Donegal Group Inc. (NASDAQ:DGICA) (NASDAQ:DGICB) today reported its

financial results for the first quarter of 2017. Significant

items included:

- Net income of $5.1 million, or 18 cents per diluted Class A

share, for the first quarter of 2017, compared to $11.8 million, or

46 cents per diluted Class A share, for the first quarter of

2016

- 8.5% increase in net premiums written to $184.5 million,

reflecting organic growth in both personal and commercial

lines

- Statutory combined ratio1 of 99.6% for the first quarter of

2017, compared to 92.1% for the first quarter of 2016

- Book value per share of $16.43 at March 31, 2017, compared to

$16.21 at year-end 2016

|

|

Three Months Ended March 31, |

|

|

|

2017 |

|

|

|

2016 |

|

|

% Change |

|

|

(dollars in thousands, except per share amounts) |

|

|

|

|

|

|

|

|

Income Statement Data |

|

|

|

|

|

|

Net premiums earned |

$ |

169,156 |

|

|

$ |

158,475 |

|

|

6.7 |

% |

|

Investment income, net |

|

5,755 |

|

|

|

5,547 |

|

|

3.8 |

|

|

Net realized investment gains |

|

2,549 |

|

|

|

471 |

|

|

441.2 |

|

|

Total revenues |

|

178,971 |

|

|

|

166,069 |

|

|

7.8 |

|

|

Net income |

|

5,105 |

|

|

|

11,849 |

|

|

-56.9 |

|

|

Operating income |

|

3,448 |

|

|

|

11,543 |

|

|

-70.1 |

|

|

Annualized return on average equity |

|

4.6 |

% |

|

|

11.4 |

% |

|

-6.8 |

pts |

|

|

|

|

|

|

|

|

Per Share Data |

|

|

|

|

|

|

Net income – Class A (diluted) |

$ |

0.18 |

|

|

$ |

0.46 |

|

|

-60.9 |

% |

|

Net income – Class B |

|

0.17 |

|

|

|

0.42 |

|

|

-59.5 |

|

|

Operating income – Class A (diluted) |

|

0.12 |

|

|

|

0.44 |

|

|

-72.7 |

|

|

Operating income – Class B |

|

0.12 |

|

|

|

0.41 |

|

|

-70.7 |

|

|

Book value |

|

16.43 |

|

|

|

16.29 |

|

|

0.9 |

|

|

|

|

|

|

|

|

1The “Definitions of Non-GAAP and Operating Measures” section of

this release defines and reconciles data that the Company prepares

on an accounting basis other than U.S. generally accepted

accounting principles (“GAAP”).

Kevin G. Burke, President and Chief Executive Officer of Donegal

Group Inc., noted, “Donegal Group reported strong organic growth, a

higher return from our investment portfolio, and profitable

operations in the first quarter of 2017, despite

higher-than-expected losses related to severe storm activity in

several of our marketing regions. Our net premiums written

increased by 8.5% compared to the prior-year first quarter. This

increase reflected a continuation of strong growth in our

commercial lines. We achieved this growth in spite of

reinsurance reinstatement premiums that reduced net premiums

written for our homeowners line of business and our commercial

multi-peril line of business by 4.5% and 2.5%, respectively, during

the first quarter. We strive to leverage our position as a

trusted and well-recognized regional insurer to win market share,

while we price our products appropriately in light of the current

conditions within our industry. We continue to implement

appropriate premium rate increases that respond to increasing loss

cost trends in our personal and commercial auto lines, with the

expectation that these premium rate increases will contribute to

higher premiums written and increased underwriting profitability

over time.”

Mr. Burke continued, “We work with our independent agents who

know their local markets well to integrate technology tools in

every facet of our underwriting process, particularly for our auto

products. Companies, such as us, that have invested in

telematics and predictive analytics to collect and evaluate

information regarding specific risk characteristics in their

underwriting processes have a clear advantage over those insurance

carriers that are now just beginning to implement such

practices. We continue to further develop, refine and

implement technology tools that will further enhance our

underwriting and risk selection processes. We remain

dedicated to providing “best-in-class” technology that will enhance

our services to our customers and our trusted network of

independent agents.”

Mr. Burke concluded, “While a higher level of storm activity

impacted our underwriting results in several of our marketing areas

in the first quarter of 2017, we believe that the strength of our

brand and our proven business strategies provide us with

sustainable competitive advantages that will enable us to deliver

higher returns in the future.”

