Current Report Filing (8-k)

July 14 2015 - 5:10PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (date of earliest event reported): July 14, 2015 (July 10, 2015)

|

U.S. ENERGY CORP.

|

|

(Exact Name of Company as Specified in its Charter)

|

|

Wyoming

|

0-6814

|

83-0205516

|

|

(State or other jurisdiction of

|

(Commission File No.)

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

Identification No.)

|

|

|

|

|

|

877 North 8th West

Riverton, WY

|

|

82501

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

|

|

|

|

Registrant's telephone number, including area code: (307) 856-9271

|

|

Not Applicable

|

|

Former Name, Former Address or Former Fiscal Year,

If Changed From Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

|

Section 3: Securities and Trading Markets

Item 3.01 - Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On July 10, 2015, U.S. Energy Corp. (the "Company") received a letter from The Nasdaq Stock Market indicating that for 30 consecutive business days the Company's common stock had not maintained a minimum closing bid price of $1.00 ("Minimum Bid Price Requirement") per share as required by Nasdaq Listing Rule 5550(a)(2). This notice of noncompliance has had no immediate impact on the continued listing or trading of the Company's common stock on the Nasdaq Capital Market.

Under Nasdaq Listing Rule 5810(c)(3)(A), if during the 180 calendar days following the date of the notification (the "Compliance Period") ending on January 6, 2016, the closing bid price of the Company's stock is at or above $1.00 for a minimum of ten consecutive business days, the Company will regain compliance with the Minimum Bid Price Requirement and the common stock will continue to be eligible for listing on the Nasdaq Capital Market.

If the Company does not achieve compliance with the Minimum Bid Price Requirement by the end of the Compliance Period, under Nasdaq Listing Rule 5810(c)(3)(A)(ii), if on the last day of the Compliance Period, the Company is in compliance with the market value requirement for continued listing of its common stock on the Nasdaq Capital Market as well as all other listing standards for initial listing of its common stock on the Nasdaq Capital Market (other than the Minimum Bid Price Requirement), and the Company provides written notice of its intention to cure the deficiency during a second compliance period, Nasdaq may grant the Company an additional Compliance Period through July 5, 2016.

The Company intends to monitor the closing bid price of its common stock and may, if appropriate, consider implementing available options to regain compliance with the Minimum Bid Price Requirement under the Nasdaq Listing Rules. The Company's ability to regain compliance with the Minimum Bid Price Requirement and satisfy other Nasdaq Listing Rules is subject to numerous risks and uncertainties, including but not limited to risks associated with the possibility of an extended period of low commodity prices, operational and regulatory issues and general economic conditions.

On July 14, 2015, the Company issued a press release announcing its receipt of the Nasdaq deficiency letter. A copy of the please release is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Section 9: Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits.

Exhibit 99.1. Press Release dated July 14, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

U.S. ENERGY CORP.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated: July 14, 2015

|

By:

|

/s/ Keith. Larsen

|

|

|

|

Keith G. Larsen, CEO

|

For Immediate Release

U.S. ENERGY CORP. RECEIVES CONTINUED LISTING STANDARD NOTICE FROM THE NASDAQ STOCK EXCHANGE

RIVERTON, Wyoming – July 14, 2015 – U.S. Energy Corp. (NASDAQ Capital Market: "USEG") ("we", "us" or the "Company"), today reported that it has received a continued listing standard notification from the NASDAQ stock exchange.

On July 10, 2015 the Company received notification from the NASDAQ Stock Exchange ("NASDAQ") that the Company has failed to meet the listing requirement of maintaining a minimum bid price of $1 per share for the last 30 consecutive business days. As of July 9, 2015, the average closing price per share of the Company's common stock over the preceding 30 day trading period was $0.74 per share.

The Company has six months to regain compliance with the NASDAQ continued listing requirements and avoid delisting. If at any time during the 180 day period the closing bid price of the Company's common stock is at least $1 per share for a minimum of ten consecutive business days, NASDAQ will provide a written confirmation of compliance and this matter will be closed.

In the event that the Company does not regain compliance during the initial 180 day period, then the Company may be eligible for additional time. To qualify, the Company will be required to meet the continued listing requirement for the market value of publicly held shares and all other initial listing standards for the NASDAQ Capital Market, with the exception of the bid price requirement, and will need to provide written notice of its intention to cure the deficiency during the second compliance period, by effecting a reverse stock split, if necessary. If the Company meets these requirements, NASDAQ will inform the Company that it has been granted an additional 180 calendar days to cure the deficiency.

"During this period, we will actively monitor the stock price and evaluate all available options in order to regain compliance within the prescribed timeframe. During the six-month period, the Company's common stock will continue to be listed and traded on the NASDAQ, subject to compliance with the other listing standards. The NASDAQ notification does not affect the Company's business operations or its SEC reporting requirements, nor does it conflict with or

cause an event of default under any of the instruments governing the Company's debt obligations. During this period, the Company's common stock will continue to be listed and traded on the NASDAQ Stock Exchange," stated Keith Larsen, CEO of U.S. Energy Corp.

* * * * *

About: U.S. Energy Corp.

U.S. Energy Corp. is a natural resource exploration and development company with a primary focus on the exploration and development of its oil and gas assets. The Company also owns the Mount Emmons molybdenum deposit located in west central Colorado. The Company is headquartered in Riverton, Wyoming and trades on the NASDAQ Capital Market under the symbol "USEG".

To view the Company's Financial Statements and Management's Discussion and Analysis, please see the Company's 10-K for the twelve months ended December 31, 2014 and its 10-Q for the three months ended March 31, 2015, which are available at www.sec.gov and www.usnrg.com.

Disclosure Regarding Forward-Looking Statement

This news release includes statements which may constitute "forward-looking" statements, usually containing the words "will," "anticipates," "believe," "estimate," "project," "expect," "target," "goal," or similar expressions. Forward looking statements in this release include, without limitation, statements with respect to the Company's actions with respect to the NASDAQ notification and its stock price, and its ability to regain compliance with the NASDAQ continuing listing standards and remain listed on the NASDAQ Stock Exchange. Where we express an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. However, our forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from future results expressed, projected or implied by those forward-looking statements. The forward-looking statements are made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995. Forward-looking statements inherently involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements. Factors that would cause or contribute to such differences include, but are not limited to, dry holes and other unsuccessful development activities, higher than expected expenses or decline rates from production wells, future trends in commodity and/or mineral prices, the availability of capital, competitive factors, other factors affecting the trading price of the Company's common stock and other risks described in the Company's filings with the SEC (including, without limitation, the Form 10-K for the year ended December 31, 2014 and the 10-Q for the three months ended March 31, 2015) all of which are incorporated herein by reference. By making these forward-looking statements, the Company undertakes no obligation to update these statements for revision or changes after the date of this release.

* * * * *

For further information, please contact:

Reggie Larsen

Director of Investor Relations

U.S. Energy Corp.

1-800-776-9271

Reggie@usnrg.com

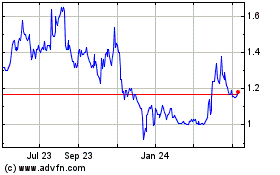

US Energy (NASDAQ:USEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

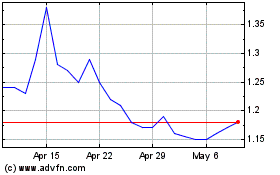

US Energy (NASDAQ:USEG)

Historical Stock Chart

From Apr 2023 to Apr 2024