UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) April 16, 2015

Associated Banc-Corp

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Wisconsin |

|

001-31343 |

|

39-1098068 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

| 433 Main Street, Green Bay, Wisconsin |

|

54301 |

| (Address of principal executive offices) |

|

(Zip code) |

Registrant’s telephone number, including area code 920-491-7500

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02. |

Results of Operations and Financial Condition. |

On April 16, 2015, Associated Banc-Corp announced

its earnings for the quarter ended March 31, 2015. A copy of the registrant’s press release containing this information and the slide presentation discussed on the conference call for investors and analysts on April 16, 2015, are

being furnished as Exhibit 99.1 and Exhibit 99.2, respectively, to this Report on Form 8-K and are incorporated herein by reference.

The information

furnished pursuant to this Item 2.02, including Exhibit 99.1 and Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to

the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Registrant under the Securities Act of 1933 or the Exchange Act.

| Item 9.01. |

Financial Statements and Exhibits. |

The following exhibits are furnished as part of this Report on Form 8-K:

|

|

|

| 99.1 |

|

Press release of the registrant dated April 16, 2015, containing financial information for the quarter ended March 31, 2015. |

|

|

| 99.2 |

|

Slide presentation discussed on the conference call for investors and analysts on April 16, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Associated Banc-Corp |

|

|

|

|

(Registrant) |

|

|

|

|

| Date: April 16, 2015 |

|

|

|

By: |

|

/s/ Christopher J. Del Moral-Niles |

|

|

|

|

|

|

Christopher J. Del Moral-Niles Chief Financial

Officer |

ASSOCIATED BANC-CORP

Exhibit Index to Current Report on Form 8-K

|

|

|

| Exhibit

Number |

|

|

|

|

| 99.1 |

|

Press release of the registrant dated April 16, 2015, containing financial information for the quarter ended March 31, 2015. |

|

|

| 99.2 |

|

Slide presentation discussed on the conference call for investors and analysts on April 16, 2015. |

Exhibit 99.1

|

|

|

|

|

NEWS RELEASE

Investor Contact: Brian Klaus, Senior Vice

President, Director of Investor Relations 920-491-7059

Media Contact: Cliff Bowers, Senior Vice President,

Director of Public Relations 920-491-7542 |

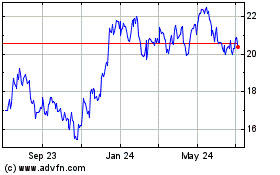

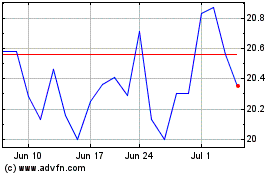

Associated Reports First Quarter Earnings of $0.30 per share

Earnings per share up 11% from prior year

GREEN BAY, Wis. — April 16, 2015 — Associated Banc-Corp (NYSE: ASB) today reported net income to common shareholders of $45 million, or

$0.30 per common share, for the quarter ended March 31, 2015. This compares to net income to common shareholders of $44 million, or $0.27 per common share, for the quarter ended March 31, 2014.

“We are pleased to report another quarter of solid results. Continued loan growth, a strong boost in insurance revenues, and a benign credit environment

all helped drive this quarter’s performance,” said President and CEO Philip B. Flynn. “We remain focused on our strategies to enhance efficiency and on opportunities for disciplined capital deployment.”

HIGHLIGHTS

| |

• |

|

Average loans grew $428 million or 2% from the fourth quarter |

| |

• |

|

Average total commercial loan balances grew $309 million, or 3% from the fourth quarter, and accounted for the majority of this quarter’s average loan growth |

| |

• |

|

Average deposits grew $523 million or 3% from the fourth quarter |

| |

• |

|

Net interest income of $168 million increased $3 million or 2% from the comparable year ago period |

| |

• |

|

Noninterest income of $80 million increased $10 million or 15% from the fourth quarter |

| |

• |

|

Insurance commissions increased $9 million from the fourth quarter |

| |

• |

|

Noninterest expenses of $174 million increased $2 million or 1% from the fourth quarter |

| |

• |

|

Pretax income of $69 million increased $2 million or 2% from the fourth quarter |

| |

• |

|

During the first quarter, the Company repurchased $30 million, or approximately 1.7 million shares, of common stock at an average cost of $17.27 per share |

| |

• |

|

Return on average Tier 1 common equity was 10.22% for the first quarter |

| |

• |

|

Capital ratios remain strong with a Tier 1 common equity ratio of 9.39% at March 31, 2015 |

– more –

FIRST QUARTER 2015 FINANCIAL RESULTS

Loans

Average loans of $17.8 billion increased $428

million, or 2% from the fourth quarter, and have increased $1.7 billion, or 10% from the year ago quarter. Total commercial loans grew $309 million on average from the fourth quarter and are up $1.1 billion from the prior year. Commercial and

business lending average balances grew $272 million, or 4% on a linked-quarter basis. Commercial real estate lending average balances grew $37 million, or 1% from the fourth quarter. Total average consumer loans were up $119 million compared to the

prior quarter as the growth in residential mortgage average balances of $174 million was partially offset by continued, but slower, run off in home equity and installment loans.

Deposits

Average deposits of $19.1 billion for the first

quarter were up $523 million, or 3% compared to the fourth quarter and have increased $2.1 billion, or 12%, from the year ago quarter. Money market average balances increased $444 million, or 5% from the fourth quarter, and were up $1.5 billion, or

21% from the year ago quarter. Average checking balances have increased four consecutive quarters and were up slightly from the fourth quarter. Average time deposits increased $45 million during the quarter marking a reversal of recent trends.

Net Interest Income and Net Interest Margin

First

quarter net interest income of $168 million was up $3 million, or 2% from the year ago quarter, but down $7 million from the fourth quarter. First quarter interest recoveries and prepayments were down $2 million relative to the fourth quarter. In

addition, long-term funding costs increased $2 million from the fourth quarter. Lastly, the day count difference between the first and fourth quarters resulted in expected lower net interest income of approximately $2 million.

