TIDMDPLM

RNS Number : 8820W

Diploma PLC

20 November 2017

DIPLOMA PLC

12 CHARTERHOUSE SQUARE, LONDON EC1M 6AX

TELEPHONE: +44 (0)20 7549 5700

FACSIMILE: +44 (0)20 7549 5715

FOR IMMEDIATE RELEASE

20 November 2017

PRELIMINARY ANNOUNCEMENT OF FINAL RESULTS

FOR THE YEARED 30 SEPTEMBER 2017

"Strong Results with Double-Digit Growth in Revenue and

Earnings"

Audited Audited

2017 2016

GBPm GBPm

Revenue 451.9 382.6 +18%

Adjusted operating

profit(1) 78.2 65.7 +19%

Adjusted operating

margin(1) 17.3% 17.2% +10bps

Adjusted profit

before tax(1),(2) 77.5 64.9 +19%

Profit before tax 66.8 54.0 +24%

Profit for the year 48.2 39.1 +23%

Free cash flow(3) 55.7 59.0 -6%

Pence Pence

Adjusted earnings

per share(1),(2) 49.8 41.9 +19%

Basic earnings per

share 42.0 33.9 +24%

Total dividend per

share 23.0 20.0 +15%

(1) Before acquisition related charges.

(2) Before fair value remeasurement and

gain on disposal of assets.

(3) Before cash payments on acquisitions

and dividends.

Financial Highlights

-- Revenue and adjusted operating profit increased by 18% and 19%, respectively.

-- Underlying revenues increased by 7%; currency movement

increased revenues by 9% and businesses acquired made a net

contribution of 2%.

-- Adjusted operating margins improved slightly to 17.3% as

transactional currency effects eased in the Healthcare businesses

and margins improved in the acquired businesses.

-- Adjusted profit before tax and adjusted EPS both increased by 19% to GBP77.5m and to 49.8p, respectively.

-- Strong free cash flow of GBP55.7m; cash funds of GBP22.3m at end of September.

-- Total dividend increased by 15% to 23.0p per share reflecting

strong financial position and confidence in Group's growth

prospects.

Operational Highlights

-- In Life Sciences, underlying revenues increased by 4%, with

strong capital revenues as new technology was introduced and

delayed projects were reactivated in the laboratory diagnostic

sectors.

-- In Seals, underlying revenues increased by 4% reflecting an

improving trend in industrial activity in North America. In the

International Seals businesses, strong growth in the UK and

Scandinavia was offset by more challenging conditions in

Switzerland, Russia and Australia.

-- In Controls, underlying revenues increased by 14%, driven by

new project activity, recovery in some end user markets and

targeted investment in sales resources.

-- Acquisition expenditure of GBP20.1m this year; ca. GBP90m

invested over three years in acquiring value enhancing businesses.

Group's return on adjusted trading capital ("ROATCE") improved to

24%.

Commenting on the results for the year, Bruce Thompson,

Diploma's Chief Executive said:

"Diploma reported another strong performance in 2017, delivering

strong double-digit growth in revenue and earnings. All of the

Group's Sectors contributed to this growth with a particularly

strong performance from Controls.

The Group's performance in 2017 provides confidence in the

Group's prospects for solid underlying growth in the year ahead,

which we aim to enhance by unlocking value enhancing acquisition

opportunities. With a proven business model, broad geographic

spread of businesses, robust balance sheet and consistently strong

free cash flow, the Board is confident that further progress will

be made in the next financial year."

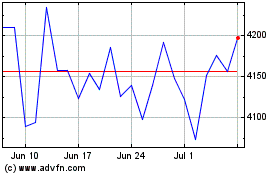

There will be a presentation of the results to analysts and

investors at 9.00am this morning at Pewterers' Hall, Oat Lane, City

of London, EC2V 7DE. This presentation will be made available as a

webcast from 2.00pm GMT via www.diplomaplc.com

For further information please contact:

+44 (0)20 7549

Diploma PLC - 5700

Bruce Thompson, Chief Executive

Officer

Nigel Lingwood, Group Finance

Director

+44 (0)20 7353

Tulchan Communications - 4200

Martin Robinson

David Allchurch

Notes:

Diploma PLC uses alternative performance measures as key

financial indicators to assess the underlying performance of the

Group. These include adjusted operating profit, adjusted profit

before tax, adjusted earnings per share, free cash flow and ROATCE.

All references in this Preliminary Announcement ("Announcement") to

"underlying" revenues or operating profits refer to reported

results on a constant currency basis and before any contribution

from acquired or disposed businesses. The narrative in this

Announcement is based on these alternative measures and an

explanation is set out in note 2 to the consolidated financial

statements in this Announcement.

Certain statements contained in this Announcement constitute

forward-looking statements. Such forward-looking statements involve

risks, uncertainties and other factors which may cause the actual

results, performance or achievements of Diploma PLC, or industry

results, to be materially different from any future results,

performance or achievements expressed or implied by such

statements. Such risks, uncertainties and other factors include,

among others, exchange rates, general economic conditions and the

business environment.

NOTE TO EDITORS:

Diploma PLC is an international group of businesses supplying

specialised technical products and services to the Life Sciences,

Seals and Controls industries.

Diploma's businesses are focussed on supplying essential

products and services which are funded by the customers' operating

rather than their capital budgets, providing recurring income and

stable revenue growth.

Our businesses then design their individual business models to

closely meet the requirements of their customers, offering a blend

of high quality customer service, deep technical support and value

adding activities. By supplying essential solutions, not just

products, we build strong long term relationships with our

customers and suppliers, which support attractive and sustainable

margins.

Finally we encourage an entrepreneurial culture in our

businesses through our decentralised management structure. We want

our managers to feel that they have the freedom to run their own

businesses, while being able to draw on the support and resources

of a larger group. These essential values ensure that decisions are

made close to the customer and that the businesses are agile and

responsive to changes in the market and the competitive

environment.

The Group employs ca. 1,700 employees and its principal

operating businesses are located in the UK, Northern Europe, North

America and Australia.

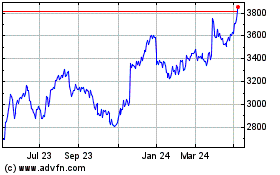

Over the last ten years, the Group has grown adjusted earnings

per share at an average of ca. 14% p.a. through a combination of

underlying growth and acquisitions. Diploma is a member of the FTSE

250 with a market capitalisation of ca. GBP1.2bn.

Further information on Diploma PLC can be found at

www.diplomaplc.com

LEI: 213800OG17VYG8FGR19

PRELIMINARY ANNOUNCEMENT OF FINAL RESULTS

FOR YEARED 30 SEPTEMBER 2017

CHAIRMAN'S STATEMENT

The Group reported another strong performance in 2017 and

delivered robust underlying growth in more confident global

economies. The Board remains focused on executing the Group's

established strategy which is designed to deliver strong growth in

earnings and shareholder value over the economic cycle.

The Group has a long track record of consistent delivery against

its key performance metrics by compounding stable "GDP plus"

underlying growth with carefully selected, value enhancing

acquisitions, funded by the Group's free cash flow. This strategy

has been successfully designed and executed under the outstanding

leadership of Bruce Thompson since he became CEO of Diploma PLC in

1996. Over the last 15 years, since emerging from a major

restructuring of the Group led by Bruce, the Group has delivered

strong double-digit growth in earnings, dividends and share price

and has grown market capitalisation from ca. GBP60m to ca. GBP1.2bn

today, without any new equity having been issued.

