Current Report Filing (8-k)

July 30 2015 - 6:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 29, 2015

TETRA TECH, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

0-19655 |

|

95-4148514 |

|

(State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

|

of incorporation) |

|

File Number) |

|

Identification Number) |

3475 East Foothill Boulevard, Pasadena, California 91107

(Address of principal executive office, including zip code)

(626) 351-4664

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On July 29, 2015, Tetra Tech, Inc. (the “Registrant”) reported its results of operations for its third fiscal quarter ended June 28, 2015. A copy of the press release issued by the Registrant concerning the foregoing and the event described in Item 8.01 below is furnished herewith as Exhibit 99.1 and is incorporated herein by reference in its entirety.

Item 8.01. Other Events.

On July 29, 2015, the Registrant also announced that its Board of Directors has declared a $0.08 per share quarterly cash dividend. The dividend is payable on September 4, 2015 to stockholders of record as of the close of business on August 17, 2015. A copy of the press release issued by the Registrant concerning the dividend and the results of operations described in Item 2.02 above is furnished herewith as Exhibit 99.1 and is incorporated herein by reference in its entirety.

The information contained in Items 2.02 and 8.01, and in the accompanying exhibit, shall not be incorporated by reference into any filing of the Registrant, whether made before or after the date hereof, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference to such filing. The information in this Current Report, including the exhibit hereto, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

99.1 Press Release, dated July 29, 2015, reporting the results of operations for the Registrant’s third fiscal quarter ended June 28, 2015, and the declaration of a $0.08 per share quarterly cash dividend.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

TETRA TECH, INC. |

|

|

|

|

|

|

|

|

|

|

|

Date: |

July 29, 2015 |

|

By: |

/S/ DAN L. BATRACK |

|

|

|

|

|

Dan L. Batrack |

|

|

|

|

|

Chairman and Chief Executive Officer |

3

Exhibit 99.1

July 29, 2015

|

|

Tetra Tech Reports Third Quarter Results |

|

|

|

|

|

|

|

· Diluted EPS of $0.43, up 39% |

|

|

|

· Record operating cash flow of $109 million |

|

|

|

· Backlog up 6% |

|

|

|

· Declared quarterly dividend of $0.08 per share |

|

Pasadena, California. Tetra Tech, Inc. (NASDAQ: TTEK) today announced results for the third quarter ended June 28, 2015.

Third Quarter Results

Revenue in the quarter was $575.1 million and revenue, net of subcontractor costs(1), was $421.9 million. Revenue and revenue, net of subcontractor costs, increased 2% and decreased 1%, respectively, in the third quarter of fiscal 2015 compared to the same period in fiscal 2014, excluding the wind-down of the Remediation and Construction Management (RCM) segment and the impact from foreign currency translation. Operating income was $40.7 million and diluted earnings per share (EPS) were $0.43. Excluding an earn-out gain in the third quarter of fiscal 2014, operating income in the quarter compared to last year’s third quarter was up 35%, and EPS were up 39% compared to the third quarter of fiscal 2014. Cash generated from operations was $109.3 million, up 88% compared to last year’s third quarter.

On July 27, 2015, Tetra Tech’s Board of Directors declared a quarterly dividend of $0.08 per share payable on September 4, 2015 to stockholders of record as of August 17, 2015. Additionally, through the first nine months of fiscal 2015, the Company spent $75.5 million of the approved $200 million share repurchase program.

Tetra Tech’s Chairman and CEO, Dan Batrack commented, “Our business delivered solid performance in the third quarter supported by our water and environmental services for our government and commercial clients. Since the end of last quarter, we were awarded $1.4 billion of new contract capacity with our U.S. federal government clients and backlog in our ongoing operations grew 6%. We continue to improve our operating margin as demonstrated by the 35% increase in operating income, which contributed to a record quarterly cash flow from operations of $109 million. Our strong balance sheet will allow us to invest in our organic growth and acquisition strategies, while continuing to return capital to our shareholders through share repurchases and dividends.”

(1) Tetra Tech’s revenue includes a significant amount of subcontractor costs and, therefore, the Company believes revenue, net of subcontractor costs, which is a non-GAAP financial measure, provides a valuable perspective on its business results.

Nine-Month Results

Revenue for the nine-month period was $1.7 billion and revenue, net of subcontractor costs, was $1.3 billion. Operating income for the nine-month period was $107.7 million and EPS were $1.14. Cash generated from operations was $134.1 million.

