UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 8-K

______________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (date of earliest event reported): February 3, 2016

EDGEWELL PERSONAL CARE COMPANY

(Exact name of registrant as specified in its charter)

|

| | |

Missouri | 1-15401 | 43-1863181 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employee Identification No.) |

1350 Timberlake Manor Parkway, Chesterfield, Missouri 63017

(Address of principal executive offices)

314-594-1900

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition

On February 3, 2016, Edgewell Personal Care Company (the "Company") issued a press release announcing financial and operating results for its first quarter of fiscal 2016. This press release is furnished as Exhibit 99.1 hereto and incorporated herein by reference.

The information contained in this Current Report on Form 8-K under Item 2.02, including the accompanying Exhibit 99.1, is being furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section. The information contained in this Current Report on Form 8-K under Items 2.02, including the accompanying Exhibit 99.1, shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

| |

Exhibit No. | Description |

99.1 | Press Release of Edgewell Personal Care Company issued on February 3, 2016. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

EDGEWELL PERSONAL CARE COMPANY

By: /s/ Sandra J. Sheldon

Sandra J. Sheldon

Chief Financial Officer

Dated: February 3, 2016

EXHIBIT INDEX

|

| |

Exhibit No. | Description |

99.1 | Press Release of Edgewell Personal Care Company issued on February 3, 2016. |

Exhibit 99.1

|

| |

| Edgewell Personal Care Company 1350 Timberlake Manor Parkway St. Louis, MO 63017 |

FOR IMMEDIATE RELEASE | Company Contact |

February 3, 2016 | Chris Gough Vice President, Investor Relations 203-944-5706 Chris.Gough@Edgewell.com |

Edgewell Personal Care Company Announces First Quarter Fiscal 2016 Results and Reaffirms Fiscal Year 2016 Outlook

St. Louis - February 3, 2016 -Edgewell Personal Care Company (NYSE: EPC) today announced results for its first fiscal

quarter, which ended December 31, 2015.

Executive Summary

| |

• | 1Q organic net sales grew 0.5%, including a 240 basis point impact from international go-to-market changes. |

| |

• | 1Q Adjusted EBITDA was $94.4 million. |

| |

• | 1Q GAAP Diluted Earnings Per Share ("EPS") was $0.39, Adjusted EPS was $0.68. |

| |

• | The Company's outlook for fiscal 2016 remains unchanged, with relatively flat organic net sales, Adjusted EPS of $3.20-$3.40 and $440-$460 million in Adjusted EBITDA. |

The Company reports results on a GAAP and "Non-GAAP" basis, and has reconciled them to the most directly comparable GAAP measures later in this release. See "Non-GAAP Financial Measures" below, for a more detailed explanation, including definitions of various terms used in this release such as "Adjusted EBITDA", "Normalized EBITDA", "Organic net sales", "Organic segment profit" and "go-to-market impacts."

All comparisons used in this release are with the same period in the prior fiscal year unless otherwise stated.

"We made progress on our top-line performance in the first quarter of fiscal 2016. Organic net sales grew 50 basis points, driven by a return to growth in North America," said David Hatfield, Edgewell's President and Chief Executive Officer. "Solid underlying growth enabled us to overcome the impact of ongoing international go-to-market changes, and we continued to make progress on our key initiatives for 2016. This positive start to the year reinforces our view that we are taking the right steps to position Edgewell for future growth and value creation."

Fiscal 1Q 2016 Operating Results (Unaudited)

Net sales were $495 million in the quarter, a decrease of 7.9%. Organic net sales grew 0.5%, driven by growth in Wet Shave and Sun and Skin Care. Wet Shave sales were primarily driven by growth in North America, and Sun and Skin Care increases were led by strong performance in Asia Pacific. Organic net sales in North America were up 2.7%, while organic net sales outside North America were down 2.1%, primarily due to go-to-market impacts. Excluding estimated international go-to-market impacts of $13 million, underlying sales were up 2.9%.

Gross margin decreased 180 basis points to 46.0%. Gross margin declined 90 basis points excluding the negative impact of currency. Although higher volumes and productivity savings contributed to margin expansion, they were more than offset by higher product costs, which included higher input costs, driven by significant foreign exchange transaction costs.

Advertising and sales promotion expense ("A&P") was $46.6 million, representing 9.4% of net sales, consistent on a percent of net sales basis with the prior year. Lower A&P spending in the quarter versus the prior year was primarily due to go-to-market changes and the timing of spend related to new product innovation.

Selling, general and administrative expense ("SG&A") was $100.4 million, or 20.3% of net sales, compared to $133.5 million, or 24.9% of net sales. Included within the current quarter results were pre-tax costs of $7.3 million related to the spin-off of the Company's Household Products business in July 2015. Excluding these spin-off costs, SG&A as a percent of net sales was 18.8%, including amortization of intangible assets not allocated to the segments. Historical SG&A results on a continuing operations basis include certain costs associated with supporting the Household Products business that were not eligible to be reported in discontinued operations. When adjusting SG&A in the prior year quarter for those ineligible expenses, SG&A this quarter would have increased an estimated 70 basis points as a percent of net sales, due in part to expected dis-synergies as the Company transitions to operating a standalone company.

First quarter Adjusted EBITDA was $94.4 million versus a first quarter 2015 Normalized EBITDA of $117.4 million, down $23 million, which included a decline of $10 million due to negative currency, a decline of $4 million due to Venezuela/Industrial in the prior year results, and a remaining $9 million primarily due to lower gross margin and higher SG&A.

The year-to-date effective tax rate was 22.8% as compared to a 4.2% benefit in the prior year. The tax rate from the prior year reflects a tax benefit on higher spin-off charges and restructuring costs which occurred in higher tax-rate jurisdictions. Excluding the impact of the separation and restructuring, the adjusted effective tax rate this quarter was 27.7%, consistent with the prior year quarter.

