UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED): December 22, 2015 (December 17, 2015)

Commission File Number: 0-24260

Amedisys, Inc.

(Exact Name of Registrant as specified in its Charter)

|

|

|

| Delaware |

|

11-3131700 |

| (State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

5959 S. Sherwood Forest Blvd., Baton Rouge, LA 70816

(Address of principal executive offices, including zip code)

(225) 292-2031 or (800) 467-2662

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 5 – Corporate Governance and Management

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

(e) Effective as of December 17, 2015, the Compensation Committee (the “Committee”) of the Amedisys, Inc. (the

“Company”) Board of Directors approved adding Ronald A. LaBorde, the Company’s Vice Chairman and Chief Financial Officer, as a “covered executive” under the terms of the Amedisys Holding, L.L.C. Severance Plan for Key

Executives dated April 30, 2015 (the “Key Executive Severance Plan”).

In connection therewith, Mr. LaBorde

agreed to relinquish any remaining rights under the terms of his Employment Agreement dated as of November 1, 2011, as amended by the First Amendment thereto dated December 29, 2011, the Second Amendment thereto dated December 19,

2012 and the Third Amendment thereto dated May 1, 2014 (as amended, the “Employment Agreement”). Although Mr. LaBorde’s “Term of Employment” (as defined in the Employment Agreement) had previously expired on

December 31, 2014, this event had no effect on Mr. LaBorde’s employment status and did not terminate the underlying Employment Agreement; certain provisions of the Employment Agreement relating to, among other topics, post-employment

severance payments and restrictive covenants, survived the expiry of the Term of Employment on an evergreen basis. Additional information regarding the Employment Agreement can be found in the Company’s 2015 Proxy Statement, as filed with the

United States Securities and Exchange Commission on April 30, 2015 (the “2015 Proxy Statement”).

Also effective as

of December 17, 2015 (the “Grant Date”), as consideration for his voluntarily agreeing to relinquish any remaining rights under the terms of his Employment Agreement, the Committee approved an equity award to Mr. LaBorde

under the terms of the Company’s 2008 Omnibus Incentive Compensation Plan, a copy of which appears as an Appendix to the 2015 Proxy Statement (the “Omnibus Plan”). The equity award consisted of: (a) 75,000 time-based

vesting Non-Qualified Stock Options (the “Time-Based Vesting Options”), each such Option contingently entitling Mr. LaBorde to purchase one share of the Company’s common stock at an exercise price of $41.38 per share

(subject to the vesting schedules and other terms and conditions appearing in the award agreement for such Options), (b) 75,000 performance-based vesting Non-Qualified Stock Options (the “Performance-Based Vesting Options”),

each such Option contingently entitling Mr. LaBorde to purchase one share of the Company’s common stock at an exercise price of $41.38 per share (subject to the vesting schedules and other terms and conditions appearing in the award

agreement for such Options), (c) 27,500 time-based vesting Restricted Share Units (“Time-Based Vesting RSUs”), each such RSU contingently entitling Mr. LaBorde to receive one fully-vested share of the Company’s common

stock (subject to the vesting schedules and other terms and conditions set forth in the award agreement for such RSUs), and (d) 27,500 performance-based vesting RSUs (the “Performance-Based Vesting RSUs”), each such RSU

contingently entitling Mr. LaBorde to receive one fully-vested share of the Company’s common stock (subject to the vesting schedules and other terms and conditions set forth in the award agreement for such RSUs).

Both the Time-Based Vesting Options and the Time-Based Vesting RSUs will vest in one-fourth increments on the first through fourth

anniversaries of the grant date, provided that Mr. LaBorde remains employed by the Company on each such vesting date (subject to certain pro-rated and accelerated vesting provisions as provided under the respective award agreements for such

awards). Both the Performance-Based Vesting Options and the Performance-Based Vesting RSUs shall vest, if at all, based on the certification by the Committee of the achievement of identified performance goals for fiscal years 2015 through 2018,

respectively, and Mr. LaBorde’s continued employment through stated anniversaries of the Grant Date (subject to certain accelerated and pro-rated vesting provisions as provided in the award agreement for such RSUs; provided that with

respect to any RSUs that have not vested for which there are performance periods that have not been completed, such pro-rated vesting shall occur only to the extent the Company achieves the performance measure for the then-applicable performance

period). Assuming all of the performance conditions are satisfied, 100% of the Performance-Based Options and 100% of the Performance-Based RSUs would be fully-vested as of the fourth anniversary of the Grant Date. The Options have a ten-year term.