First quarter net interest margin was 2.89%, a decrease of 15 basis points from the 3.04% reported in the fourth quarter. The first quarter yield on earning

assets declined 12 basis points from the prior quarter. The majority of this decline is attributed to continued loan yield compression. In addition, lower interest recoveries and prepayments accounted for 3 basis points of the decline in earning

asset yields. The majority of the 4 basis point, quarter over quarter increase in total funding costs is related to the full effect of the carrying cost of the Company’s $500 million debt issued in November 2014.

Noninterest Income and Expense

Noninterest income for

the first quarter was $80 million, up $10 million or 15% from the fourth quarter, and up $7 million or 9% from the year ago quarter. The Ahmann & Martin Co. acquisition closed during the first quarter and largely contributed to a $9 million

increase in insurance commissions from the fourth quarter. Mortgage banking income increased $4 million from the prior quarter. First quarter net asset gains of $1 million were down $3 million from the prior quarter.

– more –

Total noninterest expense for the quarter ended March 31, 2015 was $174 million, up $2 million or 1% from

the fourth quarter. Personnel expense increased $3 million from the fourth quarter, largely attributed to the Ahmann & Martin Co. acquisition which added approximately 120 colleagues. Occupancy expenses increased by $3 million from the

previous quarter, primarily related to a lease termination charge, as we further consolidated office space in Chicago. Business development and advertising expenses declined $3 million from the previous quarter, predominantly related to seasonal

advertising during the fourth quarter.

Taxes

First

quarter income taxes were $22 million with an effective tax rate of 32%, compared to $21 million with an effective tax rate of 31% in the year ago period.

Credit

Net charge offs of $6 million for the first

quarter were up $1 million from the fourth quarter, and were up slightly from the year ago quarter. Potential problem loans of $219 million increased $28 million from the prior quarter. The first quarter provision for credit losses was essentially

flat from the prior quarter at $5 million.

The Company’s allowance for loan losses was $265 million, equal to 1.48% of loans and reflects a coverage

ratio of 152% of nonaccrual loans at March 31, 2015.

Nonaccrual loans of $174 million were down 2% compared to both the fourth quarter and the year

ago quarter. The ratio of nonaccrual loans to total loans was down from the previous quarter and stands at 0.97%.

Capital Ratios

During the first quarter, the Company repurchased $30 million of common stock in several open market transactions.

The Company’s capital position remains strong, with a Tier 1 common equity ratio of 9.39% at March 31, 2015. The Company’s capital ratios

continue to be in excess of the Basel III “well-capitalized” regulatory benchmarks on a fully phased in basis.

– more –

FIRST QUARTER 2015 EARNINGS RELEASE CONFERENCE CALL

The Company will host a conference call for investors and analysts at 4:00 p.m. Central Time (CT) today, April 16, 2015. Interested parties can listen to

the call live on the internet through the investor relations section of the company’s website, https://www.associatedbank.com/investor or by dialing 877-407-8037. The slide presentation for the call will be available on the

company’s website just prior to the call. The number for international callers is 201-689-8037. Participants should ask the operator for the Associated Banc-Corp first quarter 2015 earnings call.

An audio archive of the webcast will be available on the company’s website at https://www.associatedbank.com/investor approximately fifteen

minutes after the call is over.

ABOUT ASSOCIATED BANC-CORP

Associated Banc-Corp (NYSE: ASB) has total assets of $27 billion and is one of the top 50, publicly traded, U.S. bank holding companies. Headquartered in

Green Bay, Wis., Associated is a leading Midwest banking franchise, offering a full range of financial products and services in over 200 banking locations serving more than 100 communities throughout Wisconsin, Illinois and Minnesota, and commercial

financial services in Indiana, Michigan, Missouri, Ohio and Texas. Associated Bank, N.A. is an Equal Housing Lender, Equal Opportunity Lender and Member FDIC. More information about Associated Banc-Corp is available at www.associatedbank.com.

FORWARD LOOKING STATEMENTS

Statements made in this

document which are not purely historical are forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. This includes any statements regarding management’s plans, objectives, or goals for future operations,

products or services, and forecasts of its revenues, earnings, or other measures of performance. Such forward-looking statements may be identified by the use of words such as “believe”, “expect”, “anticipate”,

“plan”, “estimate”, “should”, “will”, “intend”, “outlook”, or similar expressions. Forward-looking statements are based on current management expectations and, by their nature, are

subject to risks and uncertainties. Actual results may differ materially from those contained in the forward-looking statements. Factors which may cause actual results to differ materially from those contained in such forward-looking statements

include those identified in the Company’s most recent Form 10-K and subsequent SEC filings. Such factors are incorporated herein by reference.

NON-GAAP FINANCIAL MEASURES

This press release

contains references to measures which are not defined in generally accepted accounting principles (“GAAP”), including “efficiency ratio,” “Tier 1 common equity”, and “core fee-based revenue.” Information

concerning these non-GAAP financial measures can be found in the attached tables.

# # #

Associated Banc-Corp

Consolidated Balance Sheets (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in thousands) |

|

March 31,

2015 |

|

|

December 31,

2014 |

|

|

Seql Qtr

$ Change |

|

|

September 30,

2014 |

|

|

June 30,

2014 |

|

|

March 31,

2014 |

|

|

Comp Qtr

$ Change |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and due from banks |