First quarter Adjusted EPS was $0.68, compared to $0.62 in the prior year quarter. GAAP EPS was $0.39 as compared to $0.32 in the prior year quarter.

Other Items

The first quarter included $7.5 million of pre-tax spin charges compared to $23.8 million in the same period of the prior year. Additionally, the Company recorded pre-tax expense of $18.5 million related to its 2013 restructuring, as compared to $9.2 million in the prior year.

Average (trailing 4 quarter) working capital as a percent of sales was 17.0% at December 31, 2015, versus 17.5% as of September 30, 2015, with the 50 basis point improvement driven by Days Payable Outstanding. Working Capital continues to reflect a temporary higher level of inventory primarily in Feminine Care due to the upcoming closure of the Montreal plant.

Net Cash used by operating activities was $58.7 million during the first quarter of fiscal 2016. The quarter was negatively impacted by the seasonality of the Company's business, primarily related to Sun Care, as well as the payment timing of year-end accrued expenses and interest payments. The Company expects to have positive cash flow for the full year. In the quarter, the Company completed share repurchases of nearly 1 million shares for $79 million.

1Q 2016 Operating Segment Results (Unaudited)

Wet Shave (Men's Systems, Women's Systems, Disposables, Shave Preps)

Wet Shave organic net sales increased $3.7 million, or 1.1%, including an estimated $11.5 million negative impact from go-to-market changes. Underlying growth was driven by women's systems, disposables and shave preps in North America and men's and women's systems in Asia. Organic segment profit declined $12.7 million, or 14.0%, due to lower gross margin resulting from higher product costs, go-to-market changes, and higher SG&A. Higher product costs reflected the impact of U.S. dollar-based input costs into the Company's international manufacturing plants as well as higher cost for shave preps.

Sun and Skin Care (Sun Care, Wipes, Gloves)

Sun and Skin Care organic net sales increased $2.4 million, or 4.4%, driven by strong Sun Care sales in international markets, particularly Oceania and emerging markets in Asia. Globally, Sun Care growth was strong across both the Banana Boat® and Hawaiian Tropic® brands. Skin Care sales declined in North America, due primarily to increased competition. Organic segment profit declined $1.1 million or 29.7%, as higher sales volumes and lower SG&A were more than offset by lower gross margin, reflecting the impact of lower production volumes versus a year ago, due to temporary changes in operating levels.

Feminine Care (Tampons, Pads, Liners)

Feminine Care organic net sales decreased $2.2 million, or 2.3%. Sales in North America decreased 0.4% as volume gains in the Sport® Pads and Liner business were offset by declines in legacy products and by go-to-market impacts in Asia and Latin America. Organic segment profit was up $3.1 million, or 20.4%, driven by lower A&P spend and improved gross margin, reflecting restructuring savings.

All Other (Infant Care, all other brands)

Organic All Other net sales decreased $1.1 million, or 2.4%, as growth in Diaper Genie® was more than offset by lower volumes in infant cups and bottles related to the ongoing impact of competitive pressure. Organic segment profit grew $1.9 million on higher gross margin due to favorable product costs and lower SG&A.

Full Fiscal Year 2016 Financial Outlook remains unchanged

Organic net sales are expected to be flat, including the negative impact of go-to-market changes through the end of the third quarter of fiscal 2016. For the full year, the go-to-market changes are estimated to impact top line growth by approximately 1.5%. Therefore, underlying sales growth, excluding these go-to-market changes, is expected to increase by low single digits. Organic net sales excludes unfavorable currency impact on net sales, which is now expected to be in the range of $50-$60 million for the full fiscal year, versus the prior outlook of $40-$50 million. Reported net sales are expected to decrease by mid-single digits.

Adjusted EBITDA is projected to be in the range of $440-$460 million for fiscal 2016, including $20-$25 million of negative currency impact for the full fiscal year versus the prior outlook of $15-$20 million.

Adjusted EPS is projected to be in the range of $3.20-$3.40 for fiscal 2016 including $20-$25 million of negative currency impact for the full fiscal year versus the prior outlook of $15-$20 million.

Adjusted Tax rate is now expected to be in the range of 30%-32% for fiscal 2016.

Other Items: The full-year estimate for spin costs is unchanged at $10-$12 million, with the majority of the costs expected to be incurred in the first half of the year. The full-year estimate for restructuring related costs is unchanged at $40-$45 million. Incremental restructuring savings are expected to be approximately $15 million in fiscal 2016 and an additional $40-$50 million in fiscal 2017 and 2018 combined.

Webcast Information

In conjunction with this announcement, the Company will hold an investor conference call beginning at 9:00 a.m. eastern time today. The call will focus on fiscal 2016 first quarter earnings and the outlook for fiscal 2016. All interested parties may access a live webcast of this conference call at www.edgewell.com, under "Investors," and "News and Events" tabs or by using the following link:

http://ir.edgewell.com/news-and-events/events

For those unable to participate during the live webcast, a replay will be available on www.edgewell.com, under "Investors," "Financial Reports," and "Quarterly Earnings" tabs.

About Edgewell

Edgewell is a leading pure-play consumer products company with an attractive, diversified portfolio of established brand names such as Schick® and Wilkinson Sword® men's and women's shaving systems and disposable razors; Edge® and Skintimate® shave preparations; Playtex®, Stayfree®, Carefree® and o.b.® feminine care products; Banana Boat® and Hawaiian Tropic® sun care products; Playtex® infant feeding, Diaper Genie® and gloves; and Wet Ones® moist wipes. The Company has a broad global footprint and operates in more than 50 markets, including the U.S., Canada, Mexico, Germany, Japan and Australia, with approximately 6,000 employees worldwide.