Contemporaneously with his formal acceptance of the equity awards described above, Mr. LaBorde and the Company agreed that the

Employment Agreement would be deemed cancelled and would have no further force or effect; this had no effect on Mr. LaBorde’s employment status.

2

Key Executive Severance Plan

The following description of the Key Executive Severance Plan does not purport to be complete and is qualified in its entirety by reference to

the Key Executive Severance Plan, a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

The stated

purpose of the Key Executive Severance Plan is to provide a fair framework in the event of a termination of employment in certain circumstances of certain Company key executives. As of December 17, 2015, to be eligible for benefits under the

Key Executive Severance Plan, an executive (each, a “Covered Executive”) must (1) be employed by the Company (through the Company’s common payroll agent, Amedisys Holding, L.L.C.) with any of the following job titles:

Chief Operating Officer, Chief Financial Officer, Vice Chairman, Chief Human Resources Officer, Senior Vice President of Government Affairs, General Counsel, Chief Information Officer, Chief Strategy Officer, Chief Clinical Operations Officer, Chief

Development Officer, Senior Vice President of Accounting/Controller, Senior Vice President of Operations, Senior Vice President of Talent, or Senior Vice President of Total Rewards; (2) have been designated in writing by the Board or the

Committee, as appropriate, as being covered by the Key Executive Severance Plan; and (3) have executed and delivered to the Company (and not have revoked or attempted to revoke) the Company’s Executive Protective Covenants Agreement

(“EPCA” or other similarly named agreement).

If any Covered Executive is terminated by the Company without

“Cause” or resigns with “Good Reason” in each case prior to a “Change in Control,” such Covered Executive shall be entitled to the following:

(a) An amount equal to one (1) times the sum of (A) the Covered Executive’s base salary, as in effect on the date of employment

termination (or in the event a reduction in base salary is a basis for a termination with Good Reason, then the base salary in effect immediately prior to such reduction) and (B) the greater of (x) an amount equal to the cash bonus earned

by the Covered Executive for the previous fiscal year or (y) an amount equal to twenty-five percent of the Covered Executive’s base salary, as in effect on the date of employment termination (or, in the event a reduction in base salary is

a basis for termination for Good Reason, then the base salary in effect immediately prior to such reduction), which amount shall be payable in substantially equal monthly installments in accordance with the Company’s normal payroll practices

for a period of 12 months; and

(b) A lump-sum payment of $2,500 for the intended purpose of purchasing health insurance, but which can be

used at the discretion of the Covered Executive

Further, any unvested equity awards issued in the name of the Covered Executive as of the

date of employment termination will vest in accordance with the terms contained in the applicable award agreement for such awards.

If any

Covered Executive is terminated by the Company without “Cause” or resigns with “Good Reason” in each case following a “Change in Control,” such Covered Executive shall be entitled to the following:

(a) An amount equal to two (2) times the sum of (A) the Covered Executive’s base salary, as in effect on the date of employment

termination (or in the event a reduction in base salary is a basis for a termination with Good Reason, then the base salary in effect immediately prior to such reduction) and (B) the greater of (x) an amount equal to the cash bonus earned

by the Covered Executive for the previous fiscal year or (y) an amount equal to twenty-five (25) percent of the Covered Executive’s base salary, as in effect on the date of employment termination (or, in the event a reduction in base

salary is a basis for termination for Good Reason, then the base salary in effect immediately prior to such reduction), which amount shall be payable in substantially equal monthly installments in accordance with the Company’s normal payroll

practices for a period of 12 months; and

(b) A lump-sum payment of $2,500 for the intended purpose of purchasing health insurance, but

which can be used at the discretion of the Covered Executive.

Further, any unvested equity awards issued in the name of the Covered

Executive as of the date of employment termination will vest in accordance with the provisions of the Omnibus Plan or any successor thereto.