Operating Results

In thousands (except EPS data)

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

June 28,

2015 |

|

June 29,

2014 |

|

%

Y/Y |

|

June 28,

2015 |

|

June 29,

2014 |

|

%

Y/Y |

|

|

Revenue |

|

$ |

575,108 |

|

$ |

629,502 |

|

(9 |

)% |

$ |

1,720,927 |

|

$ |

1,861,635 |

|

(8 |

)% |

|

Foreign exchange |

|

15,726 |

|

— |

|

— |

|

48,304 |

|

— |

|

— |

|

|

RCM |

|

(16,466 |

) |

(67,083 |

) |

— |

|

(69,046 |

) |

(189,447 |

) |

— |

|

|

Core revenue |

|

$ |

574,368 |

|

$ |

562,419 |

|

2 |

% |

$ |

1,700,185 |

|

$ |

1,672,188 |

|

2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue, net of subcontractor costs |

|

$ |

421,899 |

|

$ |

458,756 |

|

(8 |

)% |

$ |

1,291,733 |

|

$ |

1,397,731 |

|

(8 |

)% |

|

Foreign exchange |

|

14,172 |

|

— |

|

— |

|

42,920 |

|

— |

|

— |

|

|

RCM |

|

(5,754 |

) |

(22,430 |

) |

— |

|

(18,446 |

) |

(77,066 |

) |

— |

|

|

Core revenue, net of subcontractor costs |

|

$ |

430,317 |

|

$ |

436,326 |

|

(1 |

)% |

$ |

1,316,207 |

|

$ |

1,320,665 |

|

0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

$ |

40,721 |

|

$ |

39,167 |

|

4 |

% |

$ |

107,732 |

|

$ |

129,070 |

|

(17 |

)% |

|

Foreign exchange |

|

180 |

|

— |

|

— |

|

1,547 |

|

— |

|

— |

|

|

Earn-out gain |

|

— |

|

(8,905 |

) |

— |

|

(3,113 |

) |

(34,878 |

) |

— |

|

|

Subtotal |

|

$ |

40,901 |

|

$ |

30,262 |

|

35 |

% |

$ |

106,166 |

|

$ |

94,192 |

|

13 |

% |

|

RCM |

|

190 |

|

5,922 |

|

— |

|

3,605 |

|

9,323 |

|

— |

|

|

Core operating income |

|

$ |

41,091 |

|

$ |

36,184 |

|

14 |

% |

$ |

109,771 |

|

$ |

103,515 |

|

6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EPS |

|

$ |

0.43 |

|

$ |

0.41 |

|

5 |

% |

$ |

1.14 |

|

$ |

1.31 |

|

(13 |

)% |

|

Foreign exchange |

|

— |

|

— |

|

— |

|

0.02 |

|

— |

|

— |

|

|

Earn-out |

|

— |

|

(0.10 |

) |

— |

|

— |

|

(0.44 |

) |

— |

|

|

Subtotal |

|

$ |

0.43 |

|

$ |

0.31 |

|

39 |

% |

$ |

1.16 |

|

$ |

0.87 |

|

33 |

% |

|

RCM |

|

— |

|

0.06 |

|

— |

|

0.04 |

|

0.09 |

|

— |

|

|

EPS |

|

$ |

0.43 |

|

$ |

0.37 |

|

16 |

% |

$ |

1.20 |

|

$ |

0.96 |

|

25 |

% |

2

Business Outlook

The following statements are based on current expectations. These statements are forward-looking and the actual results could differ materially. These statements do not include the potential impact of transactions that may be completed or developments that become evident after the date of this release. The Business Outlook section should be read in conjunction with the information on forward-looking statements at the end of this release.

Tetra Tech expects EPS for the fourth quarter of fiscal 2015 to be in the range of $0.48 to $0.52. Revenue, net of subcontractor costs, for the fourth quarter is expected to range from $420 million to $450 million. For fiscal 2015, EPS is expected to range from $1.63 to $1.67, and cash EPS(2) is expected to range from $2.85 to $3.01. Revenue, net of subcontractor costs, for fiscal 2015 is expected to range from $1.71 billion to $1.74 billion.

Webcast

Investors will have the opportunity to access a live audio-visual webcast and supplemental financial information concerning the third quarter results through a link posted on the Company’s website at www.tetratech.com/investors on July 30, 2015 at 8:00 a.m. (PT).

About Tetra Tech (www.tetratech.com)

Tetra Tech is a leading provider of consulting, engineering, program management, and construction management services. The Company supports commercial and government clients focused on water, environment, infrastructure, resource management, and energy. With 13,000 staff worldwide, Tetra Tech provides clear solutions to complex problems.