# # #

Non-GAAP Financial Measures. While the Company reports financial results in accordance with accounting principles generally accepted in the U.S. ("GAAP"), this discussion also includes Non-GAAP measures. These Non-GAAP measures are referred to as "adjusted" and exclude expenses associated with spin costs, restructuring charges (including 2013 restructuring and spin restructuring) and adjustments to prior year tax accruals.

This Non-GAAP information is provided as a supplement to, not as a substitute for, or as superior to, measures of financial performance prepared in accordance with GAAP. The Company uses this Non-GAAP information internally to make operating decisions and believes it is helpful to investors because it allows more meaningful period-to-period comparisons of ongoing operating results. The information can also be used to perform analysis and to better identify operating trends that may otherwise be masked or distorted by the types of items that are excluded. This Non-GAAP information is a component in determining management's incentive compensation. Finally, the Company believes this information provides a higher degree of transparency.

Adjusted EBITDA is defined as earnings before income taxes, interest expense, depreciation and amortization and excludes items such as spin costs and restructuring charges.

Historical results on a continuing operations basis include certain costs associated with supporting the Company's former Household Products business that are not eligible to be reported in discontinued operations. These costs affect SG&A, interest expense, spin costs, restructuring and tax. As a result, EPS and EBITDA on both a GAAP and Non-GAAP basis for this quarter and fiscal year are not comparable to the prior year, and will not be comparable as we move through each of the first three quarters of fiscal 2016. To address this, the Company has provided Normalized EBITDA, which adjusts corporate SG&A expenses to reflect the Company's estimated full-year run rate. Normalized EBITDA is presented to provide a basis for comparing to future performance. A reconciliation of Fiscal 2015 Consolidated Statement of Earnings and Normalized EBITDA by quarter was provided in an 8-K filed on December 1, 2015, and can be found on the Company's website www.edgewell.com, under "Investors," and "Financial Reports," "Key Statistics" tabs or by using the following link:

http://ir.edgewell.com/financial-reports/key-statistics

The Company analyzes its net revenue and segment profit on an organic basis to better measure the comparability of results between periods. Organic net sales and segment profit exclude the impact of changes in foreign currency, the impact of acquisitions and dispositions (including the results of the former industrial blade business) and the period-over-period change resulting from the deconsolidation of our Venezuela operations. This information is provided because these fluctuations can distort the underlying change in net sales and segment profit either positively or negatively. See Non-GAAP reconciliations later in this release.

To compete more effectively as an independent company, the Company has increased its use of third-party distributors and wholesalers, and has decreased or eliminated its business operations in certain countries, consistent with its international go-to-market strategy. Within this press release the Company discusses go-to-market impacts, which reflect its best estimate on the impact of these international go-to-market changes and exits, and represent the year-over-year change in those markets. The Company expects to realize the majority of the remaining impact from these changes in the first three quarters of fiscal year 2016.

Forward-Looking Statements. This document contains both historical and forward-looking statements. Forward-looking statements are not based on historical facts, but instead reflect the Company's expectations, estimates or projections concerning future results or events, including, without limitation, the future earnings and performance of Edgewell Personal Care Company or any of its businesses. These statements generally can be identified by the use of forward-looking words or phrases such as "believe," "expect," "expectation," "anticipate," "may," "could," "intend," "belief," "estimate," "plan," "target," "predict," "likely," "will," "should," "forecast," "outlook," or other similar words or phrases. These statements are not guarantees of performance and are inherently subject to known and unknown risks, uncertainties and assumptions that are difficult to predict and could cause the Company's actual results to differ materially from those indicated by those statements. The Company cannot assure you that any of its expectations, estimates or projections will be achieved. The forward-looking statements included in this document are only made as of the date of this document and the Company disclaims any obligation to publicly update any forward-looking statement to reflect subsequent events or circumstances. Numerous factors could cause the Company's actual results and events to differ materially from those expressed or implied by forward-looking statements, including, without limitation:

| |

• | The Company is subject to risks related to its international operations, such as global economic conditions, currency fluctuations and its changing international go-to-market strategy, that could adversely affect its results of operations; |

| |

• | The Company may not achieve some or all of the expected benefits of the spin-off of its Household Products business, and this may materially adversely affect its business; |

| |

• | The Company's manufacturing facilities, supply channels or other business operations may be subject to disruption from events beyond its control; |

| |

• | The Company's access to capital markets and borrowing capacity could be limited; |

| |

• | If the Company cannot continue to develop new products in a timely manner, and at favorable margins, it may not be able to compete effectively; |

| |

• | The Company has a substantial level of indebtedness and is subject to various covenants relating to such indebtedness, which could limit its discretion to operate and grow its business; |

| |

• | The Company faces risks arising from the restructuring of its operations and uncertainty with respect to its ability to achieve its estimated cost savings; |

| |

• | Loss of any of the Company's principal customers and emergence of new sales channels could significantly decrease its sales and profitability; |

| |

• | The Company may not be able to attract, retain and develop key personnel; |

| |

• | The Company may experience losses or be subject to increased funding and expenses related to its pension plans; |

| |

• | The Company may not be able to continue to identify and complete strategic acquisitions and effectively integrate acquired companies to achieve desired financial benefits; |

| |

• | The Company's Wet Shave segment's men's shaving systems category has faced relatively flat to declining sales; |

| |

• | The Company's business involves the potential for product liability and other claims against it, which could affect its results of operations and financial condition and result in product recalls or withdrawals; |

| |

• | A failure of a key information technology system or a breach of the Company's information security could adversely impact its ability to conduct business; |

| |

• | The resolution of the Company's tax contingencies may result in additional tax liabilities, which could adversely impact its cash flows and results of operations; |

| |

• | If the Company fails to adequately protect its intellectual property rights, competitors may manufacture and market similar products, which could adversely affect its market share and results of operations; |

| |

• | Potential liabilities in connection with the Separation may arise under fraudulent conveyance and transfer laws and legal capital requirements. |

In addition, other risks and uncertainties not presently known to the Company or that it considers immaterial could affect the accuracy of any such forward-looking statements. The list of factors above is illustrative, but not exhaustive. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. Additional risks and uncertainties include those detailed from time to time in the Company's publicly filed documents, including in Item 1A. Risk Factors of Part I of the Company's Annual Report on Form 10-K for the year ended September 30, 2015.