3

Under the terms of the Key Executive Severance Plan:

(a) “Cause” as it applies to the determination by the Company to terminate the employment of a Covered Executive, shall mean

any one or more of the following: a Covered Executive’s (i) willful, material, and irreparable breach of their duties to the Company; (ii) gross negligence in the performance or intentional nonperformance of any of their material

duties and responsibilities to the Company; (iii) willful dishonesty, fraud, or misconduct with respect to the business or affairs of the Company, which materially and adversely affects the operations or reputation of the Company;

(iv) conviction or plea of nolo contendere to a felony crime; and (v) engagement in an act or series of acts constituting misconduct resulting in a misstatement of a Company’s financial statements due to material non-compliance with

any financial reporting requirement within the meaning of Section 304 of The Sarbanes Oxley Act of 2002. In the event of a termination by the Company for Cause, a Covered Executive shall have no right to any severance benefits under the terms

of the Key Employee Severance Plan;

(b) “Good Reason,” as it applies to the determination by a Covered Executive to

terminate their employment at their own volition, shall mean the occurrence of any of the following events without their written consent: a Covered Executive (i) suffers a material diminution in their authority, responsibilities, or duties; or

(ii) suffers a material reduction in their base salary, other than in connection with a proportionate reduction in the base salaries of all similarly situated senior officer-level employees. Good Reason shall not be deemed to have occurred

unless (i) the Covered Executive provides the Company with notice of one of the conditions described above within 90 days of the existence of the condition, (ii) the Company is provided at least 30 days to cure the condition and fails to

cure same within such 30 day period and (iii) the Covered Executive terminates employment within at least 150 days of the existence of the condition; and

(c) A “Change in Control” shall be deemed to have occurred if:

a. any person or entity, including a “group” as defined in Section 13(d)(3) of the Securities Exchange Act of

1934, other than the Company or a wholly-owned subsidiary, or any employee benefit plan of the Company or any subsidiary, becomes the beneficial owner of the Company’s securities having 50% or more of the combined voting power of the then

outstanding securities of the Company that may be cast for the election of directors of the Company (other than as a result of an issuance of securities initiated by the Company in the ordinary course of business);

b. as the result of, or in connection with, any cash tender or exchange offer, merger or other business combination, sales of

assets or contested election, or any combination of the foregoing transactions, after the transaction less than a majority of the combined voting power of the then outstanding securities of the Company, or any successor corporation or cooperative or

entity, entitled to vote generally in the election of the directors of the Company, or other successor corporation or other entity, are held in the aggregate by the holders of the Company’s securities who immediately prior to the transaction

had been entitled to vote generally in the election of directors of the Company; or

c. during any period of two

consecutive years, individuals who at the beginning of the period constitute the Board cease for any reason to constitute at least a majority of the Board, unless the election, or the nomination for election by the Company’s stockholders, of

each director of the Company first elected during the relevant two-year period was approved by a vote of at least 2/3 of the directors of the Company then still in office who were directors of the Company at the beginning of that period.

As participants in the Key Executive Severance Plan, Covered Executives are entitled to certain rights and protection under the Employee

Retirement Income Security Act of 1974, as amended. The Company, in its discretion, can amend or terminate the Key Executive Severance Plan at any time, subject to the prior approval of the Board and/or the Committee, as applicable.

Under the terms of the EPCA, Covered Executives are subject to certain restrictive covenants, including (i) prohibitions against

competition for 24 months following termination of employment, (ii) prohibitions against soliciting company employees and customers for 24 months following termination of employment and (iii) a standstill provision, which prevents Covered

Executives from acquiring any Company securities or seeking to effect a Change in Control of the Company (or assisting or working with others to effect a Change in Control of the Company) for a period of 24 months following termination.

4

Under the EPCA, Covered Executive and the Company are subject to arbitration for resolution of

disputes arising out of termination of employment.