CONTACTS:

Jim Wu, Investor Relations

Charlie MacPherson, Media & Public Relations

(626) 470-2844

(2) Cash EPS is a non-GAAP financial measure that provides a valuable perspective on the Company’s financial results. Cash EPS is defined as cash flow from operations divided by diluted shares outstanding. Refer to the cash flow statement for reconciliation from net income to cash flow from operations.

3

Forward-Looking Statements

This news release contains forward-looking statements that are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include information concerning future events and the future financial performance of Tetra Tech that involve risks and uncertainties. Readers are cautioned that these forward-looking statements are only predictions and may differ materially from actual future events or results. Readers are urged to read the documents filed by Tetra Tech with the SEC, specifically the most recent reports on Form 10-K, 10-Q, and 8-K, each as it may be amended from time to time, which identify risk factors that could cause actual results to differ materially from the forward-looking statements. Among the important factors or risks that could cause actual results or events to differ materially from those in the forward-looking statements in this release are: worldwide political and economic uncertainties; fluctuations in annual revenue, expenses, and operating results; the cyclicality in demand for our overall services; the cyclicality in demand for mining services; the cyclicality in demand for oil and gas services; concentration of revenues from U.S. government agencies and potential funding disruptions by these agencies; violations of U.S. government contractor regulations; dependence on winning or renewing U.S. government contracts; the delay or unavailability of public funding on U.S. government contracts; the U.S. government’s right to modify, delay, curtail or terminate contracts at its convenience; credit risks associated with certain commercial clients; risks associated with international operations; the failure to comply with worldwide anti-bribery laws; the failure to comply with domestic and international export laws; the failure to properly manage projects; the loss of key personnel or the inability to attract and retain qualified personnel; the use of estimates and assumptions in the preparation of financial statements; the ability to maintain adequate workforce utilization; the use of the percentage-of-completion method of accounting; the inability to accurately estimate and control contract costs; the failure to adequately recover on our claims for additional contract costs; the failure to win or renew contracts with private and public sector clients; acquisition strategy and integration risks; goodwill or other intangible asset impairment; growth strategy management; backlog cancellation and adjustments; the failure of partners to perform on joint projects; the failure of subcontractors to satisfy their obligations; requirements to pay liquidated damages based on contract performance; changes in resource management, environmental, or infrastructure industry laws, regulations, or programs; changes in capital markets and the access to capital; credit agreement covenants; industry competition; liability related to legal proceedings, investigations, and disputes; the availability of third-party insurance coverage; the ability to obtain adequate bonding; employee, agent, or partner misconduct; employee risks related to international travel; safety programs; conflict of interest issues; liabilities relating to reports and opinions; liabilities relating to environmental laws and regulations; force majeure events; protection of intellectual property rights; the interruption of systems and information technology; the ability to impede a business combination based on Delaware law and charter documents; and stock price volatility. Any projections in this release are based on limited information currently available to Tetra Tech, which is subject to change. Although any such projections and the factors influencing them will likely change, Tetra Tech will not necessarily update the information, since Tetra Tech will only provide guidance at certain points during the year. Readers should not place undue reliance on forward-looking statements since such information speaks only as of the date of this release.

4

Tetra Tech, Inc.

Condensed Consolidated Balance Sheets

(unaudited - in thousands, except par value)

