UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 25, 2015

ANTERO MIDSTREAM PARTNERS LP

(Exact name of registrant as specified in its charter)

|

Delaware |

|

001-36719 |

|

46-4109058 |

|

(State or Other Jurisdiction of

Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification Number) |

1615 Wynkoop Street

Denver, Colorado 80202

(Address of principal executive offices) (Zip Code)

Registrant’s Telephone Number, including area code (303) 357-7310

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition

On February 25, 2015, Antero Midstream Partners LP issued a press release, a copy of which is attached hereto as Exhibit 99.1 and incorporated by reference herein, announcing its financial and operational results for the quarter and year ended December 31, 2014. The press release contains certain non-GAAP financial information. The reconciliation of such information to GAAP financial measures is included in the release.

The information in this Current Report, including Exhibit 99.1, is being furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities of that section, and is not incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act unless specifically identified therein as being incorporated therein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit

Number |

|

Description |

|

99.1 |

|

Antero Midstream Partners LP press release dated February 25, 2015. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ANTERO MIDSTREAM PARTNERS LP |

|

|

|

|

|

By: |

Antero Resources Midstream Management, LLC, |

|

|

|

its general partner |

|

|

|

|

|

|

|

|

By: |

/s/ Glen C. Warren, Jr. |

|

|

|

Glen C. Warren, Jr. |

|

|

|

President and Chief Financial Officer |

|

|

|

|

|

|

|

Dated: February 25, 2015 |

|

3

EXHIBIT INDEX

|

Exhibit

Number |

|

Description |

|

99.1 |

|

Antero Midstream Partners LP press release dated February 25, 2015. |

4

Exhibit 99.1

Antero Midstream Partners LP Announces 2014 Results

Denver, Colorado, February 25, 2015—Antero Midstream Partners LP (NYSE: AM) (“Antero Midstream” or the “Partnership”) today released its year-end 2014 financial and operating results. The relevant consolidated financial statements are included in Antero Midstream’s Annual Report on Form 10-K for the year ended December 31, 2014, which has been filed with the Securities and Exchange Commission (“SEC”).

Highlights for 2014:

· Full year 2014 average daily low pressure volumes were 498 MMcf/d, a 196% increase over the prior year

· High pressure and compression volumes were 460 MMcf/d and 104 MMcf/d, respectively, increases of 1,338% and 285% over the prior year

· Built 56 miles of low pressure, 35 miles of high pressure and 6 miles of condensate gathering lines

· Placed three Marcellus Shale compressor stations into service during 2014 with capacity of 275 MMcf/d

· Adjusted EBITDA of $67 million, a 411% increase over the prior year

· Generated post-IPO distributable cash flow of $15.2 million, or $0.10 per unit, resulting in DCF coverage of 1.06x

· Initial quarterly cash distribution of $0.0943 per unit (prorated minimum quarterly distribution) for the fourth quarter of 2014

Recent Developments

Initial Quarterly Cash Distribution

On February 2, 2015, Antero Midstream declared its initial quarterly cash distribution of $0.0943 per unit for the fourth quarter of 2014. The distribution represents a prorated portion of the Partnership’s minimum quarterly distribution (“MQD”) of $0.17 per unit ($0.68 per unit annualized), based upon the number of days after the closing of the Partnership’s initial public offering on November 10, 2014 through December 31, 2014. The distribution will be payable on February 27, 2015 to unitholders on record as of February 13, 2015.

2015 Capital Budget and Guidance

On January 20, 2015, Antero Midstream announced a 2015 capital budget of $425 million to $450 million, which includes the construction or expansion of 44 miles of low pressure gathering lines, 20 miles of high pressure gathering lines, and five compressor stations that will add 545 MMcf/d of additional compression capacity in 2015. At year-end 2015, Antero Midstream expects to have 180 miles of low pressure gathering lines, 117 miles of high pressure gathering lines, and 920 MMcf/d of compression capacity in service.

Antero Midstream EBITDA guidance for 2015 is $150 million to $160 million and Distributable Cash Flow (“DCF”) guidance for 2015 is $135 million to $145 million. Additionally, Antero Midstream expects to pay a distribution for the fourth quarter of 2015 that is 28% to 30% higher than the MQD of $0.17 per unit ($0.68 per unit annualized) while maintaining an average DCF coverage ratio of 1.1x to 1.2x over the course of the year.