Section 9 - Financial Statements and Exhibits

| Item 9.01. |

Financial Statements and Exhibits. |

| |

10.1 |

Composite Amedisys Holding, L.L.C. Severance Plan for Key Executives dated as of April 30, 2015 (inclusive of all amendments thereto adopted on or before December 17, 2015) |

5

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

| AMEDISYS, INC. |

|

|

| By: |

|

/s/ Scott G. Ginn |

|

|

Scott G. Ginn |

|

|

Senior Vice President of Finance and Accounting and Controller |

|

|

(principal accounting officer) |

DATE: December 22, 2015

6

Exhibit Index

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 10.1 |

|

Composite Amedisys Holding, L.L.C. Severance Plan for Key Executives dated as of April 30, 2015 (inclusive of all amendments thereto adopted on or before December 17, 2015) |

7

Exhibit 10.1

AMEDISYS HOLDING, L.L.C.

SEVERANCE PLAN FOR KEY EXECUTIVES

APRIL 30, 2015

Inclusive of all

Amendments to Section 2 dated on or before December 17, 2015

1. Purpose. The purpose of this Amedisys Holding, L.L.C.

Severance Plan for Key Employees (this “Plan”) is to provide a fair framework in the event of the termination of employment in certain circumstances of certain key executive employees of the Company. This document supersedes any prior

plan, program or arrangement that provides severance benefits to a Covered Executive (as defined below) eligible for benefits under this Plan. This document is intended to serve both as the official plan document and the summary plan description for

this Plan. The Plan is sponsored by Amedisys Holding, L.L.C. (“Company”). The Company is the Plan Administrator.

2. Covered

Executives. To be eligible for benefits under this Plan an executive must (1) be employed by the Company with any of the following job titles: Chief Operating Officer, Chief Financial Officer, Vice Chairman, Chief Human Resources Officer,

Senior Vice President of Government Affairs, General Counsel, Chief Information Officer, Chief Strategy Officer, Chief Clinical Operations Officer, Chief Development Officer, Senior Vice President of Accounting/Controller, Senior Vice President of

Operations, Senior Vice President of Talent, or Senior Vice President of Total Rewards; (2) have been designated in writing by the Board of Directors (the “Board”) of Amedisys, Inc. or the Compensation Committee of the Board (the

“Committee”), as appropriate, as being covered by this Plan; and (3) have executed and delivered to the Company (and not have revoked or attempted to revoke) the Company’s Executive Protective Covenants Agreement

(“EPCA” or other similarly named agreement) (a “Covered Executive”).

This Plan shall not be applicable to any

employee who is a party to a separate employment agreement, change of control agreement, or similar agreement with the Company.

If a

Covered Executive under this Plan is or becomes eligible to participate in the April 2013 Severance Plan for Senior Management Leaders, then such employee will only be eligible for severance benefits under the terms of the April 2013 Severance Plan

for Senior Management Leaders, except in the event of a “Change in Control” (as such term is defined in Section 3, below), in which case the terms of this Plan (including, without limitation, the provisions of Section 5, herein)

shall control, regardless of whether such employee still qualifies as a Covered Executive. In no event will a Covered Executive be entitled to simultaneously receive benefits under both the April 2013 Severance Plan for Senior Management Leaders and

this Plan.

3. Definitions.

(a) Cause. “Cause,” as it applies to the determination by the Company to terminate the employment of a Covered Executive,

shall mean any one or more of the following: (i) Covered Executive’s willful, material, and irreparable breach of Covered Executive’s duties

1

to the Company; (ii) Covered Executive’s gross negligence in the performance or intentional nonperformance of any of Covered Executive’s material duties and responsibilities to the

Company; (iii) Covered Executive’s willful dishonesty, fraud, or misconduct with respect to the business or affairs of the Company, which materially and adversely affects the operations or reputation of the Company; (iv) Covered

Executive’s conviction or plea of nolo contendere to a felony crime; and (v) Covered Executive engages in an act or series of acts constituting misconduct resulting in a misstatement of a Company’s financial statements due to material

non-compliance with any financial reporting requirement within the meaning of Section 304 of The Sarbanes Oxley Act of 2002. In the event of a termination by the Company for Cause, Covered Executive shall have no right to any severance benefits

under this Plan.

(b) Code. “Code” shall mean the United States Internal Revenue Code of 1986, as amended, or any

successor provision of law, and the regulations promulgated thereunder.