Donald H. Nikolaus, Chairman of Donegal Group Inc., remarked,

“We have a commitment to deliver underwriting results that

outperform the insurance industry and that, combined with solid

investment returns, will help to deliver superior book value

appreciation over time. At March 31, 2017, our book value per

share increased to $16.43, compared to $16.21 at December 31, 2016.

Our net income during the first quarter of 2017, as well as a

modest increase in unrealized gains within our available-for-sale

fixed-maturity and equity investment portfolios during the first

quarter, contributed to the increase in our book value at March 31,

2017.”

Insurance Operations

Donegal Group is an insurance holding company whose insurance

subsidiaries offer personal and commercial property and casualty

lines of insurance in four Mid-Atlantic states (Delaware, Maryland,

New York and Pennsylvania), three New England states (Maine, New

Hampshire and Vermont), seven Southern states (Alabama, Georgia,

North Carolina, South Carolina, Tennessee, Virginia and West

Virginia) and seven Midwestern states (Indiana, Iowa, Michigan,

Nebraska, Ohio, South Dakota and Wisconsin).

|

|

Three Months Ended March 31, |

|

|

|

2017 |

|

|

2016 |

|

% Change |

|

|

(dollars in thousands) |

|

|

|

|

|

|

|

|

Net Premiums Written |

|

|

|

|

|

|

Personal lines: |

|

|

|

|

|

|

Automobile |

$ |

61,292 |

|

$ |

55,054 |

|

11.3 |

% |

|

Homeowners |

|

25,591 |

|

|

25,882 |

|

-1.1 |

|

|

Other |

|

4,728 |

|

|

4,351 |

|

8.7 |

|

|

Total personal lines |

|

91,611 |

|

|

85,287 |

|

7.4 |

|

|

Commercial lines: |

|

|

|

|

|

|

Automobile |

|

26,835 |

|

|

22,911 |

|

17.1 |

|

|

Workers' compensation |

|

33,484 |

|

|

31,030 |

|

7.9 |

|

|

Commercial multi-peril |

|

30,030 |

|

|

28,453 |

|

5.5 |

|

|

Other |

|

2,541 |

|

|

2,394 |

|

6.1 |

|

|

Total commercial lines |

|

92,890 |

|

|

84,788 |

|

9.6 |

|

|

Total net premiums written |

$ |

184,501 |

|

$ |

170,075 |

|

8.5 |

% |

|

|

|

|

|

|

|

The 8.5% increase in the Company’s net premiums written for the

first quarter of 2017 compared to the first quarter of 2016, as

shown in the table above, represents the combination of 9.6% growth

in commercial lines net premiums written and 7.4% growth in

personal lines net premiums written. The $14.4 million growth in

net premiums written for the first quarter of 2017 compared to the

first quarter of 2016 included:

- $8.1 million in commercial lines premiums that the Company

attributes primarily to new commercial accounts the Company’s

insurance subsidiaries have written throughout their operating

regions and a continuation of modest renewal premium

increases.

- $6.3 million in personal lines premiums that the Company

attributes to a combination of new policy growth and premium rate

increases the Company has implemented over the past four quarters,

partially offset by higher reinsurance reinstatement premiums.

The Company renewed the majority of its reinsurance programs

effective January 1, 2017 with no substantive changes to its

reinsurance premium rates or coverage levels for 2017 compared to

2016.

The following table presents comparative details with respect to

our GAAP and statutory combined ratios for the three months ended

March 31, 2017 and 2016:

