Current Report Filing (8-k)

March 16 2016 - 5:11PM

Edgar (US Regulatory)

|

| | |

| UNITED STATES | |

| SECURITIES AND EXCHANGE COMMISSION | |

| Washington D.C. 20549 | |

| | |

| | |

| FORM 8-K | |

| | |

| CURRENT REPORT | |

| | |

| | |

| PURSUANT TO SECTION 13 OR 15(d) OF | |

| THE SECURITIES EXCHANGE ACT OF 1934 | |

| | |

| | |

| | |

| Date of Report (Date of earliest event reported): March 16, 2016 | |

| | |

| | |

| | |

| AVISTA CORPORATION | |

| (Exact name of registrant as specified in its charter) | |

| | |

| | |

Washington | 1-3701 | 91-0462470 |

(State of other jurisdiction of incorporation) | (Commission file number) | (I.R.S. Employer Identification No.) |

|

| | |

1411 East Mission Avenue, Spokane, Washington | | 99202-2600 |

(Address of principal executive offices) | | (Zip Code) |

|

| | |

Registrant's telephone number, including area code: | | 509-489-0500 |

Web site: http://www.avistacorp.com | | |

|

| | |

| (Former name or former address, if changed since last report) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Section 7 – Regulation FD Disclosure

Item 7.01 Regulation FD Disclosure.

On March 17, 2016, management of Avista Corporation (Avista Corp. or the Company) will be participating in meetings with investors and analysts at the West Coast Utilities Seminar hosted by Williams Capital Group L.P. in Las Vegas, Nevada. The same business update presentation will be used at all of the meetings. A copy of the business update presentation is furnished as Exhibit 99.1 and is available in the “Investors” section of Avista Corp.'s website at http://investor.avistacorp.com/phoenix.zhtml?c=97267&p=irol-calendarpast.

As part of this update, Avista Corp. expects to confirm earnings guidance for 2016. The 2016 earnings guidance was included in Avista Corp.'s fourth quarter and fiscal year 2015 earnings release furnished on Form 8-K on February 24, 2016. The 2016 earnings guidance is subject to the risks, uncertainties and other factors set forth or referred to in such earnings release and the Company's annual report on Form 10-K for the year ended December 31, 2015.

The information in this report, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

Section 9 - Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| |

99.1 | Business update presentation dated March 17, 2016, which is being furnished pursuant to Item 7.01. |

The inclusion in this Current Report or in Exhibit 99.1 of a reference to Avista Corp.'s Internet address shall not, under any circumstances, be deemed to incorporate the information available at such Internet address into this Current Report. The information available at Avista Corp.'s Internet address is not part of this Current Report or any other report furnished or filed by Avista Corp. with the Securities and Exchange Commission.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| | |

| | AVISTA CORPORATION |

| | (Registrant) |

| | |

| | |

Date: | March 16, 2016 | /s/ Marian M. Durkin |

| | Marian M. Durkin |

| | Senior Vice President, General Counsel |

| | and Chief Compliance Officer |

Positioned for performance: An overview of 2015 and beyond West Coast Utilities Seminar Las Vegas March 17, 2016 NYSE: AVA www.avistacorp.com Exhibit 99.1

All forward-looking statements are Avista management’s present expectations of future events and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. For more information on such factors and uncertainties, consult Avista’s most recent form 10-K and 10-Q, which are available on our website at www.avistacorp.com Disclaimer 2

3 Strong and stable utility core Regulated electric and natural gas operations Serves customers in Washington, Idaho and Oregon Contributes about 95% of earnings Regulated electric operations Serves customers in City and Borough of Juneau Avista Utilities Alaska Electric Light & Power Company (AEL&P) Long history of service, trust, innovation and collaboration Photo: Spokane River Upper Falls

4 Steadily building long-term value Reliably building value for our customers, investors, communities and employees Projecting earnings and dividend growth of 4% to 5% Avista Utilities AEL&P Strategic Investments 5% to 6% rate base growth through utility capital investments □ Upgrading infrastructure □ Grid modernization Customer and load growth (~1%) Strong near-term rate base growth through investment in generation Customer and load growth (~1%) Planning to bring natural gas to Juneau Developing platforms for future growth □ Targeting expanded natural gas services via LNG* □ Exploring data science and advanced analytics *LNG: Liquefied natural gas

