza seeks

to invest in companies with an enterprise value normally ranging

from EUR20m to EUR100m. The fund's typical equity investment ranges

from EUR10m to EUR25m.

C.G.I. Group Holdings Limited (Pyroguard)

Percentage of equity held 41.7%

Cost of Investment GBP9.5m

Directors' valuation GBP8.3m

Percentage of net assets 7.9%

Since Dunedin Enterprise first invested in CGI the company has

been through two refinancings allowing Dunedin Enterprise to

realise a total of GBP14.5m in capital and income to date from this

investment. CGI, trading under the Pyroguard brand, is a leading

designer, manufacturer and supplier of specialist fire resistant

glass. The company serves the construction markets in the UK,

Ireland, France, Holland, Scandinavia, Eastern Europe and the

Middle East from its manufacturing bases in Haydock, UK and

Seingbouse, France. Significant projects completed by CGI include

the installation of fire resistant glass at Manchester Airport,

Heathrow Terminal 5, Hong Kong Airport and the Houses of

Parliament.

Kee Safety Group Limited

Percentage of equity held 7.2%

Cost of Investment GBP6.3m

Directors' valuation GBP8.2m

Percentage of net assets 7.8%

Kee Safety is a UK head-quartered global market-leading provider

of collective fall protection, safety systems and solutions. The

business has 271 employees in the UK, USA, Canada, Germany, France,

Poland, Dubai, China and India and sells its products in more than

50 countries. Its core patent protected product range includes

modular barrier systems, guardrails, access platforms and

specialist fixings. The business has multiple routes to market

through an international direct sales force, direct to OEM, online

and through the distributor channel. Kee Safety's customers range

from multi-national corporations, to major contractors,

distributors and installers.

Formaplex Group Limited

Percentage of equity held 17.7%

Cost of Investment GBP1.7m

Directors' valuation GBP6.5m

Percentage of net assets 6.2%

Formaplex is a market-leading engineering company which designs

and manufactures integrated tooling and lightweight components for

the premium automotive, aerospace, defence and motor sports

markets. Operating from three state-of-the-art UK manufacturing

facilities in Hampshire, which collectively span over 140,000ft,

Formaplex offers a fully integrated service from tool design,

prototyping and manufacture, through to final component

manufacture, finishing and delivery.

EV Offshore Limited

Percentage of equity held 10.6%

Cost of Investment GBP7.1m

Directors' valuation GBP5.8m

Percentage of net assets 5.6%

EV designs, manufactures and provides high performance,

ruggedised video cameras that are used to diagnose and analyse

problems in oil and gas wells. It offers a highly specialist

service, providing skilled engineers to operate its cameras in the

most difficult down-hole conditions. The high resolution video

images produced by EV's cameras allow oil and gas well operators to

identify and solve problems rapidly. EV is based in Aberdeen and

Norwich. It has a further presence in seventeen worldwide locations

across Northern Europe, Canada, USA, West Africa, the Middle East,

Asia and Australasia. The business employs more than 100 staff.

U-POL Group Limited

Percentage of equity held 5.2%

Cost of Investment GBP5.7m

Directors' valuation GBP5.1m

Percentage of net assets 4.9%

U-POL is a leading independent manufacturer of automotive

refinish products including body fillers, coatings, aerosols,

polishing compounds and consumables. The company has a good

reputation for product quality and innovation, which is the key to

its global success. From its UK manufacturing base in

Wellingborough, U-POL exports a range of products to 120 countries

worldwide. The company has a strong market position in the UK and a

growing position in other large markets such as the USA, the Far

East, the Middle East, Africa and Russia. Its growth strategy is to

expand in both developed and emerging markets.

U-POL sells primarily through intermediate distributors but has

built brand recognition and loyalty with end-users which are mainly

comprised of car repair outlets.

Innova/5 LP

Percentage of equity held 3.9%

Cost of Investment GBP5.8m

Directors' valuation GBP5.0m

Percentage of net assets 4.8%

Innova/5 LP is EUR380.8m private equity fund based in Warsaw

which makes investments in Central Eastern Europe. Dunedin

Enterprise's investment is held via Dunedin Fund of Funds LP.

The fund invests in mid-market buyouts in businesses with an

enterprise value of between EUR50m and EUR125m. Its investment

focus is Financial Services; Technology, Media, &

Telecommunications ; Business Services; Construction; Energy; and

Industrial & Automotive.

