|

| | |

| UNITED STATES | |

| SECURITIES AND EXCHANGE COMMISSION | |

| Washington D.C. 20549 | |

| | |

| | |

| FORM 8-K | |

| | |

| CURRENT REPORT | |

| | |

| | |

| PURSUANT TO SECTION 13 OR 15(d) OF | |

| THE SECURITIES EXCHANGE ACT OF 1934 | |

| | |

| | |

| | |

| Date of Report (Date of earliest event reported): May 6, 2015 | |

| | |

| | |

| | |

| AVISTA CORPORATION | |

| (Exact name of registrant as specified in its charter) | |

| | |

| | |

Washington | 1-3701 | 91-0462470 |

(State of other jurisdiction of incorporation) | (Commission file number) | (I.R.S. Employer Identification No.) |

|

| | |

1411 East Mission Avenue, Spokane, Washington | | 99202-2600 |

(Address of principal executive offices) | | (Zip Code) |

|

| | |

Registrant's telephone number, including area code: | | 509-489-0500 |

Web site: http://www.avistacorp.com | | |

|

| | |

| (Former name or former address, if changed since last report) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Section 2 – Financial Information

Item 2.02 Results of Operations and Financial Condition.

The information in this report shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

On May 6, 2015, Avista Corporation (Avista Corp.) issued a press release reporting earnings for the first quarter 2015. A copy of the press release is furnished as Exhibit 99.1.

Section 9 - Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

99.1 Press release dated May 6, 2015, which is being furnished pursuant to Item 2.02.

Neither the furnishing of any press release as an exhibit to this Current Report nor the inclusion in such press releases of a reference to Avista Corp.'s Internet address shall, under any circumstances, be deemed to incorporate the information available at such Internet address into this Current Report. The information available at Avista Corp.'s Internet address is not part of this Current Report or any other report furnished or filed by Avista Corp. with the Securities and Exchange Commission.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| | |

| | AVISTA CORPORATION |

| | (Registrant) |

| | |

| | |

Date: | May 6, 2015 | /s/ Mark T. Thies |

| | Mark T. Thies |

| | Senior Vice President, |

| | Chief Financial Officer, and Treasurer |

Contact:

Media: Jessie Wuerst (509) 495-8578 jessie.wuerst@avistacorp.com

Investors: Jason Lang (509) 495-2930 jason.lang@avistacorp.com

Avista 24/7 Media Access (509) 495-4174

Avista Corp. Reports Financial Results for First Quarter 2015, and Confirms 2015 Earnings Guidance

SPOKANE, Wash. – May 6, 2015, 4:05 a.m. PDT: Avista Corp. (NYSE: AVA) today reported net income attributable to Avista Corp. shareholders of $46.4 million, or $0.74 per diluted share for the first quarter of 2015, compared to $48.5 million, or $0.81 per diluted share for the first quarter of 2014.

“Earnings for the first quarter of 2015 were below our expectations due to weather that was significantly warmer than normal in our service territory, which reduced heating loads. However, the impact on our earnings was somewhat mitigated through the decoupling mechanism in Washington. Excluding the impacts of weather, we had a solid first quarter, and I’m pleased how well our utilities have performed operationally. We continue to invest in our plant and equipment to maintain the reliability and strength of our systems for our customers. In addition, we are maintaining our focus on effectively managing our operating costs. I believe we are well positioned to sustain our long-term earnings growth," said Scott Morris, chairman, president and chief executive officer of Avista Corp.

"Above normal temperatures and precipitation during the quarter resulted in excellent hydroelectric generation. In addition, purchased power and natural gas fuel prices were below our expectations and below the level included in base rates, resulting in lower net power supply costs. This ultimately benefits both customers and shareholders.

"Since acquiring Alaska Electric Light and Power Company last summer, we’ve spent some time getting to know our new service territory in Alaska, participating in economic development conferences and having conversations with key community leaders. The Juneau utility is well respected in Southeast Alaska, and we’re pleased with the warm welcome we’ve received. Financially, our Alaska operations met our expectations, contributing $2.6 million to our earnings in the first quarter of 2015.

"Lastly, we are confirming our 2015 earnings guidance with a consolidated range of $1.86 to $2.06 per diluted share," Morris said.