(c) Good Reason. “Good Reason,” as it applies to

the determination by a Covered Executive to terminate Covered Executive’s employment with the Company at his or her initiative shall mean the occurrence of any of the following events without Covered Executive’s written consent:

(i) Covered Executive suffers a material diminution in authority, responsibilities, or duties; or (ii) Covered Executive suffers a material reduction in base salary other than in connection with a proportionate reduction in the base

salaries of all similarly situated senior officer-level employees. Good Reason shall not be deemed to have occurred unless (i) Covered Executive provides the Company with notice of one of the conditions described above within 90 days of the

existence of the condition, (ii) the Company is provided at least 30 days to cure the condition and fails to cure same within such 30 day period and (iii) Covered Executive terminates employment within at least 150 days of the existence of

the condition.

(d) Employment Termination. “Employment Termination” shall mean a Covered Executive no longer being an

employee of the Company as a result of a termination by the Company without Cause or by Covered Executive with Good Reason.

(e) Change

in Control. A “Change in Control” shall be deemed to have occurred if:

a. any person or entity, including a

“group” as defined in Section 13(d)(3) of the Exchange Act, other than the Company or a wholly-owned Subsidiary, or any employee benefit plan of the Company or any Subsidiary, becomes the beneficial owner of the Company’s

securities having 50% or more of the combined voting power of the then outstanding securities of the Company that may be cast for the election of directors of the Company (other than as a result of an issuance of securities initiated by the Company

in the ordinary course of business); or

b. as the result of, or in connection with, any cash tender or exchange offer,

merger or other business combination, sales of assets or contested election, or any combination of the foregoing transactions, after the transaction less than a majority of the

2

combined voting power of the then outstanding securities of the Company, or any successor corporation or cooperative or entity, entitled to vote generally in the election of the directors of the

Company, or other successor corporation or other entity, are held in the aggregate by the holders of the Company’s securities who immediately prior to the transaction had been entitled to vote generally in the election of directors of the

Company; or

c. during any period of 2 consecutive years, individuals who at the beginning of the period constitute the

Board cease for any reason to constitute at least a majority of the Board, unless the election, or the nomination for election by the Company’s stockholders, of each director of the Company first elected during the relevant 2-year period was

approved by a vote of at least 2/3 of the directors of the Company then still in office who were directors of the Company at the beginning of that period.

4. Result of Termination by the Company without Cause or by Covered Executive with Good Reason Prior to a Change in Control. The

following provisions shall apply should the Company terminate a Covered Executive’s employment without Cause or should a Covered Executive terminate Covered Executive’s employment with Good Reason:

(a) Salary and Bonus. The Company shall pay to Covered Executive an amount equal to one (1) times the sum of (A) the Covered

Executive’s base salary, as in effect on the date of Employment Termination (or in the event a reduction in base salary is a basis for a termination with Good Reason, then the base salary in effect immediately prior to such reduction) and

(B) the greater of (x) an amount equal to the cash bonus earned by the Covered Executive for the previous fiscal year or (y) an amount equal to twenty-five (25) percent of the Covered Executive’s base salary, as in effect on

the date of Employment Termination (or, in the event a reduction in base salary is a basis for termination for Good Reason, then the base salary in effect immediately prior to such reduction), which amount shall be payable in substantially equal

monthly installments in accordance with the Company’s normal payroll practices for a period of 12 months and which payments shall commence in accordance with the provisions of Section 6, herein (unless otherwise required to be paid in

accordance with Section 7 below).

(b) Lump-sum Payment. The Company shall pay to Covered Executive a lump-sum payment of

$2,500 for the intended purpose of purchasing health insurance, but which can be used at the discretion of the Covered Executive.

(c)

Stock Vesting. Any unvested equity awards issued in the name of Covered Employee as of the date of termination, will vest in accordance with the terms contained in the applicable Award Agreement for such awards.