Post-IPO Financial Results

The following results reflect post-IPO results from November 10, 2014 through December 31, 2014 (“Post-IPO”):

Post-IPO, revenues were $25 million and direct operating expenses were $6 million. Operating income was $8 million and interest expense was $0.5 million during the period. The Partnership had net income of $7 million, or $0.05 per unit outstanding.

1

Adjusted EBITDA for the post-IPO period was $17 million. Maintenance capital expenditures were $1 million and cash interest expense was $0.3 million, resulting in DCF of $15 million. Distributable cash flow coverage was 1.06x on the $0.0943 per unit prorated cash distribution declared for the fourth quarter of 2014.

|

($ in thousands) |

|

Post-IPO Period |

|

Year ended

December 31,

2014 |

|

|

Net Income |

|

$ |

7,422 |

|

$ |

16,832 |

|

|

Add: |

|

|

|

|

|

|

Interest Expense |

|

466 |

|

4,620 |

|

|

Depreciation Expense |

|

6,524 |

|

36,789 |

|

|

Stock Compensation Expense |

|

2,267 |

|

8,619 |

|

|

Adjusted EBITDA |

|

$ |

16,679 |

|

$ |

66,860 |

|

|

|

|

|

|

|

|

|

Less: |

|

|

|

|

|

|

Cash Interest Expense |

|

(331 |

) |

(4,485 |

) |

|

Maintenance Capital Expenditures |

|

(1,157 |

) |

(8,123 |

) |

|

Distributable Cash Flow |

|

$ |

15,191 |

|

$ |

54,252 |

|

For a reconciliation of adjusted EBITDA and DCF to the nearest comparable GAAP measures, please read “Non-GAAP Financial Measures.”

Full Year 2014 Financial Results

The following results reflect the combined results from Antero Midstream from November 10, 2014 through December 31, 2014 and predecessor results for periods prior to November 10, 2014:

Low pressure volumes for 2014 averaged 498 MMcf/d, a 196% increase from 2013. High pressure and compression volumes for 2014 averaged 460 MMcf/d and 104 MMcf/d, respectively, representing 1,338% and 285% year over year growth from 2013. Condensate gathering volumes averaged 2 MBbl/d in 2014. Volumetric growth was driven by increased production from Antero Resources Corporation (“Antero Resources”). Average realized low pressure, high pressure and compression fees were $0.31 per Mcf, $0.18 per Mcf and $0.18 per Mcf, respectively, while average realized condensate gathering fees were $4.08 per Bbl.

|

|

|

Year Ended December 31, |

|

|

|

|

|

|

2013 |

|

2014 |

|

% Change |

|

|

Average Daily Throughput: |

|

|

|

|

|

|

|

|

Low Pressure Gathering (MMcf/d) |

|

168 |

|

498 |

|

196 |

% |

|

High Pressure Gathering (MMcf/d) |

|

32 |

|

460 |

|

1,338 |

% |

|

Compression (MMcf/d) |

|

27 |

|

104 |

|

285 |

% |

|

Condensate Gathering (MBbl/d) |

|

— |

|

2 |

|

* |

|

Revenue for 2014 was $96 million as compared to $22 million for the prior year, primarily driven by increased throughput volumes across Antero Midstream’s systems. Revenues in 2014 were comprised entirely of fixed fees from Antero Resources. Direct operating expenses totaled $15 million and general and administrative expenses totaled $22 million, including $9 million of non-cash equity-based compensation. Total operating expenses were $74 million including $37 million of depreciation.

Net income was $17 million, as compared to a $14 million net loss in the prior year. Adjusted EBITDA of $67 million for 2014 was 411% higher than the prior year due to increased throughput and revenue. Cash interest expense was $4 million and maintenance capital expenditures totaled $8 million, resulting in DCF of $54 million.

Chairman and CEO Paul M. Rady, commented, “Our strong results in 2014 further underscore the successful development program and peer-leading growth and margins at the parent, Antero Resources. As the most active operator in Appalachia, Antero Resources is a terrific sponsor that provides for strong Antero Midstream growth for the foreseeable future.”

Mr. Rady further commented, “Antero Midstream continues to benefit from the visibility within the entire Antero organization, allowing for more prudent and timely capital allocation during volatile commodity price environments.”