|

|

Three Months Ended |

|

|

March 31, |

|

|

2017 |

|

|

2016 |

|

|

|

|

|

|

|

GAAP Combined Ratios (Total Lines) |

|

|

|

|

Loss ratio (non-weather) |

59.3 |

% |

|

55.9 |

% |

|

Loss ratio (weather-related) |

8.4 |

|

|

4.4 |

|

|

Expense ratio |

33.2 |

|

|

33.2 |

|

|

Dividend ratio |

0.5 |

|

|

0.5 |

|

|

Combined ratio |

101.4 |

% |

|

94.0 |

% |

|

|

|

|

|

|

Statutory Combined Ratios |

|

|

|

|

Personal Lines: |

|

|

|

|

Automobile |

104.7 |

% |

|

99.8 |

% |

|

Homeowners |

106.1 |

|

|

91.0 |

|

|

Other |

89.6 |

|

|

82.2 |

|

|

Total personal lines |

104.0 |

|

|

95.6 |

|

|

Commercial Lines: |

|

|

|

|

Automobile |

107.0 |

|

|

101.8 |

|

|

Workers' compensation |

80.8 |

|

|

86.5 |

|

|

Commercial multi-peril |

105.9 |

|

|

84.7 |

|

|

Total commercial lines |

94.4 |

|

|

88.0 |

|

|

Total lines |

99.6 |

% |

|

92.1 |

% |

|

|

|

|

|

Jeffrey D. Miller, Executive Vice President and Chief Financial

Officer of Donegal Group Inc., commented, “We were pleased with the

performance of our workers’ compensation line of business, which

produced an excellent 80.8% statutory combined ratio for the first

quarter of 2017. Weather-related losses adversely impacted

our underwriting results for our homeowners and commercial

multi-peril lines of business during the first quarter of 2017,

primarily attributable to numerous wind and hail events in our

Mid-Atlantic, Midwestern and Southern regions. None of these

weather-related events caused insured losses that exceeded our $5.0

million external catastrophe reinsurance retention amount, but the

cumulative impact of numerous smaller storm systems was far greater

than our historical first-quarter average for weather-related

losses. Intercompany catastrophe reinsurance with Donegal

Mutual Insurance Company capped the financial impact of losses from

two of these wind and hail events and resulted in reinsurance

reinstatement premiums of $2.0 million during the first quarter of

2017.”

For the first quarter of 2017, the Company’s statutory loss

ratio1 increased to 67.9%, compared to 60.2% for the first quarter

of 2016. Weather-related losses of $14.3 million for the

first quarter of 2017, or 8.4 percentage points of the Company’s

loss ratio, increased from the $6.9 million, or 4.4 percentage

points of the Company’s loss ratio, for the first quarter of 2016.

Weather-related loss activity for the first quarter of 2017

significantly exceeded the Company's five-year average of $8.3

million for first-quarter weather-related losses.

Large fire losses, which the Company defines as individual fire

losses in excess of $50,000, for the first quarter of 2017 were

$5.9 million, or 3.5 percentage points of the Company’s loss

ratio. That amount was in line with the large fire losses of

$5.8 million, or 3.7 percentage points of the Company’s loss ratio,

for the first quarter of 2016.

The Company’s statutory expense ratio1 was 31.1% for the first

quarter of 2017, compared to 31.3% for the first quarter of

2016. The decrease in the Company's statutory expense ratio

reflected lower underwriting-based incentive costs for the first

quarter of 2017.

Investment Operations

Donegal Group’s investment strategy is to generate an

appropriate amount of after-tax income on its invested assets while

minimizing credit risk through investment in high-quality

securities. As a result, the Company had invested 89.8% of its

consolidated investment portfolio in diversified, highly rated and

marketable fixed-maturity securities at March 31, 2017.

|

|

March 31, 2017 |

|

December 31, 2016 |

|

|

Amount |

|

% |

|

Amount |

|

% |

|

|

(dollars in thousands) |

|

Fixed maturities, at carrying value: |

|

|

|

|

|

|

|

|

U.S. Treasury securities and obligations of U.S. |

|

|

|

|

|

|

|

|

government corporations and agencies |

$ |

102,081 |

|

|

10.6 |

% |

|

$ |

99,970 |

|

|

10.6 |

% |

|

Obligations of states and political subdivisions |

|

303,806 |

|

|

31.6 |

|

|

|

308,876 |

|

|

32.7 |

|

|

Corporate securities |

|

193,323 |

|

|

20.1 |

|

|

|

179,011 |

|

|

18.9 |

|

|

Mortgage-backed securities |

|

264,255 |

|

|

27.5 |

|

|

|

263,319 |

|

|

27.8 |

|

|

Total fixed maturities |

|

863,465 |

|

|

89.8 |

|

|

|

851,176 |

|

|

90.0 |

|

|

Equity securities, at fair value |

|

48,601 |

|

|

5.1 |

|

|

|

47,088 |

|

|

5.0 |

|

|

Investments in affiliates |

|

38,186 |

|

|

4.0 |

|

|

|

37,885 |

|

|

4.0 |

|

|

Short-term investments, at cost |

|

10,268 |

|

|

1.1 |

|

|

|

9,371 |

|

|

1.0 |

|

|

Total investments |

$ |

960,520 |

|

|

100.0 |

% |

|

$ |

945,520 |

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

Average investment yield |

|

2.4 |

% |

|

|

|

|

2.5 |

% |

|

|

|

Average tax-equivalent investment yield |

|

2.9 |

% |

|

|

|

|

3.0 |

% |

|

|

|

Average fixed-maturity duration (years) |

|

4.4 |

|

|

|

|

|

4.5 |

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income of $5.8 million for the first quarter of

2017 increased 3.8% compared to $5.5 million in net investment

income for the first quarter of 2016. The increase in net

investment income reflected primarily an increase in average

invested assets relative to the prior-year first quarter.