Overview of portfolio

Fund Analysis

30 June 2015

%

--------------------- -------------

Direct 10

Dunedin Buyout Fund

I -

Dunedin Buyout Fund

II 53

Dunedin Buyout Fund

III 18

Equity Harvest Fund

(Dunedin managed) 5

Third party managed 13

Cash 1

(MORE TO FOLLOW) Dow Jones Newswires

August 28, 2015 02:01 ET (06:01 GMT)

Analysed by valuation method

30 June 2015

%

---------------------- -------------

Cost/written

down 9

Earnings - provision 23

Earnings - uplift 65

Net assets 3

Analysed by geographic location

30 June 2015

%

---------------- -------------

UK 86

Rest of Europe 13

Cash 1

Analysed by sector

30 June 2015

%

--------------------- -------------

Automotive 3

Construction and

building materials 8

Consumer products

& services 3

Financial services 13

Healthcare 4

Industrials 28

Support services 40

Technology, media

& telecoms 1

Analysed by age of investment

30 June 2015

%

----------- -------------

<1 year 10

1-3 years 23

3-5 years 29

>5 years 38

Consolidated Income Statement

for the six months ended 30 June 2015

Unaudited Unaudited Audited

Six months ended Six months ended Year ended

30 June 2015 30 June 2014 31 December 2014

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- -------- -------- -------- -------- -------- -------- -------- -------- --------

Investment income 98 - 98 292 - 292 1,711 - 1,711

Gain / (loss) on

investments - 76 76 - (1,430) (1,430) - (1,218) (1,218)

-------------------------- -------- -------- -------- -------- -------- -------- -------- -------- --------

Total Income 98 76 174 292 (1,430) (1,138) 1,711 (1,218) 493

Expenses

Investment management

fees (51) (153) (204) (61) (183) (244) (104) (311) (415)

Management performance

fee - - - - - - 7 22 29

Other expenses (254) - (254) (323) - (323) (633) - (633)

-------------------------- -------- -------- -------- -------- -------- -------- -------- -------- --------

Profit / (loss) before

finance costs and tax (207) (77) (284) (92) (1,613) (1,705) 981 (1,507) (526)

Finance costs (62) (187) (249) (75) (225) (300) (138) (413) (551)

-------------------------- -------- -------- -------- -------- -------- -------- -------- -------- --------

Profit / (loss) before

tax (269) (264) (533) (167) (1,838) (2,005) 843 (1,920) (1,077)

Taxation - - - - - - 137 162 299

-------------------------- -------- -------- -------- -------- -------- -------- -------- -------- --------

Profit / (loss) for the

period (269) (264) (533) (167) (1,838) (2,005) 980 (1,758) (778)

-------------------------- -------- -------- -------- -------- -------- -------- -------- -------- --------

Earnings per ordinary

share (basic & diluted) (1.3)p (1.3)p (2.6)p (0.8)p (8.4)p (9.2)p 4.6p (8.3)p (3.7)p

The Total column of this statement represents the Income

Statement of the Group, prepared in accordance with International

Financial Reporting Standards as adopted by the EU. The

supplementary revenue and capital columns are both prepared under

guidance published by the Association of Investment Companies.

All items in the above statement derive from continuing

operations.

All income is attributable to the equity shareholders of Dunedin

Enterprise Investment Trust PLC.

Consolidated Statement of Changes in Equity

for the six months ended 30 June 2015

Six months ended 30 June 2015 (unaudited)

Capital Capital Capital Special Total

Share redemption Reserve reserve Distributable Revenue retained Total

capital reserve realised - Reserve account earnings equity

GBP'000 GBP'000 GBP'000 unrealised GBP'000 GBP'000 GBP'000 GBP'000

GBP'000

--------------- ---------- ----------- ---------- ------------ -------------- ---------- ---------- ----------

At 31 December

2014 5,217 2,709 47,552 (3,436) 47,600 6,914 98,630 106,556

Profit/(loss)

for the half

year - - (6,750) 6,486 - (269) (533) (533)

Purchase and

cancellation

of shares (56) 56 (700) - - - (700) (700)

Dividends

paid - - - - - (981) (981) (981)

--------------- ---------- ----------- ---------- ------------ -------------- ---------- ---------- ----------

At 30 June

2015 5,161 2,765 40,102 3,050 47,600 5,664 96,416 104,342

--------------- ---------- ----------- ---------- ------------ -------------- ---------- ---------- ----------

Six months ended 30 June 2014 (unaudited)

Capital Capital Capital Special Total

Share redemption Reserve reserve Distributable Revenue retained Total

capital reserve realised - Reserve account earnings equity

GBP'000 GBP'000 GBP'000 unrealised GBP'000 GBP'000 GBP'000 GBP'000

GBP'000

--------------- ---------- ----------- ---------- ------------ -------------- ---------- ---------- ----------

