UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report: April 28, 2015

AUBURN

NATIONAL BANCORPORATION, INC.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

0-26486 |

|

63-0885779 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

100 North Gay Street, P.O. Drawer 3110, Auburn, Alabama 36831-3110

(Addresses of Principal Executive Offices, including Zip Code)

(334) 821-9200

(Registrant’s Telephone Number, including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition

The information, including the exhibits attached hereto, in this Current Report on Form 8-K is being “furnished” and shall not be

deemed “filed” for the purposes of Section 18 of the Securities and Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Current Report shall not be incorporated by

reference into any registration statement or other document filed by the Company pursuant to the Securities Act of 1933, as amended, or into any other filing or document made by the Company pursuant to the Securities Exchange Act of 1934, as

amended, except as otherwise expressly stated in any such filing.

Attached and incorporated herein by reference as Exhibit 99.1 is a copy

of the press release of Auburn National Bancorporation, Inc., dated April 28, 2015, reporting the Company’s financial results for the quarter ended March 31, 2015.

| Item 9.01. |

Financial Statements, Pro Forma Financial Information and Exhibits. |

| |

(c) |

Exhibits. The following exhibit is furnished herewith: |

|

|

|

| Exhibit No. |

|

Exhibit Description |

|

|

| 99.1 |

|

Press Release, dated April 28, 2015 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

AUBURN NATIONAL BANCORPORATION, INC. |

|

|

(Registrant) |

|

|

|

|

|

|

|

/s/ E.L. Spencer, Jr. |

|

|

|

|

E.L. Spencer, Jr. |

|

|

|

|

Chairman, President and Chief Executive Officer |

Date: April 28, 2015

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Exhibit Description |

|

|

| 99.1 |

|

Press Release, dated April 28, 2015 |

Exhibit 99.1

|

|

|

|

|

|

|

|

|

For additional information, contact: |

|

|

|

E.L. Spencer, Jr. |

|

|

|

President, CEO and |

|

|

|

Chairman of the Board |

|

|

|

(334) 821-9200 |

Press Release – April 28, 2015

Auburn National Bancorporation, Inc. Reports First Quarter Net Earnings

First Quarter 2015 Highlights:

| ● |

|

Earnings per share increased 2% compared to first quarter 2014 |

| ● |

|

Net interest income (tax-equivalent) increased 5% compared to first quarter 2014 |

| ● |

|

Average loans increased $22.9 million or 6% compared to first quarter 2014 |

| ● |

|

Annualized net charge-offs as a % of average loans were 0.11% compared to 0.17% in first quarter 2014 |

| ● |

|

Nonperforming assets were 0.22% of total assets at March 31, 2015 compared to 0.81% a year earlier |

AUBURN, Alabama – Auburn National Bancorporation, Inc. (Nasdaq: AUBN) reported net earnings of $1.9 million, or $0.51 per share, for the

first quarter of 2015, compared to $1.8 million, or $0.50 per share, for the first quarter of 2014.

“The Company’s first

quarter results reflect solid growth in net interest income and strong asset quality,” said E.L. Spencer, Jr., President, CEO and Chairman of the Board.

Net interest income (tax-equivalent) was $5.9 million for the first quarter of 2015, an increase of 5% compared to the first quarter of 2014.

This increase reflects management’s efforts to increase earnings by shifting the Company’s asset mix through loan growth, focusing on deposit pricing, and repaying higher-cost wholesale funding. Average loans were $400.2 million in the

first quarter of 2015, an increase of $22.9 million or 6%, from the first quarter of 2014. Average deposits were $705.7 million in the first quarter of 2015, an increase of $27.4 million or 4%, from the first quarter of 2014.

Nonperforming assets were $1.8 million, or 0.32% of total assets, at March 31, 2015, compared to $1.7 million, or 0.21% of total assets,

at December 31, 2014. The Company recorded no provision for loan losses for the first quarter of 2015, compared to a negative provision of $0.4 million for the first quarter of 2014. Provision expense reflects the absolute level of loans, loan

growth, the credit quality of the loan portfolio, and the amount of net charge-offs.

Noninterest income was $1.3 million for the first

quarter of 2015, compared to $0.8 million in the first quarter of 2014. The increase was primarily due to an increase in income from bank-owned life insurance of $0.3 million related to non-taxable death benefits recognized in the first quarter of

2015 and an increase in net securities gains (losses) of $0.3 million due to other-than-temporary impairment charges recognized in the first quarter of 2014 related to available-for-sale, agency residential mortgage-backed securities the Company

intended to sell at March 31, 2014 and subsequently sold in early April 2014.

Noninterest expense was $4.3 million in the first

quarter of 2015, compared to $3.9 million in the first quarter of 2014. The increase was primarily due to an increase in prepayment penalties incurred on long-term debt. The Company incurred prepayment penalties of $0.4 million during the first

quarter of 2015 when the company repaid $5.0 million of long-term debt with a weighted average interest rate of 3.59%, compared to none during the first quarter of 2014.

