UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 5, 2015

NN, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

0-23486 |

|

62-1096725 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

| 207 Mockingbird Lane, Johnson City, Tennessee |

|

37604 |

| (Address of principal executive offices) |

|

(Zip Code) |

(423) 743-9151

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d- 2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c)) |

| ITEM 7.01 |

REGULATION FD DISCLOSURE |

On Thursday, February 5, 2015, beginning at 8:30 a.m.

eastern time, NN, Inc. (the “Company”) will host its Investor & Analyst Day in New York City. A copy of the slide presentation for the event is furnished as Exhibit 99.1 to this Current Report on Form 8-K and will also be

accessible through the Company’s website at www.nninc.com in the Investor Relations section under Events and Presentations.

The

information presented in Item 7.01 to this Current Report on Form 8-K is being furnished in accordance with Rule 101(e)(1) under Regulation FD and shall not be deemed to be “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended, and will not be incorporated by reference into any registration statement filed under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated by reference.

| ITEM 9.01 |

FINANCIAL STATEMENTS AND EXHIBITS |

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Investor & Analyst Presentation of NN, Inc., dated February 5, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Date: February 5, 2015

|

|

|

| NN, INC. |

|

|

| By: |

|

/s/ William C. Kelly, Jr. |

| Name: |

|

William C. Kelly, Jr. |

| Title: |

|

Vice President and Chief |

|

|

Administrative Officer |

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Investor & Analyst Presentation of NN, Inc., dated February 5, 2015. |

Exhibit 99.1

2015 Investor Day Conference: Growing into the Future

February 5, 2015

New York Investor Day 2015

Robbie Atkinson

Corporate Treasurer and Investor Relations Manager

History of building and organizing financial infrastructures

Joined NN from Regions Financial Corporation where he held several positions, most recently serving as Vice President of

Commercial Banking in the Corporate Bank Group

Previously held positions at Eaton Corporation and Wells Fargo

Bank

Certified Treasury Professional

Forward-Looking Statement & Disclaimer

Forward Looking Statement: With the exception of the historical information contained in this presentation, the matters

described herein contain forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve a number of risks and uncertainties that may cause

actual results to be materially different from such forward-looking statements. Such factors include, among others, general economic conditions and economic conditions in the industrial sector, competitive influences, risks that current customers

will commence or increase captive production, risks of capacity underutilization, quality issues, availability of raw materials, currency and other risks associated with international trade, the Company’s dependence on certain major customers,

and other risk factors and cautionary statements listed from time to time in the Company’s periodic reports filed with the Securities and Exchange Commission, including, but not limited to, the Company’s Annual Report on 10-K for the

fiscal year ended December 31, 2013.

Disclaimer: NN disclaims any obligation to update any such factors

or to publicly announce the result of any revisions to any of the forward-looking statements included herein or therein to reflect future events or developments.

New York Investor Day 2015

Richard D. Holder

President & CEO

Highly successful history of growing profitable organizations by acquisition, organic growth, and adjacent market growth

Joined NN from Eaton Corporation where he held several leadership positions, most recently serving as President of Eaton

Electrical Components Group

Held leadership positions at US Airways, AlliedSignal and Parker Hannifin

Corporation prior to joining Eaton

Served 10 years in USMC

Agenda

NN: A Diversified Industrial

Company Overview

Strategic Plan Update

Financials / Market Outlook

Group Presentations

Autocam Precision Components (APC) Group

Metal

Bearing Components (MBC) Group

Summary

Question & Answer Session

New Company, No Limits, Endless Opportunities, Growth Beyond End Markets

Building a Diversified Industrial

Hallmarks of a Successful Diversified Industrial

Outgrowing End Markets

Solid Strategy

Transformational Technology

Flawless Execution Techno

Building a Diversified Industrial

Our

Strategy…

Focus on a high precision portfolio and outgrowing end markets

Build a balanced business that earns through the cycle

Invest in and develop transformational technology

Develop a fully integrated operating system that supports all of our businesses

Building a Diversified Industrial

We have made

significant progress against other DIs…

Rank among comparable S/Mid-Cap DIs

Metric Rank

2012—13 2013—14

Sales Growth 8 1 +7

Adjusted Operating Margin

Return on Equity 8 5 +3

Total Return 10 1 +9

P/E Ratio 5 6 -1

but we remain undervalued to our peers

Compared

to 9 S/Mid Cap companies outlined on page 10

Analysis was done on year over year, TTM, and 2 year TTM period

or using 2014 estimates Source: Bloomberg Analytics

9

Building a Diversified Industrial

| 1 |

|

year into the Strategic Period |

16

14

12

10

EV/EBITDA 8

0

S/Mid Cap DIs Premiere DIs

NN Actuant Altra Ametek Circor

Colfax Crane Kaman Park Ohio Worthington

Eaton

ITW Honeywell Danaher

NN multiple based on midpoint of 2015 EBITDA Guidance Source: Bloomberg Analytics