|

|

|

June 28,

2015 |

|

September 28,

2014 |

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

175,183 |

|

$ |

122,379 |

|

|

Accounts receivable - net |

|

633,544 |

|

701,892 |

|

|

Prepaid expenses and other current assets |

|

48,178 |

|

52,256 |

|

|

Income taxes receivable |

|

13,562 |

|

22,076 |

|

|

Total current assets |

|

870,467 |

|

898,603 |

|

|

|

|

|

|

|

|

|

Property and equipment - net |

|

68,602 |

|

73,864 |

|

|

Investments in and advances to unconsolidated joint ventures |

|

2,090 |

|

2,140 |

|

|

Goodwill |

|

684,909 |

|

714,190 |

|

|

Intangible assets - net |

|

49,197 |

|

63,095 |

|

|

Other long-term assets |

|

28,257 |

|

24,512 |

|

|

Total Assets |

|

$ |

1,703,522 |

|

$ |

1,776,404 |

|

|

|

|

|

|

|

|

|

Liabilities and Equity |

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

141,011 |

|

$ |

175,952 |

|

|

Accrued compensation |

|

113,346 |

|

110,186 |

|

|

Billings in excess of costs on uncompleted contracts |

|

92,951 |

|

103,343 |

|

|

Deferred income taxes |

|

26,373 |

|

20,387 |

|

|

Current portion of long-term debt |

|

10,708 |

|

10,989 |

|

|

Estimated contingent earn-out liabilities |

|

603 |

|

3,568 |

|

|

Other current liabilities |

|

69,905 |

|

79,436 |

|

|

Total current liabilities |

|

454,897 |

|

503,861 |

|

|

|

|

|

|

|

|

|

Deferred income taxes |

|

31,279 |

|

28,786 |

|

|

Long-term debt |

|

225,513 |

|

192,842 |

|

|

Long-term estimated contingent earn-out liabilities |

|

3,524 |

|

3,462 |

|

|

Other long-term liabilities |

|

33,890 |

|

34,397 |

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity: |

|

|

|

|

|

|

Preferred stock - authorized, 2,000 shares of $0.01 par value; no shares issued and outstanding at June 28, 2015, and September 28, 2014 |

|

— |

|

— |

|

|

Common stock - authorized, 150,000 shares of $0.01 par value; issued and outstanding, 60,162 and 62,591 shares at June 28, 2015, and September 28, 2014, respectively |

|

602 |

|

626 |

|

|

Additional paid-in capital |

|

344,833 |

|

402,516 |

|

|

Accumulated other comprehensive loss |

|

(100,310 |

) |

(42,538 |

) |

|

Retained earnings |

|

708,833 |

|

651,475 |

|

|

Tetra Tech stockholders’ equity |

|

953,958 |

|

1,012,079 |

|

|

Noncontrolling interests |

|

461 |

|

977 |

|

|

Total equity |

|

954,419 |

|

1,013,056 |

|

|

Total Liabilities and equity |

|

$ |

1,703,522 |

|

$ |

1,776,404 |

|

5

Tetra Tech, Inc.

Condensed Consolidated Statements of Income

(unaudited - in thousands, except per share data)

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

June 28, |

|

June 29, |

|

June 28, |

|

June 29, |

|

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

575,108 |

|

$ |

629,502 |

|

$ |

1,720,927 |

|

$ |

1,861,635 |

|

|

Subcontractor costs |

|

(153,209 |

) |

(170,746 |

) |

(429,194 |

) |

(463,904 |

) |

|

Other costs of revenue |

|

(340,181 |

) |

(381,319 |

) |

(1,061,419 |

) |

(1,164,761 |

) |

|

Selling, general and administrative expenses |

|

(40,997 |

) |

(47,175 |

) |

(125,695 |

) |

(138,778 |

) |

|

Contingent consideration - fair value adjustments |

|

— |

|

8,905 |

|

3,113 |

|

34,878 |

|

|

Operating income |

|

40,721 |

|

39,167 |

|

107,732 |

|

129,070 |

|

|

Interest expense |

|

(2,026 |

) |

(2,454 |

) |

(5,621 |

) |

(7,373 |

) |

|

Income before income tax expense |

|

38,695 |

|

36,713 |

|

102,111 |

|

121,697 |

|

|

Income tax expense |

|

(12,443 |

) |

(10,002 |

) |

(31,202 |

) |

(35,751 |

) |

|

Net income including noncontrolling interests |

|

26,252 |

|

26,711 |

|

70,909 |

|

85,946 |

|

|

Net income attributable to noncontrolling interests |

|

(46 |

) |

(54 |

) |

(111 |

) |

(266 |

) |

|

Net income attributable to Tetra Tech |

|

$ |

26,206 |

|

$ |

26,657 |

|

$ |

70,798 |

|

$ |

85,680 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share attributable to Tetra Tech: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.44 |

|

$ |

0.41 |

|

$ |

1.16 |

|

$ |

1.32 |

|

|

Diluted |

|

$ |

0.43 |

|

$ |

0.41 |

|

$ |

1.14 |

|

$ |

1.31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

60,207 |

|

64,566 |

|

61,293 |

|

64,683 |

|

|

Diluted |

|

60,792 |

|

65,302 |

|

61,887 |

|

65,493 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends per share |

|

$ |

0.08 |

|

$ |

0.07 |

|

$ |

0.22 |

|

$ |

0.07 |

|

6

TETRA TECH, INC.