In September of this year, the Board received notice from Bruce

of his intention to retire as CEO before the end of 30 September

2018. This notice period ensures sufficient time to complete a

thorough search process and a smooth transition of

responsibilities. Bruce will be leaving the Group with a clearly

defined and sustainable strategy, with a substantial runway for

future growth and an experienced senior management team. We all

wish him a long, healthy and well-earned retirement.

Results

Group revenues increased in 2017 by 18% to GBP451.9m (2016:

GBP382.6m), with the Group's results again boosted by currency

effects from translating the results of the overseas businesses,

following the substantial depreciation in UK sterling. After

adjusting for the contribution from acquisitions completed both

this year and last year, net of a small disposal and for these

currency effects on translation, Group revenues increased by 7% on

an underlying basis. The Controls businesses delivered robust

underlying revenue growth of ca. 14% and both the Life Sciences and

Seals businesses reported a 4% growth in underlying revenues.

Adjusted operating profit increased by 19% to GBP78.2m (2016:

GBP65.7m) reflecting the strong growth in revenues and a small

increase of 10bps in adjusted operating margins to 17.3% (2016:

17.2%). Adjusted profit before tax increased by 19% to GBP77.5m

(2016: GBP64.9m) and adjusted earnings per share ("EPS") also

increased by 19% to 49.8p (2016: 41.9p).

The Group's free cash flow remained robust at GBP55.7m (2016:

GBP59.0m) as working capital increased by GBP4.0m to support the

stronger trading environment across the Group. Last year's free

cash flow included an inflow of GBP6.3m from reduced working

capital and GBP4.6m of cash realised on the sale of assets. Capital

expenditure of GBP3.3m (2016: GBP3.7m) remained at a similar level

to last year.

The Group has invested ca. GBP90m over three years in acquiring

value enhancing businesses. However, expenditure on acquisitions

slowed this year to GBP20.1m (2016: GBP32.7m) as some vendors

postponed their exit plans in the face of a more favourable

macroeconomic environment. There are still a number of good quality

businesses in our acquisition pipeline which we are confident of

completing when the vendors are ready to move forward.

The Group's balance sheet remains robust with cash funds at 30

September 2017 of GBP22.3m (2016: GBP10.6m), after investing

GBP20.1m in acquisitions and making distributions to shareholders

of GBP23.5m (2016: GBP21.0m). The Group also has renewed committed

bank facilities of GBP30m with an accordion option to extend these

facilities up to GBP60m.

Dividends

The combination of strong results and free cash flow, supported

by a robust balance sheet has led the Board to recommend an

increase in the final dividend of 16% to 16.0p per share (2016:

13.8p). Subject to shareholder approval at the Annual General

Meeting ("AGM"), this dividend will be paid on 24 January 2018 to

shareholders on the register at 1 December 2017.

The total dividend per share for the year will be 23.0p (2016:

20.0p) which represents a 15% increase on 2016. With underlying

adjusted earnings increasing by 19%, the level of dividend cover

increases slightly to 2.2 times on an adjusted EPS basis, from 2.1

times in recent years.

Governance

The Board's Committees, led by the non-Executive Directors, have

had a productive year. Anne Thorburn led the Audit Committee

through an audit tender process which in September resulted in a

proposal to appoint PricewaterhouseCoopers LLP as Company and Group

auditor from next year. Andy Smith has also led the Remuneration

Committee through a thorough review of the Company's Remuneration

Policy, in advance of the triennial vote by shareholders at the AGM

on 17 January 2018. I have worked closely with Charles Packshaw as

Senior Independent Director and with the Nomination Committee to

commence a search for a new CEO to lead the Group, following the

intended retirement of Bruce Thompson later in 2018.

Employees

Our employees remain our most important asset and their hard

work continues to be a driving force behind our consistent and

strong performance. Diploma is very much a people business and

success is always a team effort. I wish to thank all of our

employees for their support and contribution to the success of the

Group this year.

Outlook

Diploma reported another strong performance in 2017, delivering

strong double-digit growth in revenue and earnings. All of the

Group's Sectors contributed to this growth with a particularly

strong performance from Controls.

The Group's performance in 2017 provides confidence in the

Group's prospects for solid underlying growth in the year ahead,

which we aim to enhance by unlocking value enhancing acquisition

opportunities. With a proven business model, broad geographic

spread of businesses, robust balance sheet and consistently strong

free cash flow, the Board is confident that further progress will

be made in the next financial year.

CHIEF EXECUTIVE'S REVIEW

In 2017, the Group delivered strong double-digit growth in

revenue and earnings with robust underlying growth, a modest net

contribution from acquisitions and further benefiting from the

strong tailwind from the depreciation in UK sterling.

The Group's reported revenues increased by 18%, with currency

movements increasing revenues by 9% and acquisitions contributing a

further 2% to the revenue growth, net of a small prior year

disposal. On an underlying basis, after adjusting for acquisitions

and for currency effects on translation, Group revenues increased

by 7%.

Group adjusted operating margins improved by 10bps to 17.3%,

compared with 17.2% in the prior full year and the first half of

the current year. Management gross margins have reduced overall by

60bps with margin pressures in several businesses from a

combination of the impact on product costs from currency movements

and increases in other margin support costs. These pressures have

been partly mitigated by the stronger gross margins in recent

acquisitions and transactional currency pressures in the Healthcare

businesses have eased during the year. Operating costs as a

percentage of revenue have reduced by 70bps with improved operating

leverage from the increase in revenues and generally tight control

of operating costs.

Working capital as a percentage of revenue was managed down

through the year to 15.0%, although the Group's free cash flow

reduced by 6% to GBP55.7m, reflecting the absence of prior year

proceeds from one-off property sales and the divestment of the

Medivators business.

Sector performance

In Life Sciences, underlying revenues increased by 4% after

adjusting for currency movements, the acquisition of Abacus and the

prior year disposal of the Medivators business. The Healthcare

businesses benefited from stronger capital revenues as new

technology was introduced and delayed projects were reactivated in

the laboratory diagnostic sector. The Environmental businesses

delivered steady growth in instrumentation sales and increasing

service contract revenues.

In Seals, underlying revenues increased by 4% after adjusting

for currency movements and the acquisitions of PSP and Edco. In

North America, the improving trend in industrial activity seen in

the second quarter, following the US election, strengthened further

as the year progressed. In the International Seals businesses,

strong growth in the UK and Scandinavia was offset by more

challenging market conditions in Switzerland, Russia and

Australia.

In Controls, underlying revenues increased by 14% after

adjusting for currency movements and the prior year acquisitions of

Cablecraft and Ascome. The Specialty Fasteners business increased

revenues strongly, driven principally by a ramp-up in demand from

customers in the Civil Aerospace sector. The Interconnect and Fluid

Controls businesses also delivered good growth benefiting from

increased project work and targeted investment in sales

resources.

Acquisitions and disposals

Over the last three years, a total of ca. GBP90m has been

invested in acquisitions which contributed ca. 16% of 2017 Group

revenues.

During 2017, total acquisition spend was ca. GBP20m, of which

ca. GBP15m was invested in the acquisition of Abacus, a long

established supplier of diagnostics instrumentation and consumables

to the Pathology and Life Sciences sectors in Australia and New

Zealand. Abacus adds critical mass to our existing Healthcare

businesses in the region and opens up new growth opportunities.

In addition, two smaller bolt-on acquisitions were completed in

the Seals Sector during the year - PSP in the US and Edco in the

UK. After the year end, a small acquisition was completed in the

Controls Sector of Coast Fabrication Inc ("Coast"), a US specialty

fastener distributor.

Group strategy

The Group's "compounding" strategy is designed to generate

strong growth in earnings and shareholder value over the business

cycle, while building larger, broader-based businesses in the three

Group Sectors of Life Sciences, Seals and Controls.