10

Company Overview

11

Corporate Organization

President & CEO

Richard Holder

James Dorton, CFO William Kelly, CCO Thomas Burwell, Controller Gail Nixon, VP HR Robbie Atkinson, Treasurer & IR Scott Weinstein, CIO

Corporate Integration & Transformation

James Widders Daniel Brown Angel Calderon

Metal

Bearing Components

Jeffrey Manzagol

Autocam Precision Components

Warren Veltman

Plastic & Rubber Components

Evelise Faro

Names in Yellow have joined within

the last 15 months

12

Value Proposition

Ability to manufacture

precision products with ultra tight tolerances in high volume

Total product life cycle

Established global footprint

Highly specialized skill and engineering in bearing components and precision machining

Significant proprietary knowledge and trade secrets

Leading manufacturer of high precision components

13

Differentiation

High precision manufacturing

Operating tolerances of <1 micron

Specialty machine building and in-house tooling leading to significant competitive advantages – trade secrets

Application specific customer design

Repeatable

high volume global manufacturing in millions of parts per day

Zero defect process design, extendable to

additional industry platforms

14

Global Footprint

- Metal Bearing Components

- Autocam Precision Components

- Plastic & Rubber Components

-

Corporate Headquarters

25 high precision manufacturing facilities on 4 continents

15

2014 Strategic Progress

16

2014 at a Glance

January: Presented our strategic

plan with goals to double revenue and triple EPS by 2018

—, , IL and Juarez, Mexico

June: Acquired tapered roller manufacturer RFK, located in Bosnia & Herzegovina

July: Acquired the assets of Chelsea Grinding Company, a cylindrical roller manufacturer

September: Acquired Autocam, a high precision manufacturer with locations on 4 continents

2014: Achieved strategic goal of 3% organic and 5% adjacent market expansion

We are ahead of schedule on the Strategic Plan

17

Foundation for Growth

Five new Board appointments

since 2012

New President & CEO in 2013, key management retained

Developed Treasury, FP&A, Supply Chain, Shared Services and

IT group infrastructure

Design of the NN Operating System

Enhanced

management bandwidth with acquisitions

The fundaments of our plan have not changed. We will continue to

deliver on our commitments.

18

Strategic Plan Progress

Segment Mix

21%

9%

9%

70%

51%

43%

52%

39%

6%

10

9%

Metal Bearing Components Plastic &

Rubber Components Autocam Precision Components

The fundaments of our plan have not changed. We will continue

to deliver on our commitments.

19

Strategic Plan Progress

2013

2014

2018

4%

5%

5%

8%

10%

8%

17%

70%

9%

31%

60%

50%

39%

52%

32%

End Market Mix

Light Auto Industrial/Aerospace/Medical

Commercial Transportation General/Plastics

The

fundaments of our plan have not changed. We will continue to deliver on our commitments.

20

Strategic Plan Accomplishments in 2014

Corporate

Identity and Branding

Operational Excellence

Functional Excellence

One Corporate Identity Enhanced Marketing Common Customer Solutions

Top Down Strategy

New Supply Chain Operations

Financial and Business Systems Consolidation

Level 3: Offset Economic Costs Quality: Drive a Zero Defect Culture Safety: Drive a Zero Incident Culture Delivery: Exceed

Customers’ Expectations

21

Today

2015 forecasted revenue of $690M—$710M

Traded on Nasdaq (NNBR)

Global reach, local depth

25 manufacturing

facilities with operations in 10 countries

4,200 employees

Continuous investment in technology leadership

Supplying to diversified end markets in over 30 countries

NN founded in Erwin, TN

Industrial

Molding

Corporation

Euroball

Delta Rubber

Company

Veenendaal

SNR Ball

Assets

Whirlaway

Corporation

V-S

Industries

RFK

Chelsea

Grinding

Autocam

22

Road to $1 Billion

$ Millions

$1,000 $1,000 $1,000

$926

$900

$800

$772

$700

$680

$600

$500

$400

$373

$300

$200 2013 Base 2018

2014 Full Year Pro Forma Revenue

Organic Growth

3% per Year

Adjacent Markets

5% per Year

Acquisitions

Outpace the Market with Expanded Focus and Investment

$1+ billion in revenue

~$75 million planned

acquisitions

~$245 million from organic and adjacent market growth based on enhanced R&D and market