EDGEWELL PERSONAL CARE COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS

(unaudited, in millions, except per share data)

|

| | | | | | | |

| Quarter Ended December 31, |

| 2015 | | 2014 |

| | | |

Net sales | $ | 495.1 |

| | $ | 537.1 |

|

Cost of products sold | 267.6 |

| | 280.3 |

|

Gross profit | 227.5 |

| | 256.8 |

|

| | | |

Selling, general and administrative expense | 100.4 |

| | 133.5 |

|

Advertising and sales promotion expense | 46.6 |

| | 50.7 |

|

Research and development expense | 16.0 |

| | 15.7 |

|

Spin restructuring charges | — |

| | 1.2 |

|

2013 restructuring charges | 18.5 |

| | 9.2 |

|

Interest expense | 17.7 |

| | 27.8 |

|

Other income, net | (2.4 | ) | | (0.4 | ) |

Earnings from continuing operations before income taxes | 30.7 |

| | 19.1 |

|

Income tax provision (benefit) | 7.0 |

| | (0.8 | ) |

Earnings from continuing operations | 23.7 |

| | 19.9 |

|

Earnings from discontinued operations, net of tax | — |

| | 85.2 |

|

Net earnings | $ | 23.7 |

| | $ | 105.1 |

|

| | | |

Basic earnings per share: | | | |

Continuing operations | $ | 0.40 |

| | 0.32 |

|

Discontinued operations | — |

| | 1.38 |

|

Net earnings | 0.40 |

| | 1.70 |

|

| | | |

Diluted earnings per share: | | | |

Continuing operations | $ | 0.39 |

| | $ | 0.32 |

|

Discontinued operations | — |

| | 1.37 |

|

Net earnings | 0.39 |

| | 1.69 |

|

| | | |

Weighted-average shares outstanding: | | | |

Basic | 59.7 |

| | 62.0 |

|

Diluted | 59.9 |

| | 62.4 |

|

See Accompanying Notes.

EDGEWELL PERSONAL CARE COMPANY

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited, in millions)

|

| | | | | | | |

Assets | December 31,

2015 | | September 30,

2015 |

Current assets | | | |

Cash and cash equivalents | $ | 694.2 |

| | $ | 712.1 |

|

Trade receivables, net | 240.0 |

| | 279.8 |

|

Inventories | 355.8 |

| | 332.8 |

|

Other current assets (1) | 174.0 |

| | 311.9 |

|

Total current assets | 1,464.0 |

| | 1,636.6 |

|

Property, plant and equipment, net | 483.1 |

| | 476.1 |

|

Goodwill | 1,416.6 |

| | 1,421.8 |

|

Other intangible assets, net | 1,402.3 |

| | 1,408.5 |

|

Other assets (1) | 120.5 |

| | 48.7 |

|

Total assets | $ | 4,886.5 |

| | $ | 4,991.7 |

|

| | | |

Liabilities and Shareholders' Equity | | | |

Current liabilities | | | |

Notes payable | $ | 17.3 |

| | $ | 17.5 |

|

Accounts payable | 210.9 |

| | 236.9 |

|

Other current liabilities (1) | 283.0 |

| | 412.4 |

|

Total current liabilities | 511.2 |

| | 666.8 |

|

Long-term debt | 1,841.3 |

| | 1,704.0 |

|

Deferred income tax liabilities (1) | 346.2 |

| | 335.8 |

|

Other liabilities | 391.3 |

| | 421.0 |

|

Total liabilities | 3,090.0 |

| | 3,127.6 |

|

Shareholders' equity | | | |

Common shares | 0.7 |

| | 0.7 |

|

Additional paid-in capital | 1,634.5 |

| | 1,644.2 |

|

Retained earnings | 796.6 |

| | 772.9 |

|

Treasury shares | (451.9 | ) | | (382.2 | ) |

Accumulated other comprehensive loss | (183.4 | ) | | (171.5 | ) |

Total shareholders' equity | 1,796.5 |

| | 1,864.1 |

|

Total liabilities and shareholders' equity | $ | 4,886.5 |

| | $ | 4,991.7 |

|

| |

(1) | The Company early adopted new accounting guidance during the first quarter of fiscal 2016 which required all deferred income tax assets and liabilities to be classified as non-current, resulting in a reclassification of $85.1 deferred income tax assets and $2.7 deferred income tax liabilities from current to non-current as of December 31, 2015. The adoption of the new guidance had no impact on the balance sheet as of September 30, 2015. |

See Accompanying Notes.

EDGEWELL PERSONAL CARE COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in millions)

|

| | | | | | | |

| Quarter Ended December 31, |

| 2015 | | 2014 |

Cash Flow from Operating Activities | | | |

Net earnings | $ | 23.7 |

| | $ | 105.1 |

|

Non-cash restructuring costs | 0.7 |

| | 1.4 |

|

Depreciation and amortization | 20.2 |

| | 33.2 |

|

Non-cash items included in income, net | 13.6 |

| | 8.9 |

|

Other, net | (11.5 | ) | | 3.7 |

|

Changes in current assets and liabilities used in operations | (105.4 | ) | | (184.3 | ) |