Income tax expense was $0.7 million for the first quarter of 2015 and 2014. The Company’s income tax expense for the first quarter of

2015 reflects an effective income tax rate of 26.40%, compared to 26.51% for the first quarter of 2014. The Company’s income tax expense is principally impacted by tax-exempt earnings from the Company’s investments in municipal securities

and bank-owned life insurance.

-more-

Reports First Quarter Net Earnings/page 2

The Company paid cash dividends of $0.22 per share in the first quarter

of 2015, an increase of 2.3% from the same period in 2014. At March 31, 2015, the Bank’s regulatory capital was well above the minimum amounts required to be “well capitalized” under current regulatory standards.

About Auburn National Bancorporation, Inc.

Auburn National Bancorporation, Inc. (the “Company”) is the parent company of AuburnBank (the “Bank”), with total assets

of approximately $790 million. The Bank is an Alabama state-chartered bank that is a member of the Federal Reserve System and has operated continuously since 1907. Both the Company and the Bank are headquartered in Auburn, Alabama. The Bank conducts

its business in East Alabama, including Lee County and surrounding areas. The Bank operates full-service branches in Auburn, Opelika, Valley, Hurtsboro and Notasulga, Alabama. In-store branches are located in the Kroger in Opelika and Wal-Mart

SuperCenter stores in both Auburn and Opelika. The Bank also operates a commercial loan production office in Phenix City, Alabama. Additional information about the Company and the Bank may be found by visiting www.auburnbank.com.

Cautionary Notice Regarding Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the Securities Act of 1933 and the Securities Exchange

Act of 1934, including, without limitation, statements about future financial and operating results, costs and revenues, economic conditions in our markets, loan demand, mortgage lending activity, changes in the mix of our earning assets and our

deposit liabilities, net interest margin, yields on earning assets, securities valuations and performance, interest rates (generally and those applicable to our assets and liabilities), loan performance, nonperforming assets, other real estate

owned, loan losses, charge-offs, other-than-temporary impairments, collateral values, credit quality, asset sales, and market trends, as well as statements with respect to our objectives, expectations and intentions and other statements that are not

historical facts. Actual results may differ from those set forth in the forward-looking statements.

Forward-looking statements, with

respect to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the actual results,

performance, achievements, or financial condition of the Company or the Bank to be materially different from future results, performance, achievements, or financial condition expressed or implied by such forward-looking statements. You should

not expect us to update any forward-looking statements.

All written or oral forward-looking statements attributable to us are expressly

qualified in their entirety by this cautionary notice, together with those risks and uncertainties described in our annual report on Form 10-K for the year ended December 31, 2014 and otherwise in our other SEC reports and filings.

Explanation of Certain Unaudited Non-GAAP Financial Measures

This press release contains financial information determined by methods other than U.S. generally accepted accounting principles

(“GAAP”). The attached financial highlights include certain designated net interest income amounts presented on a tax-equivalent basis, a non-GAAP financial measure, including the presentation and calculation of the efficiency ratio.

Management uses these non-GAAP financial measures in its analysis of the Company’s performance and believes the presentation of net interest income on a tax-equivalent basis provides comparability of net interest income from both taxable and

tax-exempt sources and facilitates comparability within the industry. Although the Company believes these non-GAAP financial measures enhance investors’ understanding of its business and performance, these non-GAAP financial measures should not

be considered an alternative to GAAP. Along with the attached financial highlights, the Company provides reconciliations between the GAAP financial measures and these non-GAAP financial measures.

-more-

Reports First Quarter Net Earnings/page 3

Financial Highlights (unaudited)