presence

Improving segment operating margins: 2013 2018

Metal Bearing Components: 10.7% 17.4%

Autocam Precision Components: 11.6% 16.0%

Plastic

and Rubber Components: 2.0% 12.0%

NN will be growing revenue 270% and EPS 400% over the Strategic Plan years

23

New York Investor Day 2015

James H. Dorton

Senior Vice President & Chief Financial Officer

30+ year career in public company financial management

Joined NN in 2005 as CFO after serving as CFO of Specialty Foods Group

Previously held several leadership positions at Bowater, Inc. and Intergraph Corporation, including Treasurer, and VP of

Corporate Development.

Certified Public Accountant

24

Expanding Operating Margins

18

16

14

12

10

0

APC MBC PRC

2013 Operating Margin 2018 Operating Margin

25

Strategic Building Blocks 2018

31.9%

EPS CAGR

18.2%

ROIC

21.8%

Sales CAGR

37.5%

Operating Income CAGR

25.8%

Manufacturing Margin

26

Today & Future Vision – Segment Mix

2014

Revenue = $680M*

2018

Revenue = $1B

Metal Bearing Components

Plastic &

Rubber Components

Autocam Precision Components

*Proforma full year consolidated revenue

27

Today & Future Vision – End Markets

2014

Revenue = $680M*

2018

Revenue = $1B

5% 0%

8%

17%

[PERCENTAGE]

10% 0%

8%

[PERCENTAGE]

32%

Light Auto

Industrial/Aerospace/Medical

Commercial

Transportation

General/Plastics

*Proforma full year consolidated revenue

28

Macro Trends

Positioned to become the feeder

company of choice in our markets

Tier 1 and Tier 2 suppliers are concentrating on purchasing with fewer,

larger suppliers

Supply chain localization continues to gain momentum

Low cost oil is an economic stimulus

CAFE Standards driving global innovation

29

Macro Trend: CAFE Standards

Global Fuel

Efficiency Standards

U.S. fuel efficiency requirements increase from 35 MPG in 2014 to 56 MPG in 2025 ? 60%

higher

The EU’s 2020 requirement of 77 MPG is ~40% higher than the U.S. same-year requirement

China and Japan will both require fuel efficiency to reach 50 MPG or above by 2020

Rapidly increasing standards are driving OEMs to accelerate new technology development

Technology Increase in Fuel Efficiency

Direct fuel Injection / High Pressure Diesel 15-30% Multi-Speed Transmissions (6-9 gears) 5-10% Variable Valve Timing / Variable Cam Timing 4-6%

Electric Power Steering 1 mpg

Source: ICCT

30

Financial Strategy / Policy

Build upon a strong,

global operating platform while maintaining financial strength and flexibility

Financial policy:

Maintain healthy leverage over business cycles and strategic growth period: Debt to EBITDA 2.0x – 3.0x, < 4.0x at

peak

Cash flow priorities:

1) Debt repayment to achieve target leverage

2)

Capex to achieve operational excellence and growth

3) Stable common dividends to shareholders (< 20% free

cash flow)

4) Strategic acquisitions financed by debt and equity issuance to maintain leverage target

Generate above-market-average revenue growth and capture market share in key areas of new technology over

Strategic Plan period

Improve market mix by decreasing auto exposure from 70% to 50%

Increase industrial /aerospace/medical offerings in existing product lines

Expand segment gross and operating margins (optimize mix, operational improvement, cost reductions)

Continue to invest in R&D

Continue to pursue selective strategic acquisitions to diversify end markets and expand global reach, within leverage targets

31

32

New York Investor Day 2015

Warren A. Veltman

Senior Vice President & Autocam Precision Components Group

31 year career in financial management

Joined NN in 2014 after serving as CFO of Autocam since 1990

During his career at Autocam Mr. Veltman helped steer the company through an IPO, and through several iterations under private equity ownership

Deloitte & Touche including Audit Manager

33

APC Group Organization

John Buchan

Vice President Operations

Ed Hekman

Vice President Business Development

Mark Scott

Director of Finance

Robert Fraser

Director of Information Systems

Mike Clay

Technical Director

Years with Autocam

Industry Experience

34

APC Group Overview

Produce complex close

tolerance precision components through highly engineered process technologies and advanced machining development

Target transportation and general industry segments whose advancing technologies provide expanding growth opportunities

and result in a balanced economic cycle portfolio

Our customers value our engineered process technologies,

global footprint, and flexible production system allowing full life cycle management across many volume/mix scenarios