Net cash used by operating activities | (58.7 | ) | | (32.0 | ) |

| | | |

Cash Flow from Investing Activities | | | |

Capital expenditures | (14.5 | ) | | (15.3 | ) |

Acquisitions, net of cash acquired | — |

| | (11.1 | ) |

Proceeds from sale of assets | — |

| | 1.8 |

|

Net cash used by investing activities | (14.5 | ) | | (24.6 | ) |

| | | |

Cash Flow from Financing Activities | | | |

Cash proceeds from debt with original maturities greater than 90 days | 144.8 |

| | — |

|

Cash payments on debt with original maturities greater than 90 days | — |

| | (80.0 | ) |

Net (decrease) increase in debt with original maturities of 90 days or less | (2.2 | ) | | 188.2 |

|

Common shares purchased | (78.9 | ) | | — |

|

Cash dividends paid | — |

| | (31.1 | ) |

Proceeds from issuance of common shares, net | — |

| | 1.4 |

|

Excess tax benefits from share-based payments | — |

| | 8.4 |

|

Net cash from financing activities | 63.7 |

| | 86.9 |

|

| | | |

Effect of exchange rate changes on cash | (8.4 | ) | | (27.7 | ) |

| | | |

Net (decrease) increase in cash and cash equivalents | (17.9 | ) | | 2.6 |

|

Cash and cash equivalents, beginning of period | 712.1 |

| | 1,129.0 |

|

Cash and cash equivalents, end of period | $ | 694.2 |

| | $ | 1,131.6 |

|

See Accompanying Notes.

EDGEWELL PERSONAL CARE COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, in millions, except per share data)

| |

1. | The Company conducts its business in the following four segments: Wet Shave, Sun and Skin Care, Feminine Care and All Other. Segment performance is evaluated based on segment profit, exclusive of general corporate expenses, share-based compensation costs, costs associated with most restructuring initiatives (including the Spin restructuring and the 2013 Restructuring), and amortization of intangible assets. Financial items, such as interest income and expense, are managed on a global basis at the corporate level. The exclusion of charges such as other acquisition transaction and integration costs, and substantially all restructuring, from segment results reflects management's view on how it evaluates segment performance. |

On July 1, 2015, the Company completed the separation of its Household Products business into a separate publicly-traded company (the "Spin" or the "Separation"). The historical financial results of the Company's Household Products business are presented as discontinued operations on the Condensed Consolidated Statements of Earnings and, as such, have been excluded from both continuing operations and segment results for all periods presented. The prior year Condensed Consolidated Statements of Cash Flows has not been adjusted to reflect the effect of the Separation, as the Company had not adopted the Financial Accounting Standards Board's updated guidance on the presentation of discontinued operations at the time of Separation. Historical results on a continuing operations basis include certain costs associated with supporting the Household Products business that were not eligible to be reported in discontinued operations.

The Company incurred incremental costs to evaluate, plan and execute the Separation. For the first quarter of fiscal 2016, $7.3 of pre-tax charges were recorded in Selling, general and administrative expense ("SG&A") and $0.2 of pre-tax charges for the first quarter of fiscal 2016 were recorded in Cost of products sold. For the first quarter of fiscal 2015, $23.8 of pre-tax charges were recorded in SG&A and $1.2 were recorded in Spin restructuring costs.

For the first quarter of fiscal 2016, the Company recorded pre-tax expense of $18.5 related to its 2013 restructuring, as compared to pre-tax expense of $9.2 for the first quarter of fiscal 2015. The 2013 restructuring charges were reported as a separate line item on the income statement.

Segment net sales and profitability are presented below:

|

| | | | | | | |

| Quarter Ended December 31, |

| 2015 | | 2014 |

Net Sales | | | |

Wet Shave | $ | 316.3 |

| | $ | 341.4 |

|

Sun and Skin Care | 53.5 |

| | 54.3 |

|

Feminine Care | 92.5 |

| | 95.8 |

|

All Other | 32.8 |

| | 45.6 |

|

Total net sales | $ | 495.1 |

| | $ | 537.1 |

|

| | | |

Segment Profit | | | |

Wet Shave | $ | 66.8 |

| | $ | 90.5 |

|

Sun and Skin Care | 1.7 |

| | 3.7 |

|

Feminine Care | 17.6 |

| | 15.2 |

|

All Other | 7.2 |

| | 6.8 |

|

Total segment profit | 93.3 |

| | 116.2 |

|

General corporate and other expenses | (17.7 | ) | | (31.4 | ) |

Spin costs (1) | (7.5 | ) | | (23.8 | ) |

Spin restructuring charges | — |

| | (1.2 | ) |

2013 restructuring and related costs | (18.5 | ) | | (9.2 | ) |

Amortization of intangibles | (3.6 | ) | | (4.1 | ) |

Interest and other expense, net | (15.3 | ) | | (27.4 | ) |

Total earnings from continuing operations before income taxes | $ | 30.7 |

| | $ | 19.1 |

|

| |

(1) | Includes pre-tax costs of $7.3 for the first quarter of fiscal 2016 and $23.8 for the first quarter of fiscal 2015, which were included in SG&A, and pre-tax costs of $0.2 for the first quarter of fiscal 2016 included in Cost of products sold. |

| |

2. | Basic earnings per share is based on the average number of common shares outstanding during the period. Diluted earnings per share is based on the weighted average number of shares used for the basic earnings per share calculation, adjusted for the dilutive effect of share options and restricted stock equivalent awards. |

The following table provides a reconciliation of net earnings and net earnings per diluted share ("EPS") to Adjusted net earnings and Adjusted EPS, which are Non-GAAP measures.