Net realized investment gains, primarily from sales of equity

securities, were $2.5 million for the first quarter of 2017,

compared to $470,941 for the first quarter of 2016. The Company had

no impairments in its investment portfolio that it considered to be

other than temporary during the first quarter of 2017 or 2016.

Definitions of Non-GAAP and Operating

Measures

The Company prepares its consolidated financial statements on

the basis of GAAP. The Company’s insurance subsidiaries also

prepare financial statements based on statutory accounting

principles state insurance regulators prescribe or permit (“SAP”).

In addition to using GAAP-based performance measurements, the

Company also utilizes certain non-GAAP financial measures that it

believes provide value in managing its business and for comparison

to the financial results of its peers. These non-GAAP measures are

operating income and statutory combined ratio.

Operating income is a non-GAAP financial measure investors in

insurance companies commonly use. The Company defines operating

income as net income excluding after-tax net realized investment

gains or losses. Because the Company’s calculation of operating

income may differ from similar measures other companies use,

investors should exercise caution when comparing the Company’s

measure of operating income to the measure of other companies.

The following table provides a reconciliation of the Company's

net income to the Company's operating income for the periods

indicated:

|

|

Three Months Ended March 31, |

|

|

|

2017 |

|

|

|

2016 |

|

|

% Change |

|

|

(dollars in thousands, except per share amounts) |

|

|

|

|

|

|

|

|

Reconciliation of Net Income |

|

|

|

|

|

|

to Operating Income |

|

|

|

|

|

|

Net income |

$ |

5,105 |

|

|

$ |

11,849 |

|

|

-56.9 |

% |

|

Realized gains (after tax) |

|

(1,657 |

) |

|

|

(306 |

) |

|

441.5 |

% |

|

Operating income |

$ |

3,448 |

|

|

$ |

11,543 |

|

|

-70.1 |

% |

|

|

|

|

|

|

|

|

Per Share Reconciliation of Net |

|

|

|

|

|

|

Income to Operating Income |

|

|

|

|

|

|

Net income – Class A (diluted) |

$ |

0.18 |

|

|

$ |

0.46 |

|

|

-60.9 |

% |

|

Realized gains (after tax) |

|

(0.06 |

) |

|

|

(0.02 |

) |

|

200.0 |

% |

|

Operating income – Class A |

$ |

0.12 |

|

|

$ |

0.44 |

|

|

-72.7 |

% |

|

|

|

|

|

|

|

|

Net income – Class B |

$ |

0.17 |

|

|

$ |

0.42 |

|

|

-59.5 |

% |

|

Realized gains (after tax) |

|

(0.05 |

) |

|

|

(0.01 |

) |

|

400.0 |

% |

|

Operating income – Class B |

$ |

0.12 |

|

|

$ |

0.41 |

|

|

-70.7 |

% |

|

|

|

|

|

|

|

The statutory combined ratio is a non-GAAP standard measurement

of underwriting profitability that is based upon amounts determined

under SAP. The statutory combined ratio is the sum of:

- the statutory loss ratio, which is the ratio of calendar-year

incurred losses and loss expenses, excluding anticipated salvage

and subrogation recoveries, to premiums earned;

- the statutory expense ratio, which is the ratio of expenses

incurred for net commissions, premium taxes and underwriting

expenses to premiums written; and

- the statutory dividend ratio, which is the ratio of dividends

to holders of workers’ compensation policies to premiums

earned.

The statutory combined ratio does not reflect investment income,

federal income taxes or other non-operating income or expense. A

statutory combined ratio of less than 100% generally indicates

underwriting profitability.

Conference Call and Webcast

The Company will hold a conference call and webcast on

Wednesday, April 19, 2017, beginning at 11:00 A.M. Eastern Time.

You may listen via the Internet by accessing the webcast link on

the Company’s web site at http://investors.donegalgroup.com. A

replay of the conference call will also be available via the

Company’s website.