2

For a reconciliation of adjusted EBITDA and DCF to the nearest comparable GAAP measures, please read “Non-GAAP Financial Measures.”

Balance Sheet and Liquidity

As of December 31, 2014, Antero Midstream had $230 million of cash on its balance sheet and a fully undrawn $1.0 billion credit facility, resulting in $1.2 billion in available liquidity. Antero Midstream expects to fund all 2015 expansion capital expenditures, excluding potential third party transactions or the potential acquisition of fresh water distribution assets from Antero Resources pursuant to the exercise of its option, with the cash on its balance sheet and drawings under its credit facility.

Glen Warren, President and CFO, commented, “Antero Midstream’s balance sheet and liquidity, following the highly successful IPO in November, strongly positions the Partnership heading into 2015. Additionally, our 100% fee-based business model reduces the Partnership’s direct commodity price risk and allows us to target peer-leading distribution growth that is not dependent on more costly third-party acquisitions or drop-down transactions that are typically priced in the market at higher multiples.”

2014 Capital Spending

Capital expenditures were $554 million in 2014 as compared to $389 million in 2013. The increase is primarily driven by the build-out of midstream infrastructure to support Antero Resources’ production growth. Capital expenditures in the Marcellus were $422 million, or 76% of total capital invested, and capital expenditures in the Utica were $132 million, or 24% of total capital invested. The aforementioned capital invested does not include the $214 million expended on fresh water distribution assets and other certain gathering infrastructure, all of which remains at Antero Resources.

During 2014, Antero Midstream placed into service three compressor stations in the Marcellus Shale with a total capacity of 275 MMcf/d. Additionally, the Partnership placed into service 56 miles of low pressure pipeline, 35 miles of high pressure pipeline and six miles of condensate pipeline. The below table summarizes the Partnership’s cumulative miles of pipeline and compression capacity at year-end 2013 and 2014:

|

|

|

Low

Pressure

Pipeline

(miles) |

|

High

Pressure

Pipeline

(miles) |

|

Condensate

Pipeline

(miles) |

|

Compression

Capacity

(MMcf/d) |

|

|

|

|

As of December 31, |

|

|

|

|

2013 |

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

2014 |

|

|

Marcellus |

|

54 |

|

91 |

|

39 |

|

62 |

|

— |

|

— |

|

100 |

|

375 |

|

|

Utica |

|

26 |

|

45 |

|

23 |

|

35 |

|

10 |

|

16 |

|

— |

|

— |

|

|

Total |

|

80 |

|

136 |

|

62 |

|

97 |

|

10 |

|

16 |

|

100 |

|

375 |

|

Conference Call

Antero Midstream will hold a call on Thursday, February 26, 2015, at 10:00 am MT to discuss the results. A brief Q&A session for security analysts will immediately follow the discussion of the results. To participate in the call, dial in at 888-347-8204 (U.S.), 866-605-3851 (Canada), or 412-902-4229 (International) and reference passcode 10060096. A telephone replay of the call will be available until Thursday, March 5, 2015, at 10:00 am MT at 877-870-5176 (U.S.) or 858-384-5517 (International) using the same passcode.

A simultaneous webcast of the call may be accessed over the internet at www.anteromidstream.com. The webcast will be archived for replay on the Partnership’s website until Thursday, March 5, 2015, at 10:00 am MT.

Presentation

An updated presentation will be posted to the partnership’s website before the February 26, 2015 conference call. The presentation can be found at www.anteromidstream.com on the homepage. Information on the Company’s website does not constitute a portion of this press release.

3

Non-GAAP Financial Measures

As used in this news release, adjusted EBITDA means net income plus interest expense, depreciation and amortization expense, income tax expense (if applicable), and non-cash stock compensation expense. As used in this news release, distributable cash flow means adjusted EBITDA less cash interest expense and maintenance capital expenditures. Distributable cash flow should not be viewed as indicative of the actual amount of cash that the Partnership has available for distributions from operating surplus or that the Partnership plans to distribute. Adjusted EBITDA and distributable cash flow are non-GAAP supplemental financial measures that management and external users of the Partnership’s consolidated financial statements, such as industry analysts, investors, lenders and rating agencies, use to assess:

· the Partnership’s operating performance as compared to other publicly traded partnerships in the midstream energy industry without regard to historical cost basis or, in the case of adjusted EBITDA, financing methods;

· the ability of the Partnership’s assets to generate sufficient cash flow to make distributions to the Partnership’s unitholders;

· the Partnership’s ability to incur and service debt and fund capital expenditures; and

· the viability of acquisitions and other capital expenditure projects and the returns on investment of various investment opportunities.