The businesses target stable "GDP plus" underlying revenue

growth over the business cycle with sustainable attractive margins

and then convert the profit into strong free cash flow by tightly

managing working capital and focused capital investments. The free

cash flow generated then funds healthy growing dividends and

selective value enhancing acquisitions which accelerate growth in

revenues and profit to double-digit levels. The strategy

consistently delivers a return in excess of 20% pre-tax on total

capital invested and steadily increasing shareholder value.

Business model and KPIs

Stable and resilient "GDP plus" underlying revenue growth is

achieved through our focus on essential products and services

funded by customers' operating rather than capital budgets and

supplied across a range of specialised industry segments. By

supplying essential solutions, not just products, we build strong

long term relationships with our customers and suppliers, which

support sustainable and attractive margins. Finally, we encourage

an entrepreneurial culture in our businesses through our

decentralised management structure. These essential values ensure

that decisions are made close to the customer and that the

businesses are agile and responsive to changes in the market and

the competitive environment.

The key performance indicators ("KPIs") we use to measure the

success of the business model relate to recurring income and stable

underlying revenue growth, sustainable and attractive margins and

organisational health. This year, underlying revenue growth, after

adjusting for currency movements and acquisitions, has been a

robust 7% with the growth rate strengthening in the second half of

the year. Over five years, the average underlying revenue growth

has been 5% p.a. which meets the Group's target of "GDP plus"

growth.

Adjusted operating margins improved this year by 10bps to 17.3%

of revenue, as transactional currency pressures eased during the

year in the Healthcare businesses and improved operating leverage

with tight control of operating costs have offset other pressures

on gross margins. Over five years the average adjusted operating

margin has been ca. 18% against the Group's medium term target of

18-19%.

The agility and responsiveness of the organisation is more

difficult to measure directly, but non-financial KPIs can give an

indication of the organisational health. The number of working days

lost to sickness has consistently been only ca. 1% a year and over

the last five years, the average length of service for all

employees has been ca. 6.5 years (ca. 11 years for the senior

management cadre).

Growth strategy and KPIs

Overall growth is accelerated from underlying "GDP plus" levels

to the corporate target of double-digit growth, through carefully

selected, value enhancing acquisitions which fit the business model

and offer entry into new but related strategic markets.

Acquisitions are not made just to add revenue and profit, but

rather to bring into the Group successful businesses which have

growth potential, capable management and a good track record of

profitable growth and cash generation. As part of our Acquire,

Build, Grow strategy, we invest in the businesses post-acquisition

to build a firm foundation to allow them to move to a new level of

growth and improve operating margins. These acquisitions form a

critical part of our Sector growth strategies and are designed to

generate a pre-tax return on investment of at least 20% and hence

support our Group objectives for return on total investment.

Again we measure the success of the growth strategy with KPIs,

the first of which is acquisition spend. To achieve the Group's

objective of strong double-digit growth, acquisition spend of at

least GBP30m p.a. is targeted, though year-on-year spend will vary

with the acquisition environment. This year, the Group invested ca.

GBP20m in acquisitions, bringing the total over three years to ca.

GBP90m. The acquisitions completed over the last three years have

contributed ca. 16% of 2017 revenues.

Strong cash flow funds our growth strategy (and supports

healthy, growing dividends) and tight management of working capital

maximises the conversion of profit to cash flow. This year, working

capital has been managed down to a record low of 15.0% of revenue,

generating free cash flow of GBP55.7m and representing a conversion

rate of 99% of adjusted post tax earnings. Over five years, the

average working capital to revenue ratio has been 16-17% and

average free cash flow has been GBP45m p.a. with an average

conversion ratio of 98%.

The Group's return on total investment measure is the pre-tax

return on adjusted trading capital employed, excluding net cash,

but including all goodwill and acquired intangible assets

("ROATCE"). This is used to measure the overall performance of the

Group and very importantly, our success in creating value for

shareholders through our acquisition programme. Over the last five

years, ROATCE has comfortably exceeded the 20% target and this year

was 24.0%.

Executive Management Group

As the Group grows larger and becomes more broadly spread both

geographically and operationally, it is important that we have in

place a strong and broad based executive management team to drive

the next stage of the Group's growth strategy.

The Executive Management Group ("EMG") was established in 2016,

comprising the Executive Directors along with the executive

managers who are responsible for the major business clusters and

key Group functions. The EMG members are a combination of

internally developed managers and experienced senior managers who

have been recruited externally.

The EMG provides the opportunity for its members to broaden

their perspective of the Group's activities in order to reinforce

the key elements of the Group's culture and to identify best

practices which are transferable across the Group. The EMG meets

quarterly through a combination of full group meetings in London

and sub-group meetings held in the major business locations.

The EMG provides the senior management bench strength to manage

a growing and broadly spread Group while laying the groundwork for

succession in key executive positions.

SECTOR DEVELOPMENTS

LIFE SCIENCES

The Life Sciences Sector businesses supply a range of

consumables, instrumentation and related services to the healthcare

and environmental industries.

2017 2016

Revenue GBP125.9m GBP109.9m +15%

Adjusted operating profit GBP23.3m GBP19.6m +19%

Adjusted operating margin 18.5% 17.8% +70bps

Free cash flow GBP17.0m GBP19.0m -11%

--------------------------- ----------- ---------- --------

-- Sector revenue growth of 15%; underlying growth of 4% after

adjusting for currency, an acquisition and a disposal

-- In Canada, DHG underlying revenues increased by 6% with

strong capital revenues as projects were reactivated; AMT and

Vantage combined into single Surgical Products business

-- In Australia, underlying revenues increased by 4%; Abacus

acquired in April 2017 and being integrated with DS to form a

larger broader-based business

-- TPD revenues broadly flat in Ireland and the UK with new

suppliers and products replacing suppliers moving to direct supply

model

-- Environmental businesses increased underlying revenues by 3%,

finishing the year with strong order books

Reported revenues of the Life Sciences businesses increased by

15% to GBP125.9m (2016: GBP109.9m). The acquisition of Abacus ALS

("Abacus"), acquired in April 2017, added GBP7.6m or 7% to Sector

revenues, but this was offset by the prior year disposal of the

Medivators business. Currency movements, on translation of the

results from overseas businesses to UK sterling, contributed a

further 11% to Sector revenues. After adjusting for currency, the

acquisition and the disposal, underlying revenues increased by

4%.

Sector adjusted operating margins improved by 70bps benefiting

from a combination of stronger gross margins in Abacus and from

reduced operating costs following the consolidation of the AMT and

Vantage business operations into one facility at the beginning of

the year. Transactional currency pressures on the Healthcare

businesses also eased towards the end of the year, following a

number of years when gross margins were significantly impacted by

the progressive depreciation of the Canadian and Australian dollars

relative to the US dollar and Euro. Operating margins also

strengthened in the Environmental businesses, with an increase in

gross margins and with improved leverage from the increased

revenues. Sector adjusted operating profits increased by 19% to

GBP23.3m (2016: GBP19.6m).

The Life Sciences businesses invested GBP2.0m in new capital

during the year (2016: GBP1.9m) of which GBP1.6m (2016: GBP0.9m)

was spent on acquiring field equipment for both new placements in

hospitals and laboratories and for loan equipment and demonstration

models to support existing placements. The increase in spend on

field equipment was largely driven by the launch of a new series of

flexible endoscopes, together with the addition of a range of rigid

endoscopes under a new supplier agreement. A further GBP0.3m was

invested, in part on the AMT/Vantage facility consolidation and in

part on the general IT infrastructure of the Life Sciences

businesses. Free cash flow reduced to GBP17.0m (2016: GBP19.0m),

reflecting the slightly higher working capital in the Healthcare

businesses; although last year's free cash flow also included

GBP2.2m received on the disposal of the Medivators business.

