Current Report Filing (8-k)

March 01 2017 - 4:28PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHAN

GE COMMISSION

Washington, D.C.

20549

_____________________

FORM 8

‑K

_____________________

CURRENT REPORT

Pursuant to Section 13

OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 28

, 201

7

_________

__________

___________________________________

L

INDSAY CORPORATION

(Exact name of registrant as specified in its charter)

_

___________________

__________

________________________

|

|

|

|

|

Delaware

|

1-13419

|

47-0554096

|

|

(State of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification Number)

|

|

|

|

|

|

2222 North 111

th

Street

|

|

|

|

Omaha, Nebraska

|

|

68164

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(402)

829-6800

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

_________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-

2(b) under the Exchange Act (17

CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-

4(c) under the Exchange Act (17

CFR 240.13e-4(c)

)

Item 1.01

.

Entry Into a Material Definitive Agreement.

As previously disclosed, on February 18, 2015, Lindsay Corporation (the “Company”) entered into the Amended and Restated Revolving Credit Agreement (the “Credit Agreement”) with Wells Fargo Bank, National Association (the “Bank”), which continues to provide for a $50 million unsecured revolving credit facility. A copy of the Credit Agreement was filed as Exhibit 10.2 to the Current Report on Form 8-K filed by the Company on February 20, 2015.

On February 28, 2017, the Company and the Bank entered into the First Amendment to the Credit Agreement (the “First Amendment”). Capitalized terms used herein and not otherwise defined have the meanings given to them in the Credit Agreement, as amended by the First Amendment.

The First Amendment, among other things, (i) extends the Termination Date from February 18, 2018 to February 28, 2020, (ii) increases the Letter of Credit Sublimit from $10 million to $15 million, (iii) increases the Company’s maximum permitted Leverage Ratio from 2.50:1.0 to 2.75:1.0, (iv) reduces certain intermediate tiers of the Leverage-Ratio-based LIBOR Rate Margin pricing grid by 10 basis points while leaving unchanged the minimum and maximum spreads to the LIBOR Rate, and (v) introduces a LIBOR Rate floor of 0%.

The foregoing description of the First Amendment does not purport to be complete and is subject to and qualified in its entirety by reference to the complete text of the First Amendment, a copy of which is filed herewith as Exhibit 10.1 and incorporated herein by reference.

Item 2.03

.

Creation of a Direct Financial Obligation or an Obligation Under an Off

‑

Balance Sheet

Arrangement of a Registrant.

The description of the First Amendment set forth in Item 1.01 of this Current Report on Form 8

‑K is incorporated herein by reference.

Item 9.01

.

Financial Statements and Exhibits

(d) Exhibits

Exhibit

Description

10.1

First Amendment to Amended and Restated Revolving Credit Agreement, dated February 28, 2017, by and between the Company and the Bank.

SIGNATURES

Pursuant to the requirements of the Securities Exchang

e Act of 1934, as amended, the r

egistrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

/s/ Brian L. Ketcham _

|

|

Dated: March

1, 2017

|

LINDSAY CORPORATION

By:

/s/ Brian L. Ketcham

Brian L. Ketcham, Vice President and Chief Financial Officer

|

|

|

|

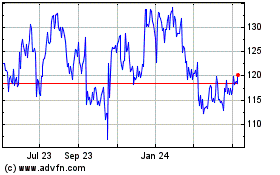

Lindsay (NYSE:LNN)

Historical Stock Chart

From Mar 2024 to Apr 2024

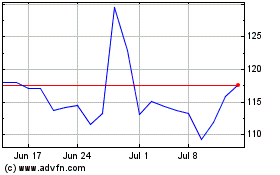

Lindsay (NYSE:LNN)

Historical Stock Chart

From Apr 2023 to Apr 2024