|

|

|

|

|

|

|

|

|

| |

|

Quarter ended March 31, |

|

| (Dollars in thousands, except per share amounts) |

|

2015 |

|

|

2014 |

|

| |

|

| Results of Operations |

|

|

|

|

|

|

|

|

| Net interest income (a) |

|

$ |

5,858 |

|

|

$ |

5,594 |

|

| Less: tax-equivalent adjustment |

|

|

335 |

|

|

|

324 |

|

| Net interest income (GAAP) |

|

|

5,523 |

|

|

|

5,270 |

|

| Noninterest income |

|

|

1,321 |

|

|

|

756 |

|

| Total revenue |

|

|

6,844 |

|

|

|

6,026 |

|

| Provision for loan losses |

|

|

— |

|

|

|

(400) |

|

| Noninterest expense |

|

|

4,314 |

|

|

|

3,948 |

|

| Income tax expense |

|

|

668 |

|

|

|

657 |

|

| Net earnings |

|

$ |

1,862 |

|

|

$ |

1,821 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Per share data: |

|

|

|

|

|

|

|

|

| Basic and diluted net earnings |

|

$ |

0.51 |

|

|

$ |

0.50 |

|

| Cash dividends declared |

|

$ |

0.22 |

|

|

$ |

0.215 |

|

| Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

| Basic and diluted |

|

|

3,643,365 |

|

|

|

3,643,161 |

|

| Shares outstanding, at period end |

|

|

3,643,378 |

|

|

|

3,643,173 |

|

| Book value |

|

$ |

21.28 |

|

|

$ |

18.74 |

|

| Common stock price: |

|

|

|

|

|

|

|

|

| High |

|

$ |

25.25 |

|

|

$ |

25.80 |

|

| Low |

|

|

23.15 |

|

|

|

23.20 |

|

| Period-end |

|

|

24.85 |

|

|

|

23.20 |

|

| To earnings ratio |

|

|

12.12 |

x |

|

|

11.72 |

x |

| To book value |

|

|

117 |

% |

|

|

124 |

% |

| Performance ratios: |

|

|

|

|

|

|

|

|

| Return on average equity (annualized) |

|

|

9.68 |

% |

|

|

11.11 |

% |

| Return on average assets (annualized) |

|

|

0.93 |

% |

|

|

0.96 |

% |

| Dividend payout ratio |

|

|

43.14 |

% |

|

|

43.00 |

% |

| Other financial data: |

|

|

|

|

|

|

|

|

| Net interest margin (a) |

|

|

3.15 |

% |

|

|

3.20 |

% |

| Effective income tax rate |

|

|

26.40 |

% |

|

|

26.51 |

% |

| Efficiency ratio (b) |

|

|

60.09 |

% |

|

|

62.17 |

% |

| Asset Quality: |

|

|

|

|

|

|

|

|

| Nonperforming assets: |

|

|

|

|

|

|

|

|

| Nonperforming (nonaccrual) loans |

|

$ |

1,251 |

|

|

$ |

3,188 |

|

| Other real estate owned |

|

|

499 |

|

|

|

3,111 |

|

| Total nonperforming assets |

|

$ |

1,750 |

|

|

$ |

6,299 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net charge-offs |

|

$ |

114 |

|

|

$ |

157 |

|

|

|

|

|

|

|

|

|

|

| Allowance for loan losses as a % of: |

|

|

|

|

|

|

|

|

| Loans |

|

|

1.19 |

% |

|

|

1.25 |

% |

| Nonperforming loans |

|

|

377 |

% |

|

|

148 |

% |

| Nonperforming assets as a % of: |

|

|

|

|

|

|

|

|

| Loans and other real estate owned |

|

|

0.44 |

% |

|

|

1.66 |

% |

| Total assets |

|

|

0.22 |

% |

|

|

0.81 |

% |

| Nonperforming loans as a % of total loans |

|

|

0.32 |

% |

|

|

0.84 |

% |

| Net charge-offs (annualized) as a % of average loans |

|

|

0.11 |

% |

|

|

0.17 |

% |

| Selected average balances: |

|

|

|

|

|

|

|

|

| Securities |

|

$ |

264,268 |

|

|

$ |

268,013 |

|

| Loans, net of unearned income |

|

|

400,161 |

|

|

|

377,322 |

|

| Total assets |

|

|

802,062 |

|

|

|

762,153 |

|

| Total deposits |

|

|

705,746 |

|

|

|

678,324 |

|

| Long-term debt |

|

|

11,550 |

|

|

|

12,217 |

|

| Total stockholders’ equity |

|

|

76,915 |

|

|

|

65,556 |

|

| Selected period end balances: |

|

|

|

|

|

|

|

|

| Securities |

|

$ |

262,141 |

|

|

$ |

279,989 |

|

| Loans, net of unearned income |

|

|

396,613 |

|

|

|

377,350 |

|

| Allowance for loan losses |

|

|

4,722 |

|

|

|

4,711 |

|

| Total assets |

|

|

790,224 |

|

|

|

773,333 |

|

| Total deposits |

|

|

698,336 |

|

|

|

687,088 |

|

| Long-term debt |

|

|

7,217 |

|

|

|

12,217 |

|

| Total stockholders’ equity |

|

|

77,544 |

|

|

|

68,284 |

|

| |

|

(a) Tax equivalent. See “Explanation of Certain Unaudited Non-GAAP Financial

Measures” and “Reconciliation of GAAP to non-GAAP Measures (unaudited).”

(b) Efficiency ratio is the

result of noninterest expense divided by the sum of noninterest income and tax-equivalent net interest income.

Reconciliation of GAAP to non-GAAP Measures (unaudited):

|

|

|

|

|

|

|

|

|

| |

|

Quarter ended March 31, |

|

| (Dollars in thousands, except per share amounts) |

|

2015 |

|

|

2014 |

|

| |

|

| Net interest income, as reported (GAAP) |

|

$ |

5,523 |

|

|

$ |

5,270 |

|

| Tax-equivalent adjustment |

|

|

335 |

|

|

|

324 |

|

| |

|

| Net interest income (tax-equivalent) |

|

$ |

5,858 |

|

|

$ |

5,594 |

|

| |

|

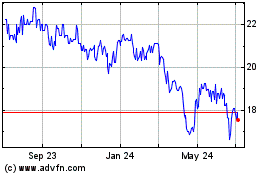

Auburn National Bancorpo... (NASDAQ:AUBN)

Historical Stock Chart

From Mar 2024 to Apr 2024

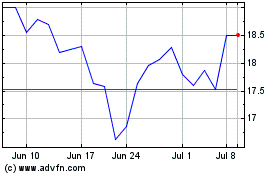

Auburn National Bancorpo... (NASDAQ:AUBN)

Historical Stock Chart

From Apr 2023 to Apr 2024