About the Company

Donegal Group is an insurance holding company. The insurance

subsidiaries of Donegal Group and Donegal Mutual Insurance Company

conduct business together as the Donegal Insurance Group. The

Company’s Class A common stock and Class B common stock trade on

the NASDAQ Global Select Market under the symbols DGICA and DGICB,

respectively. As an effective acquirer of small to medium-sized

“main street” property and casualty insurers, Donegal Group has

grown profitably over the last three decades. The Company continues

to seek opportunities for growth while striving to achieve its

longstanding goal of outperforming the property and casualty

insurance industry in terms of service, profitability and book

value growth.

The Company owns 48.2% of the outstanding stock of Donegal

Financial Services Corporation (“DFSC”). DFSC owns all of the

outstanding stock of Union Community Bank (“UCB”). The Company

accounts for its investment in DFSC using the equity method of

accounting. Donegal Mutual Insurance Company owns the remaining

51.8% of the outstanding stock of DFSC.

Safe Harbor

We base all statements contained in this release that are not

historic facts on our current expectations. These statements are

forward-looking in nature (as defined in the Private Securities

Litigation Reform Act of 1995) and involve a number of risks and

uncertainties. Actual results could vary materially. Factors that

could cause actual results to vary materially include: our ability

to maintain profitable operations, the adequacy of the loss and

loss expense reserves of our insurance subsidiaries, business and

economic conditions in the areas in which our insurance

subsidiaries operate, interest rates, competition from various

insurance and other financial businesses, terrorism, the

availability and cost of reinsurance, adverse and catastrophic

weather events, legal and judicial developments, changes in

regulatory requirements, our ability to integrate and manage

successfully the insurance companies we may acquire from time to

time and other risks we describe from time to time in the periodic

reports we file with the Securities and Exchange Commission. You

should not place undue reliance on any such forward-looking

statements. We disclaim any obligation to update such statements or

to announce publicly the results of any revisions that we may make

to any forward-looking statements to reflect the occurrence of

anticipated or unanticipated events or circumstances after the date

of such statements.