5. Termination by the Company without Cause or Termination by Covered Executive with Good Reason Following a Change in Control. The

following provisions shall apply should the Company terminate a Covered Executive’s employment without Cause or should a Covered Executive terminate Covered Executive’s employment with Good Reason, in either case within one year following

a Change in Control (as defined above):

(a) Salary and Bonus. The Company shall pay to Covered Executive (i) an amount equal

to two (2) times the sum of (A) the Covered Executive’s base salary, as in effect on the date of Employment Termination (or in the event a reduction in base salary is a basis for a termination with Good Reason, then the base salary in

effect immediately prior to such reduction) and (B) the greater of (x) an amount equal to the cash bonus earned by the Covered Executive for the previous fiscal year or (y) an amount equal to twenty-five (25) percent of the

Covered Executive’s base salary, as in effect on the date of Employment Termination (or, in the event a reduction in base salary is a basis for termination for Good Reason, then the base salary in effect immediately prior to such reduction),

which amount shall be payable in a lump sum on the date or dates specified in Section 6, herein (unless otherwise required to be paid in accordance with Section 7 below).

3

(b) Lump-sum Payment. The Company shall pay to Covered Executive a lump-sum payment of

$2,500 for the intended purpose of purchasing health insurance, but which can be used at the discretion of the Covered Executive.

(c)

Stock Vesting. Any unvested equity awards issued in the name of Covered Employee as of the occurrence of a Change in Control will vest in accordance with the provisions of the Amedisys, Inc. 2008 Omnibus Incentive Compensation Plan, as the

same may be amended from time to time, or any successor plan thereto.

6. Release of Claims. The Company’s obligations under

this Plan are contingent upon Covered Executive’s executing (and not revoking during any applicable revocation period) a valid, enforceable, full and unconditional release of all claims Covered Executive may have against the Company, Amedisys,

Inc. and their respective directors, officers, employees, subsidiaries, stockholders, successors, assigns, agents, representatives subsidiaries and affiliates (whether known or unknown) as of the date of Employment Termination in such form as

provided by the Company no later than 60 days after the date of Employment Termination. If the foregoing release is executed and delivered and no longer subject to revocation within 60 days after the date of Employment Termination, then the

following shall apply:

(a) To the extent any payments due to Covered Executive under this Plan are not “deferred compensation”

for purposes of Section 409A of the Code then such payments shall commence upon the first regularly-scheduled payment date immediately following the date the release is executed and no longer subject to revocation (the “Release Effective

Date”). The first such cash payment shall include payment of all amounts that otherwise would have been due prior to the Release Effective Date under the terms of this Plan had such payments commenced after the date of Employment Termination,

and any payments to be made thereafter shall continue as provided herein. The delayed payments shall in any event expire at the time such payments would have expired had such payments commenced after the date of Employment Termination.

(b) To the extent any payments due to Covered Executive under this Plan above are “deferred compensation” for purposes of

Section 409A, then such payments shall commence upon the 60th day following the date of Employment Termination. The first such cash payment shall include payment of all amounts that otherwise would have been due prior

4

thereto under the terms of this Plan had such payments commenced after the date of Employment Termination, and any payments to be made thereafter shall continue as provided herein. The delayed

payments shall in any event expire at the time such payments would have expired had such payments commenced immediately following the date of Employment Termination.

7. Section 409A. Notwithstanding any provisions in this Plan to the contrary, if at the time of the Employment Termination the

Covered Executive is a “specified employee” as defined in Section 409A and the deferral of the commencement of any payments or benefits otherwise payable as a result of such Employment Termination is necessary to avoid the additional

tax under Section 409A, the Company will defer the payment or commencement of the payment of any such payments or benefits (without any reduction in such payments or benefits ultimately paid or provided to Covered Executive) until one day after

the day which is six months from the date of Employment Termination. Any monthly payment amounts deferred will be accumulated and paid to Covered Executive (without interest) six months after the date of Employment Termination in a lump sum, and the

balance of payments due to Covered Executive will be paid as otherwise provided in this Plan. Each monthly payment described in this Plan is designated as a “separate payment” for purposes of Section 409A and, subject to the six month

delay, if applicable, and the first monthly payment shall commence on the payroll date as in effect on termination following the termination. For purposes of this Plan, a termination of employment means a separation from service as defined in

Section 409A. No reimbursement payable to Covered Executive pursuant to any provisions of this Plan or pursuant to any plan or arrangement of the Company shall be paid later than the last day of the calendar year following the calendar year in

which the related expense was incurred, and no such reimbursement during any calendar year shall affect the amounts eligible for reimbursement in any other calendar year, except, in each case, to the extent that the right to reimbursement does not

provide for a “deferral of compensation” within the meaning of Section 409A. This Plan will be interpreted, administered and operated in accordance with Section 409A, although nothing herein will be construed as an entitlement to

or guarantee of any particular tax treatment to Covered Executive.