Summary Results: Avista Corp.’s results for the first quarter of 2015 as compared to the first quarter of 2014 are presented in the table below: |

| | | | | | |

($ in thousands, except per-share data) | Q1 2015 | Q1 2014 |

Operating Revenues (continuing operations) | $ | 446,490 |

| $ | 446,578 |

|

Income from Operations (continuing operations) | $ | 89,575 |

| $ | 90,342 |

|

Net Income from continuing operations attributable to Avista Corp. Shareholders | $ | 46,449 |

| $ | 47,476 |

|

Net Income from discontinued operations attributable to Avista Corp. Shareholders | $ | — |

| $ | 1,023 |

|

Total net income attributable to Avista Corp. shareholders | $ | 46,449 |

| $ | 48,499 |

|

Net Income (Loss) attributable to Avista Corp. Shareholders by Business Segment: |

Avista Utilities | $ | 44,384 |

| $ | 47,996 |

|

Alaska Electric Light and Power Company | $ | 2,634 |

| $ | — |

|

Ecova (Discontinued Operations) | $ | — |

| $ | 1,111 |

|

Other | $ | (569 | ) | $ | (608 | ) |

Earnings (Loss) per diluted share by Business Segment attributable to Avista Corp. Shareholders: |

Avista Utilities | $ | 0.71 |

| $ | 0.80 |

|

Alaska Electric Light and Power Company | $ | 0.04 |

| $ | — |

|

Ecova (Discontinued Operations) | $ | — |

| $ | 0.02 |

|

Other | $ | (0.01 | ) | $ | (0.01 | ) |

Total earnings per diluted share attributable to Avista Corp. Shareholders | $ | 0.74 |

| $ | 0.81 |

|

Earnings per diluted share from Continuing Operations | $ | 0.74 |

| $ | 0.79 |

|

Earnings per diluted share from Discontinued Operations | $ | — |

| $ | 0.02 |

|

Total earnings per diluted share attributable to Avista Corp. Shareholders | $ | 0.74 |

| $ | 0.81 |

|

Avista Utilities' earnings for the first quarter of 2015 decreased primarily due to weather that was significantly warmer than normal and warmer than the prior year, which reduced heating loads. The decrease in heating loads was offset by the new decoupling mechanism in Washington (implemented Jan. 1, 2015), a general rate increase in Washington, lower net power supply costs and a decrease in the provision for earnings sharing in Idaho. In addition, we experienced expected increases in other operating expenses, depreciation and amortization, and taxes other than income taxes.

Alaska Electric Light and Power Company (AEL&P), which was acquired on July 1, 2014, contributed $2.6 million to our overall earnings.

The net loss at our other businesses was consistent with the prior year and was comprised of costs to explore strategic opportunities and net losses on investments, partially offset by increased net income at METALfx.

Avista Utilities

Utility Gross Margin - First Quarter 2015 compared to First Quarter 2014

Operating revenues (exclusive of intra-company revenues between electric and natural gas of $17.8 million in the first quarter of 2015 and $34.9 million in the first quarter of 2014) decreased $13.5 million, and resource costs decreased $13.8 million, which resulted in an increase of $0.3 million in gross margin. The gross margin on electric sales increased $3.5 million and the gross margin on natural gas sales decreased $3.2 million. Electric gross margin reflects weather that

was significantly warmer than the prior year and warmer than normal, which decreased heating loads. This reduction in heating loads was offset by decoupling in Washington, which had a positive effect on electric gross margin of $3.9 million, a general rate increase in Washington, lower net power supply costs and a $1.9 million decrease in the provision for earnings sharing in Idaho. For the first quarter of 2015, we recognized a pre-tax benefit of $5.7 million under the Energy Recovery Mechanism (ERM) in Washington compared to a benefit of $1.3 million for the first quarter of 2014. This change represents a decrease in net power supply costs primarily due to increased hydroelectric generation, as well as lower natural gas fuel and purchased power prices in 2015. The decrease in natural gas gross margin was primarily due to lower heating loads from warmer weather, partially offset by general rate increases. The decrease in heating loads was partially offset by decoupling in Washington, which had a positive effect on natural gas gross margin of $2.7 million.

The electric and natural gas decoupling mechanisms approved by the Washington Utilities and Transportation Commission (UTC) are designed to break the link between a utility's revenues and a consumer's energy usage. The company's actual revenue, based on kilowatt hour and therm sales will vary, up or down, from the level set by the UTC. This could be due to changes in weather, conservation or the economy. Under the decoupling mechanisms, the company's electric and natural gas revenues will be adjusted to reflect revenue based on the number of customers, rather than kilowatt hour and therm sales, which will provide more stability to the company's retail revenues. The difference between revenues based on sales and revenues based on the number of customers will result in either surcharges or rebates to customers in the following year.