Condensed Consolidated Statements of Cash Flows

(unaudited - in thousands)

|

|

|

Nine Months Ended |

|

|

|

|

June 28, |

|

June 29, |

|

|

|

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net income including noncontrolling interests |

|

$ |

70,909 |

|

$ |

85,946 |

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net income to net cash from operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

34,300 |

|

42,147 |

|

|

Equity in earnings of unconsolidated joint ventures |

|

(3,097 |

) |

(1,929 |

) |

|

Distributions of earnings from unconsolidated joint ventures |

|

3,045 |

|

2,145 |

|

|

Stock-based compensation |

|

8,093 |

|

8,329 |

|

|

Excess tax benefits from stock-based compensation |

|

(170 |

) |

(692 |

) |

|

Deferred income taxes |

|

(9,826 |

) |

2,040 |

|

|

Provision for doubtful accounts |

|

(1,866 |

) |

384 |

|

|

Fair value adjustments to contingent consideration |

|

(3,113 |

) |

(34,878 |

) |

|

(Gain) loss on disposal of property and equipment |

|

(5,295 |

) |

66 |

|

|

Foreign exchange loss (gain) |

|

244 |

|

(184 |

) |

|

|

|

|

|

|

|

|

Changes in operating assets and liabilities, net of effects of business acquisitions: |

|

|

|

|

|

|

Accounts receivable |

|

78,110 |

|

(9,166 |

) |

|

Prepaid expenses and other assets |

|

6,023 |

|

(3,738 |

) |

|

Accounts payable |

|

(36,733 |

) |

28,944 |

|

|

Accrued compensation |

|

1,448 |

|

817 |

|

|

Billings in excess of costs on uncompleted contracts |

|

(11,363 |

) |

(351 |

) |

|

Other liabilities |

|

(21,741 |

) |

(16,437 |

) |

|

Income taxes receivable/payable |

|

25,130 |

|

10,854 |

|

|

Net cash provided by operating activities |

|

134,098 |

|

114,297 |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

Capital expenditures |

|

(20,262 |

) |

(14,879 |

) |

|

Payments for business acquisitions, net of cash acquired |

|

(11,750 |

) |

(10,695 |

) |

|

Proceeds from sale of property and equipment |

|

10,039 |

|

3,740 |

|

|

Payment received on note for sale of operation |

|

— |

|

3,900 |

|

|

Net cash used in investing activities |

|

(21,973 |

) |

(17,934 |

) |

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

Payments on long-term debt |

|

(32,631 |

) |

(3,641 |

) |

|

Proceeds from borrowings |

|

64,794 |

|

— |

|

|

Payments of earn-out liabilities |

|

(3,199 |

) |

(18,662 |

) |

|

Payments of debt issuance costs |

|

(1,457 |

) |

— |

|

|

Excess tax benefits from stock-based compensation |

|

170 |

|

692 |

|

|

Repurchases of common stock |

|

(75,500 |

) |

(26,088 |

) |

|

Net change in overdrafts |

|

— |

|

(915 |

) |

|

Dividends paid |

|

(13,440 |

) |

(4,506 |

) |

|

Net proceeds from issuance of common stock |

|

5,621 |

|

18,310 |

|

|

Net cash used in financing activities |

|

(55,642 |

) |

(34,810 |

) |

|

|

|

|

|

|

|

|

Effect of foreign exchange rate changes on cash |

|

(3,679 |

) |

(1,986 |

) |

|

Net increase in cash and cash equivalents |

|

52,804 |

|

59,567 |

|

|

Cash and cash equivalents at beginning of period |

|

122,379 |

|

129,305 |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at end of period |

|

$ |

175,183 |

|

$ |

188,872 |

|

|

|

|

|

|

|

|

|

Supplemental information: |

|

|

|

|

|

|

Cash paid during the period for: |

|

|

|

|

|

|

Interest |

|

$ |

5,084 |

|

$ |

6,181 |

|

|

Income taxes, net of refunds received of $4.4 million and $12.1 million |

|

$ |

15,679 |

|

$ |

22,109 |

|

7

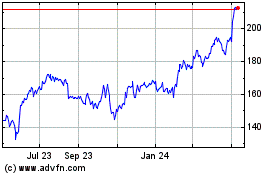

Tetra Tech (NASDAQ:TTEK)

Historical Stock Chart

From Mar 2024 to Apr 2024

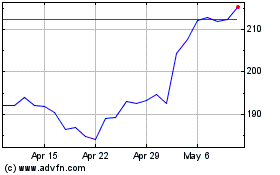

Tetra Tech (NASDAQ:TTEK)

Historical Stock Chart

From Apr 2023 to Apr 2024