|

$ |

355,541 |

|

|

$ |

444,113 |

|

|

$ |

(88,572 |

) |

|

$ |

381,287 |

|

|

$ |

549,883 |

|

|

$ |

526,951 |

|

|

$ |

(171,410 |

) |

| Interest-bearing deposits in other financial institutions |

|

|

488,426 |

|

|

|

571,924 |

|

|

|

(83,498 |

) |

|

|

74,945 |

|

|

|

78,233 |

|

|

|

92,071 |

|

|

|

396,355 |

|

| Federal funds sold and securities purchased under agreements to resell |

|

|

3,380 |

|

|

|

16,030 |

|

|

|

(12,650 |

) |

|

|

18,320 |

|

|

|

18,135 |

|

|

|

4,400 |

|

|

|

(1,020 |

) |

| Securities held to maturity, at amortized cost |

|

|

438,047 |

|

|

|

404,455 |

|

|

|

33,592 |

|

|

|

301,941 |

|

|

|

246,050 |

|

|

|

193,759 |

|

|

|

244,288 |

|

| Securities available for sale, at fair value |

|

|

5,358,310 |

|

|

|

5,396,812 |

|

|

|

(38,502 |

) |

|

|

5,345,422 |

|

|

|

5,506,379 |

|

|

|

5,277,908 |

|

|

|

80,402 |

|

| Federal Home Loan Bank and Federal Reserve Bank stocks, at cost |

|

|

189,222 |

|

|

|

189,107 |

|

|

|

115 |

|

|

|

188,875 |

|

|

|

186,247 |

|

|

|

181,360 |

|

|

|

7,862 |

|

| Loans held for sale |

|

|

159,963 |

|

|

|

154,935 |

|

|

|

5,028 |

|

|

|

141,672 |

|

|

|

78,657 |

|

|

|

46,529 |

|

|

|

113,434 |

|

| Loans |

|

|

17,979,032 |

|

|

|

17,593,846 |

|

|

|

385,186 |

|

|

|

17,159,090 |

|

|

|

17,045,052 |

|

|

|

16,441,444 |

|

|

|

1,537,588 |

|

| Allowance for loan losses |

|

|

(265,268 |

) |

|

|

(266,302 |

) |

|

|

1,034 |

|

|

|

(266,262 |

) |

|

|

(271,851 |

) |

|

|

(267,916 |

) |

|

|

2,648 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans, net |

|

|

17,713,764 |

|

|

|

17,327,544 |

|

|

|

386,220 |

|

|

|

16,892,828 |

|

|

|

16,773,201 |

|

|

|

16,173,528 |

|

|

|

1,540,236 |

|

| Premises and equipment, net |

|

|

274,591 |

|

|

|

274,688 |

|

|

|

(97 |

) |

|

|

272,283 |

|

|

|

264,735 |

|

|

|

269,257 |

|

|

|

5,334 |

|

| Goodwill |

|

|

968,774 |

|

|

|

929,168 |

|

|

|

39,606 |

|

|

|

929,168 |

|

|

|

929,168 |

|

|

|

929,168 |

|

|

|

39,606 |

|

| Other intangible assets, net |

|

|

77,984 |

|

|

|

67,582 |

|

|

|

10,402 |

|

|

|

69,201 |

|

|

|

70,538 |

|

|

|

72,629 |

|

|

|

5,355 |

|

| Trading assets |

|

|

42,336 |

|

|

|

35,163 |

|

|

|

7,173 |

|

|

|

34,005 |

|

|

|

40,630 |

|

|

|

40,822 |

|

|

|

1,514 |

|

| Other assets |

|

|

998,402 |

|

|

|

1,010,253 |

|

|

|

(11,851 |

) |

|

|

1,003,875 |

|

|

|

985,930 |

|

|

|

997,815 |

|

|

|

587 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

27,068,740 |

|

|

$ |

26,821,774 |

|

|

$ |

246,966 |

|

|

$ |

25,653,822 |

|

|

$ |

25,727,786 |

|

|

$ |

24,806,197 |

|

|

$ |

2,262,543 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest-bearing demand deposits |

