UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 27, 2015

ACCURAY INCORPORATED

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

|

001-33301 |

|

20-8370041 |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

1310 Chesapeake Terrace

Sunnyvale, California 94089

(Address of principal executive offices, including Zip Code)

Registrant’s telephone number, including area code: (408) 716-4600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On January 27, 2015, Accuray Incorporated (the “Company”) issued a press release announcing its financial results for the quarter ended December 31, 2014. A copy of the Company’s press release dated January 27, 2015, titled “Accuray Reports Financial Results for Second Quarter of Fiscal Year 2015” is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The foregoing information (including the exhibit hereto) is being furnished under “Item 2.02 Results of Operations and Financial Condition” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Number |

|

Description |

|

99.1 |

|

Press Release dated January 27, 2015, titled “Accuray Reports Financial Results for Second Quarter of Fiscal Year 2015” |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ACCURAY INCORPORATED |

|

|

|

|

Dated: January 27, 2015 |

By: |

/s/ Gregory Lichtwardt |

|

|

|

Gregory E. Lichtwardt |

|

|

|

Executive Vice President, Operations &

Chief Financial Officer |

3

EXHIBIT INDEX

|

Number |

|

Description |

|

99.1 |

|

Press Release dated January 27, 2015, titled “Accuray Reports Financial Results for Second Quarter of Fiscal Year 2015” |

Exhibit 99.1

|

Doug Sherk

Investor Relations, EVC Group

+1 (415) 652-9100

dsherk@evcgroup.com |

|

Beth Kaplan

Public Relations Director, Accuray

+1 (408) 789-4426

bkaplan@accuray.com |

Accuray Reports Financial Results for Second Quarter of Fiscal Year 2015

SUNNYVALE, Calif., January 27, 2015 — Accuray Incorporated (Nasdaq: ARAY) announced today financial results for the second fiscal quarter and six months ended December 31, 2014.

Second Quarter Highlights

· Generates improved order volume with gross orders of $72.3 million

· Increases total revenue by 5% to $98.2 million from year ago period

· Expands service gross profit margins sequentially to 36% from 31%

· Achieves adjusted EBITDA of $3.7 million

“Our fiscal second quarter results illustrate the progress our team is making in executing our plan. The company’s gross system order volume increased as expected and supports our belief that we will see gross orders in the second half of the fiscal year grow at a rate faster than the overall market,” said Joshua H. Levine, president and chief executive officer of Accuray. “Additionally, the trends in the business enable us to reaffirm our full fiscal year financial guidance despite foreign currency headwinds that have materially reduced our overall year-to-date revenue results. The Accuray team remains focused on generating profitable revenue growth, expanding gross profit margins and ultimately driving sustained cash flow and profitability for all of our stakeholders.”

Financial Highlights

Gross product orders totaled $72.3 million for the second fiscal quarter, a decrease of $8.0 million or 10% from the second quarter of the prior fiscal year. On a constant currency basis, gross product orders for the current year fiscal quarter would have totaled $74.4 million. Ending product backlog was $358 million or approximately 1% lower than backlog at the end of the prior fiscal year second quarter.

Total revenue reached $98.2 million, representing an increase of 5%, or 9% on a constant currency basis, from the prior fiscal year second quarter. The Americas region total revenues were $45.7 million, an increase of 31% from the prior fiscal year second quarter.

Total revenues outside the Americas region were $52.5 million, a decrease of 11% from the prior fiscal year second quarter. Product revenues totaled $47.7 million and represented an increase of 6% from the prior fiscal year second quarter while service revenues totaled $50.5 million, an increase of 4% over the prior fiscal year second quarter.

Total gross profit for the second quarter of fiscal 2015 was $38.5 million or 39% of sales comprised of product gross margin of 43% and service gross margin of 36%. This compares to total gross margin of 41%, product gross margin of 45% and service gross margin of 37% for the prior fiscal year second quarter. Total gross margin for the second quarter of fiscal 2015 would have been 41% on a constant currency basis as compared to the prior year period.