Avista Utilities Significant investments in utility infrastructure 5

6 Diverse customer base □ 30,000 square mile service territory □ Service area population 1.6 million – 375,000 electric customers – 335,000 natural gas customers Strong customer focus □ 90% percent or better customer satisfaction ratings every year since 1999 □ Developing key customer initiatives Invested in our communities □ More than $1.5 million per year in charitable donations and over 48,000 volunteer hours from our employees Providing safe and reliable service for 127 years Solid foundation and continued commitment to innovation Information as of Dec. 31, 2015

7 A responsible mix of generation Hydro 48% Biomass 2% Wind 6% Coal 9% Natural Gas 35% Avista Utilities Electricity Generation Resource Mix* Dec. 31, 2015 Strategy is to control a portfolio of resources that responsibly meet our long-term energy needs Long resources through 2020; plan to add 96 MW natural gas peaker by the end of 2020 Exceeds Washington state’s 15% Renewable Portfolio Standard for the next 20 years Founded on clean, renewable hydropower *Based on maximum capacity Excludes AEL&P Post Falls Dam, Idaho

8 $136 $131 $151 $178 $55 $51 $53 $56 $50 $43 $43 $42 $48 $29 $30 $39 $49 $47 $56 $45 $71 $52 $54 $33 $6 $22 $18 $12 $415 $375 $405 $405 2015 2016 2017 2018 Avista Utilities Capital Expenditures** ($ millions) Environmental Generation Gas Other* Growth Enterprise Technology T&D Projected Significant investments to upgrade all systems * Other includes Facilities and Fleet ** Excludes capital expenditures at AEL&P of $13 million in 2015, and projected capital expenditures of $17 million in 2016, $13 million in 2017 and $18 million in 2018 5% to 6% rate base growth

9 Investing in our utility Nine Mile Falls Rehab Little Falls Plant Upgrade Grid Modernization Aldyl A Natural Gas Pipe Replacement Advanced Metering Infrastructure (AMI) Preserving and enhancing service reliability

10 Driving effective regulatory outcomes Continued recovery of costs and capital investments Washington Feb. 19, 2016, filed an electric and natural gas rate request with a proposed 18-month rate plan designed for new rates effective Jan. 1, 2017 and Jan. 1, 2018. Under this plan, we would not file a rate case for new rates to be effective prior to July 1, 2018. Request designed to increase annual electric revenues by 7.6 percent or $38.6 million, and annual natural gas revenues by 2.8 percent or $4.4 million on Jan. 1, 2017. The request also includes a second- step increase designed to increase annual electric revenues by 1.6 percent or $10.3 million, and annual natural gas revenues by 1.0 percent or $0.9 million on Jan. 1, 2018. Request based on 48.5% equity ratio and a 9.9% return on equity. Oregon We continue to evaluate the need to file a natural gas general rate case in Oregon in 2016 Idaho Expect to file electric and natural gas general rate cases in Idaho during the first half of 2016.

Alaska Electric Light & Power Company (AEL&P) Growing the utility core 11

Oldest regulated electric utility in Alaska, founded in 1893 12 Serves 17,000 electric customers in the City and Borough of Juneau, meeting nearly all of its energy needs with hydropower One of the lowest-cost electric utilities in the state Approved capital structure of 53.8% equity and an authorized return on equity of 12.875% Diversifying our utility footprint Juneau, Alaska

13 Opportunity to drive additional growth in Alaska Planning to bring natural gas to Juneau Invest approximately $130 million over 10 years □ 50% during first five years □ Expect $0.05 of earnings by third year of operations □ Two-year construction phase – Construction could begin in the first half 2016 – Slightly dilutive to earnings during construction phase – Accretive to earnings during first year of operations Next steps □ Seek low-cost debt financing through mechanisms provided by Alaska Industrial Development & Export Authority (AIDEA) □ Request state and local funds to support customers’ conversion costs □ File and obtain from the regulatory commission of Alaska a non- conditional Certificate of Public Convenience and Necessity Juneau, Alaska