|

$ |

4,570,872 |

|

|

$ |

4,505,272 |

|

|

$ |

65,600 |

|

|

$ |

4,302,454 |

|

|

$ |

4,211,057 |

|

|

$ |

4,478,981 |

|

|

$ |

91,891 |

|

| Interest-bearing deposits |

|

|

15,280,720 |

|

|

|

14,258,232 |

|

|

|

1,022,488 |

|

|

|

13,898,804 |

|

|

|

13,105,202 |

|

|

|

13,030,946 |

|

|

|

2,249,774 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total deposits |

|

|

19,851,592 |

|

|

|

18,763,504 |

|

|

|

1,088,088 |

|

|

|

18,201,258 |

|

|

|

17,316,259 |

|

|

|

17,509,927 |

|

|

|

2,341,665 |

|

| Federal funds purchased and securities sold under agreements to repurchase |

|

|

587,272 |

|

|

|

493,991 |

|

|

|

93,281 |

|

|

|

765,641 |

|

|

|

959,051 |

|

|

|

939,254 |

|

|

|

(351,982 |

) |

| Other short-term funding |

|

|

75,265 |

|

|

|

574,297 |

|

|

|

(499,032 |

) |

|

|

664,539 |

|

|

|

1,378,120 |

|

|

|

308,652 |

|

|

|

(233,387 |

) |

| Long-term funding |

|

|

3,429,925 |

|

|

|

3,930,117 |

|

|

|

(500,192 |

) |

|

|

2,931,547 |

|

|

|

2,931,809 |

|

|

|

2,932,040 |

|

|

|

497,885 |

|

| Trading liabilities |

|

|

44,730 |

|

|

|

37,329 |

|

|

|

7,401 |

|

|

|

36,003 |

|

|

|

43,311 |

|

|

|

43,450 |

|

|

|

1,280 |

|

| Accrued expenses and other liabilities |

|

|

197,818 |

|

|

|

222,285 |

|

|

|

(24,467 |

) |

|

|

185,256 |

|

|

|

169,290 |

|

|

|

171,850 |

|

|

|

25,968 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

24,186,602 |

|

|

|

24,021,523 |

|

|

|

165,079 |

|

|

|

22,784,244 |

|

|

|

22,797,840 |

|

|

|

21,905,173 |

|

|

|

2,281,429 |

|

| Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred equity |

|

|

59,727 |

|

|

|

59,727 |

|

|

|

— |

|

|

|

61,024 |

|

|

|

61,024 |

|

|

|

61,158 |

|

|

|

(1,431 |

) |

| Common stock |

|

|

1,674 |

|

|

|

1,665 |

|

|

|

9 |

|

|

|

1,719 |

|

|

|

1,750 |

|

|

|

1,750 |

|

|

|

(76 |

) |

| Surplus |

|

|

1,505,170 |

|

|

|

1,484,933 |

|

|

|

20,237 |

|

|

|

1,583,032 |

|

|

|

1,628,356 |

|

|

|

1,623,323 |

|

|

|

(118,153 |

) |

| Retained earnings |

|

|

1,509,967 |

|

|

|

1,497,818 |

|

|

|

12,149 |

|

|

|

1,466,525 |

|

|

|

1,432,518 |

|

|

|

1,402,549 |

|

|

|

107,418 |

|

| Accumulated other comprehensive income (loss) |

|

|

24,800 |

|

|

|

(4,850 |

) |

|

|

29,650 |

|

|

|

(1,725 |

) |

|

|

10,494 |

|

|

|

(11,577 |

) |

|

|

36,377 |

|

| Treasury stock |

|

|

(219,200 |

) |

|

|

(239,042 |

) |

|

|

19,842 |

|

|

|

(240,997 |

) |

|

|

(204,196 |

) |

|

|

(176,179 |

) |

|

|

(43,021 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

2,882,138 |

|

|

|

2,800,251 |

|

|

|

81,887 |

|

|

|

2,869,578 |

|

|

|

2,929,946 |

|

|

|

2,901,024 |

|

|

|

(18,886 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

27,068,740 |

|

|

$ |

26,821,774 |

|

|

$ |

246,966 |

|

|

$ |

25,653,822 |

|

|

$ |

25,727,786 |

|

|

$ |

24,806,197 |

|

|

$ |

2,262,543 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 1

Associated Banc-Corp

Consolidated Statements of Income (Unaudited)—Quarterly Trend

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Sequential Qtr |

|

|

|

|

|

|

|

|

|

|

|

Comparable Qtr |

|

| (in thousands, except per share amounts) |

|

1Q15 |

|

|

4Q14 |

|

|

$ Change |

|

|

%

Change |

|

|

3Q14 |

|

|

2Q14 |

|

|

1Q14 |

|

|

$ Change |

|

|

%

Change |

|

| Interest Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest and fees on loans |

|

$ |

151,945 |

|

|

$ |

156,536 |

|

|

$ |

(4,591 |

) |

|

|

(2.9 |

)% |

|

$ |

152,030 |

|

|

$ |

146,629 |

|

|

$ |

143,387 |

|

|

$ |

8,558 |

|

|

|

6.0 |

% |

| Interest and dividends on investment securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Taxable |

|

|

25,092 |

|

|

|

25,061 |

|

|

|

31 |

|

|

|

0.1 |

% |

|

|

25,037 |

|

|

|

26,109 |

|

|

|

26,257 |

|

|

|

(1,165 |

) |

|

|

(4.4 |

)% |

| Tax-exempt |

|

|

7,887 |

|

|

|

7,580 |

|

|

|

307 |

|

|

|

4.1 |

% |

|

|

7,483 |

|

|

|

7,030 |

|

|

|

6,971 |

|

|

|

916 |

|

|

|

13.1 |

% |

| Other interest |

|

|

1,692 |

|

|

|

1,821 |

|

|

|

(129 |

) |

|

|

(7.1 |

)% |

|

|

1,503 |

|

|

|

1,862 |

|

|

|

1,449 |

|

|

|

243 |

|

|

|

16.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total interest income |

|

|

186,616 |

|

|

|

190,998 |

|

|

|

(4,382 |

) |

|

|

(2.3 |

)% |

|

|

186,053 |

|

|

|

181,630 |

|

|

|

178,064 |

|

|

|

8,552 |

|

|

|

4.8 |

% |

| Interest Expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest on deposits |

|

|

7,619 |

|

|

|

7,319 |

|

|

|

300 |

|

|

|

4.1 |

% |

|

|

6,621 |

|

|

|

6,195 |

|

|

|

6,159 |

|

|

|

1,460 |

|

|

|

23.7 |

% |

| Interest on Federal funds purchased and securities sold under agreements to repurchase |

|

|

231 |

|

|

|

218 |

|

|

|

13 |

|

|

|

6.0 |

% |

|

|

390 |

|

|

|

306 |

|

|

|

305 |

|

|

|

(74 |

) |

|

|

(24.3 |

)% |

| Interest on other short-term funding |

|

|

81 |

|

|

|

156 |

|

|

|

(75 |

) |

|

|

(48.1 |

)% |

|

|

233 |

|

|

|

280 |

|

|

|

116 |

|

|

|

(35 |

) |

|

|

(30.2 |

)% |

| Interest on long-term funding |

|

|

10,872 |

|

|

|

8,644 |

|

|

|

2,228 |

|

|

|

25.8 |

% |

|

|

6,179 |

|

|

|

6,146 |

|

|

|

6,511 |

|

|

|

4,361 |

|

|

|

67.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total interest expense |

|

|

18,803 |

|

|

|

16,337 |

|

|

|

2,466 |

|

|

|

15.1 |

% |

|

|

13,423 |

|

|

|

12,927 |

|

|

|

13,091 |

|

|

|

5,712 |

|

|

|

43.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Interest Income |

|

|

167,813 |

|

|

|

174,661 |

|

|

|

(6,848 |

) |

|

|

(3.9 |

)% |

|

|

172,630 |

|

|

|

168,703 |

|

|

|

164,973 |

|

|

|

2,840 |

|

|

|

1.7 |

% |

| Provision for credit losses |

|

|

4,500 |

|

|

|

5,000 |

|

|

|

(500 |

) |

|

|

(10.0 |

)% |

|

|

1,000 |

|

|

|

5,000 |

|

|

|

5,000 |

|

|

|

(500 |

) |

|

|

(10.0 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income after provision for credit losses |

|

|

163,313 |

|

|

|

169,661 |

|

|

|

(6,348 |

) |

|

|

(3.7 |

)% |

|

|

171,630 |

|

|

|

163,703 |

|

|

|

159,973 |

|

|

|

3,340 |

|

|

|

2.1 |

% |

| Noninterest Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Trust service fees |