Operating expenses were $42.1 million, reflecting an increase of 8% compared with $38.9 million in the prior fiscal year second quarter. Included in other income and expense is a foreign exchange loss of approximately $1.5 million. Selling and marketing expenses rose 11% against the prior fiscal year second quarter due to the growth and compensation of the sales force that occurred in the prior fiscal year. General and administrative expenses also grew 10% primarily due to legal costs incurred in the second fiscal quarter of 2015.

Net loss was $10.0 million, or $0.13 per share for the second quarter of fiscal 2015, compared to a net loss of $5.4 million, or $0.07 per share, for the prior fiscal year second quarter.

Adjusted EBITDA for the second quarter of 2015 was $3.7 million, compared to $6.8 million in the prior fiscal year second quarter.

Cash, cash equivalents, and investments were $150.8 million as of December 31, 2014, a decrease of $1.9 million from September 30, 2014.

Six Month Highlights

For the six months ended December 31, 2014, total revenue reached $180.5 million, representing an increase of 6%, or 9% on a constant currency basis, from the comparable period of fiscal year 2014. Product revenue for the six month period was $80.7 million, representing an increase of 8% while service revenue was $99.9 million, representing 5% growth over the comparable prior fiscal year period.

Gross profit margin for the six months ended December 31, 2014 was 37%, comprised of product gross margin of 41% and service gross margin of 34%. This compares to total gross margin of 38% for the comparable prior fiscal year period. Total gross margin for the six months ended December 31, 2014 would have been 38% on a constant currency basis as compared to the comparable prior fiscal year period.

Operating expenses were $85.2 million for the six months ended December 31, 2014, compared with $77.7 million in the comparable prior fiscal year period.

Net loss for the six months ended December 31, 2014 was $31.6 million, or $0.41 per share, compared to a net loss of $21.0 million, or $0.28 per share, for the comparable prior fiscal year period.

Adjusted EBITDA for the six months ended December 31, 2014 was a loss of $4.8 million, compared to a profit of $3.0 million in the comparable prior fiscal year period.

2015 Financial Guidance

Accuray reaffirmed its financial guidance for fiscal year 2015 as follows: total revenue of $390.0 million to $410.0 million and adjusted EBITDA of $18.0 million to $27.0 million.

2

Conference Call Information

Accuray will host a conference call beginning at 1:30 p.m. PT/4:30 p.m. ET today to discuss these results. Conference call dial-in information is as follows:

· U.S. callers: (888) 539-3612

· International callers: (719) 325-2494

· Conference ID Number (U.S. and international): 7150733

Individuals interested in listening to the live conference call via the Internet may do so by logging on to the company’s website, www.accuray.com. In addition, a dial-up replay of the conference call will be available beginning January 27, 2015 at 5:00 p.m. PT/8:00 p.m. ET and ending February 5, 2015. The replay telephone number is 1-888-203-1112 (USA) or 1-719-457-0820 (International), Conference ID: 7150733.

Use of Non-GAAP Financial Measures

The company has supplemented its GAAP net loss with a non-GAAP measure of adjusted earnings before interest, taxes, depreciation, amortization and stock-based compensation (“adjusted EBITDA”). Management believes that this non-GAAP financial measure provides useful supplemental information to management and investors regarding the performance of the company and facilitates a more meaningful comparison of results for current periods with previous operating results. A reconciliation of GAAP net loss (the most directly comparable GAAP measure) to non-GAAP adjusted EBITDA is provided in the schedule below.

There are limitations in using this non-GAAP financial measure because it is not prepared in accordance with GAAP and may be different from non-GAAP financial measures used by other companies. This non-GAAP financial measure should not be considered in isolation or as a substitute for GAAP financial measures. Investors and potential investors should consider non-GAAP financial measures only in conjunction with the company’s consolidated financial statements prepared in accordance with GAAP and the reconciliations of the non-GAAP financial measure provided in the schedule below.