Electric Revenues - First Quarter 2015 compared to First Quarter 2014

Electric revenues decreased $7.5 million for the first quarter of 2015, as compared to the first quarter of 2014. Retail electric revenues decreased by $9.7 million, wholesale electric revenues decreased by $3.0 million, sales of fuel decreased by $0.8 million, other electric revenues increased by $0.2 million and a decoupling mechanism in Washington had a positive impact to revenues of $3.9 million. We also recorded a provision for earnings sharing with our Idaho customers of $1.9 million for the first quarter of 2014, representing an adjustment of our 2013 estimate.

Retail electric revenues decreased $9.7 million due to a decrease in total MWhs sold (decreased revenues $15.6 million), partially offset by an increase in revenue per MWh (increased revenues $5.9 million). The increase in revenue per MWh was primarily due to a general rate increase in Washington.

The decrease in total MWhs sold was primarily the result of weather that was significantly warmer than normal and the prior year. Compared to the first quarter of 2014, residential electric use per customer decreased 16 percent and commercial use per customer decreased 9 percent. Heating degree days at Spokane were 15 percent below normal and 19 percent below the first quarter of 2014.

Wholesale electric revenues decreased $3.0 million due to a decrease in sales prices (decreased revenues $6.2 million), partially offset by an increase in sales volumes (increased revenues $3.2 million). The fluctuation in volumes and prices was primarily the result of decreased retail loads from warmer weather and our optimization activities during the quarter.

When current and forward electric wholesale market prices are below the cost of operating our natural gas-fired thermal generating units, we sell the related natural gas purchased for generation in the wholesale market rather than operate the generating units. The revenues from sales of fuel decreased $0.8 million due to a decrease in sales of natural gas fuel as part of thermal generation resource optimization activities. As relative power and natural gas prices vary, our volume of thermal optimization also varies.

Natural Gas Revenues - First Quarter 2015 compared to First Quarter 2014

Natural gas revenues decreased $23.0 million for the first quarter of 2015, as compared to the first quarter of 2014, due to a decrease in retail natural gas revenues and wholesale natural gas revenues, partially offset by a decoupling mechanism in Washington, which had a positive impact to revenues of $2.7 million.

Retail natural gas revenues decreased $15.4 million due to a decrease in volumes (decreased revenues $25.2 million), partially offset by higher retail rates (increased revenues $9.8 million). Higher retail rates were due to Purchased Gas Adjustments and general rate cases. We sold less retail natural gas in the first quarter of 2015 as compared to the first quarter of 2014 due to significantly warmer weather. Compared to the first quarter of 2014, residential natural gas use per customer decreased 20 percent and commercial use per customer decreased 21 percent. Heating degree days at Spokane were 15 percent below historical average for the first quarter of 2015, and 19 percent below the first quarter of 2014. Heating degree days at Medford were 19 percent below historical average for the first quarter of 2015 and 9 percent below the first quarter of 2014.

Wholesale natural gas revenues decreased $9.4 million due to a decrease in prices (decreased revenues $26.7 million), partially offset by an increase in volumes (increased revenues $17.3 million), which were related to an increase in optimization activities. Our optimization activities can fluctuate up or down each period depending on wholesale market metrics and the amount of economic value we can generate with our pipeline and storage capacity.

Other natural gas revenues decreased $0.9 million due to a decrease in natural gas exchange revenue and revenues from natural gas byproducts.

Utility Resource Costs and Expenses - First Quarter 2015 compared to First Quarter 2014

Avista Utilities' resource costs decreased $13.8 million, after elimination of intra-company resource costs of $17.8 million for the first quarter of 2015 and $34.9 million for first quarter of 2014. Including intra-company resource costs, Avista Utilities' electric resource costs decreased $11.0 million and natural gas resource costs decreased $19.9 million. The decrease in Avista Utilities' electric resource costs was primarily due to a decrease in purchased power and fuel costs, partially offset by an increase in power cost deferrals as net power supply costs were below the amount included in base rates. The decrease in natural gas resource costs was primarily due to a decrease in natural gas purchased.

Avista Utilities' other operating expenses increased $3.1 million and were due to an increase in pension and other postretirement benefits and administrative and general wages, partially offset by decreased generation operating and electric distribution maintenance expenses.

Avista Utilities' depreciation and amortization increased $2.3 million driven by additions to utility plant.