8. Claims Procedure. If a Covered Executive does not receive a

benefit to which the Covered Executive believes he or she is entitled under the Plan, or if the Covered Executive believes that the Covered Executive is entitled to a greater benefit than was approved, the Covered Executive must, within 60 days

following the date of Employment Termination, file a written claim with the Plan Administrator. The Plan Administrator will investigate the claim and will send the Covered Executive a written decision within 60 days from the date upon which it

receives the claim. If the claim is denied, the written decision will specify the reasons for the denial (including the pertinent Plan provisions upon which the denial is based), as well as an explanation of how the Covered Executive may obtain a

further review by the Plan Administrator. If the Covered Executive does not receive a notice regarding his or her claim within these time periods, the claim will be considered denied.

If the Covered Executive disagrees with the Plan Administrator’s decision, in whole or in part, the Covered Executive has 60 days

following receipt of written notice from the Plan Administrator to request a review in writing. The request must describe the reasons why the Covered Executive believes the denial was wrong and whatever evidence the Covered Executive believes

supports his or her position. If the Covered Executive wishes to examine any Company documents, he or she must request an examination and specify the documents requested.

5

Within 60 days following a request for review, the Plan Administrator will send the Covered

Executive its written decision specifying the reasons for the decision, including the pertinent Plan provisions upon which it is based. This decision shall be final and binding.

If special circumstances require an extension of time for the Plan Administrator to render a decision, the Plan Administrator will send the

Covered Executive a written notice of the extension prior to the commencement of the extension and will explain the reasons for the delay.

The Company, as Plan Administrator, has the exclusive discretionary authority to construe and interpret the Plan, to decide all questions of

eligibility for severance benefits under the Plan and to determine the amount of any such severance benefits, and its decisions on such matters are final and conclusive. Any interpretations or determinations made pursuant to such discretionary

authority will be upheld on judicial review, unless it is shown that the interpretation or determination was an abuse of discretion (i.e., arbitrary and capricious).

9. Your Rights Under ERISA. As a participant in the Plan, a Covered Executive is entitled to certain rights and protection under the

Employee Retirement Income Security Act of 1974, as amended (“ERISA”). ERISA provides that all Plan participants shall be entitled to:

| |

• |

|

Examine, without charge, at the Plan Administrator’s office and at other specified locations, such as worksites, all documents governing the Plan, including a copy of the latest annual report (Form 5500 Series)

filed by the Plan with the U.S. Department of Labor. |

| |

• |

|

Obtain, upon written request to the Plan Administrator, copies of documents governing the operation of the Plan, including a copy of the latest annual report (Form 5500 Series) and updated summary plan description. The

Administrator may make a reasonable charge for the copies. |

| |

• |

|

Receive a summary of the Plan’s annual financial report. The Plan Administrator is required by law to furnish each participant with a copy of this summary annual report. |

In addition to creating rights for Plan participants, ERISA imposes duties upon the people who are responsible for the operation of the

employee benefit plan. The people who operate the Plan, called “fiduciaries” of the Plan, have a duty to do so prudently and in the interest of the Covered Executive and other Plan participants and beneficiaries. No one, including the

employer, or any other person, may fire the Covered Executive or otherwise discriminate against the Covered Executive in any way to prevent the Covered Executive from obtaining a welfare benefit or exercising his or her rights under ERISA. If the

Covered Executive’s claim for a welfare benefit is denied, in whole or in part, he or she must receive a written explanation of the reason for the denial. The Covered Executive has the right to have the Plan review and reconsider his or her

claim.

6

Under ERISA, there are steps a Covered Executive can take to enforce the above rights. For

instance, if the Covered Executive requests materials from the Plan and does not receive them within 30 days, he or she may file suit in a Federal court. In such a case, the court may require the Plan Administrator to provide the materials and pay

the Covered Executive up to $110 a day until he or she receives the materials, unless the materials were not sent because of reasons beyond the control of the Plan Administrator.