Healthcare

The DHG group of Healthcare businesses, which account for 84% of

Life Sciences revenues, increased underlying revenues by 4% after

adjusting for currency, the acquisition of Abacus and the disposal

of the Medivators business.

In Canada, underlying revenues increased by 6% against the

background of continuing budget pressures throughout the Provincial

healthcare systems, but with strong capital revenues as new

technology was introduced and delayed projects were reactivated in

the diagnostic laboratory sector.

Somagen's core Clinical Diagnostics business in Canada delivered

an increase of 10% in revenues, with steady growth in consumable

and service revenues boosted by strong growth in capital revenues.

Demand for diagnostic testing remained robust, particularly with

the growth of cancer screening tests and related diagnostics and

capital revenues increased strongly with new technology introduced

in the areas of Allergy, Autoimmunity and Histology. Capital

revenues also benefited from some relaxation in the policy of

regional consolidation of diagnostic laboratories in Quebec despite

the continued drive for cost savings and efficiencies within many

public medical laboratories.

AMT and Vantage were combined into a single, more efficient

Surgical and GI specialty medical device business in Canada

following the disposal of the Medivators business in September last

year. Warehousing, logistics and back office functions have been

integrated within AMT's facility in Kitchener, which has provided

good opportunities for operational leverage from the increased

scale of the combined business. In its core electrosurgery

business, AMT continued to face pricing pressures from the tender

and evaluation processes introduced by shared service organisations

and national group purchasing organisations ("GPOs"). These pricing

pressures will continue to be a factor as the GPOs continue to

consolidate in Canada. However, AMT was able to maintain revenues

by increasing sales of specialised surgical instruments and devices

used in laparoscopic and other minimally invasive surgical

procedures.

Vantage, operating now as a division of AMT, increased revenues

in its core GI/endoscopy product lines and successfully launched a

new series of flexible endoscopes with significantly improved light

imaging performance and higher reliability. Vantage also secured

the exclusive distribution rights for a premium range of rigid and

flexible endoscopes and surgical instrument sets, which give entry

into the Urology and Gynaecology segments and provide further

opportunities for growth in the Surgical products sector.

In Australia, the Healthcare sector in recent years has

experienced similar healthcare budget pressures to Canada, but has

the added capacity of private Healthcare spending to offset some of

the economic constraints. Against this background, the BGS and DS

businesses have increased revenues by 4% in local currency terms.

BGS increased revenues by 8%, with smoke evacuation programmes in

existing and new accounts continuing to be the principal driver to

growth. DS also delivered modest revenue growth, with strong sales

of Protein Electrophoresis consumables following a number of

capital placements during the prior year.

In April 2017, DHG completed the acquisition of Abacus, a long

established supplier of diagnostics instrumentation and consumables

to the Pathology and Life Sciences sectors in Australia and New

Zealand. Abacus supplies to the large private laboratories that

dominate the Clinical Diagnostic services industry in the region as

well as supplying direct to certain hospitals and to the regional

laboratory service groups that support hospital testing in the

various States. Abacus has particular strengths in Immunology and

Biochemistry testing and also is developing a niche specialty

Patient Simulation business in the Australian market.

Abacus has very complementary clinical diagnostics products to

the DS business and these two businesses are now in the process of

being integrated to form "abacus dx", a larger broader-based

Clinical Diagnostics, Life Science and Patient Simulation business,

supplying to both the public and private pathology laboratories and

to research and educational institutions across Australasia.

The TPD business in Ireland and the UK reported revenues broadly

flat in Euro terms, with business transacted in UK sterling (ca.

40% of revenues) impacted by the weaker currency. TPD continued to

achieve steady growth in supplying clinical chemistry and serology

products used to control quality in Clinical Diagnostics

laboratories. TPD also delivered revenue growth in specialty

medical devices used in digestive health and rapid microbial

testing products used in industrial laboratories. However, revenues

reduced in the water testing and interventional cardiology segments

as certain suppliers moved from specialised distribution to a

direct supply model. TPD is introducing a number of new suppliers

and products to replace these revenues and it is broadening its

service capability beyond diagnostic instrumentation to extend into

the blood services sector. TPD has also established a new Surgical

Products division to bring to market the electrosurgical and smoke

evacuation products similarly supplied by AMT and BGS in Canada and

Australia.

Environmental

The a1-group of Environmental businesses in Europe, which

account for 16% of Life Sciences revenues, saw revenues increase by

9% in UK sterling terms and 3% growth in constant currency

terms.

The a1-envirosciences business based in Germany increased

revenues by 3% in Euro terms against a strong prior year

comparative, which had benefited from a large mercury detector

order. Revenue from high-end trace and elemental analysers used in

the Environmental and Petrochemical industries delivered good

growth, with the second half of the year being particularly strong

in the UK and the Benelux region. Service revenue continued to grow

with the larger installed base and with increasing demand from the

larger customers for faster response times. Demand for containment

enclosures for the safe weighing of hazardous materials remains

robust.

The a1-CBISS business based in the UK, increased revenues by 2%

with continued growth in the installation of continuous emissions

monitoring systems ("CEMS") and increased service contract revenues

from CEMS projects delivered in the last 18 months. The sector

remains buoyant with new Energy from Waste ("EFW") plants playing

an important role in reducing landfill waste. The gas detection

sector has started to see increased demand from Oil & Gas

customers for single-use gas detection tubes after a number of

years of lower activity levels.

SEALS

The Seals Sector businesses supply a range of seals, gaskets,

filters, cylinders, components and kits used in heavy mobile

machinery and specialised industrial equipment.

2017 2016

Revenue GBP195.3m GBP166.6m +17%

Adjusted operating profit GBP31.9m GBP28.2m +13%

Adjusted operating margin 16.3% 16.9% -60bps

Free cash flow GBP24.9m GBP24.9m -

--------------------------- ---------- ---------- --------

-- Sector revenue growth of 17%; underlying growth of 4% after

adjusting for currency and acquisitions

-- In North America, Aftermarket underlying revenues increased

by 5% with a good performance in the core Hercules business and a

strong recovery in the HKX business

-- Industrial OEM underlying revenues in North America increased

by 7% with an improving trend through the year following the US

election

-- Senior leadership team established to manage cluster of Industrial OEM businesses in the US

-- International Seals businesses increased underlying revenues

by 1% with performances of the businesses very dependent on local

market conditions

Reported revenues of the Seals businesses increased by 17% to

GBP195.3m (2016: GBP166.6m), with the acquisitions of PSP and Edco

completed during the year contributing GBP2.1m or 1% to Sector

revenues. Currency movements, on translation of the results from

overseas businesses to UK sterling, contributed a further 12% to

Sector revenues. After adjusting for the acquisitions and for

currency effects, underlying revenues increased by 4%.

Adjusted operating margins for the Sector reduced by 60bps to

16.3% (2016: 16.9%). Across the businesses, gross margins reduced

with product margins under pressure from supplier cost increases,

but also reflecting an increase in other margin support costs, such

as freight, discounts and stock adjustments. This reduction in

gross margins was significantly mitigated by a combination of tight

control over operating costs and improved operating leverage

through increased revenues. Adjusted operating profits increased by

13% to GBP31.9m (2016: GBP28.2m).

During the year, GBP1.1m (2016: GBP1.4m) of capital expenditure

was invested in the Seals businesses which included GBP0.6m to fit

out new and expanded facilities in J Royal, Hercules Canada and

Kentek. A further GBP0.2m was spent on new warehouse equipment in

the Industrial OEM businesses, both in the US and in Europe and

GBP0.3m was spent in connection with a major upgrade to the IT

facilities in the Hercules businesses. The free cash flow generated

in this Sector was GBP24.9m, which remained unchanged from last

year with the additional after tax operating cash flow offsetting

an increase in working capital as trading strengthened in the

second half of the year.