At 31 December

2013 5,492 2,434 62,832 (11,649) 47,600 9,558 108,341 116,267

Profit/(loss)

for the half

year - - (6,917) 5,079 - (167) (2,005) (2,005)

Purchase and

cancellation

of shares (275) 275 (5,288) - - - (5,288) (5,288)

Dividends

paid - - - - - (3,624) (3,624) (3,624)

--------------- ---------- ----------- ---------- ------------ -------------- ---------- ---------- ----------

At 30 June

2014 5,217 2,709 50,627 (6,570) 47,600 5,767 97,424 105,350

--------------- ---------- ----------- ---------- ------------ -------------- ---------- ---------- ----------

Year ended 31 December 2014 (audited)

Capital Capital Capital Special Total

Share redemption Reserve reserve Distributable Revenue retained Total

capital reserve realised - Reserve account earnings equity

GBP'000 GBP'000 GBP'000 unrealised GBP'000 GBP'000 GBP'000 GBP'000

GBP'000

--------------- ---------- ----------- ---------- ------------ -------------- ---------- ---------- ----------

At 31 December

2013 5,492 2,434 62,832 (11,649) 47,600 9,558 108,341 116,267

Profit/(loss)

for the year - - (9,971) 8,213 - 980 (778) (778)

Purchase and

cancellation

of shares (275) 275 (5,309) - - - (5,309) (5,309)

Dividends

paid - - - - - (3,624) (3,624) (3,624)

--------------- ---------- ----------- ---------- ------------ -------------- ---------- ---------- ----------

At 31 December

2014 5,217 2,709 47,552 (3,436) 47,600 6,914 98,630 106,556

--------------- ---------- ----------- ---------- ------------ -------------- ---------- ---------- ----------

Consolidated Balance Sheet

(MORE TO FOLLOW) Dow Jones Newswires

August 28, 2015 02:01 ET (06:01 GMT)

As at 30 June 2015

Unaudited Unaudited Audited

30 June 30 June 31 December

2015 2014 2014

GBP'000 GBP'000 GBP'000

------------------------------- ---------- ---------- -------------

Non-current assets

Investments held at fair

value 105,061 95,127 98,371

Current assets

Other receivables 209 905 269

Cash and cash equivalents 396 10,078 8,726

------------------------------- ---------- ---------- -------------

605 10,983 8,995

Total assets 105,666 106,110 107,366

Current liabilities

Other liabilities (1,324) (626) (810)

Current tax liabilities - (134) -

Net assets 104,342 105,350 106,556

------------------------------- ---------- ---------- -------------

Capital and reserves

Share capital 5,161 5,217 5,217

Capital redemption reserve 2,765 2,709 2,709

Capital reserve - realised 40,102 50,627 47,552

Capital reserve - unrealised 3,050 (6,570) (3,436)

Special distributable reserve 47,600 47,600 47,600

Revenue reserve 5,664 5,767 6,914

------------------------------- ---------- ---------- -------------

Total equity 104,342 105,350 106,556

------------------------------- ---------- ---------- -------------

Net asset value per ordinary

share (basic and diluted) 505.4p 504.8p 510.6p

Consolidated Cash Flow Statement

for the six months ended 30 June 2015

Unaudited Unaudited Audited

30 June 30 June 31 December

2015 2014 2014

GBP'000 GBP'000 GBP'000

-------------------------------------- ---------- ---------- -------------

Operating activities

Loss before tax (533) (2,005) (1,077)

Adjustments for:

(Gain) / loss on investments (76) 1,430 1,218

Interest paid 249 300 551

(Increase) / decrease in debtors 60 (312) 324

(Decrease) / increase in creditors 514 (44) 140

Other non cash movements - - 199

Net cash (outflow) / inflow

from operating activities 214 (631) 1,355

Servicing of finance

Interest paid (249) (300) (551)

Investing activities

Purchase of investments (10,636) (9,768) (16,025)

Purchase of 'AAA' rated money

market funds (6,707) (10,379) (13,395)

Sale of investments 3,045 2,272 6,108

Sale of 'AAA' rated money

market funds 7,750 14,379 16,629

-------------------------------------- ---------- ---------- -------------

Net cash (outflow) / inflow

from investing activities (6,548) (3,496) (6,683)

Taxation

Tax - (49) 116

Financing activities

Purchase of ordinary shares (700) (5,288) (5,309)

Dividends paid (981) (3,624) (3,624)

-------------------------------------- ---------- ---------- -------------

Net cash (outflow) from financing

activities (1,681) (8,912) (8,933)

Effect of exchange rate fluctuations

on cash held (66) (18) (62)