|

|

12,087 |

|

|

|

12,457 |

|

|

|

(370 |

) |

|

|

(3.0 |

)% |

|

|

12,218 |

|

|

|

12,017 |

|

|

|

11,711 |

|

|

|

376 |

|

|

|

3.2 |

% |

| Service charges on deposit accounts |

|

|

15,806 |

|

|

|

17,006 |

|

|

|

(1,200 |

) |

|

|

(7.1 |

)% |

|

|

17,961 |

|

|

|

17,412 |

|

|

|

16,400 |

|

|

|

(594 |

) |

|

|

(3.6 |

)% |

| Card-based and other nondeposit fees |

|

|

12,416 |

|

|

|

12,019 |

|

|

|

397 |

|

|

|

3.3 |

% |

|

|

12,407 |

|

|

|

12,577 |

|

|

|

12,509 |

|

|

|

(93 |

) |

|

|

(0.7 |

)% |

| Insurance commissions |

|

|

19,728 |

|

|

|

10,593 |

|

|

|

9,135 |

|

|

|

86.2 |

% |

|

|

7,860 |

|

|

|

13,651 |

|

|

|

12,317 |

|

|

|

7,411 |

|

|

|

60.2 |

% |

| Brokerage and annuity commissions |

|

|

3,683 |

|

|

|

3,496 |

|

|

|

187 |

|

|

|

5.3 |

% |

|

|

4,040 |

|

|

|

4,520 |

|

|

|

4,033 |

|

|

|

(350 |

) |

|

|

(8.7 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total core fee-based revenue |

|

|

63,720 |

|

|

|

55,571 |

|

|

|

8,149 |

|

|

|

14.7 |

% |

|

|

54,486 |

|

|

|

60,177 |

|

|

|

56,970 |

|

|

|

6,750 |

|

|

|

11.8 |

% |

| Mortgage banking, net |

|

|

7,408 |

|

|

|

2,928 |

|

|

|

4,480 |

|

|

|

153.0 |

% |

|

|

6,669 |

|

|

|

5,362 |

|

|

|

6,361 |

|

|

|

1,047 |

|

|

|

16.5 |

% |

| Capital market fees, net |

|

|

2,467 |

|

|

|

2,613 |

|

|

|

(146 |

) |

|

|

(5.6 |

)% |

|

|

2,939 |

|

|

|

2,099 |

|

|

|

2,322 |

|

|

|

145 |

|

|

|

6.2 |

% |

| Bank owned life insurance income |

|

|

2,875 |

|

|

|

2,739 |

|

|

|

136 |

|

|

|

5.0 |

% |

|

|

3,506 |

|

|

|

3,011 |

|

|

|

4,320 |

|

|

|

(1,445 |

) |

|

|

(33.4 |

)% |

| Asset gains, net |

|

|

1,096 |

|

|

|

3,727 |

|

|

|

(2,631 |

) |

|

|

(70.6 |

)% |

|

|

4,934 |

|

|

|

899 |

|

|

|

728 |

|

|

|

368 |

|

|

|

50.5 |

% |

| Investment securities gains, net |

|

|

— |

|

|

|

25 |

|

|

|

(25 |

) |

|

|

(100.0 |

)% |

|

|

57 |

|

|

|

34 |

|

|

|

378 |

|

|

|

(378 |

) |

|

|

(100.0 |

)% |

| Other |

|

|

2,510 |

|

|

|

2,040 |

|

|

|

470 |

|

|

|

23.0 |

% |

|

|

2,317 |

|

|

|

665 |

|

|

|

2,442 |

|

|

|

68 |

|

|

|

2.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total noninterest income |

|

|

80,076 |

|

|

|

69,643 |

|

|

|

10,433 |

|

|

|

15.0 |

% |

|

|

74,908 |

|

|

|

72,247 |

|

|

|

73,521 |

|

|

|

6,555 |

|

|

|

8.9 |

% |

| Noninterest Expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Personnel expense |

|

|

100,152 |

|

|

|

97,258 |

|

|

|

2,894 |

|

|

|

3.0 |

% |

|

|

97,650 |

|

|

|

97,793 |

|

|

|

97,698 |

|

|

|

2,454 |

|

|

|

2.5 |

% |

| Occupancy |

|

|

17,683 |

|

|

|

14,589 |

|

|

|

3,094 |

|

|

|

21.2 |

% |

|

|

13,743 |

|

|

|

13,785 |

|

|

|

15,560 |

|

|

|

2,123 |

|

|

|

13.6 |

% |

| Equipment |

|

|

5,772 |

|

|

|

6,148 |

|

|

|

(376 |

) |

|

|

(6.1 |

)% |

|

|

6,133 |

|

|

|

6,227 |

|

|

|

6,276 |

|

|

|

(504 |

) |

|

|

(8.0 |

)% |

| Technology |

|

|

15,558 |

|

|

|

14,581 |

|

|

|

977 |

|

|

|

6.7 |

% |

|

|

13,573 |

|

|

|

14,594 |

|

|

|

12,724 |

|

|

|

2,834 |

|

|

|

22.3 |

% |

| Business development and advertising |

|

|

5,327 |

|

|

|

8,538 |

|

|

|

(3,211 |

) |

|

|

(37.6 |

)% |

|

|

7,467 |

|

|

|

5,077 |

|

|

|

5,062 |

|

|

|

265 |

|

|

|

5.2 |

% |

| Other intangible amortization |

|

|

801 |

|

|

|

775 |

|

|

|

26 |

|

|

|

3.4 |

% |

|

|

990 |

|

|

|

991 |

|

|

|

991 |

|

|

|

(190 |

) |

|

|

(19.2 |

)% |

| Loan expense |

|

|

2,996 |

|

|

|

3,646 |

|

|

|

(650 |

) |

|

|

(17.8 |

)% |

|

|

3,813 |

|

|

|

3,620 |

|

|

|

2,787 |

|

|

|

209 |

|

|

|

7.5 |

% |

| Legal and professional fees |

|

|

4,538 |

|

|

|

4,257 |

|

|

|

281 |

|

|

|

6.6 |

% |

|

|

4,604 |

|

|

|

4,436 |

|

|

|

4,188 |

|

|

|

350 |

|

|

|

8.4 |

% |

| Foreclosure / OREO expense |

|

|

1,425 |

|

|

|

1,168 |

|

|

|

257 |

|

|

|

22.0 |

% |

|

|

2,083 |

|

|

|

1,575 |

|

|

|

1,896 |

|

|

|

(471 |

) |

|

|

(24.8 |

)% |

| FDIC expense |

|

|

6,500 |

|

|

|

6,956 |

|

|

|

(456 |

) |

|

|

(6.6 |

)% |

|

|

6,859 |

|

|

|

4,945 |

|

|

|

5,001 |

|

|

|

1,499 |

|

|

|

30.0 |

% |

| Other |

|

|

13,503 |

|

|

|

13,889 |

|

|

|

(386 |

) |

|

|

(2.8 |

)% |

|

|

14,938 |

|

|

|

14,882 |

|

|

|

15,475 |

|

|

|

(1,972 |

) |

|

|

(12.7 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total noninterest expense |