|

| | | | | | | | | | | | | | | |

| Net Earnings | | Diluted EPS |

| Q1 2016 | | Q1 2015 | | Q1 2016 | | Q1 2015 |

Net Earnings from Continuing Operations and Diluted EPS - GAAP (Unaudited) | $ | 23.7 |

| | $ | 19.9 |

| | $ | 0.39 |

| | $ | 0.32 |

|

Impacts, net of tax: Expense (Income) | | | | | | | |

Spin costs (1) | 4.8 |

| | 15.5 |

| | 0.08 |

| | 0.25 |

|

Spin restructuring charges | — |

| | 0.9 |

| | — |

| | 0.01 |

|

2013 restructuring and related charges, net | 12.5 |

| | 4.9 |

| | 0.21 |

| | 0.08 |

|

Adjustment to prior years' tax accruals | — |

| | (2.5 | ) | | — |

| | (0.04 | ) |

Adjusted Net Earnings and Adjusted Diluted EPS - Non-GAAP | $ | 41.0 |

| | $ | 38.7 |

| | $ | 0.68 |

| | $ | 0.62 |

|

| | | | | | | |

Weighted average shares - Diluted | | | | | 59.9 |

| | 62.4 |

|

| |

(1) | Includes costs of $4.7 and $15.5 (net of tax) for the first quarters of fiscal 2016 and 2015, respectively, which are included in SG&A. Additionally, costs of $0.1 (net of tax) for the first quarter of fiscal 2016 were included in Cost of products sold. |

The following tables provide a GAAP to Non-GAAP reconciliation of certain line items from the Condensed Consolidated Statement of Earnings:

|

| | | | | | | | | | | | | | | |

Q1 2016 | GAAP - Reported | | Spin Costs | | 2013 Restructuring Charges | | Total Adjusted Non-GAAP |

Net sales | $ | 495.1 |

| | $ | — |

| | $ | — |

| | $ | 495.1 |

|

| | | | | | | |

Gross profit | 227.5 |

| | 0.2 |

| | — |

| | 227.7 |

|

% of net sales | 46.0 | % | | | | | | 46.0 | % |

| | | | | | | |

SG&A | 100.4 |

| | 7.3 |

| | — |

| | 93.1 |

|

% of net sales | 20.3 | % | | | | | | 18.8 | % |

| | | | | | | |

Advertising and sales promotion expense ("A&P") | 46.6 |

| | — |

| | — |

| | 46.6 |

|

% of net sales | 9.4 | % | | | | | | 9.4 | % |

| | | | | | | |

Research and development expense ("R&D") | 16.0 |

| | — |

| | — |

| | 16.0 |

|

% of net sales | 3.2 | % | | | | | | 3.2 | % |

| | | | | | | |

Operating income | 30.7 |

| | 7.5 |

| | 18.5 |

| | 56.7 |

|

| | | | | | | |

Net earnings | 23.7 |

| | 4.8 |

| | 12.5 |

| | 41.0 |

|

| | | | | | | |

Diluted EPS | $ | 0.39 |

| | $ | 0.08 |

| | $ | 0.21 |

| | $ | 0.68 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | |

Q1 2015 | GAAP - Reported | | Spin Costs | | Spin Restructuring Charges | | 2013 Restructuring Charges | | Adjustments to Prior Year Tax Accruals | | Total Adjusted Non-GAAP |

Net sales | $ | 537.1 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 537.1 |

|

| | | | | | | | | | | |

Gross profit | 256.8 |

| | — |

| | — |

| | — |

| | — |

| | 256.8 |

|

% of net sales | 47.8 | % | | | | | | | | | | 47.8 | % |

| | | | | | | | | | | |

SG&A | 133.5 |

| | 23.8 |

| | — |

| | — |

| | — |

| | 109.7 |

|

% of net sales | 24.9 | % | | | | | | | | | | 20.4 | % |

| | | | | | | | | | | |

A&P | 50.7 |

| | — |

| | — |

| | — |

| | — |

| | 50.7 |

|

% of net sales | 9.4 | % | | | | | | | | | | 9.4 | % |

| | | | | | | | | | | |

R&D | 15.7 |

| | — |

| | — |

| | — |

| | — |

| | 15.7 |

|

% of net sales | 2.9 | % | | | | | | | | | | 2.9 | % |

| | | | | | | | | | | |

Operating income from continuing operations | 19.1 |

| | 23.8 |

| | 1.2 |

| | 9.2 |

| | — |

| | 53.3 |

|

| | | | | | | | | | | |

Earnings from continuing operations | 19.9 |

| | 15.5 |

| | 0.9 |

| | 4.9 |

| | (2.5 | ) | | 38.7 |

|

| | | | | | | | | | | |

Diluted EPS from continuing operations | $ | 0.32 |

| | $ | 0.25 |

| | $ | 0.01 |

| | $ | 0.08 |

| | $ | (0.04 | ) | | $ | 0.62 |

|

| |

3. | Starting July 1, 2015, as a result of the Separation, operations for the Company are reported via four segments - Wet Shave, Sun and Skin Care, Feminine Care and All Other. The following tables present changes in net sales and segment profit for the first quarter of fiscal 2016. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Sales (In millions - Unaudited) |

Quarter Ended December 31, 2015 |

| | | | | | | | | | | | | | | | | | | |

| Wet Shave | | Sun and Skin Care | | Feminine Care | | All Other | | Total |

| Q1 | | %Chg | | Q1 | | %Chg | | Q1 | | %Chg | | Q1 | | %Chg | | Q1 | | %Chg |

Net Sales - Q1 '15 | $ | 341.4 |

| | | | $ | 54.3 |

| | | | $ | 95.8 |

| | | | $ | 45.6 |

| | | | $ | 537.1 |

| | |

Organic | 3.7 |

| | 1.1 | % | | 2.4 |

| | 4.4 | % | | (2.2 | ) | | (2.3 | )% | | (1.1 | ) | | (2.4 | )% | | 2.8 |

| | 0.5 | % |

Impact of Venezuela | (9.6 | ) | | (2.8 | )% | | — |

| | — | % | | — |

| | — | % | | — |

| | — | % | | (9.6 | ) | | (1.8 | )% |

Impact of currency | (19.2 | ) | | (5.6 | )% | | (3.2 | ) | | (5.9 | )% | | (1.1 | ) | | (1.1 | )% | | (1.0 | ) | | (2.2 | )% | | (24.5 | ) | | (4.6 | )% |