Avista Utilities' taxes other than income taxes increased $1.1 million primarily due to increased production, distribution and transmission property taxes.

Alaska Electric Light and Power Company

AEL&P’s operating revenues were $12.8 million and its resource costs were $2.9 million, which resulted in gross margin of $9.9 million, and it was all related to electric sales. Earnings for the first quarter were in line with our expectations, despite weather that was warmer than normal with heating degree days that were 12 percent below normal. AEL&P's revenues are not as sensitive to weather fluctuations as Avista Utilities', because it has a more stable load profile as there is not a large population of customers in its service territory with electric heating and cooling. Resource costs are primarily comprised of the costs associated with the Snettisham hydroelectric project.

AEL&P's other operating expenses totaled $2.8 million for the first quarter of 2015. Depreciation and amortization was $1.3 million and taxes other than income taxes were $0.7 million.

Other Businesses

The net loss from these operations was $0.6 million for both the first quarters of 2015 and 2014. The net loss for the first quarter of 2015 was primarily the result of $0.5 million (net of tax) of corporate costs, including costs associated with exploring strategic opportunities, and net losses on investments of $0.4 million. This was offset by METALfx net income of $0.3 million for the first quarter of 2015, which compares to net income of $0.1 million for the first quarter of 2014.

Liquidity and Capital Resources

We have a committed line of credit with various financial institutions in the total amount of $400.0 million that expires in April 2019. As of March 31, 2015, there were $65.0 million of cash borrowings and $35.6 million in letters of credit outstanding leaving $299.4 million of available liquidity under this line of credit.

AEL&P has a committed line of credit in the amount of $25.0 million that expires in November 2019. As of March 31, 2015, there are no borrowings outstanding under this committed line of credit.

In the three months ended March 31, 2015, we issued $0.4 million (net of issuance costs) of common stock under the employee benefit plans. We do not expect to issue any shares in 2015, other than small amounts under these plans.

We initiated a stock repurchase program commencing on Jan. 2, 2015 and expiring on March 31, 2015 for the repurchase of up to 800,000 shares of Avista Corp.’s outstanding common stock. Through March 31, 2015, we repurchased 89,400 shares at a total cost of $2.9 million and an average cost of $32.66 per share.

For 2015, we expect to issue up to $125.0 million of long-term debt in order to maintain an appropriate capital structure and to fund planned capital expenditures.

Avista Utilities' accrual-basis capital expenditures were $65.7 million for the three months ended March 31, 2015. We expect Avista Utilities' capital expenditures to be about $375.0 million in 2015 and $350.0 million for each of 2016 and 2017. AEL&P's capital expenditures were $0.4 million for the three months ended March 31, 2015. We expect to spend approximately $15.0 million annually for the period 2015 to 2017 related to capital expenditures at AEL&P.

2015 Earnings Guidance and Outlook

Avista Corp. is confirming its 2015 guidance for consolidated earnings to be in the range of $1.86 to $2.06 per diluted share. Due to significantly warmer than normal weather and reduced heating loads in the first quarter of 2015, we expect a reduction to annual consolidated earnings of approximately $0.08 per diluted share, including the impacts of decoupling in Washington. We expect this to be partially offset by a benefit under the ERM of approximately $0.06 to $0.07 per diluted share. In addition, because we did not reach the targeted level of repurchases for our stock repurchase programs, we expect earnings dilution of approximately $0.03 per diluted share in 2015.

We expect Avista Utilities to contribute in the range of $1.81 to $1.95 per diluted share for 2015. In 2015, we expect growth in operating expenses of approximately 3 percent. Also, due to warmer than normal first quarter weather, we expect a reduction to annual Avista Utilities' earnings of approximately $0.08 per diluted share, including the impacts of decoupling in Washington. Our range for Avista Utilities encompasses expected variability in power supply costs and the application of the ERM to that power supply cost variability. The midpoint of our guidance range for Avista Utilities does not include any benefit or expense under the ERM. In 2015, we expect to be in a benefit position under the ERM within the 90 percent customers/10 percent company sharing band, which is expected to add $0.06 to $0.07 per diluted share to Avista Utilities' earnings. Our outlook for Avista Utilities assumes, among other variables, normal precipitation and temperatures for the remainder of the year and it includes the expected impact from decoupling in Washington. Also, we are expecting below normal hydroelectric generation for May through August and normal hydroelectric generation for the remainder of the year. Due to the strong generation through April, we are expecting above normal hydroelectric generation for the full year. We estimate that our 2015 Avista Utilities earnings guidance range encompasses a return on equity range of approximately 8.4 to 9.0 percent.

