Current Report Filing (8-k)

September 21 2016 - 4:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

September 19, 2016

Rambus Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

000-22339

|

|

94-3112828

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I. R. S. Employer

Identification No.)

|

1050 Enterprise Way, Suite 700, Sunnyvale, California 94089

(Address of principal executive offices, including ZIP code)

(408) 462-8000

(Registrant’s telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers.

(c)

On

September 19, 2016, Rambus Inc. (the “Company”) announced that Rahul Mathur has accepted the offer to join the Company as its Senior Vice President, Chief Financial Officer. Mr. Mathur is planning to commence employment on October 3, 2016.

Mr. Mathur will replace Martin Pilling, who has been serving as interim Chief Financial Officer since August 5, 2016. As Chief Financial Officer, Mr. Mathur will serve as the Company’s principal financial officer and principal accounting

officer, subject to formal approvals. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Mr. Mathur, 42, has served as senior vice president of finance at Cypress Semiconductor Corp., a provider of embedded memory, microcontroller, and analog

semiconductor system solutions, since March 2015, where he is responsible for financial planning and investor relations. From August 2012 to March 2015, Mr. Mathur served as vice president of finance at Spansion, Inc. (later acquired by Cypress

Semiconductor Corp.). Mr. Mathur served as vice president of finance at Picaboo Corporation from January 2012 to August 2012 and vice president of finance at CDNetworks Inc. from January 2011 to December 2011. Prior to January 2011, Mr. Mathur

held senior finance positions at Telesis Technologies, Inc., NetSuite Inc. and KLA-Tencor Corporation. Mr. Mathur holds a Bachelor of Arts in applied mathematics from Dartmouth College and an MBA from the Wharton School of Business at the

University of Pennsylvania.

There are no family relationships between Mr. Mathur and any of our directors or executive officers and there are no

arrangements or understandings between him and any other persons pursuant to which he was selected as an officer. There are no related party transactions between Mr. Mathur and the Company.

(e)

Pursuant to Mr. Mathur’s offer letter, Mr. Mathur

will receive an annual salary of $330,000 and will be eligible to participate in the Company’s 2016 Corporate Incentive Plan (“2016 CIP”), under which he will have a 2016 CIP target of $270,000, with payout based on an assessment of

his performance and the performance of his division, business unit or other area of responsibility. In addition, Mr. Mathur will receive a $50,000 hiring bonus. Mr. Mathur will be granted an option to purchase 60,000 shares of common stock of the

Company. 10% of the shares subject to the option will vest six months from the date of grant, and the remaining shares will vest monthly thereafter until fully vested four years from the date of grant. Mr. Mathur will also be granted 80,000

restricted stock units which will vest annually over four years.

The foregoing description of Mr. Mathur’s offer letter is a summary and is

qualified in its entirety by reference to the offer letter, which is attached hereto as Exhibit 10.1 and incorporated by reference herein.

The Company

plans to enter into its standard form of indemnification agreement, a copy of which is filed as Exhibit 10.1 to the Company’s Registration Statement on Form S-1 that was filed with the Securities and Exchange Commission on March 6, 1997, and

its standard form of change of control severance agreement, a copy of which is filed as Exhibit 10.1 to the Company’s Form 8-K that was filed with the Securities and Exchange Commission on March 9, 2015, with Mr. Mathur.

Item 9.01. Financial Statements and Exhibits.

(d)

Exhibits.

|

|

|

|

|

|

|

|

10.1

|

|

Offer Letter between the Rambus Inc. and Rahul Mathur, dated September 16, 2016

|

|

|

|

|

99.1

|

|

Press Release of Rambus Inc., issued on September 19, 2016

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Date: September 21, 2016

|

|

|

|

Rambus Inc.

|

|

|

|

|

|

|

|

|

|

/s/ Jae Kim

|

|

|

|

|

|

Jae Kim, Senior Vice President and General Counsel

|

Exhibit Index

|

|

|

|

|

Exhibit

Number

|

|

Exhibit Title

|

|

|

|

|

10.1

|

|

Offer Letter between the Rambus Inc. and Rahul Mathur, dated September 16, 2016

|

|

|

|

|

99.1

|

|

Press Release of Rambus Inc., issued on September 19, 2016

|

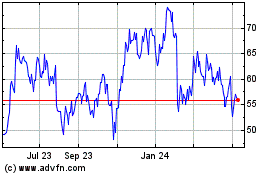

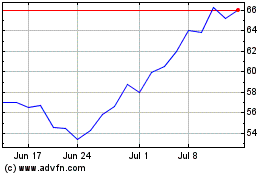

Rambus (NASDAQ:RMBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rambus (NASDAQ:RMBS)

Historical Stock Chart

From Apr 2023 to Apr 2024