About Accuray

Accuray Incorporated (Nasdaq: ARAY) is a radiation oncology company that develops, manufactures and sells precise, innovative treatment solutions that set the standard of care with the aim of helping patients live longer, better lives. The company’s leading-edge technologies deliver the full range of radiation therapy and radiosurgery treatments. For more information, please visit www.accuray.com.

Safe Harbor Statement

Statements made in this press release that are not statements of historical fact are forward-looking statements and are subject to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this press release relate, but are not limited, to the company’s future results of operations, including management’s expectations regarding growth in gross orders, gross profit margins, revenues and adjusted EBITDA, ability to meet financial targets, and Accuray’s leadership position in radiation oncology innovation and technologies. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from expectations, including but not limited to: the company’s ability to convert backlog to revenue; the success of the adoption of our CyberKnife and TomoTherapy Systems; the successful commercialization of

3

the company’s new technologies; the company’s ability to manage its expenses; continuing uncertainty in the global economic environment; and other risks detailed from time to time under the heading “Risk Factors” in the company’s report on Form 10-K, which was filed on August 29, 2014, the company’s report on Form 10-Q which was filed on November 7, 2014, and the company’s other filings with the SEC.

Forward-looking statements speak only as of the date the statements are made and are based on information available to the company at the time those statements are made and/or management’s good faith belief as of that time with respect to future events. The company assumes no obligation to update forward-looking statements to reflect actual performance or results, changes in assumptions or changes in other factors affecting forward-looking information, except to the extent required by applicable securities laws. Accordingly, investors should not put undue reliance on any forward-looking statements.

###

Financial Tables to Follow

4

Accuray Incorporated

Consolidated Statements of Operations

(in thousands, except per share data)

(Unaudited)

|

|

|

Three Months Ended

December 31, |

|

Six Months Ended

December 31, |

|

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Orders |

|

$ |

72,261 |

|

$ |

80,294 |

|

$ |

131,024 |

|

$ |

143,692 |

|

|

Net Orders |

|

41,474 |

|

59,366 |

|

73,756 |

|

119,429 |

|

|

Order Backlog |

|

357,831 |

|

362,044 |

|

357,831 |

|

362,044 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net revenue: |

|

|

|

|

|

|

|

|

|

|

Products |

|

$ |

47,650 |

|

$ |

45,148 |

|

$ |

80,665 |

|

$ |

74,716 |

|

|

Services |

|

50,505 |

|

48,486 |

|

99,871 |

|

95,559 |

|

|

Total net revenue |

|

98,155 |

|

93,634 |

|

180,536 |

|

170,275 |

|

|

Cost of revenue: |

|

|

|

|

|

|

|

|

|

|

Cost of products |

|

27,171 |

|

24,980 |

|

47,836 |

|

43,581 |

|

|

Cost of services |

|

32,495 |

|

30,483 |

|

66,410 |

|

62,045 |

|

|

Total cost of revenue |

|

59,666 |

|

55,463 |

|

114,246 |

|

105,626 |

|

|

Gross profit |

|

38,489 |

|

38,171 |

|

66,290 |

|

64,649 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

Research and development |

|

13,917 |

|

13,435 |

|

28,066 |

|

26,385 |

|

|

Selling and marketing |

|

15,802 |

|

14,262 |

|

33,776 |

|

28,716 |

|

|

General and administrative |

|

12,361 |

|

11,190 |

|

23,311 |

|

22,550 |

|

|

Total operating expenses |

|

42,080 |

|

38,887 |

|

85,153 |

|

77,651 |

|

|

Loss from operations |

|

(3,591 |

) |

(716 |

) |

(18,863 |

) |

(13,002 |

) |

|

Other expense, net |

|

(5,528 |

) |

(3,775 |

) |

(10,989 |

) |

(6,235 |

) |

|

Loss before provision for income taxes |

|

(9,119 |

) |

(4,491 |

) |

(29,852 |

) |

(19,237 |

) |

|

Provision for income taxes |

|

873 |

|

950 |

|

1,790 |

|

1,737 |

|

|

Net loss |

|

$ |

(9,992 |

) |

$ |

(5,441 |

) |

$ |

(31,642 |

) |

$ |

(20,974 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share - basic and diluted |

|

$ |

(0.13 |

) |

$ |

(0.07 |

) |

$ |

(0.41 |

) |

$ |

(0.28 |

) |

|

Weighted average common shares used in computing loss per share: |

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

77,924 |

|

75,280 |

|

77,607 |

|

74,990 |

|

Accuray Incorporated

Consolidated Balance Sheets

(in thousands)