For 2015, we expect AEL&P to contribute in the range of $0.08 to $0.12 per diluted share. Our outlook for AEL&P assumes, among other variables, normal precipitation, temperatures and hydroelectric generation for the remainder of the year.

We expect the other businesses to be between a loss of $0.03 and a loss of $0.01 per diluted share, which includes costs associated with exploring strategic opportunities.

Our guidance generally includes only normal operating conditions and does not include unusual items such as settlement transactions, impairments or acquisitions/dispositions until the effects are known and certain.

NOTE: We will host a conference call with financial analysts and investors on May 6, 2015, at 10:30 a.m. EDT to discuss this news release. The call will be available at (800) 447-0521, Confirmation number: 39385712. A simultaneous webcast of the call will be available on our website, www.avistacorp.com. A replay of the conference call will be available through May 13, 2015. Call (888) 843-7419, confirmation number 39385712#, to listen to the replay.

Avista Corp. is an energy company involved in the production, transmission and distribution of energy as well as other energy-related businesses. Avista Utilities is our operating division that provides electric service to 369,000 customers and natural gas to 329,000 customers. Our service territory covers 30,000 square miles in eastern Washington, northern Idaho and parts of southern and eastern Oregon, with a population of 1.5 million. AERC is an Avista subsidiary that, through its subsidiary AEL&P, provides retail electric service to 16,000 customers in the city and borough of Juneau, Alaska. Our stock is traded under the ticker symbol “AVA”. For more information about Avista, please visit www.avistacorp.com.

Avista Corp. and the Avista Corp. logo are trademarks of Avista Corporation.

This news release contains forward-looking statements, including statements regarding our current expectations for future financial performance and cash flows, capital expenditures, financing plans, our current plans or objectives for future operations and other factors, which may affect the company in the future. Such statements are subject to a variety of risks, uncertainties and other factors, most of which are beyond our control and many of which could have significant impact on our operations, results of operations, financial condition or cash flows and could cause actual results to differ materially from those anticipated in such statements.

The following are among the important factors that could cause actual results to differ materially from the forward-looking statements: weather conditions (temperatures, precipitation levels and wind patterns) which affect both energy demand and electric generating capability, including the effect of precipitation and temperature on hydroelectric resources, the effect of wind patterns on wind-generated power, weather-sensitive customer demand, and similar effects on supply and demand in the wholesale energy markets; state and federal regulatory decisions that affect our ability to recover costs and earn a reasonable return including, but not limited to, disallowance or delay in the recovery of capital investments and operating costs and discretion over allowed return on investment; volatility and illiquidity in wholesale energy markets, including the availability of willing buyers and sellers, changes in wholesale energy prices that can affect operating income, cash requirements to purchase electricity and natural gas, value received for wholesale sales, collateral required of us by counterparties on wholesale energy transactions and credit risk to us from such transactions, and the market value of derivative assets and liabilities; economic conditions in our service areas, including the economy's effects on customer demand for utility services; declining energy demand related to customer energy efficiency and/or conservation measures; our ability to obtain financing through the issuance of debt and/or equity securities, which can be affected by various factors including our credit ratings, interest rates and other capital market conditions and the global economy; the potential effects of legislation or administrative rulemaking, including possible effects on our generating resources of restrictions on greenhouse gas emissions to mitigate concerns over global climate changes; political pressures or regulatory practices that could constrain or place additional cost burdens on our energy supply sources, such as campaigns to halt coal-fired power generation and opposition to other thermal generation, wind turbines or hydroelectric facilities; changes in actuarial assumptions, interest rates and the actual return on plan assets for our pension and