North American Seals

The North American Seals businesses, which account for 61% of

Seals revenues, reported revenues up 21% on the prior year,

benefiting from the weakening of UK sterling against the US and

Canadian dollars and from the small bolt-on acquisition of PSP.

After excluding contributions from the acquired businesses and

currency effects, underlying revenues increased by 6%.

The HFPG Aftermarket businesses increased revenues by 5% on a

constant currency basis, driven by a good performance in the core

Hercules Aftermarket Seals business in the US and Canada and a

strong recovery in the HKX attachment kit business.

In the domestic US market, Hercules revenues increased by 5% as

utilisation of heavy mobile machinery increased substantially

compared with the previous year and expenditure levels in the

Construction sector showed steady growth. The additional investment

last year in sales and marketing resources also had a positive

impact on revenues and specific growth initiatives continued to

gain traction, including the focus on national accounts and

specialty distributors. E-commerce continues to deliver strong year

on year growth of ca. 20% p.a. in terms of both revenues and

invoices processed and now accounts for 23% of Hercules US

revenues. Hercules continues to add new products and to expand the

breadth of equipment supported, with the new focus on Bobcat

cylinders and Aerial Lifts gaining good momentum.

In Canada, revenues increased by 5% in local currency terms,

with the strengthening Construction sector driving growth in the

repair market and good growth in the Manufacturing sector,

particularly in Ontario and Quebec. The modest recovery in the Oil

& Gas and Mining sectors has had a positive impact and sales to

hydraulic component and attachment manufacturers have also seen

good growth. In markets outside of North America, Hercules and

Bulldog revenues were broadly flat with limited growth in Mexico

and the Middle East and reduced revenues in South and Central

America.

The HKX attachment kit business returned to growth after two

years of significant revenue reductions, which had reflected the

severely depressed market for new excavators. Revenues increased by

11% with growth particularly strong in sales to Canadian customers,

driven by recovery in the Oil & Gas sector, increased pipeline

construction and strong sales of excavators ahead of new emissions

regulations. New attachment kits have been developed to drive

further growth as well as quick coupler kits with added safety

features. The HKX product line has also been extended into higher

tonnage equipment which has seen good momentum supporting large

scale demolition projects.

The HFPG Industrial OEM businesses in North America (J Royal, RT

Dygert and All Seals) increased revenues by 9% in US dollar terms,

as the improving trend in industrial activity seen in the second

quarter, following the US election, strengthened further as the

year progressed. All three businesses delivered double-digit

revenue increases in the second half of the year with strong demand

from key accounts across a range of specialised industrial

applications in industries including Water, Medical, Oil & Gas,

Appliances and Food Equipment. The businesses continue to provide

high levels of customer service and technical support to service

existing projects while looking for opportunities to deploy higher

specification, regulatory-compliant compounds to target new

projects with higher levels of added-value.

In April 2017, J Royal relocated its operations to a newly

constructed, purpose built facility in Winston Salem, North

Carolina, which was then sold and leased back to the business. At

the same time, the Group acquired PSP, a small bolt-on acquisition

to All Seals based in Denver, Colorado which supplies O-rings and

custom rubber moulded products and has strong customer

relationships in the semi-conductor and pneumatics industries. PSP

adds complementary new products and strengthens the position of the

Industrial OEM Seals business in the Mountain Region of the US.

The Industrial OEM Seal businesses continue to pursue

opportunities to create synergies through joint purchasing and

through leveraging the different product, material and application

skill-sets of the individual businesses. In the second half of the

year, this was developed further by establishing a senior

leadership team to manage this cluster of businesses in North

America. While maintaining the distinct identity of the businesses

and close local contact with customers, key functions including

Sales, Supply Chain, Technical and Finance will be managed

centrally by this team. The team has also initiated a project to

implement a new ERP system across the Industrial OEM Seals

businesses in the US, to replace the disparate legacy IT systems in

the businesses. The new ERP system will be designed to increase

operational efficiency, improve business intelligence and deliver

broader marketing capabilities.

International Seals

The International Seals businesses, which account for 39% of

Seals revenues, reported a 12% increase in UK sterling terms. After

adjusting for currency and the acquisition of Edco, underlying

revenues increased by 1%, but with performances in the individual

businesses very dependent on local market conditions.

The FPE Seals and M Seals businesses, with their principal

operations in the UK, Scandinavia and the Netherlands, together

delivered underlying growth of 11% in revenues on a constant

currency basis. FPE Seals experienced good growth in its core UK

market for Aftermarket hydraulic seals and metal cylinder parts and

benefited from a recovery in demand from the Oil & Gas sector

for sealing products used in Maintenance, Repair and Overhaul

("MRO") operations. FPE Seals also benefited from strong growth in

several export markets.

M Seals delivered good growth in revenues in its core markets,

with particularly strong growth in Sweden, building on its strong

customer relationships to develop a number of major new projects. M

Seals has also extended its activities into the Finnish market for

seals, by investing in a sales resource based in Kentek's facility

and making use of its operational infrastructure. As with FPE

Seals, M Seals has also seen a recovery in demand from the Oil

& Gas sector in the UK and is targeting specialised Industrial

OEMs in other sectors of the market.

In June 2017, the Group completed the acquisition of Edco, a

specialised distributor of O-rings, seals and gaskets based in

Leicester and supplying to UK OEMs and MRO companies operating

within the Oil & Gas and other process industries. Edco's

success has been built on deep technical knowledge, high levels of

customer service and the ability to supply a wide range of products

from stock. Edco is being managed as part of the M Seals group with

good opportunities for cross-selling and improved purchasing

power.

The Kentek business, with principal operations in Finland and

Russia, increased revenues by 4% in Euro terms. The revenues

generated in Russia, which account for ca. 65% of Kentek revenues,

slowed in the second half of the year after strong revenue growth

in Euro terms in the first half. As selling prices for US and

European sourced filters are linked to the Euro in this territory,

the weakening of the Russian Rouble against the Euro as well as

increasing competitive pressures in this market contributed to the

slow down in revenue growth. However, Kentek significantly

increased sales of its own-brand filters in Russia and the Baltics

and achieved good growth in Finland, benefiting from a recovery in

both the Aftermarket and Industrial OEM sectors.

Kubo and WCIS saw combined underlying revenues for the year

reduce by 3%, with a return to modest revenue growth in the second

half of the year after a 9% reduction in the first half. Kubo has

been facing significant challenges in its core industrial market in

Switzerland, where the strong currency has made Swiss industrial

manufacturers less competitive. However, the strengthening of the

Euro through the year has contributed to an increase in industrial

activity in Switzerland. In Austria, Kubo's improved sales focus

has introduced new customer revenues in Pharmaceutical and

Industrial OEMs to replace a large prior year order which was not

repeated this year.

WCIS has core capabilities in gaskets and mechanical seals used

in MRO operations in complex and arduous conditions and has been

significantly impacted by cutbacks in the Mining sector in recent

years. In New Caledonia, WCIS has come under substantial pricing

pressure from cost reduction initiatives in the nickel mining and

processing operations of its major customer and in Australia, it

has also experienced reduced revenues from its core Mining customer

base. WCIS has responded by investing in additional sales resources

to broaden coverage across a wider range of market sectors and

territories and this initiative is starting to gain some traction,

though as yet the revenues are not sufficient to offset fully the

reductions in the Mining customer base.

CONTROLS

The Controls Sector businesses supply specialised wiring,

connectors, fasteners and control devices used in a range of

technically demanding applications.