The Partnership believes that adjusted EBITDA and distributable cash flow provide useful information to investors in assessing the Partnership’s financial condition and results of operations. Adjusted EBITDA and distributable cash flow should not be considered as alternatives to net income, operating income, net cash provided by operating activities or any other measure of financial performance or liquidity presented in accordance with GAAP. Adjusted EBITDA and distributable cash flow have important limitations as analytical tools because they exclude some, but not all, items that affect net income and net cash provided by operating activities. Additionally, because adjusted EBITDA and distributable cash flow may be defined differently by other companies in its industry, the Partnership’s definition of adjusted EBITDA and distributable cash flow may not be comparable to similarly titled measures of other companies, thereby diminishing their utility.

For a reconciliation of adjusted EBITDA and distributable cash flow to net income, please refer to the table on page two of this press release.

The following table reconciles adjusted EBITDA to net cash provided by operating activities:

|

|

|

Post-IPO

Period |

|

Year ended

December 31,

2014 |

|

|

Reconciliation of Adjusted EBITDA to Net Cash Provided by Operating Activities: |

|

|

|

|

|

|

Adjusted EBITDA |

|

$ |

16,679 |

|

$ |

66,860 |

|

|

Less: |

|

|

|

|

|

|

Interest expense |

|

(466 |

) |

(4,620 |

) |

|

Changes in operating assets and liabilities which provided (used) cash |

|

(11,015 |

) |

(13,488 |

) |

|

Plus: |

|

|

|

|

|

|

Amortization of deferred financing costs |

|

135 |

|

135 |

|

|

Net cash provided by operating activities |

|

$ |

5,333 |

|

$ |

48,887 |

|

The partnership does not provide financial guidance for projected net income or changes in working capital, and, therefore, is unable to provide a reconciliation of its adjusted EBITDA and distributable cash flow guidance to net income, operating income, or net cash flow provided by operating activities, the most comparable financial measures calculated in accordance with GAAP.

Antero Midstream Partners LP is a limited partnership that owns, operates and develops midstream gathering, compression and pipeline assets that service Antero Resources’ production located in the Appalachian Basin in West Virginia, Ohio and Pennsylvania.

This release includes “forward-looking statements” within the meaning of federal securities laws. Such forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond the Partnership’s control. All statements, other than historical facts included in this release, are forward-looking statements. All forward-looking statements speak only as of the date of this release. Although the Partnership believes that the plans, intentions and expectations reflected in or suggested by the forward-looking statements are reasonable, there is no assurance that these plans, intentions or expectations will be achieved. Therefore, actual outcomes and results could materially differ from what is expressed, implied or forecasted in such statements. Nothing in this press release is intended to constitute guidance with regard to Antero Resources.

4

The Partnership cautions you that these forward-looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond our control, incident to the gathering and compression business. These risks include, but are not limited to, commodity price volatility, inflation, environmental risks, drilling and completion and other operating risks, regulatory changes, the uncertainty inherent in projecting future rates of production, cash flow and access to capital, the timing of development expenditures, and the other risks described under “Risk Factors” in this Annual Report on Form 10-K..

For more information, contact Michael Kennedy — VP Finance, at (303) 357-6782 or mkennedy@anteroresources.com.

5

ANTERO MIDSTREAM PARTNERS LP

Consolidated Balance Sheet

December 31, 2013 and 2014

(In thousands)

|

|

|

2013 |

|

2014 |

|

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

— |

|

$ |

230,192 |

|

|

Accounts receivable—affiliate |

|

3,032 |

|

17,646 |

|

|

Prepaid |

|

— |

|

518 |

|

|

Total current assets |

|

3,032 |

|

248,356 |

|

|

Property and equipment: |

|

|

|

|

|

|

Gathering and compressions systems |

|

580,800 |

|

1,180,707 |

|

|

Less accumulated depreciation |

|

(14,324 |

) |

(51,110 |

) |

|

Property and equipment, net |

|

566,476 |

|

1,129,597 |

|

|

Other assets, net |

|

8,581 |

|

17,168 |

|

|

Total assets |

|

$ |

578,089 |

|

$ |

1,395,121 |

|

|

Liabilities and Partners’ capital |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