other postretirement benefit plans, which can affect future funding obligations, pension and other postretirement benefit expense and the related liabilities; the outcome of pending legal proceedings arising out of the “western energy crisis” of 2000 and 2001, specifically related to the Pacific Northwest refund proceedings; the outcome of legal proceedings and other contingencies; changes in environmental and endangered species laws, regulations, decisions and policies, including present and potential environmental remediation costs and our compliance with these matters; wholesale and retail competition including alternative energy sources, growth in customer-owned power resource technologies that displace utility-supplied energy or that may be sold back to the utility, and alternative energy suppliers and delivery arrangements; growth or decline of our customer base and the extent to which new uses for our services may materialize or existing uses may decline; the ability to comply with the terms of the licenses for our hydroelectric generating facilities at cost-effective levels; severe weather or natural disasters that can disrupt energy generation, transmission and distribution, as well as the availability and costs of materials, equipment, supplies and support services; explosions, fires, accidents, mechanical breakdowns, avalanches or other incidents that may impair assets and may disrupt operations of any of our generation facilities, transmission and distribution systems or other operations; public injuries or damage arising from or allegedly arising from our operations; blackouts or disruptions of interconnected transmission systems (the regional power grid); disruption to information systems, automated controls and other technologies that we rely on for our operations, communications and customer service; terrorist attacks, cyber attacks or other malicious acts that may disrupt or cause damage to our utility assets or to the national economy in general, including any effects of terrorism, cyber attacks or vandalism that damage or disrupt information technology systems; cyber attacks or other potential lapses that result in unauthorized disclosure of private information, which could result in liabilities against us, costs to investigate, remediate and defend, and damage to our reputation; delays or changes in construction costs, and/or our ability to obtain required permits and materials for present or prospective facilities; changes in the costs to implement new information technology systems and/or obstacles that impede our ability to complete such projects timely and effectively; changes in the long-term global and our utilities' service area climates, which can affect, among other things, customer demand patterns and the volume and timing of streamflows to our hydroelectric resources; changes in industrial, commercial and residential growth and demographic patterns in our service territory or changes in demand by significant customers; the loss of key suppliers for materials or services or disruptions to the supply chain; default or nonperformance on the part of any parties from which we purchase and/or sell capacity or energy; deterioration in the creditworthiness of our customers; potential decline in our credit ratings, with effects including impeded access to capital markets, higher interest costs, and restrictive covenants in our financing arrangements and wholesale energy contracts; increasing health care costs and the resulting effect on employee injury costs and health insurance provided to our employees and retirees; increasing costs of insurance, more restrictive coverage terms and our ability to obtain insurance; work force issues, including changes in collective bargaining unit agreements, strikes, work stoppages, the loss of key executives, availability of workers in a variety of skill areas, and our ability to recruit and retain employees; the potential effects of negative publicity regarding business practices, whether true or not, which could result in litigation or a decline in our common stock price; changes in technologies, possibly making some of the current technology obsolete; changes in tax rates and/or policies; changes in interest rates that affect borrowing costs, our ability to effectively hedge interest rates for anticipated debt issuances, variable interest rate borrowing and the extent that we recover interest costs through utility operations; potential difficulties in integrating acquired operations and in realizing expected opportunities, diversions of management resources and losses of key

employees, challenges with respect to operating new businesses and other unanticipated risks and liabilities; changes in our strategic business plans, which may be affected by any or all of the foregoing, including the entry into new businesses and/or the exit from existing businesses and the extent of our business development efforts where potential future business is uncertain; compliance with extensive federal, state and local legislation and regulation, including numerous environmental, health, safety and other laws and regulations that affect our operations and costs; our ability to fully collect the indemnification escrow amounts because of information that was covered under management's representations and warranties related to the Ecova sale which could be inaccurate or incomplete at the time of sale, or because of new information which could be identified subsequent to the sale date, and adverse impacts to our Alaska operations because a majority of the hydroelectric power generation for such operations is provided by a single facility that is subject to a long-term power purchase agreement; hence any issues that negatively affect this facility’s ability to generate or transmit power, the cost and ability to replace power in the event of an extended outage, any decrease in the demand for the power generated by this facility or any loss by our subsidiary of its contractual rights with respect thereto or other adverse effect thereon could negatively affect our Alaska operations' financial results.

For a further discussion of these factors and other important factors, please refer to our Annual Report on Form 10-K for the year ended Dec. 31, 2014. The forward-looking statements contained in this news release speak only as of the date hereof. We undertake no obligation to update any forward-looking statement or statements to reflect events or circumstances that occur after the date on which such statement is made or to reflect the occurrence of unanticipated events. New risks, uncertainties and other factors emerge from time to time, and it is not possible for management to predict all of such factors, nor can it assess the impact of each such factor on our business or the extent to which any such factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement.

To unsubscribe from Avista’s news release distribution, send reply message to shirley.wolf@avistacorp.com.