2017 2016

Revenue GBP130.7m GBP106.1m +23%

Adjusted operating profit GBP23.0m GBP17.9m +28%

Adjusted operating margin 17.6% 16.9% +70bps

Free cash flow GBP18.6m GBP16.4m +13%

--------------------------- ---------- ----------- --------

-- Sector revenue increased by 23%; underlying increase of 14%

after adjusting for currency and acquisitions

-- The Interconnect businesses benefited from increased project

work and delivered strong underlying growth of 8%; Cablecraft has

expanded the range of products supplied and markets served

-- Clarendon increased revenues by over 30%, with growth driven

by increased customer demand in Civil Aerospace and Motorsport

-- Fluid Controls increased revenues by 14% with upturn in

refrigeration equipment sales and increased export sales in Europe

and the US

Reported revenues of the Controls businesses increased by 23% to

GBP130.7m (2016: GBP106.1m). Full year contributions from

Cablecraft and Ascome, acquired in the first half of last year,

added GBP6.4m or 6% to Sector revenues and currency movements

contributed a further 3% to Sector revenues on translation to UK

sterling. On an underlying basis, after adjusting for these

acquisitions and currency effects, underlying revenues increased by

14%, with growth moderating in the second half (though still

double-digit) against stronger prior year comparatives.

Adjusted operating margins increased by 70bps to 17.6% (2016:

16.9%). Gross margins were broadly stable overall, with stronger

margins in the Cablecraft business broadly offsetting the impact of

weaker UK sterling on products purchased by the other Controls

businesses. Operating costs remained tightly controlled across the

businesses and improved leverage from the increased revenue more

than offset increased investment in sales resources. Adjusted

operating profits increased by 28% to GBP23.0m (2016:

GBP17.9m).

Capital expenditure in this Sector remained very modest at

GBP0.2m (2016: GBP0.4m), with GBP0.1m invested in the Clarendon

business to upgrade its Totnes facility to improve operational

efficiency. A further GBP0.1m was invested on general IT

infrastructure across the Controls businesses. Free cash flow

increased strongly to GBP18.6m (2016: GBP16.4m) reflecting stronger

trading, including the additional contribution from Cablecraft and

despite an increase in working capital to support the growth in

trading.

Interconnect

The Interconnect businesses (IS-Group, Filcon and Cablecraft)

account for 59% of Controls revenues and reported a revenue

increase of 25% in UK sterling terms. After adjusting for the

Cablecraft and Ascome acquisitions and for currency effects,

underlying revenues increased by 8%.

The IS-Group continued to implement the business development

programmes initiated last year, designed to position the business

as the European supplier of choice for the full range of

specialised cable harnessing components. Field sales resources have

been realigned to focus on sectors and customer accounts with the

highest growth potential and internal sales processes have been

refocused to more efficiently manage the baseline business. Further

investment has also been made in broadening the product range and

further developing E--commerce capabilities.

The IS-Group UK businesses saw revenues increase by 7% in UK

sterling terms. In Defence and Aerospace, the IS-Group reported a

small increase in revenues, with the stronger growth seen in the

first half of the year offset by slower trading in the second half.

The lower level of activity at UK electrical harness customers

towards the end of the year is partly from a tightening in Defence

spending and partly from certain key customers being in between

projects. In Motorsport, IS-Group increased revenues strongly,

benefiting from regulation changes and the increased level of

competition in races this year in the Formula 1 ("F1") series,

development of new cars in the World Rally Championship ("WRC")

Series and upgrades to the GT500 cars in Japan. The IS-Group also

benefited from good double-digit growth in revenues from the

Industrial sector in the UK and more broadly in Europe, as the

business improved its competitive position under new sales

leadership, following the appointment of a sales director focused

on the EMEA region.

In Germany, IS-Sommer and Filcon reported a 14% increase in

revenues in Euro terms, with modest growth in IS-Sommer boosted by

major project activity in Filcon. In the Aerospace sector,

IS-Sommer delivered good growth with a particularly strong

performance in the Space market, supplying connectors and

backshells to the Meteosat Third Generation ("MTG") and Sentinel

satellites. Solid growth in the Industrial market was driven by the

stronger global economy, which benefited German exporters. Revenues

were held back in the important Energy market where lower Utility

company budgets delayed repair and maintenance of the electricity

network and Motorsport revenues were impacted by the withdrawal of

VW from the WRC Rally Series and Audi from the World Endurance

Championship ("WEC") Series, which includes the Le Mans race.

Revenues in the Medical sector performed strongly with key medical

device manufacturers managing a solid pipeline of projects on the

back of new regulations.

Filcon delivered a very strong performance, increasing revenues

by ca. 30% in Euro terms. There was a full year contribution from

the small Ascome acquisition, but the primary driver of growth came

from major orders secured in the final quarter of the prior year

from key Military Aerospace and Space customers. These sectors have

generally seen increased activity, with projects delivered for the

Tornado aircraft, the RAM missile program and the Orion Mars

capsule. In the Motorsport sector, the increased activity levels

and demand in the F1 series has offset the reduced demand from the

withdrawal by Audi from Le Mans. The Industrial market for

connectors remains competitive and generally more challenging.

Cablecraft is a leading supplier of cable accessory products

used to identify, connect, secure and protect electrical cables and

has made a strong contribution to the Group since its acquisition

in March 2016. Cablecraft has extended the markets served by the

Interconnect businesses and has added attractive ranges of

own-branded and manufactured products. During the year the business

continued to focus on its areas of specialism, including the

development of new own branded identification products, the

promotion of its upgraded Identification Solutions offering and the

specialist sales resources added to support sales growth. Revenues

have increased by 7% on a like-for-like basis, with good growth

generated from the continued focus on end user customers,

especially electrical panel builders and contractors upgrading the

UK rail network. Cablecraft continues to benefit from the move by

customers towards E-commerce, with online sales growing by ca. 30%

in the year.

Specialty Fasteners

The Clarendon Specialty Fasteners business accounts for 18% of

Controls revenues and increased revenues by over 30% compared with

the prior year, with growth driven principally by increased demand

from customers in the Civil Aerospace sector. Revenues increased

strongly with the ramp up of the major business class seating

programme at a key aircraft seating customer which Clarendon

supplies through its automatic inventory replenishment system

("Clarendon AIR"). Clarendon also had success in increasing sales

to a range of other aircraft seating and cabin interiors

manufacturers and their sub-contractors across Europe and

introduced Clarendon AIR to a number of new customer locations.

Good growth was also achieved in Clarendon's other major market

of Motorsport, where Clarendon supplies aerospace-quality fasteners

to the F1 race teams, engine builders and subcontractors and also

supplies the Aerocatch own-brand range of aerodynamic bonnet

latches for high performance sports cars and offshore powerboat

racing. More modest growth has been achieved in the supply of

pre-assembled and captive fasteners and bespoke engineered

solutions to the Defence and general Industrial sectors.

After the year end, in October 2017, Clarendon completed the

acquisition of Coast Fabrication Inc. ("Coast"), a small US

specialty fastener distributor based in Huntington Beach,

California. Coast has a strong reputation in the US Motorsport

industry and also provides a base in the US for supporting

Clarendon's current Aerospace customers as well as expanding its

aircraft interiors business in this large market. A US presence is

also a strategic purchasing priority for Clarendon, giving access

to major fastener suppliers that principally sell to US

entities.

Fluid Controls

The Hawco Group of Fluid Controls businesses (comprising Hawco

and Abbeychart) accounts for 23% of Controls revenues and increased

revenues by 14% against the prior year, in a market that remains

highly competitive and price sensitive.