-------------------------------------- ---------- ---------- -------------

Net (decrease) in cash and

cash equivalents (8,330) (13,406) (14,758)

-------------------------------------- ---------- ---------- -------------

Cash and cash equivalents

at the start of the period 8,726 23,484 23,484

Net (decrease) in cash and

cash equivalents (8,330) (13,406) (14,758)

Cash and cash equivalents

at the end of the period 396 10,078 8,726

-------------------------------------- ---------- ---------- -------------

Responsibility statement of the Directors

in respect of the half-yearly financial report

We confirm that to the best of our knowledge:

- the condensed set of financial statements has been prepared in

accordance with IAS 34 Interim Financial Reporting as adopted by

the EU and gives a true and fair view of the assets, liabilities,

financial position and profit of the Company

- the interim management report includes a fair review of the information required by:

(a) DTR 4.2.7R of the Disclosure and Transparency Rules, being

an indication of important events that have occurred during the

first six months of the financial year and their impact on the

condensed set of financial statements; and a description of the

principal risks and uncertainties for the remaining six months of

the year; and

(b) DTR 4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the first six

months of the current financial year and that have materially

affected the financial position or performance of the entity during

that period; and any changes in the related party transactions

described in the last annual report that could do so.

By Order of the Board

Duncan Budge

Chairman

27 August 2015

Notes to the Accounts

1. Unaudited Interim Report

The comparative financial information contained in this report

for the year ended 31 December 2014 does not constitute the

Company's statutory accounts but is derived from those accounts.

Statutory accounts for the year ended 31 December 2014 have been

delivered to the Registrar of Companies. The auditor has reported

on those accounts; their report was (i) unqualified, (ii) did not

include a reference to any matters to which the auditor drew

attention by way of emphasis without qualifying their report and

(iii) did not contain a statement under section 498 (2) or (3) of

the Companies Act 2006.

The financial statements for the six months ended 30 June 2014

and 30 June 2015 have not been audited.

2. Basis of Preparation

These condensed consolidated set of financial statements for the

six months ended 30 June 2015 have been prepared in accordance the

Disclosure Rules and Transparency Rules of the Financial Conduct

Authority (FCA) and IAS 34 Interim Financial Reporting as adopted

by the European Union (EU). They do not include all the information

required by International Financial Reporting Standards (IFRS) in

full annual financial statements and should be read in conjunction

with the Annual Report and Accounts for the year ended 31 December

2014.

The Association of Investment Companies ('AIC') issued a revised

Statement of Recommended Practice for the Financial Statements of

Investment Trust Companies and Venture Capital Trusts in November

2014 ('SORP') applicable to accounting periods commencing on or

after 1 January 2015. Where presentational guidance set out in the

SORP is consistent with the requirements of IFRS, the Directors

have sought to prepare the financial statements on a basis

compliant with the recommendations of the SORP.

The accounting policies applied in these condensed financial

statements are the same as those in the Group's consolidated

financial statements as at and for the year ended 31 December 2014,

copies of which are available on the Company's website.

3. Dividends

Six months Six months

to to Year to

30 June 30 June 31 December

2015 2014 2014

GBP'000 GBP'000 GBP'000

Dividends paid in the period 981 3,624 3,624

========== ========== ============

4. Investments

All investments are designated fair value through profit or loss

at initial recognition, therefore all gains and losses that arise

on investments are designated at fair value through profit or loss.

Given the nature of the Company's investments the fair value gains

recognised in these financial statements are not considered to be

readily convertible to cash in full at the balance sheet date and

therefore the movement in these fair values are treated as

unrealised.

Fair value hierarchy

The Group measures fair values using the following fair value

hierarchy that reflects the significance of the inputs used in

making the measurements:

-- Level 1: Quoted market price (unadjusted) in an active market

for an identical instrument.

-- Level 2: Valuation techniques based on observable inputs,

either directly (i.e., as prices) or indirectly (i.e., derived from

prices). This category includes instruments valued using: quoted

market prices in active markets for similar instruments; quoted

prices for identical or similar instruments in markets that are

considered less than active; or other valuation techniques where

all significant inputs are directly or indirectly observable from

market data.

(MORE TO FOLLOW) Dow Jones Newswires

August 28, 2015 02:01 ET (06:01 GMT)

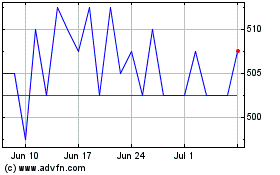

Dunedin Enterprise Inves... (LSE:DNE)

Historical Stock Chart

From Aug 2024 to Sep 2024

Dunedin Enterprise Inves... (LSE:DNE)

Historical Stock Chart

From Sep 2023 to Sep 2024