|

|

174,255 |

|

|

|

171,805 |

|

|

|

2,450 |

|

|

|

1.4 |

% |

|

|

171,853 |

|

|

|

167,925 |

|

|

|

167,658 |

|

|

|

6,597 |

|

|

|

3.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

69,134 |

|

|

|

67,499 |

|

|

|

1,635 |

|

|

|

2.4 |

% |

|

|

74,685 |

|

|

|

68,025 |

|

|

|

65,836 |

|

|

|

3,298 |

|

|

|

5.0 |

% |

| Income tax expense |

|

|

22,462 |

|

|

|

18,761 |

|

|

|

3,701 |

|

|

|

19.7 |

% |

|

|

24,478 |

|

|

|

21,660 |

|

|

|

20,637 |

|

|

|

1,825 |

|

|

|

8.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

46,672 |

|

|

|

48,738 |

|

|

|

(2,066 |

) |

|

|

(4.2 |

)% |

|

|

50,207 |

|

|

|

46,365 |

|

|

|

45,199 |

|

|

|

1,473 |

|

|

|

3.3 |

% |

| Preferred stock dividends |

|

|

1,228 |

|

|

|

1,225 |

|

|

|

3 |

|

|

|

0.2 |

% |

|

|

1,255 |

|

|

|

1,278 |

|

|

|

1,244 |

|

|

|

(16 |

) |

|

|

(1.3 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income available to common equity |

|

$ |

45,444 |

|

|

$ |

47,513 |

|

|

$ |

(2,069 |

) |

|

|

(4.4 |

)% |

|

$ |

48,952 |

|

|

$ |

45,087 |

|

|

$ |

43,955 |

|

|

$ |

1,489 |

|

|

|

3.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings Per Common Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.30 |

|

|

$ |

0.31 |

|

|

$ |

(0.01 |

) |

|

|

(3.2 |

)% |

|

$ |

0.31 |

|

|

$ |

0.28 |

|

|

$ |

0.27 |

|

|

$ |

0.03 |

|

|

|

11.1 |

% |

| Diluted |

|

$ |

0.30 |

|

|

$ |

0.31 |

|

|

$ |

(0.01 |

) |

|

|

(3.2 |

)% |

|

$ |

0.31 |

|

|

$ |

0.28 |

|

|

$ |

0.27 |

|

|

$ |

0.03 |

|

|

|

11.1 |

% |

| Average Common Shares Outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

150,070 |

|

|

|

151,931 |

|

|

|

(1,861 |

) |

|

|

(1.2 |

)% |

|

|

155,925 |

|

|

|

159,940 |

|

|

|

161,467 |

|

|

|

(11,397 |

) |

|

|

(7.1 |

)% |

| Diluted |

|

|

151,164 |

|

|

|

153,083 |

|

|

|

(1,919 |

) |

|

|

(1.3 |

)% |

|

|

156,991 |

|

|

|

160,838 |

|

|

|

162,188 |

|

|

|

(11,024 |

) |

|

|

(6.8 |

)% |

Page 2

Associated Banc-Corp

Selected Quarterly Information

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in millions, except per share and full time equivalent employee data) |

|

1Q15 |

|

|

4Q14 |

|

|

3Q14 |

|

|

2Q14 |

|

|

1Q14 |

|

| Per Common Share Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends |

|

$ |

0.10 |

|

|

$ |

0.10 |

|

|

$ |

0.09 |

|

|

$ |

0.09 |

|

|

$ |

0.09 |

|

| Market Value: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| High |

|

|

19.07 |

|

|

|

19.37 |

|

|

|

18.90 |

|

|

|

18.39 |

|

|

|

18.35 |

|

| Low |

|

|

16.62 |

|

|

|

16.75 |

|

|

|

17.42 |

|

|

|

16.82 |

|

|

|

15.58 |

|

| Close |

|

|

18.60 |

|

|

|

18.63 |

|

|

|

17.42 |

|

|

|

18.08 |

|

|

|

18.06 |

|

| Book value |

|

|

18.38 |

|

|

|

18.32 |

|

|

|

18.15 |

|

|

|

17.99 |

|

|

|

17.64 |

|

| Tier 1 common equity / share (1) (6) |

|

|

11.97 |

|

|

|

12.09 |

|

|

|

12.10 |

|

|

|

12.04 |

|

|

|

11.88 |

|

| Tangible book value / share |

|

$ |

11.95 |

|

|

$ |

12.06 |

|

|

$ |

12.09 |

|

|

$ |

12.11 |

|

|

$ |

11.80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Performance Ratios (annualized) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets |

|

|

0.71 |

% |

|

|

0.75 |

% |

|

|

0.78 |

% |

|

|

0.75 |

% |

|

|

0.76 |

% |

| Return on average tangible common equity |

|

|

10.16 |

|

|

|

10.27 |

|

|

|

10.35 |

|

|

|

9.56 |

|

|

|

9.45 |

|

| Return on average Tier 1 common equity (1) (6) |

|

|

10.22 |

|

|

|

10.35 |

|

|

|

10.38 |

|

|

|

9.56 |

|

|

|

9.38 |

|

| Effective tax rate |

|

|

32.49 |

|

|

|

27.79 |

|

|

|

32.77 |

|

|

|

31.84 |

|

|

|

31.35 |

|

| Dividend payout ratio (2) |

|

|

33.33 |

|

|

|

32.26 |

|

|

|

29.03 |

|

|

|

32.14 |

|

|

|

33.33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Balances |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common stockholders’ equity |