Hawco reported a good upturn in activity in the UK Refrigeration

Equipment market, as store refurbishment activity in the UK

increased and as the cabinet display manufacturers targeted

opportunities outside the UK. Hawco benefited in particular from

supplying scroll compressors into a significant project with a

major US retailer and demand in the commercial Catering and Home

Delivery market remained robust. In the Contractor market, strong

growth was achieved, as Hawco targeted the independent trade

counters and medium sized contractors who value Hawco's stock

holding, next-day delivery and exclusive supplier relationships.

Revenues from the Industrial OEM market reduced in the second half

of the year, as demand from UK manufacturers softened, but this was

partly offset by an increase in export revenues.

Abbeychart has continued to strengthen its relationship with the

large vending machine operators in Europe and during the year

supplied products to a large project to refresh a range of vending

machines for a major customer in Switzerland. Abbeychart revenues

also benefited from a full year of sales activity for a range of

spare parts for Wurlitzer vending machines and from the

introduction of a catalogue of essential spare parts for the

specialist coffee market, which has offset reduced revenues from

one of its larger coffee OEM customers. Abbeychart has continued to

take market share in the soft drinks market by targeting both the

major and the independent soft drink suppliers, with its bar gun

and pump refurbishment offering.

FINANCE REVIEW

Results in 2017

Diploma delivered another strong performance this year,

increasing revenues by 18% to GBP451.9m and increasing adjusted

operating profit by 19% to GBP78.2m. The Group's reported financial

results benefited from strong underlying growth, particularly in

the Controls businesses, following two years of weaker end markets.

The significant depreciation in UK sterling of ca. 11%, following

the UK's Brexit vote on Europe led to increases in revenues and

adjusted operating profits of GBP34.9m and GBP6.3m respectively on

the translation of the results of the overseas businesses, when

compared with last year's average exchange rates.

The environment for completing acquisitions has been more

challenging over the past twelve months and the contribution from

acquisitions completed both this year and last year, net of a small

disposal last year, was GBP8.5m (2016: GBP26.6m) to revenue and

GBP2.3m (2016: GBP4.2m) to adjusted operating profit.

The stronger growth in underlying revenues of 7% this year

helped compensate for this smaller contribution from acquired

businesses. Underlying revenues are after adjusting for the

contribution from businesses acquired during the year (and from the

incremental impact from those acquired last year) and for the

impact on the translation of the results of the overseas businesses

from the significant weakening in the UK sterling exchange rate

against the currencies of the Group's overseas businesses.

Adjusted operating margin

The Group's adjusted operating margin improved by 10bps this

year to 17.3% (2016: 17.2%) as transactional currency losses

finally eased in the Group's Healthcare businesses. These

businesses represent 23% of Group revenue and since late in 2013,

their gross margins have been significantly impacted on a

transactional basis by the continuing depreciation of the Canadian

and Australian dollars, against the US dollar in particular which

is the currency in which most of their products are purchased.

The Canadian and Australian exchange rates have remained more

stable since the early part of this year and after a short period

of weakness during the early Summer, both currencies strengthened

sharply against the US dollar towards the end of the financial

year.

The transactional impact on the Group's adjusted operating

margin from the substantial depreciation in UK sterling has been

limited. The UK businesses (26% of Group revenues) have faced

higher product costs from the depreciation in UK sterling, but they

have generally managed to mitigate these increases by a combination

of selling price increases, support from suppliers and by switching

some key customer accounts into Euro or US dollar invoicing.

The operating margins in those businesses acquired in recent

years have, as anticipated, also made a slightly stronger

contribution to the Group this year reflecting the benefits from

initiatives taken shortly after acquisition.

Adjusted profit before tax, earnings per share and dividends

Adjusted profit before tax increased by 19% to GBP77.5m (2016:

GBP64.9m). The interest expense this year was GBP0.7m (2016:

GBP0.8m) which included a GBP0.2m (2016: GBPNil) arrangement fee

paid on renewal of the bank facility during the year. However

interest costs on borrowings decreased by GBP0.3m to GBP0.1m this

year reflecting a lower level of acquisition activity in 2017,

compared with last year. The notional interest expense on the

Group's defined pension liabilities increased to GBP0.3m (2016:

GBP0.2m) reflecting the larger deficit in the fund this year,

following the actuarial valuation completed as at 30 September

2016.

Statutory profit before tax was GBP66.8m (2016: GBP54.0m), after

acquisition related charges of GBP9.7m (2016: GBP10.3m), which

largely comprises the amortisation of acquisition related

intangible assets and fair value remeasurements. These

remeasurements of GBP1.0m (2016: GBP1.3m) relate to the put options

held over minority interests and the charge this year reflects a

small increase in the liability to acquire these minority interests

and an unwinding of the discount on the liability. Last year's

statutory profit also included a one-off gain of GBP0.7m from the

disposal of the Medivators business in Canada and three small

legacy properties in the UK.

The Group's effective tax charge in 2017 was 80bps above the

previous year at 26.5% (2016: 25.7%) of adjusted profit before tax.

The increase this year is despite a further reduction in the

effective UK corporation tax rate to 19.5% (2016: 20.0%) which was

insufficient to offset the impact from higher tax rates applied to

the businesses acquired in Australia and the US this year.

Adjusted earnings per share ("EPS") increased by 19% to 49.8p,

compared with 41.9p last year and statutory basic EPS increased to

42.0p (2016: 33.9p).

The Board continues to pursue a progressive dividend policy

which aims to increase the dividend each year broadly in line with

the growth in adjusted EPS. In determining the dividend in any one

year in accordance with this policy, the Board also considers a

number of factors which include the strength of the free cash flow

generated by the Group, the future cash commitments and investment

needed to sustain the Group's long term growth strategy and the

target level of dividend cover. The Board continues to target

towards two times dividend cover (defined as the ratio of adjusted

EPS to total dividends paid and proposed for the year) which

provides a prudent buffer.

The ability of the Board to maintain future dividend policy will

be influenced by the principal risks identified on pages 18 to 22

that could adversely impact the performance of the Group.

For 2017, the Board has recommended a final dividend of 16.0p

per share (2016: 13.8p) making the proposed full year dividend

23.0p (2016: 20.0p). This represents a 15% increase in the proposed

full year dividend with dividend cover increasing slightly to 2.2

times (2016: 2.1 times).

Free cash flow

The Group again generated strong free cash flow this year of

GBP55.7m (2016: GBP59.0m). Last year's free cash flow included

exceptional proceeds of GBP4.6m from the sale of the Medivators

business in Canada and legacy properties and from an unusually

large cash inflow of GBP6.3m from reduced working capital. Free

cash flow represents cash available to invest in acquisitions or

return to shareholders. Free cash flow conversion was 99% (2016:

124%) of adjusted earnings.

The Group's operating cash flow increased by GBP2.7m to GBP79.3m

(2016: GBP76.6m) this year, despite a GBP4.0m outflow of cash into

working capital. The generally stronger trading environment this

year, together with some earlier seasonal stock builds in the

Healthcare businesses contributed to a GBP5.1m increase in stock

levels at the year end (2016: GBP1.3m) while the inflow from net

payables reduced to GBP1.1m from GBP7.6m last year.

The Group's KPI metric of working capital to revenue at 30

September 2017 reduced to a record low of 15.0% (2016: 16.6%)

reflecting much stronger revenues in the previous rolling 12

months, compared with last year.

Group tax payments increased by GBP1.7m to GBP19.3m (2016:

GBP17.6m). On an underlying basis cash tax payments represented ca.

24% (2016: 23%) of adjusted profit before tax which was broadly

unchanged from last year. Underlying tax payments are before

currency effects of translation and exclude payments for

pre-acquisition tax liabilities in acquired businesses.