Impact of industrial blade sale | — |

| | — | % | | — |

| | — | % | | — |

| | — | % | | (10.7 | ) | | (23.5 | )% | | (10.7 | ) | | (2.0 | )% |

Net Sales - Q1 '16 | $ | 316.3 |

| | (7.3 | )% | | $ | 53.5 |

| | (1.5 | )% | | $ | 92.5 |

| | (3.4 | )% | | $ | 32.8 |

| | (28.1 | )% | | $ | 495.1 |

| | (7.9 | )% |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Segment Profit (In millions - Unaudited) |

Quarter Ended December 31, 2015 |

| | | | | | | | | | | | | | | | | | | |

| Wet Shave | | Sun and Skin Care | | Feminine Care | | All Other | | Total |

| Q1 | | %Chg | | Q1 | | %Chg | | Q1 | | %Chg | | Q1 | | %Chg | | Q1 | | %Chg |

Segment Profit - Q1 '15 | $ | 90.5 |

| | | | $ | 3.7 |

| | | | $ | 15.2 |

| | | | $ | 6.8 |

| | | | $ | 116.2 |

| | |

Organic | (12.7 | ) | | (14.0 | )% | | (1.1 | ) | | (29.7 | )% | | 3.1 |

| | 20.4 | % | | 1.9 |

| | 27.9 | % | | (8.8 | ) | | (7.6 | )% |

Impact of Venezuela | (3.3 | ) | | (3.6 | )% | | — |

| | — | % | | — |

| | — | % | | — |

| | — | % | | (3.3 | ) | | (2.8 | )% |

Impact of currency | (7.7 | ) | | (8.5 | )% | | (0.9 | ) | | (24.3 | )% | | (0.7 | ) | | (4.6 | )% | | (0.7 | ) | | (10.3 | )% | | (10.0 | ) | | (8.6 | )% |

Impact of industrial blade sale | — |

| | — | % | | — |

| | — | % | | — |

| | — | % | | (0.8 | ) | | (11.8 | )% | | (0.8 | ) | | (0.7 | )% |

Segment Profit - Q1 '16 | $ | 66.8 |

| | (26.1 | )% | | $ | 1.7 |

| | (54.0 | )% | | $ | 17.6 |

| | 15.8 | % | | $ | 7.2 |

| | 5.8 | % | | $ | 93.3 |

| | (19.7 | )% |

| |

4. | The Company reports financial results on a GAAP and adjusted basis. The table below is used to reconcile earnings from continuing operations before income taxes to EBITDA, Adjusted EBITDA and Normalized EBITDA which are Non-GAAP measures to improve comparability of results between periods. |

|

| | | | | | | |

| Q1 2016 | | Q1 2015 |

Earnings from continuing operations before income taxes - GAAP | $ | 30.7 |

| | $ | 19.1 |

|

Interest expense | 17.7 |

| | 27.8 |

|

Depreciation and amortization | 20.7 |

| | 25.2 |

|

EBITDA (1) | $ | 69.1 |

| | $ | 72.1 |

|

| | | |

Spin restructuring charges | — |

| | 1.2 |

|

Spin costs | 7.5 |

| | 23.8 |

|

2013 restructuring and related costs (2) | 17.8 |

| | 7.8 |

|

Adjusted EBITDA (1) | $ | 94.4 |

| | $ | 104.9 |

|

| | | |

SG&A (3) | — |

| | 12.5 |

|

| | | |

Normalized EBITDA | $ | 94.4 |

| | $ | 117.4 |

|

| |

(1) | Historical adjusted EBITDA results on a continuing operations basis include costs associated with supporting the Household Product business that are not eligible to be reported in discontinued operations which affect corporate SG&A. As such, both EBITDA and adjusted EBITDA this quarter and this fiscal year are not comparable to the prior year, and will not be comparable year-over-year as we move through each of the first three quarters of fiscal 2016. |

| |

(2) | Excludes $0.7 and $1.4 of accelerated depreciation for the first fiscal quarters of 2016 and 2015, respectively, which was included within Depreciation and Amortization. |

| |

(3) | Corporate SG&A has been adjusted to reflect an estimated full year run-rate of $74 in fiscal 2015. |

| |

5. | Segment Working Capital metrics for Q1 2016 compared to Q4 2015 are presented below. |

|

| | | | | | | | | | | | | |

| Q1 2016 | | Days | | Q4 2015 | | Days |

Average receivables, adjusted (1) (2) | $ | 245.2 |

| | 37.6 |

| | $ | 246.7 |

| | 37.2 |

|

Average inventories (1) | 356.2 |

| | 106.5 |

| | 362.0 |

| | 107.1 |

|

Average accounts payable (1) | 197.1 |

| | 58.9 |

| | 185.4 |

| | 54.8 |

|

| | | | | | | |

Average working capital (3) | $ | 404.3 |

| | | | $ | 423.4 |

| | |

% of net sales (4) | 17.0 | % | | | | 17.5 | % | | |

| |

(1) | Excludes amounts identified as corporate. |

| |

(2) | Adjusted for trade allowances recorded as a reduction of net sales per GAAP and reported in accrued expenses on the Condensed Consolidated Balance Sheets. |

| |

(3) | Working capital is defined as receivables (less trade allowance in accrued liabilities), plus inventories, less accounts payable. Average working capital is calculated using an average of the four-quarter end balances for each working capital component as of December 31, 2015 and September 30, 2015, respectively. |

| |

(4) | Average working capital ÷ trailing four quarter net sales. |

Statements included in this working capital comparative are not guarantees of performance and are inherently subject to known risks and uncertainties, which could cause actual performance or achievement to differ materially from those expressed in or indicated by those statements. Numerous factors could cause the Company's actual results and events to differ materially from those expressed or implied by forward-looking statements. Refer to "Forward-Looking Statements" included within this release, as well as the Company's publicly-filed documents for the risks that may cause actual results to differ from statements herein, including its Annual Report on Form 10-K filed with the SEC on November 30, 2015.