|

$ |

2,785 |

|

|

$ |

2,772 |

|

|

$ |

2,815 |

|

|

$ |

2,830 |

|

|

$ |

2,827 |

|

| Average Tier 1 common equity (1) (6) |

|

$ |

1,804 |

|

|

$ |

1,821 |

|

|

$ |

1,871 |

|

|

$ |

1,892 |

|

|

$ |

1,900 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selected Trend Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average full time equivalent employees |

|

|

4,422 |

|

|

|

4,320 |

|

|

|

4,359 |

|

|

|

4,431 |

|

|

|

4,517 |

|

| Trust assets under management, at market value |

|

$ |

8,138 |

|

|

$ |

7,993 |

|

|

$ |

7,700 |

|

|

$ |

7,720 |

|

|

$ |

7,535 |

|

| Total revenue (3) |

|

$ |

253 |

|

|

$ |

249 |

|

|

$ |

252 |

|

|

$ |

246 |

|

|

$ |

243 |

|

| Core fee-based revenue (4) |

|

$ |

64 |

|

|

$ |

56 |

|

|

$ |

54 |

|

|

$ |

60 |

|

|

$ |

57 |

|

| Mortgage loans originated for sale during period |

|

$ |

268 |

|

|

$ |

292 |

|

|

$ |

298 |

|

|

$ |

276 |

|

|

$ |

204 |

|

| Mortgage portfolio serviced for others |

|

$ |

7,920 |

|

|

$ |

7,999 |

|

|

$ |

8,012 |

|

|

$ |

8,052 |

|

|

$ |

8,084 |

|

| Mortgage servicing rights, net / Portfolio serviced for others |

|

|

0.75 |

% |

|

|

0.75 |

% |

|

|

0.76 |

% |

|

|

0.76 |

% |

|

|

0.77 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| At Period End |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans / deposits |

|

|

90.57 |

% |

|

|

93.77 |

% |

|

|

94.27 |

% |

|

|

98.43 |

% |

|

|

93.90 |

% |

| Stockholders’ equity / assets |

|

|

10.65 |

% |

|

|

10.44 |

% |

|

|

11.19 |

% |

|

|

11.39 |

% |

|

|

11.69 |

% |

| Tangible common equity / tangible assets (5) |

|

|

7.04 |

% |

|

|

6.97 |

% |

|

|

7.57 |

% |

|

|

7.79 |

% |

|

|

7.96 |

% |

| Tangible equity / tangible assets (5) |

|

|

7.27 |

% |

|

|

7.20 |

% |

|

|

7.82 |

% |

|

|

8.03 |

% |

|

|

8.22 |

% |

| Shares outstanding, end of period |

|

|

153,567 |

|

|

|

149,560 |

|

|

|

154,743 |

|

|

|

159,480 |

|

|

|

161,012 |

|

| Capital (6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Risk weighted assets (7) (8) |

|

$ |

19,565 |

|

|

$ |

18,568 |

|

|

$ |

18,031 |

|

|

$ |

17,911 |

|

|

$ |

17,075 |

|

| Tier 1 common equity (1) |

|

$ |

1,838 |

|

|

$ |

1,808 |

|

|

$ |

1,873 |

|

|

$ |

1,920 |

|

|

$ |

1,912 |

|

| Tier 1 common equity / risk-weighted assets (7) (8) |

|

|

9.39 |

% |

|

|

9.74 |

% |

|

|

10.39 |

% |

|

|

10.72 |

% |

|

|

11.20 |

% |

| Tier 1 leverage ratio (7) (8) |

|

|

7.39 |

% |

|

|

7.48 |

% |

|

|

7.87 |

% |

|

|

8.26 |

% |

|

|

8.46 |

% |

| Tier 1 risk-based capital ratio (7) (8) |

|

|

9.70 |

% |

|

|

10.06 |

% |

|

|

10.73 |

% |

|

|

11.06 |

% |

|

|

11.56 |

% |

| Total risk-based capital ratio (7) (8) |

|

|

12.21 |

% |

|

|

12.66 |

% |

|

|

11.98 |

% |

|

|

12.31 |

% |

|

|

12.81 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Financial Measures Reconciliation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Efficiency ratio (9) |

|

|

70.30 |

% |

|

|

70.33 |

% |

|

|

69.44 |

% |

|

|

69.70 |

% |

|

|

70.41 |

% |

| Taxable equivalent adjustment |

|

|

(1.42 |

)% |

|

|

(1.40 |

)% |

|

|

(1.36 |

)% |

|

|

(1.32 |

)% |

|

|

(1.35 |

)% |

| Asset gains, net |

|

|

0.30 |

% |

|

|

1.05 |

% |

|

|

1.36 |

% |

|

|

0.26 |

% |

|

|

0.22 |

% |

| Other intangible amortization |

|

|

(0.32 |

)% |

|

|

(0.32 |

)% |

|

|

(0.40 |

)% |

|

|

(0.41 |

)% |

|

|

(0.42 |

)% |

| Efficiency ratio, fully taxable equivalent (9) |

|

|

68.86 |

% |

|

|

69.66 |

% |

|

|

69.04 |

% |

|

|

68.23 |

% |

|

|

68.86 |

% |

| (1) |

Tier 1 common equity, a non-GAAP financial measure, is used by banking regulators, investors and analysts to assess and compare the quality and composition of our capital with the capital of other financial services

companies. Management uses Tier 1 common equity, along with other capital measures, to assess and monitor our capital position. Tier 1 common equity (period end and average) is Tier 1 capital excluding qualifying perpetual preferred stock and

qualifying trust preferred securities. |

| (2) |

Ratio is based upon basic earnings per common share. |

| (3) |

Total revenue, a non-GAAP financial measure, is the sum of taxable equivalent net interest income, core fee-based revenues, and other noninterest income categories, as presented on Page 2 in the Consolidated Statements