If the Covered Executive has a claim tor benefits which is denied or ignored, in whole or in part, the Covered Executive may file suit in a

state or Federal court. In addition, if the Covered Executive disagrees with the Plan’s decision or lack thereof concerning the qualified status of a medical child support order, he or she may file suit in Federal court. If it should happen

that Plan fiduciaries misuse the Plan’s money, or if the Covered Executive is discriminated against for asserting his or her rights, the Covered Executive may seek assistance from the U.S. Department of Labor, or may file suit in a Federal

court. The court will decide who should pay court costs and legal fees. If the Covered Executive is successful, the court may order the person the Covered Executive has sued to pay these costs and fees. If the Covered Executive loses, the court may

order him or her to pay these costs and fees — for example, if the court finds the Covered Executive’s claim is frivolous.

If

the Covered Executive has any questions about the Plan, he or she should contact the Plan Administrator. If the Covered Executive has any questions about this statement or about his or her rights under ERISA, the Covered Executive should contact the

nearest office of the Pension and Welfare Benefits Administration, U.S. Department of Labor, listed in the telephone directory or the Division of Technical Assistance and Inquiries, Pension and Welfare Benefits Administration, U.S. Department of

Labor, 200 Constitution Avenue, N.W., Washington, D.C. 20210.

10. Additional Important Information. The name of the Plan is the

Amedisys Holding, L.L.C. Severance Plan for Key Executives.

The sponsor of the Plan is Amedisys Holding, L.L.C. and its employer

identification number is 36-4576454. The sponsor’s address and telephone number is 5959 South Sherwood Forest Boulevard, Baton Rouge, Louisiana 70816, (225) 292-2031.

Amedisys Holding, L.L.C. also serves as the Plan Administrator under ERISA for the Plan, and can be contacted at 5959 South Sherwood Forest

Boulevard, Baton Rouge, Louisiana 70816, (225) 292-2031.

The agent for service of process for the Plan is Secretary, Amedisys

Holding, L.L.C., 5959 South Sherwood Forest Boulevard, Baton Rouge, Louisiana 70816, (225) 292-2031.

The Plan is an employee welfare

benefit plan providing severance pay and benefits as described in this Plan document. All Severance Benefits under the Plan shall be paid directly by the Company from its general assets, and the rights of an eligible employee to any benefits

hereunder shall not be superior to those of an unsecured general creditor of the Company.

7

The Plan year shall be the calendar year. The Plan number is 1.

Severance benefits under the Plan may not be assigned, transferred or pledged to a third party.

11. At-Will Employment. No provision of the Plan is intended to provide any Covered Executive with any right to continue as an employee

or in any other capacity with the Company, for any specific period of time, or otherwise affect the right of the Company to terminate the employment or service of any individual at any time for any reason with or without cause.

12. Amendment and Termination. The Company reserves the right in its discretion to terminate the Plan and to amend the Plan in any

manner at any time, subject to the prior approval of the Board and/or the Committee, as applicable. Any such action will be in writing and signed by the Chief Executive Officer or the Chief Human Resources Officer of the Company or such other

persons as he or she shall designate. Oral or other informal communications made by the Company or its representatives shall not give rise to any rights or benefits other than those contained in the Plan described herein, and such communications

will not diminish the Company’s rights to amend or terminate the Plan in any manner.

This document is executed as of this 17th day of December 2015.

|

|

|

| AMEDISYS HOLDING, L.L.C. |

|

|

| By: |

|

AMEDISYS, INC. |

|

|

Its Sole Member and Manager |

|

|

| By: |

|

/s/ Larry Pernosky |

|

|

Larry Pernosky |

|

|

Chief Human Resources Officer |

8

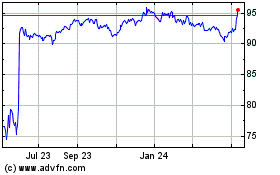

Amedisys (NASDAQ:AMED)

Historical Stock Chart

From Mar 2024 to Apr 2024

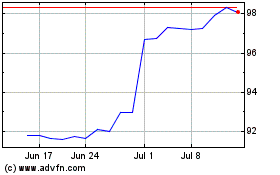

Amedisys (NASDAQ:AMED)

Historical Stock Chart

From Apr 2023 to Apr 2024