| Donegal Group Inc. |

| Consolidated Statements of Income |

| (unaudited; in thousands, except share data) |

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended March 31, |

|

|

|

|

|

2017 |

|

|

|

2016 |

|

| |

|

|

|

|

|

| Net

premiums earned |

$ |

169,156 |

|

|

$ |

158,475 |

|

| Investment

income, net of expenses |

|

5,755 |

|

|

|

5,547 |

|

| Net

realized investment gains |

|

2,549 |

|

|

|

471 |

|

| Lease

income |

|

142 |

|

|

|

178 |

|

| Installment

payment fees |

|

1,136 |

|

|

|

1,363 |

|

| Equity in

earnings of DFSC |

|

233 |

|

|

|

35 |

|

| |

Total revenues |

|

178,971 |

|

|

|

166,069 |

|

| |

|

|

|

|

|

| Net losses

and loss expenses |

|

114,433 |

|

|

|

95,578 |

|

|

Amortization of deferred acquisition costs |

|

27,683 |

|

|

|

25,956 |

|

| Other

underwriting expenses |

|

28,489 |

|

|

|

26,638 |

|

|

Policyholder dividends |

|

834 |

|

|

|

832 |

|

|

Interest |

|

|

364 |

|

|

|

408 |

|

| Other

expenses |

|

443 |

|

|

|

638 |

|

| |

Total expenses |

|

172,246 |

|

|

|

150,050 |

|

| |

|

|

|

|

|

| Income

before income tax expense |

|

6,725 |

|

|

|

16,019 |

|

| Income tax

expense |

|

1,620 |

|

|

|

4,170 |

|

| |

|

|

|

|

|

| Net

income |

$ |

5,105 |

|

|

$ |

11,849 |

|

| |

|

|

|

|

|

| Net income

per common share: |

|

|

|

| |

Class A - basic |

$ |

0.19 |

|

|

$ |

0.46 |

|

| |

Class A - diluted |

$ |

0.18 |

|

|

$ |

0.46 |

|

| |

Class B - basic and diluted |

$ |

0.17 |

|

|

$ |

0.42 |

|

| |

|

|

|

|

|

|

Supplementary Financial Analysts' Data |

|

|

|

| |

|

|

|

|

|

|

Weighted-average number of shares |

|

|

|

| |

outstanding: |

|

|

|

| |

Class A - basic |

|

21,544,864 |

|

|

|

20,544,741 |

|

| |

Class A - diluted |

|

22,625,578 |

|

|

|

20,815,540 |

|

| |

Class B - basic and diluted |

|

5,576,775 |

|

|

|

5,576,775 |

|

| |

|

|

|

|

|

| Net

premiums written |

$ |

184,501 |

|

|

$ |

170,075 |

|

| |

|

|

|

|

|

| Book value

per common share |

|

|

|

| |

at end of period |

$ |

16.43 |

|

|

$ |

16.29 |

|

| |

|

|

|

|

|

| Annualized

return on average equity |

|

4.6 |

% |

|

|

11.4 |

% |

| Donegal Group Inc. |

| Consolidated Balance Sheets |

| (in thousands) |

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

December 31, |

|

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

| ASSETS |

|

Investments: |

|

|

|

| |

Fixed

maturities: |

|

|

|

| |

|

Held to maturity, at

amortized cost |

$ |

352,296 |

|

|

$ |

336,101 |

|

| |

|

Available for sale, at

fair value |

|

511,169 |

|

|

|

515,075 |

|

| |

Equity

securities, at fair value |

|

48,601 |

|

|

|

47,088 |

|

| |

Investments

in affiliates |

|

38,186 |

|

|

|

37,885 |

|

| |

Short-term

investments, at cost |

|

10,268 |

|

|

|

9,371 |

|

| |

|

Total investments |

|

960,520 |

|

|

|

945,520 |

|

| Cash |

|

|

33,656 |

|

|

|

24,587 |

|

| Premiums

receivable |

|

169,303 |

|

|

|

159,390 |

|

| Reinsurance

receivable |

|

269,804 |

|

|

|

263,028 |

|

| Deferred

policy acquisition costs |

|

58,364 |

|

|

|

56,309 |

|

| Prepaid

reinsurance premiums |

|

131,682 |

|

|

|

124,256 |

|

| Other

assets |

|

39,864 |

|

|

|

50,041 |

|

| |

|

Total assets |

$ |

1,663,193 |

|

|

$ |

1,623,131 |

|

| |

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS' EQUITY |

|

Liabilities: |

|

|

|

|

| |

Losses and

loss expenses |

$ |

620,849 |

|

|

$ |

606,665 |

|

| |

Unearned

premiums |

|

488,827 |

|

|

|

466,055 |

|

| |

Accrued

expenses |

|

19,071 |

|

|

|

28,247 |

|

| |

Borrowings

under lines of credit |

|

69,000 |

|

|

|

69,000 |

|

| |

Subordinated debentures |

|

5,000 |

|

|

|

5,000 |

|

| |

Other

liabilities |

|

13,735 |

|

|

|

9,549 |

|

| |

|

Total liabilities |

|

1,216,482 |

|

|

|

1,184,516 |

|

|

Stockholders' equity: |

|

|

|

| |

Class A

common stock |

|

246 |

|

|

|

245 |

|

| |

Class B

common stock |

|

56 |

|

|

|

56 |

|

| |

Additional

paid-in capital |

|

239,690 |

|

|

|

236,852 |

|

| |

Accumulated

other comprehensive loss |

|

(1,907 |

) |

|

|

(2,254 |

) |

| |

Retained

earnings |

|

249,852 |

|

|

|

244,942 |

|

| |

Treasury

stock |

|

(41,226 |

) |

|

|

(41,226 |

) |

| |

|

Total stockholders'

equity |

|

446,711 |

|

|

|

438,615 |

|

| |

|

Total liabilities and

stockholders' equity |

$ |

1,663,193 |

|

|

$ |

1,623,131 |

|

For Further Information:

Jeffrey D. Miller, Executive Vice President & Chief Financial Officer

Phone: (717) 426-1931

E-mail: investors@donegalgroup.com

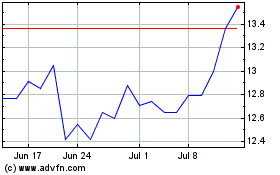

Donegal (NASDAQ:DGICA)

Historical Stock Chart

From Aug 2024 to Sep 2024

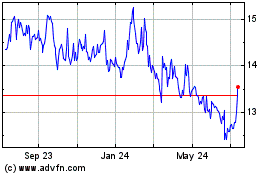

Donegal (NASDAQ:DGICA)

Historical Stock Chart

From Sep 2023 to Sep 2024