5,804 |

|

$ |

8,728 |

|

|

Accounts payable—affiliate |

|

— |

|

1,380 |

|

|

Payables for capital expenditures |

|

33,343 |

|

37,208 |

|

|

Accrued liabilities |

|

648 |

|

5,346 |

|

|

Other current liabilities |

|

910 |

|

— |

|

|

Total current liabilities |

|

40,705 |

|

52,662 |

|

|

Long-term liabilities |

|

|

|

|

|

|

Other |

|

4,864 |

|

— |

|

|

Total liabilities |

|

45,569 |

|

52,662 |

|

|

Commitments and contingencies |

|

|

|

|

|

|

Partners’ capital: |

|

|

|

|

|

|

Common unitholders - public (46,000,000 units issued and outstanding) |

|

— |

|

71,665 |

|

|

Common unitholder — Antero Resources (29,940,957 units issued and outstanding) |

|

— |

|

180,757 |

|

|

Subordinated unitholder - Antero Resources (75,940,957 units issued and outstanding) |

|

— |

|

1,090,037 |

|

|

Total partners’ capital |

|

— |

|

1,342,459 |

|

|

Parent net investment |

|

532,520 |

|

— |

|

|

Total capital |

|

532,520 |

|

1,342,459 |

|

|

Total liabilities and partners’ capital |

|

$ |

578,089 |

|

$ |

1,395,121 |

|

6

ANTERO MIDSTREAM PARTNERS LP

Consolidated Results of Operations

December 31, 2013 and 2014

(In thousands)

|

|

|

Year ended December 31, |

|

Amount of |

|

Percentage |

|

|

|

|

2013 |

|

2014 |

|

Increase |

|

Change |

|

|

|

|

($ in thousands, except average realized fees) |

|

|

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

Gathering and compression—affiliate |

|

$ |

22,363 |

|

$ |

95,746 |

|

$ |

73,383 |

|

328 |

% |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

Direct operating |

|

2,079 |

|

15,470 |

|

13,391 |

|

644 |

% |

|

General and administrative (including $15,931 and $8,619 of equity-based compensation in 2013 and 2014, respectively) |

|

23,124 |

|

22,035 |

|

(1,089 |

) |

(5 |

)% |

|

Depreciation |

|

11,346 |

|

36,789 |

|

25,443 |

|

224 |

% |

|

Total operating expenses |

|

36,549 |

|

74,294 |

|

37,745 |

|

103 |

% |

|

Operating income (loss) |

|

(14,186 |

) |

21,452 |

|

35,638 |

|

* |

% |

|

Interest expense |

|

146 |

|

4,620 |

|

4,474 |

|

3,064 |

% |

|

Net income (loss) |

|

$ |

(14,332 |

) |

$ |

16,832 |

|

$ |

31,164 |

|

* |

% |

|

Adjusted EBITDA |

|

$ |

13,091 |

|

$ |

66,860 |

|

$ |

53,769 |

|

411 |

% |

|

Operating Data: |

|

|

|

|

|

|

|

|

|

|

Gathering—low pressure (MMcf) |

|

61,406 |

|

181,727 |

|

120,321 |

|

196 |

% |

|

Gathering—high pressure (MMcf) |

|

11,736 |

|

167,935 |

|

156,199 |

|

1,331 |

% |

|

Compression (MMcf) |

|

9,900 |

|

38,104 |

|

28,204 |

|

285 |

% |

|

Condensate gathering (MBbl) |

|

— |

|

621 |

|

621 |

|

* |

|

|

Gathering—low pressure (MMcf/d) |

|

168 |

|

498 |

|

330 |

|

196 |

% |

|

Gathering—high pressure (MMcf/d) |

|

32 |

|

460 |

|

428 |

|

1,338 |

% |

|

Compression (MMcf/d) |

|

27 |

|

104 |

|

77 |

|

285 |

% |

|

Condensate gathering (MBbl/d) |

|

— |

|

2 |

|

2 |

|

* |

|

|

Average realized fees: |

|

|

|

|

|

|

|

|

|

|

Average gathering—low pressure fee ($/Mcf) |

|

$ |

0.30 |

|

$ |

0.31 |

|

$ |

0.01 |

|

3 |

% |

|

Average gathering—high pressure fee ($/Mcf) |

|

$ |

0.18 |

|

$ |

0.18 |

|

$ |

— |

|

— |

% |

|

Average compression fee ($/Mcf) |

|

$ |

0.18 |

|

$ |

0.18 |

|

$ |

— |

|

— |

% |

|

Average gathering—condensate fee ($/Bbl) |

|

$ |

— |

|

$ |

4.08 |

|

$ |

4.08 |

|

* |

|

7

ANTERO MIDSTREAM PARTNERS LP

Consolidated Statements of Cash Flows

December 31, 2012, 2013 and 2014

(In thousands)

