UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________

FORM 8-K

________________________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 25, 2015

________________________________________________

Advanced Energy Industries, Inc.

(Exact name of registrant as specified in its charter)

________________________________________________

|

| | | | |

Delaware | | 000-26966 | | 84-0846841 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | | | | |

1625 Sharp Point Drive, Fort Collins, Colorado | | 80525 | |

(Address of principal executive offices) | | (Zip Code) | |

|

| | | |

(970) 221-4670 |

(Registrant's telephone number, including area code) |

| | | |

Not applicable |

(Former name or former address, if changed since last report) |

________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| | |

Item 2.05 | | Costs Associated with Exit or Disposal |

On June 25, 2015, the Board of Directors of Advanced Energy Industries, Inc. (the “Company”) approved a management recommendation to wind down operations of its Solar Inverter business unit in order to focus solely on its Precision Power business. The Solar Inverter business is solely operated by and under AE Solar Energy Inc., AEI Power GmbH and their subsidiaries.

The Company expects to record a pre-tax charge of approximately $260 million to $290 million related to the wind down of the Solar Inverter business operations, the majority of which will be recorded in the second quarter of 2015. Of this write down, approximately $150 million relates to the impairment of goodwill and intangibles, $45 million to $75 million to the write down of inventory, fixed and other assets, $15 million for employee termination cost, $10 million for tax valuation allowances and the remaining $40 million for other costs to exit the business. We anticipate that the wind down will be substantially complete by the end of 2015. Cash costs for severance and other expenses related to this decision are expected to range from $30 million to $45 million of which we expect $20 million to $30 million will be in 2015 with the remainder in subsequent years. These costs will be recorded as impairment and restructuring charges on the company’s income statement. The company plans to fund the cash costs through internally generated funds. The Company anticipates that minimal, if any, tax benefits will be recorded in the financial statements as a result of these charges.

The Company’s press release related to this exit is attached as Exhibit 99.1 and incorporated by reference.

|

| | |

Item 2.06 | | Material Impairments. |

The information set forth under Item 2.05 of this report on Form 8-K is incorporated by reference into this Item 2.06.

Item 9.01 Financial Statements and Exhibits.

|

| | |

(d) | Exhibits |

| | |

99.1 | | Press release dated June 29, 2015 by Advanced Energy Industries, Inc., announcing “Advanced Energy to Wind Down Solar Inverter Business to Focus on Precision Power Business.” |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | | |

| | /s/ Thomas O. McGimpsey |

Date: June 29, 2015 | | Thomas O. McGimpsey |

| | Executive Vice President, General Counsel & Corporate Secretary |

EXHIBIT INDEX

|

| | |

Exhibit Number | | Description |

99.1 | | Press release dated June 29, 2015 by Advanced Energy Industries, Inc., announcing “Advanced Energy to Wind Down Solar Inverter Business to Focus on Precision Power Business.” |

Press Release

|

| | | |

CONTACTS: | | | |

Annie Leschin | | Tom Liguori, EVP & CFO | |

Advanced Energy Industries, Inc. | | Advanced Energy Industries, Inc. | |

970.407.6555 | | 970.407.6570 | |

ir@aei.com | | tom.liguori@aei.com | |

|

|

Advanced Energy to Wind Down Solar Inverter Business to Focus on Precision Power Business |

Fort Collins, Colo., June 29, 2015 - Advanced Energy Industries, Inc. (NASDAQ: AEIS), a leader in precision power conversion, today announced that it has made a strategic decision to focus solely on its Precision Power business and wind down its Solar Inverter business, which is operated under AE Solar Energy Inc., AEI Power GmbH and their subsidiaries.

"Following on the heels of a strong 2014 and first quarter 2015 in Precision Power that reinforced the strength of our business model, and after an extensive strategic process over the last six months, we concluded that focusing solely on our Precision Power business, and exiting the Solar Inverter business aligns with our long-term goal of maximizing value for our shareholders,” said Yuval Wasserman, President and CEO of Advanced Energy.