Issued by: Avista Corporation

|

| | | | | | | |

AVISTA CORPORATION |

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) |

(Dollars in Thousands except Per Share Amounts) |

| | | |

| First Quarter |

| 2015 | | 2014 |

Operating revenues | $ | 446,490 |

| | $ | 446,578 |

|

Operating expenses: | | | |

Utility resource costs | 209,560 |

| | 220,497 |

|

Other operating expenses | 82,988 |

| | 76,720 |

|

Depreciation and amortization | 34,469 |

| | 30,873 |

|

Utility taxes other than income taxes | 29,898 |

| | 28,146 |

|

Total operating expenses | 356,915 |

| | 356,236 |

|

Income from continuing operations | 89,575 |

| | 90,342 |

|

Interest expense, net of capitalized interest | 19,097 |

| | 18,194 |

|

Other income - net | (2,231 | ) | | (2,600 | ) |

Income from continuing operations before income taxes | 72,709 |

| | 74,748 |

|

Income tax expense | 26,247 |

| | 27,282 |

|

Net income from continuing operations | 46,462 |

| | 47,466 |

|

Net income from discontinued operations | — |

| | 1,515 |

|

Net income | 46,462 |

| | 48,981 |

|

Net income attributable to noncontrolling interests | (13 | ) | | (482 | ) |

Net income attributable to Avista Corp. shareholders | $ | 46,449 |

| | $ | 48,499 |

|

Issued May 6, 2015 | | | |

|

| | | | | | | |

AVISTA CORPORATION |

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (continued) (UNAUDITED) |

(Dollars in Thousands except Per Share Amounts) |

| | | |

| First Quarter |

| 2015 | | 2014 |

Amounts attributable to Avista Corp. shareholders: | | | |

Net income from continuing operations attributable to Avista Corp. shareholders | $ | 46,449 |

| | $ | 47,476 |

|

Net income from discontinued operations attributable to Avista Corp. shareholders | — |

| | 1,023 |

|

Net income attributable to Avista Corp. shareholders | $ | 46,449 |

| | $ | 48,499 |

|

Weighted-average common shares outstanding (thousands), basic | 62,318 |

| | 60,122 |

|

Weighted-average common shares outstanding (thousands), diluted | 62,889 |

| | 60,168 |

|

Earnings per common share attributable to Avista Corp. shareholders, basic: | | | |

Earnings per common share from continuing operations | $ | 0.75 |

| | $ | 0.79 |

|

Earnings per common share from discontinued operations | — |

| | 0.02 |

|

Total earnings per common share attributable to Avista Corp. shareholders, basic | $ | 0.75 |

| | $ | 0.81 |

|

Earnings per common share attributable to Avista Corp. shareholders, diluted: | | | |

Earnings per common share from continuing operations | $ | 0.74 |

| | $ | 0.79 |

|

Earnings per common share from discontinued operations | — |

| | 0.02 |

|

Total earnings per common share attributable to Avista Corp. shareholders, diluted | $ | 0.74 |