|

|

|

2012 |

|

2013 |

|

2014 |

|

|

Cash flows provided by (used in) operating activities: |

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

(4,586 |

) |

$ |

(14,332 |

) |

$ |

16,832 |

|

|

Adjustment to reconcile net income (loss) to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

Depreciation |

|

1,679 |

|

11,346 |

|

36,789 |

|

|

Equity-based compensation |

|

— |

|

15,931 |

|

8,619 |

|

|

Amortization of deferred financing costs |

|

— |

|

— |

|

135 |

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable—affiliate |

|

(126 |

) |

(2,873 |

) |

(19,465 |

) |

|

Prepaid expenses |

|

— |

|

— |

|

(518 |

) |

|

Accounts payable |

|

— |

|

— |

|

738 |

|

|

Accounts payable—affiliate |

|

— |

|

— |

|

1,059 |

|

|

Accrued liabilities |

|

(119 |

) |

541 |

|

4,698 |

|

|

Net cash provided by (used in) operating activities |

|

(3,152 |

) |

10,613 |

|

48,887 |

|

|

Cash flows used in investing activities: |

|

|

|

|

|

|

|

|

Additions to property and equipment |

|

(115,267 |

) |

(389,340 |

) |

(553,582 |

) |

|

Change in working capital of affiliate related to property and equipment |

|

— |

|

— |

|

(40,277 |

) |

|

Change in other assets |

|

— |

|

(8,581 |

) |

(3,530 |

) |

|

Net cash used in investing activities |

|

(115,267 |

) |

(397,921 |

) |

(597,389 |

) |

|

Cash flows provided by financing activities: |

|

|

|

|

|

|

|

|

Deemed contribution from parent, net |

|

118,446 |

|

388,059 |

|

29,764 |

|

|

Net proceeds from initial public offering |

|

— |

|

— |

|

1,087,224 |

|

|

Distribution to Antero |

|

— |

|

— |

|

(332,500 |

) |

|

Borrowings on bank credit facility |

|

— |

|

— |

|

510,000 |

|

|

Repayments on bank credit facility |

|

— |

|

— |

|

(510,000 |

) |

|

Payments of deferred financing costs |

|

— |

|

— |

|

(4,871 |

) |

|

Payments on capital lease obligations |

|

(27 |

) |

(751 |

) |

(923 |

) |

|

Net cash provided by financing activities |

|

118,419 |

|

387,308 |

|

778,694 |

|

|

Net increase in cash and cash equivalents |

|

— |

|

— |

|

230,192 |

|

|

Cash and cash equivalents, beginning of period |

|

— |

|

— |

|

— |

|

|

Cash and cash equivalents, end of period |

|

$ |

— |

|

$ |

— |

|

$ |

230,192 |

|

|

Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

|

|

Cash paid during the period for interest |

|

$ |

8 |

|

$ |

146 |

|

$ |

4,485 |

|

|

Supplemental disclosure of noncash investing activities: |

|

|

|

|

|

|

|

|

Increase in accrued capital expenditures and accounts payable for property and equipment |

|

$ |

27,721 |

|

$ |

9,003 |

|

$ |

46,327 |

|

8

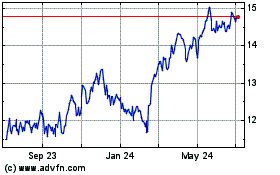

Antero Midstream (NYSE:AM)

Historical Stock Chart

From Mar 2024 to Apr 2024

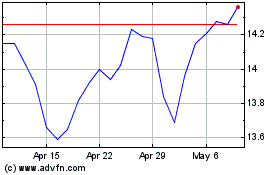

Antero Midstream (NYSE:AM)

Historical Stock Chart

From Apr 2023 to Apr 2024