| |

6. | Segment net sales and profitability for each quarter of fiscal 2015, respectively, are presented below. |

|

| | | | | | | | | | | | | | | | | | | |

| Q1 2015 | | Q2 2015 | | Q3 2015 | | Q4 2015 | | Fiscal Year 2015 |

Net Sales | | | | | | | | | |

Wet Shave | $ | 341.4 |

| | $ | 372.2 |

| | $ | 369.3 |

| | $ | 358.4 |

| | $ | 1,441.3 |

|

Sun and Skin Care | 54.3 |

| | 130.2 |

| | 153.3 |

| | 65.8 |

| | 403.6 |

|

Feminine Care | 95.8 |

| | 101.6 |

| | 104.1 |

| | 96.7 |

| | 398.2 |

|

All Other | 45.6 |

| | 47.1 |

| | 46.2 |

| | 39.2 |

| | 178.1 |

|

Total net sales | $ | 537.1 |

| | $ | 651.1 |

| | $ | 672.9 |

| | $ | 560.1 |

| | $ | 2,421.2 |

|

| | | | | | | | | |

Segment Profit | | | | | | | | | |

Wet Shave | $ | 90.5 |

| | $ | 99.8 |

| | $ | 56.4 |

| | $ | 62.0 |

| | $ | 308.7 |

|

Sun and Skin Care | 3.7 |

| | 37.3 |

| | 25.8 |

| | 4.7 |

| | 71.5 |

|

Feminine Care | 15.2 |

| | 20.9 |

| | 7.9 |

| | 4.7 |

| | 48.7 |

|

All Other | 6.8 |

| | 7.1 |

| | 5.2 |

| | 5.5 |

| | 24.6 |

|

Total segment profit | 116.2 |

| | 165.1 |

| | 95.3 |

| | 76.9 |

| | 453.5 |

|

General corporate and other expenses | (31.4 | ) | | (38.6 | ) | | (36.6 | ) | | (15.4 | ) | | (122.0 | ) |

Impairment charge | — |

| | — |

| | — |

| | (318.2 | ) | | (318.2 | ) |

Venezuela deconsolidation charge | — |

| | (79.3 | ) | | — |

| | — |

| | (79.3 | ) |

Spin costs (1) | (23.8 | ) | | (32.2 | ) | | (55.7 | ) | | (30.3 | ) | | (142.0 | ) |

Spin restructuring charges | (1.2 | ) | | (22.8 | ) | | (4.3 | ) | | — |

| | (28.3 | ) |

2013 restructuring and related costs (2) | (9.2 | ) | | (6.6 | ) | | (4.9 | ) | | (6.3 | ) | | (27.0 | ) |

Industrial sale charges | — |

| | — |

| | (21.9 | ) | | (10.8 | ) | | (32.7 | ) |

Amortization of intangibles | (4.1 | ) | | (3.6 | ) | | (3.8 | ) | | (3.6 | ) | | (15.1 | ) |

Cost of early debt retirements | — |

| | — |

| | (59.6 | ) | | — |

| | (59.6 | ) |

Interest and other expense, net | (27.4 | ) | | (26.8 | ) | | (20.9 | ) | | (12.9 | ) | | (88.0 | ) |

Total earnings from continuing operations before income taxes | $ | 19.1 |

| | $ | (44.8 | ) | | $ | (112.4 | ) | | $ | (320.6 | ) | | $ | (458.7 | ) |

| |

(1) | Includes pre-tax costs of $23.8, $31.5, $52.4, $30.1 and $137.8, respectively, for the first, second, third and fourth quarter of fiscal 2015 and fiscal year 2015, which were included in SG&A, and pre-tax costs of $0.7, $3.3, $0.2 and $4.2, respectively, for the second, third and fourth quarters of fiscal 2015 and fiscal year 2015, included in Cost of products sold. |

| |

(2) | Includes pre-tax costs of $0.3 for the third quarter of fiscal 2015 and fiscal year 2015 associated with certain information technology and related activities, which were included in SG&A. |

| |

7. | On March 31, 2015, the Company deconsolidated its Venezuelan subsidiaries. Included in consolidated results of operations, and reflected below, are the historical results of the Company's Venezuela operations through the second quarter of fiscal 2015 (reflected at the official exchange rate of 6.30 bolivars per U.S. dollar). |

|

| | | | | | |

| | Q1 | Q2 | Q3 | Q4 | FY |

Wet Shave - Net Sales | Fiscal 2015 | $9.6 | $14.4 | — | — | $24.0 |

| | | | | | |

| | Q1 | Q2 | Q3 | Q4 | FY |

Wet Shave - Segment Profit | Fiscal 2015 | $3.3 | $6.0 | — | — | $9.3 |

| |

8. | The sale of the industrial blade business was completed in September 2015. The historical results of the industrial blade business are included in consolidated results of operations through September 30, 2015. Reflected below are the net sales for the industrial blade business. The impact on All Other segment profit is not material. |

|

| | | | | | |

| | Q1 | Q2 | Q3 | Q4 | FY |

Industrial - Net Sales | Fiscal 2015 | $10.7 | $11.2 | $12.4 | $7.6 | $41.9 |

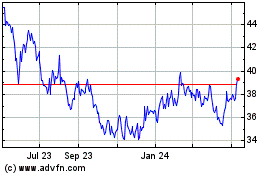

Edgewell Personal Care (NYSE:EPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

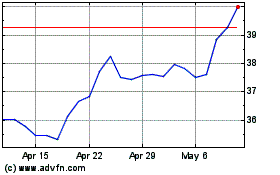

Edgewell Personal Care (NYSE:EPC)

Historical Stock Chart

From Apr 2023 to Apr 2024