| | $ | 0.81 |

|

Dividends declared per common share | $ | 0.33 |

| | $ | 0.3175 |

|

Issued May 6, 2015 | | | |

|

| | | | | | | |

AVISTA CORPORATION |

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) |

(Dollars in Thousands) |

| March 31, | | December 31, |

| 2015 | | 2014 |

Assets | | | |

Cash and cash equivalents | $ | 22,081 |

| | $ | 22,143 |

|

Accounts and notes receivable | 162,203 |

| | 171,925 |

|

Other current assets | 126,212 |

| | 201,279 |

|

Total net utility property | 3,651,079 |

| | 3,619,962 |

|

Other non-current assets | 146,688 |

| | 151,174 |

|

Regulatory assets for deferred income taxes | 98,606 |

| | 100,412 |

|

Regulatory assets for pensions and other postretirement benefits | 232,721 |

| | 235,758 |

|

Regulatory asset for unsettled interest rate swaps | 112,835 |

| | 77,063 |

|

Other regulatory assets | 119,763 |

| | 116,403 |

|

Other deferred charges | 16,841 |

| | 16,212 |

|

Total Assets | $ | 4,689,029 |

| | $ | 4,712,331 |

|

Liabilities and Equity | | | |

Accounts payable | $ | 62,853 |

| | $ | 112,974 |

|

Current portion of long-term debt and capital leases | 3,132 |

| | 6,424 |

|

Current portion of nonrecourse long-term debt of Spokane Energy | — |

| | 1,431 |

|

Short-term borrowings | 65,000 |

| | 105,000 |

|

Other current liabilities | 194,643 |

| | 159,440 |

|

Long-term debt and capital leases | 1,495,546 |

| | 1,492,062 |

|

Long-term debt to affiliated trusts | 51,547 |

| | 51,547 |

|

Regulatory liability for utility plant retirement costs | 257,146 |

| | 254,140 |

|

Pensions and other postretirement benefits | 188,798 |

| | 189,489 |

|

Deferred income taxes | 714,440 |

| | 710,342 |

|

Other non-current liabilities and deferred credits | 149,165 |

| | 146,240 |

|

Total Liabilities | 3,182,270 |

| | 3,229,089 |

|

Equity | | | |

Avista Corporation Shareholders' Equity: | | | |

Common stock (62,271,133 and 62,243,374 outstanding shares) | 998,975 |

| | 999,960 |

|

Retained earnings and accumulated other comprehensive loss | 508,200 |

| | 483,711 |

|

Total Avista Corporation Shareholders' Equity | 1,507,175 |

| | 1,483,671 |

|

Noncontrolling interests | (416 | ) | | (429 | ) |

Total Equity | 1,506,759 |

| | 1,483,242 |

|

Total Liabilities and Equity | $ | 4,689,029 |

| | $ | 4,712,331 |

|

Issued May 6, 2015 | | | |

|

| | | | | | | |

AVISTA CORPORATION |

FINANCIAL AND OPERATING HIGHLIGHTS (UNAUDITED) |

(Dollars in Thousands) |

| | | |

| | | |

| First Quarter |

| 2015 | | 2014 |

Avista Utilities | | | |

Retail electric revenues | $ | 198,748 |

| | $ | 208,450 |

|

Retail kWh sales (in millions) | 2,229 |

| | 2,402 |

|

Retail electric customers at end of period | 369,192 |

| | 366,713 |

|

Wholesale electric revenues | $ | 34,310 |

| | $ | 37,290 |

|

Wholesale kWh sales (in millions) | 1,077 |

| | 976 |

|

Sales of fuel | $ | 23,346 |

| | $ | 24,150 |

|

Other electric revenues | $ | 6,622 |

| | $ | 6,413 |

|

Decoupling (electric) | $ | 3,868 |

| | $ | — |

|

Provision for electric earnings sharing | $ | — |

| | $ | (1,867 | ) |

Retail natural gas revenues | $ | 117,555 |

| | $ | 132,988 |

|

Wholesale natural gas revenues | $ | 51,108 |

| | $ | 60,485 |

|

Transportation and other natural gas revenues | $ | 3,646 |

| | $ | 4,550 |

|

Decoupling (natural gas) | $ | 2,673 |

| | $ | — |

|

Provision for natural gas earnings sharing | $ | — |

| | $ | (2 | ) |

Total therms delivered (in thousands) | 351,414 |

| | 313,465 |

|

Retail natural gas customers at end of period | 329,187 |

| | 326,321 |

|

Intracompany revenues | $ | 17,794 |

| | $ | 34,883 |

|

Income from operations (pre-tax) | $ | 84,788 |

| | $ | 90,868 |

|

Net income attributable to Avista Corp. shareholders | $ | 44,384 |

| | $ | 47,996 |

|

Alaska Electric Light and Power Company | | | |

Revenues | $ | 12,774 |

| | $ | — |

|

Retail kWh sales (in millions) | 112 |

| | — |

|

Retail electric customers at end of period | 16,452 |

| | — |

|

Income from operations (pre-tax) | $ | 5,139 |

| | $ | — |

|

Net income attributable to Avista Corp. shareholders | $ | 2,634 |

| | $ | — |

|

Other | | | |

Revenues | $ | 10,083 |

| | $ | 9,454 |

|

Loss from operations (pre-tax) | $ | (352 | ) | | $ | (526 | ) |

Net loss attributable to Avista Corp. shareholders | $ | (569 | ) | | $ | (608 | ) |

Issued May 6, 2015 | | | |

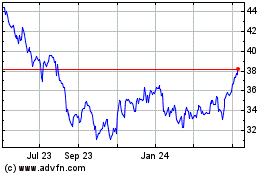

Avista (NYSE:AVA)

Historical Stock Chart

From Mar 2024 to Apr 2024

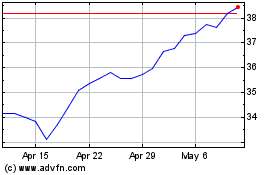

Avista (NYSE:AVA)

Historical Stock Chart

From Apr 2023 to Apr 2024