of Income and Page 6 in the Net Interest Income Analysis. |

| (4) |

Core fee-based revenue, a non-GAAP financial measure, is the sum of trust service fees, service charges on deposit accounts, card-based and other nondeposit fees, insurance commissions, and brokerage and annuity

commissions, as presented on Page 2 in the Consolidated Statements of Income. |

| (5) |

Tangible equity, tangible common equity and tangible assets exclude goodwill and other intangible assets, which is a non-GAAP financial measure. These financial measures have been included as they are considered to be

critical metrics with which to analyze and evaluate financial condition and capital strength. |

| (6) |

Prior to 2015, the regulatory capital requirements effective for the Corporation followed the Capital Accord of the Basel Committee on Banking Supervision (“Basel I”). Beginning January 1, 2015, the

regulatory capital requirements effective for the Corporation follow Basel III, subject to certain transition provisions from Basel I over the next three years to full implementation by January 1, 2018. |

| (7) |

March 31, 2015 data is estimated. |

| (8) |

The Federal Reserve establishes capital adequacy requirements, including well-capitalized standards for the Corporation. The OCC establishes similar capital adequacy requirements and standards for the Bank. Regulatory

capital primarily consists of Tier 1 risk-based capital and Tier 2 risk-based capital. The sum of Tier 1 risk-based capital and Tier 2 risk-based capital equals our total risk-based capital. Risk-based capital guidelines require a minimum level of

capital as a percentage of risk-weighted assets. Risk-weighted assets consist of total assets plus certain off-balance sheet and market items, subject to adjustment for predefined credit risk factors. |

| (9) |

Efficiency ratio is defined by the Federal Reserve guidance as noninterest expense divided by the sum of net interest income plus noninterest income, excluding investment securities gains / losses, net. Efficiency

ratio, fully taxable equivalent, is noninterest expense, excluding other intangible amortization, divided by the sum of taxable equivalent net interest income plus noninterest income, excluding investment securities gains / losses, net and asset

gains / losses, net. This efficiency ratio is presented on a taxable equivalent basis, which adjusts net interest income for the tax-favored status of certain loans and investment securities. Management believes this measure to be the preferred

industry measurement of net interest income as it enhances the comparability of net interest income arising from taxable and tax-exempt sources and it excludes certain specific revenue items (such as investment securities gains / losses, net and

asset gains / losses, net). |

Page 3

Associated Banc-Corp

Selected Asset Quality Information

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in thousands) |

|

Mar 31,

2015 |

|

|

Dec 31,

2014 |

|

|

Mar 15 vs

Dec 14

% Change |

|

|

Sep 30,

2014 |

|

|

Jun 30,

2014 |

|

|

Mar 31,

2014 |

|

|

Mar 15 vs

Mar 14

% Change |

|

| Allowance for Loan Losses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Beginning balance |

|

$ |

266,302 |

|

|

$ |

266,262 |

|

|

|

— |

% |

|

$ |

271,851 |

|

|

$ |

267,916 |

|

|

$ |

268,315 |

|

|

|

(0.8 |

)% |

| Provision for loan losses |

|

|

4,500 |

|

|

|

4,500 |

|

|

|

— |

% |

|

|

(3,000 |

) |

|

|

6,500 |

|

|

|

5,000 |

|

|

|

(10.0 |

)% |

| Charge offs |

|

|

(13,270 |

) |

|

|

(8,778 |

) |

|

|

51.2 |

% |

|

|

(14,850 |

) |

|

|

(9,107 |

) |

|

|

(11,361 |

) |

|

|

16.8 |

% |

| Recoveries |

|

|

7,736 |

|

|

|

4,318 |

|

|

|

79.2 |

% |

|

|

12,261 |

|

|

|

6,542 |

|

|

|

5,962 |

|

|

|

29.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net charge offs |

|

|

(5,534 |

) |

|

|

(4,460 |

) |

|

|

24.1 |

% |

|

|

(2,589 |

) |

|

|

(2,565 |

) |

|

|

(5,399 |

) |

|

|

2.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ending balance |

|

$ |

265,268 |

|

|

$ |

266,302 |

|

|

|

(0.4 |

)% |

|

$ |

266,262 |

|

|

$ |

271,851 |

|

|

$ |

267,916 |

|

|

|

(1.0 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance for Unfunded Commitments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Beginning balance |

|

$ |

24,900 |

|

|

$ |

24,400 |

|

|

|

2.0 |

% |

|

$ |

20,400 |

|

|

$ |

21,900 |

|

|

$ |

21,900 |

|

|

|

13.7 |

% |

| Provision for unfunded commitments |

|

|

— |

|

|

|

500 |

|

|

|

(100.0 |

)% |

|

|

4,000 |

|

|

|

(1,500 |

) |

|

|

— |

|

|

|

N/M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ending balance |

|

$ |

24,900 |

|

|

$ |

24,900 |

|

|

|

— |

% |

|

$ |

24,400 |

|

|

$ |

20,400 |

|

|

$ |

21,900 |

|

|

|

13.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance for credit losses |

|

$ |

290,168 |

|

|

$ |

291,202 |

|

|

|

(0.4 |

)% |

|

$ |

290,662 |

|

|

$ |

292,251 |

|

|

$ |

289,816 |

|

|

|

0.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Charge Offs |

|

Mar 31,

2015 |

|

|

Dec 31,

2014 |

|

|

Mar 15 vs

Dec 14

% Change |

|

|

Sep 30,

2014 |

|

|

Jun 30,

2014 |

|

|

Mar 31,

2014 |

|

|

Mar 15 vs

Mar 14

% Change |

|

| Commercial and industrial |

|

$ |

4,650 |

|

|

$ |

1,323 |

|

|

|

251.5 |

% |

|

$ |

572 |

|

|

$ |

(1,377 |

) |

|

$ |

2,725 |

|

|

|

70.6 |

% |

| Commercial real estate—owner occupied |

|

|

739 |

|

|

|

134 |

|

|

|

N/M |

|

|

|