Advanced Energy expects to record a pre-tax charge of approximately $260 million to $290 million related to the wind down of the Solar Inverter business operations, the majority of which will be recorded in the second quarter of 2015. Of this write down, approximately $150 million relates to the impairment of goodwill and intangibles, $45 million to $75 million to the write down of inventory, fixed and other assets, $15 million for employee termination cost, $10 million for tax valuation allowances and the remaining $40 million for other costs to exit the business. Cash costs for severance and other expenses related to this decision are expected to range from $30 million to $45 million of which we expect $20 million to $30 million will be in 2015 with the remainder in subsequent years. These costs will be recorded as impairment and restructuring charges on the company’s income statement. The company plans to fund the cash costs through internally generated funds.

Over the past six months the company has engaged in a rigorous process exploring and evaluating various strategic alternatives for the Solar Inverter business, including a potential sale, joint venture, partnership, spin-off, licensing and other alternatives. To date, strategic discussions with third parties regarding the sale of the entire business have not provided sufficient value and terms that were in the best interest of our shareholders, customers, employees and partners. Therefore, the company has made the decision to wind down the Solar Inverter business.

The company anticipates an orderly wind down of the Solar Inverter business, with AE Solar Energy Inc., AEI Power GmbH and their subsidiaries supporting their customers, the installed base and fulfilling customer purchase orders on hand.

About Advanced Energy

Advanced Energy (Nasdaq: AEIS) is a global leader in innovative power and control technologies for high-growth, precision power conversion solutions. Advanced Energy is headquartered in Fort Collins, Colorado, with dedicated support and service locations around the world. For more information, go to www.advanced-energy.com.

Please refer to the Form 8-K regarding this release furnished today to the Securities and Exchange Commission.

Forward-Looking Statements

The company's statements regarding the anticipated financial impact of the wind down of the Solar Inverter business and other statements that are not historical information are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Such forward-looking statements include statements which may be preceded by the words "plan," "will," "expect," “anticipate” or similar words. Risks and uncertainties that could cause or contribute to such differences include, but are not limited to: (a) potential decreases in customer orders and sales and disruptions in operations, supplier relationships and employee relations given the decision to wind down the Solar Inverter business, (b) the company’s ability to identify and execute upon a sale of the assets (if any) of the Solar Inverter business, (c) unanticipated developments that may prevent or delay wind down or sale activities, (d) the quarter-end financial close process which may result in material adjustments from our expectations stated in this press release, (e) other facts we discover that would require us to record additional charges that may be materially different from our expectations stated in the press release, (f) the company’s ability to realize on its plan to avoid costs as it winds down the Solar Inverter business, (g) the accuracy of the company's estimates and assumptions on which its financial statement projections are based, including estimates and assumptions related to the wind down of the Solar Inverter business, (h) the effects of global macroeconomic conditions upon demand for our products; (i) the impact of price changes resulting from a variety of factors; (j) the timing of orders received from customers; (k) the company's ability to realize benefits from cost improvement efforts including avoided costs, restructuring plans and inorganic growth; (l) the company's ability to obtain materials and manufacture products; and (m) unanticipated changes to management's estimates, reserves or allowances. These and other risks are described in Advanced Energy's Form 10-K, Forms 10-Q and other reports and statements filed with the Securities and Exchange Commission. These reports and statements are available on the SEC's website at www.sec.gov. Copies may also be obtained from Advanced Energy's website at www.advancedenergy.com or by contacting Advanced Energy's investor relations at 970-407-6555. Forward-looking statements are made and based on information available to the company on the date of this press release. The company assumes no obligation to update the information in this press release. The company is not updating guidance previously provided. The Solar Inverter business is solely operated by and under AE Solar Energy Inc., AEI Power GmbH and their subsidiaries.

###

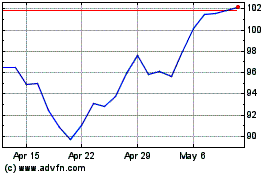

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

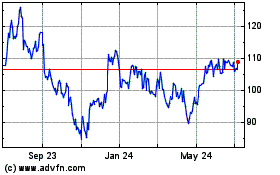

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Apr 2023 to Apr 2024