14 Strategic Investments Developing platforms for future growth

Expand natural gas services via LNG □ Salix (subsidiary) – Generation – diesel substitution – Marine fueling – Rail fueling □ Finalist for LNG liquefaction plant to serve the Interior Energy Project, specifically Fairbanks, Alaska – One of two finalists selected in RFP process – Decision expected in the first quarter of 2016 Targeted investments □ Plum Energy – Small LNG project investments □ TROVE – Leverage AMI data through applied analytics Market Opportunities Creating new growth platforms 15

16 Financial Performance Metrics

$1.32 $1.85 $3.10 $1.97 2012 2013 2014 2015 2016 Guidance Continuing Operations Ecova (DiscOp) $1.96-$2.16 17 Continued earnings growth Total Earnings per Diluted Share Attributable to Avista Corporation Business Segments Q4 2015 Q4 2014 Avista Utilities $0.51 $0.45 AEL&P $0.04 $0.04 Other $(0.01) $(0.01) Continuing Operations Diluted EPS $0.54 $0.48 Ecova (DiscOp) $0.07 $0.03 TOTAL Diluted EPS $0.61 $0.51

18 2016 Earnings Guidance Avista Utilities $1.91 - $2.05 AEL&P $0.09 - $0.13 Other $(0.04) - $(0.02) Consolidated $1.96 - $2.16 Guidance Assumptions Our outlook for Avista Utilities assumes, among other variables, normal precipitation, temperatures and hydroelectric generation for the remainder of the year and includes the expected impact from decoupling. Our outlook for AEL&P assumes, among other variables, normal precipitation, temperatures and hydroelectric generation for the remainder of the year. Our guidance range for Avista Utilities encompasses expected variability in power supply costs and the application of the ERM to that power supply cost variability. The midpoint of our guidance range for Avista Utilities does not include any benefit or expense under the ERM. In 2016 we expect to be in a benefit position under the ERM within the $4.0 million band. In 2016, we expect to issue about $155 million of long-term debt and about $55 million of common stock. Growth for 2016

*Current quarterly dividend of $0.3425 annualized 19 Dividend growth expected to keep pace with long-term earnings growth Attractive and growing dividend $1.16 $1.22 $1.27 $1.32 $1.37 2012 2013 2014 2015 2016*

20 An attractive investment Strong and responsible core utility □ Investing substantially to modernize infrastructure and upgrade systems □ Steady returns and attractive dividend yield* □ One of the greenest utilities in the U.S.** Focus on utility growth □ Selective acquisitions □ Developing new products and services and supporting economic development throughout service area □ LDC opportunity in Juneau Positioning for future □ Strategically investing in ways to extend access to natural gas via LNG and leverage AMI data through applied analytics □ Track record of innovation (e.g. Itron, ReliOn, Ecova) * Dividend yield 3.6% based on stock price as of March 10, 2016 ** Source: Benchmarking Air Emissions of the 100 Largest Power Producers in the United States, NRDC, July 2015 LDC: Local distribution company Photo: Cabinet Gorge Dam Reliably building value for our customers, investors, communities and employees

We welcome your questions Company Contact Jason Lang, Investor Relations Manager 509-495-2930 jason.lang@avistacorp.com www.avistacorp.com Photo: Huntington Park, Spokane, Wash. 21

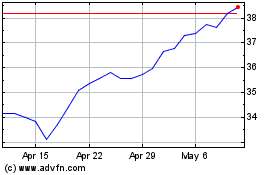

Avista (NYSE:AVA)

Historical Stock Chart

From Mar 2024 to Apr 2024

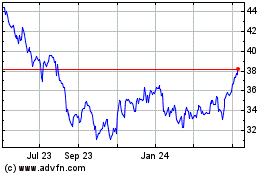

Avista (NYSE:AVA)

Historical Stock Chart

From Apr 2023 to Apr 2024