35

Marshall, MI (2)

Kentwood, MI (2)

Wheeling, IL

Juárez, Mexico

Marnaz, France

Dowagiac, MI

Wellington, OH (2)

Kamienna Góra, Poland

São João da Boa Vista, Brazil (2)

Boituva, Brazil

Wuxi, China

Wuxi, China (JV)

Strong global footprint allows NN to serve customers around the world

36

Market Size: Fuel Saving Segment

Product

Segments, Markets and Customers

Fuel Systems Powertrain Power Steering Electric Motors

Addressable

$2 billion $1 billion $500 million $300 million

Market (2014)

17% 13% 10% 10%

Market Growth

CAGR CAGR CAGR CAGR

Technologies GDI Conversion VVT/VCT More Electric

EPS (Steering)

Driving Growth Diesel Conversion Multi-Speed Trans Motors per Vehicle

Customers

General Other

Industrial 3%

Electric 10%

Motor

9%

Automotive Fuel

Chassis 38%

4%

Powertrain

22% Power

Steering

14%

2014

New Technologies, New Growth Opportunities

37

Target Segments: Fuel Saving Technologies

GDI HP

Diesel VCT/VVT Multi-Speed Trans EPS

MPG Increase + 15—20% (1) + 20—30% (1) + 4—6%

(2) + 5—10% (3) + 3—5% (4)

CPV Impact + $54 (1) + $89 (1) + $10 (2) + $20

(3) + $4 (4)

Market Growth > 17% CAGR > 10% CAGR > 10% CAGR > 15% CAGR > 10% CAGR

Global Adoption (5) (6)

27% / 46% 20% / 30% 72% / 95% 30% / 45% 50% / 75%

Rate 2014/2018

Key Regions /

Markets

Technologies needed on a global scale to meet fuel economy regulations

Conversion/implementation rates will outpace market growth

All of these technologies require numerous high precision metal components

38

Segments: General Industrial, Aerospace

Product

Segments, Markets & Customers

Consumer Tools HVAC Rec/ATV Industrial Motors Aerospace Fluid Power

Addressable

$2 billion $3 billion $200 million $3 billion $10+ billion $5+ billion

Market (2014)

Market Growth

Technologies Longer battery life, EPS (Steering) Higher pressure, greater

Compressor modulation High efficiency motors Weight reduction

Driving Growth Lighter weight ABS control

Customers

39

APC Customer Profile

40

Sales Growth Path – China JV

Wuxi Weifu

Autocam Precision Machinery Co. Ltd.

• JV Partner - Wuxi Weifu High-Technology Co., Ltd., publically

traded on the Shenzhen Stock Exchange

• Location — Wuxi, China

• Business Purpose— manufacture high-precision automotive parts

for relevant domestic manufacturers

• APC Group

o 49% ownership

o Appoints General Manager of Operations

o Primary source of machining technology

o

Investment accounting - equity method

o Annual cash dividend representing 70% of prior years net income has

historically been paid

Started with MPFI parts and have transitioned to GDI and HP Diesel

Strong YOY growth, 28% CAGR

28% CAGR

2009 2012 2013 2014 2015 2016 2017 2018

41

41

APC: Road to $500 Million

$ Millions

$500 $500 $500

$480

$475

$450

$425 $425

$400

$375

$350 $348

$325

$300

$200 2014 Base 2018

End of Life Projects

$30 million

Fuel Saving Technologies Growth

$107 million

Adjacent Markets

General Industrial $55 million

Strategic

Acquisition

$20 million

Outpace the Market with Expanded Focus and Investment

$500 million in revenue

$107 million in organic

growth

$55 million in adjacent market expansion

$20 million in strategic acquisitions

Enhanced R&D and market presence

Improving

segment operating margins: 2013 ?2018

Precision Metal Components: 11.6% ?16.00%

42

APC Summary

Experienced management

Technology leader

Targeted growth markets

o Transportation –

fuel savings technologies

o General industrial

o Aerospace

Global footprint

Full life cycle management

Our customers value our engineered process technologies, global footprint, and flexible production system

allowing full life cycle management across many volume/mix scenarios

43

Metal Bearing Components

44

New York Investor Day 2015

Jeffrey Manzagol

Senior Vice President, Metal Bearing Components Group

Joined NN from Kaydon Corporation where he served as President of the Bearings Division from 2005 to 2014, leading their

penetration into Renewable Energy and their acquisition of Avon Bearings

Started his career with The Timken

Company and then held a variety of leadership positions during 24 years with SKF, working in both the automotive and industrial markets, both domestically and internationally

Served as Chairman of the American Bearing Manufacturers Association from 2010 to 2012

45

MBC Group Organization

Rob Heinrich

Jeff Manzagol

Senior Vice President

Vice President Global

Rollers Div.