The Group's tax strategy is to comply with tax laws in all of

the countries in which it operates and to balance its

responsibilities for controlling the tax costs with its

responsibilities to pay tax where it does business. The Group's tax

strategy has been approved by the Board and tax risks are regularly

reviewed by the Audit Committee.

The Group's capital expenditure this year was GBP3.3m, compared

with GBP3.7m last year. This expenditure excludes GBP1.9m (2016:

GBP0.5m) which the Group paid for the construction of a new

expanded facility for J Royal, a Seals business based in the US. On

completion in April 2017, the facility was immediately sold and

leased back to the business. A similar transaction was undertaken

in 2015 in connection with the new FPE Seals facility.

The Life Sciences businesses invested GBP2.0m in new capital

this year (2016: GBP2.2m) most of which was invested in field

equipment in the Healthcare businesses to support placements in

hospitals and diagnostic laboratories. This investment was GBP1.6m

(2016: GBP0.9m) and included demonstration and loan equipment in

connection with new capital equipment released in 2017 and a new

supply agreement for a range of rigid endoscopes in Vantage. A

further GBP0.3m was spent on upgrading the IT infrastructure in

both the Healthcare businesses and the a1-group and GBP0.1m was

spent on refurbishing a new facility in Markham, Canada which is

used to service flexible endoscopes.

The Seals businesses invested GBP1.1m during the year in its

operations with GBP0.5m being spent in the North American Seals

businesses and GBP0.6m in the International Seals businesses.

Across these businesses, GBP0.6m was invested to fit out new and

expanded facilities in J Royal, Hercules Canada and Kentek. A

further GBP0.2m was invested in new warehouse equipment in M Seals

and Kubo and GBP0.3m was spent on upgrading the IT infrastructure

across the Seals Sector. Capital expenditure in the Controls

businesses remained modest at GBP0.2m (2016: GBP0.4m).

The Company paid the PAYE income tax liability of GBP0.7m (2016:

GBP0.3m) on the exercise of LTIP share awards, in exchange for

reduced share awards to participants.

The Group spent GBP20.1m of the free cash flow on acquisitions,

including payment of deferred consideration, as described below and

GBP23.7m (2016: GBP21.4m) on paying dividends to both Company and

minority shareholders.

Acquisitions completed during the year

The Group invested GBP19.5m in acquiring new businesses this

year and paid a further GBP0.6m of deferred consideration on a

business acquired in the prior year. This compares with an

aggregate of GBP32.7m invested last year in acquisitions, minority

shareholdings and deferred consideration. The stronger economies in

the US and Continental Europe contributed to a tougher environment

to make acquisitions as business owners generally remained

confident of increasing profitability in the year ahead.

In April 2017, the Group was successful in completing the

acquisition of Abacus for cash consideration of GBP15.0m, including

debt acquired and expenses. Abacus is a long-established supplier

of clinical diagnostics instrumentation to the Pathology and Life

Sciences sectors in Australia and New Zealand and provides critical

mass to the Group's existing Healthcare businesses in this region.

A further GBP4.5m in aggregate was invested in June 2017 to acquire

Edco, a small hydraulic seal distributor in the UK and in April

2017 to acquire PSP, a small supplier of specialist seals based in

the US.

These acquisitions added GBP10.1m to the Group's acquired

intangible assets, which represents the valuation of customer and

supplier relationships which will be amortised over periods ranging

from five to ten years. At 30 September 2017, the carrying value of

the Group's acquired intangible assets was GBP54.0m. Goodwill at 30

September 2017 was GBP122.7m and included GBP7.5m relating to those

businesses acquired during the year (including fair value

adjustments to the assets acquired).

Goodwill is not amortised but is assessed each year at a Sector

level to determine whether there has been any impairment in the

carrying value of goodwill acquired. The exercise to assess whether

goodwill has been impaired is described in note 10 to the

consolidated financial statements and concluded that there was

significant headroom on the valuation of this goodwill, compared

with the carrying value of goodwill at the year end.

Liabilities to minority shareholders

The Group's liability to purchase outstanding minority

shareholdings at 30 September 2017 increased to GBP6.1m (2016:

GBP5.1m) which comprise put options the Group holds over the

outstanding minority interests held in M Seals, Kentek and TPD.

The liabilities for these put options are valued based on the

Directors' latest estimate of the earnings before interest and tax

("EBIT") of these businesses when these options crystallise. The

increase in this liability of GBP1.0m reflects in part a slightly

higher value attributed to these businesses and in part an

unwinding of the discount on the liability. Shortly after the year

end the Group agreed to pay cash of GBP1.0m to acquire a further 5%

shareholding in TPD from the minority shareholder.

In addition to the liability to minority shareholders, the Group

also has a small liability at 30 September 2017 for deferred

consideration of up to GBP0.5m (2016: GBP1.7m) which comprises the

amount likely to be paid to the vendors of businesses purchased

during the year, based on the Group's best estimate of the

performance of these businesses next year. During the year, GBP0.6m

was paid as deferred consideration relating to the acquisition of

WCIS completed early in 2016 and a provision of GBP1.0m relating to

the acquisition of Cablecraft was not required and was released to

the Consolidated Income Statement as part of acquisition related

charges.

Return on adjusted trading capital employed and capital

management

A key metric that the Group uses to measure the overall

profitability of the Group and its success in creating value for

shareholders is the return on adjusted trading capital employed

("ROATCE"). At a Group level, this is a pre-tax measure which is

applied against the fixed and working capital of the Group,

together with all gross intangible assets and goodwill, including

goodwill previously written off against retained earnings. At 30

September 2017, the Group ROATCE improved to 24.0% (2016: 21.1%)

which reflects the strong increase in adjusted operating profits

this year. Adjusted trading capital employed is defined in note 3

to the consolidated financial statements.

The Group continues to maintain a strong balance sheet with cash

funds of GBP22.3m at 30 September 2017, compared with net cash

funds of GBP10.6m last year. Surplus cash funds are generally

repatriated to the UK, unless they are required locally to meet

certain commitments, including acquisitions.

On 1 June 2017 the Group renewed its bank facility with a

similar revolving multi-currency credit facility for a further

three years and with an option to extend the facility from three

years up to five years. The facility initially comprises a GBP30m

committed facility, but with an accordion option which allows the

Group to increase the commitment up to a maximum of GBP60m of

borrowings. These new facilities were provided at a cost of 50bps

and with a ratchet margin ranging from 70bps to 115bps over LIBOR

depending on the ratio of EBITDA to net debt. These bank facilities

are primarily used to meet any shortfall in cash to fund

acquisitions.

Employee pension obligations

Pension benefits to existing employees, both in the UK and

overseas, are provided through defined contribution schemes at an

aggregate cost in 2017 of GBP2.8m (2016: GBP2.5m).

The Group maintains a legacy small closed defined benefit

pension scheme in the UK. During the year a formal triennial

funding valuation of this scheme as at 30 September 2016 was

completed. This valuation reported an increase in the funding

deficit of GBP6.5m to GBP9.2m with a 75% funding level which

reflected the impact of bond yields falling to a record low of 1.5%

at the valuation date from 3.6% in the previous funding valuation.

However bond yields have increased slightly since the valuation

date and investment returns have been strong again this year.

This recent improvement in market conditions, together with the

strength of the employer covenant, helped limit the increase in

cash contributions paid by the company to GBP0.5m from 1 October

2017, from GBP0.4m of cash contributions paid this year. This

contribution rate will increase annually by 2% with the objective

of eliminating the deficit within ten years.

In Switzerland, local law requires Kubo to provide a

contribution based pension for all employees, which are funded by

employer and employee contributions. This pension plan is managed

for Kubo through a separate multi-employer plan of non-associated