Dario Galetti

Vice President Global Balls Div.

Jeff Hodge

Vice President Business Development

Trevor Lynch

Group Controller

Mike Hand

Vice President Global Sales

46

MBC Group Overview

Global Leader in the Supply of

Precision Components to the Bearing Industry and other Related Applications

o Precision Balls o Precision

Rollers o Stamped Metal Components

World Class Performance in Quality, Delivery and Cost Management

7 Factories in 6 Countries

2 Centers of Excellence

o Process and Product

Development o Italy and The Netherlands

47

MBC Global Footprint

Pinerolo, Italy

Erwin, TN Mountain City, TN

Kysucke Nove Mesto, Slovakia

Veenendaal,

Netherlands

Konjic, Bosnia

Kunshan, China

Strong global footprint allows NN to serve customers around the world

48

Global Market Size

Product Segments, Markets and

Customers

Automotive Aerospace Railway Linear Systems Fluid Power

Addressable

$1 billion $250 million $125 million $100 million $100 million

Market (2014)

Market Growth

Growth Drivers Penetration in Build rate on Increased utilization Expanding industrial Manufacturing

developing markets commercial aircraft of rail automation investment

Customers

2014

Industrial

35%

65%

Automotive

2018

Industrial

58%

Automotive

49

MBC High Growth Product Segments

Competitive

Profile

Primary Markets

Market Growth

Key

Regions/Markets

Balls Tapered Rollers Other Rollers Cages Sheet Metal Parts

Primarily outsourced

Automotive, electrical aero

and industrial

Automotive growth in developing markets

Primarily insourced

Industrial, automotive, off-highway, rail and industrial Developing trend towards outsourcing

Primarily insourced

Industrial and some

automotive

Industrial investment and aftermarket demand

Mixed and fragmented

General industrial

Follows the roller markets

Mixed and fragmented

Diversified end market

Niche market within

automotive

Growth in developing markets will drive end market expansion

Expansion of content into broader industrial markets

Outsourcing will create significant opportunities

50

MBC Customer Profiles

51

MBC: Road to $400 Million

$ Millions

$400

$400

$390

$375

$350

$325 $326

$300 $290

$275

$250

$225

2014 Base 2018

End of Life Projects

$20 million

Organic Growth

$36 million

Adjacent Markets

$63 million

Strategic Acquisition

$20 million

Outpace the Market with Expanded Focus and Investment

$400 million in revenue

$36 million in organic

growth

$63 million in adjacent market growth

$20 million from additional acquisitions

Enhanced R&D and market presence

Improving

segment operating margins: 2013 ?2018

Metal Bearing Components: 10.7% ?17.4%

Outgrowing end markets while expanding margins

52

MBC Summary

Strategic Priorities:

Exploit the roller outsourcing trend

Expand our range in industrial and aerospace bearings

Expand capacity in developing markets

Expand in

non-bearing applications

53

Wrap Up & Summary

54

Road to $1 Billion

$ Millions

$1,000 $1,000 $1,000

$926

$900

$800

$772

$700

$680

$600

$500

$400

$373

$300

$200 2013 Base 2018

2014 Full Year Pro Forma Revenue

Organic Growth

3% per Year

Adjacent Markets

5% per Year

Acquisitions

Outpace the Market with Expanded Focus and Investment

$1+ billion in revenue

~$75 million planned

acquisitions

~$245 million from organic and adjacent market growth based on enhanced R&D and market

presence

Improving segment operating margins: 2013 ? 2018

Metal Bearing Components: 10.7% ? 17.4%

Autocam Precision Components: 11.6% ? 16.0%

Plastic and Rubber Components: 2.0% ? 12.0%

NN will be growing revenue 270% and EPS 400% over the Strategic Plan years

55

Summary – NN, a Diversified Industrial

all

our business groups

the parts

Bringing the best of NN to all our markets

56

57

2015 Investor Day Conference: Growing into the Future

February 5, 2015

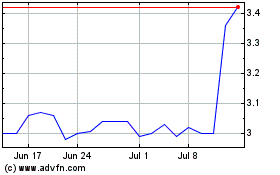

NN (NASDAQ:NNBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

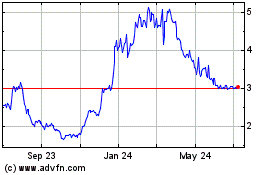

NN (NASDAQ:NNBR)

Historical Stock Chart

From Apr 2023 to Apr 2024