(Unaudited)

|

|

|

December 31, |

|

June 30, |

|

|

|

|

2014 |

|

2014 |

|

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

97,273 |

|

$ |

92,346 |

|

|

Investments |

|

53,517 |

|

79,553 |

|

|

Restricted cash |

|

1,436 |

|

1,492 |

|

|

Accounts receivable, net |

|

62,987 |

|

72,152 |

|

|

Inventories |

|

104,490 |

|

87,752 |

|

|

Prepaid expenses and other current assets |

|

15,076 |

|

17,873 |

|

|

Deferred cost of revenue |

|

11,960 |

|

13,302 |

|

|

Total current assets |

|

346,739 |

|

364,470 |

|

|

Property and equipment, net |

|

30,830 |

|

34,391 |

|

|

Goodwill |

|

58,015 |

|

58,091 |

|

|

Intangible assets, net |

|

19,541 |

|

23,517 |

|

|

Deferred cost of revenue |

|

2,220 |

|

2,899 |

|

|

Other assets |

|

10,220 |

|

11,820 |

|

|

Total assets |

|

$ |

467,565 |

|

$ |

495,188 |

|

|

Liabilities and equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

15,980 |

|

$ |

15,639 |

|

|

Accrued compensation |

|

19,482 |

|

32,569 |

|

|

Other accrued liabilities |

|

24,478 |

|

24,464 |

|

|

Customer advances |

|

19,673 |

|

19,804 |

|

|

Deferred revenue |

|

92,495 |

|

92,093 |

|

|

Total current liabilities |

|

172,108 |

|

184,569 |

|

|

Long-term liabilities: |

|

|

|

|

|

|

Long-term other liabilities |

|

10,483 |

|

6,593 |

|

|

Deferred revenue |

|

9,875 |

|

9,866 |

|

|

Long-term debt |

|

199,152 |

|

195,612 |

|

|

Total liabilities |

|

391,618 |

|

396,640 |

|

|

Commitment and contingencies |

|

|

|

|

|

|

Equity: |

|

|

|

|

|

|

Common stock |

|

78 |

|

77 |

|

|

Additional paid-in capital |

|

461,995 |

|

451,750 |

|

|

Accumulated other comprehensive income |

|

610 |

|

1,815 |

|

|

Accumulated deficit |

|

(386,736 |

) |

(355,094 |

) |

|

Total equity |

|

75,947 |

|

98,548 |

|

|

Total liabilities and equity |

|

$ |

467,565 |

|

$ |

495,188 |

|

Accuray Incorporated

Reconciliation of GAAP net loss to Adjusted Earnings Before Interest, Taxes, Depreciation,

Amortization and Stock-Based Compensation (Adjusted EBITDA)

(In thousands)

(Unaudited)

|

|

|

Three Months Ended

December 31, |

|

Six Months Ended December

31, |

|

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

GAAP net loss |

|

$ |

(9,992 |

) |

$ |

(5,441 |

) |

$ |

(31,642 |

) |

$ |

(20,974 |

) |

|

Amortization of intangibles (a) |

|

1,988 |

|

2,201 |

|

3,976 |

|

4,403 |

|

|

Depreciation (b) |

|

2,994 |

|

2,927 |

|

5,984 |

|

6,173 |

|

|

Stock-based compensation (c) |

|

3,854 |

|

2,803 |

|

7,127 |

|

4,983 |

|

|

Interest expense, net (d) |

|

4,023 |

|

3,341 |

|

8,011 |

|

6,647 |

|

|

Provision for income taxes |

|

873 |

|

950 |

|

1,790 |

|

1,737 |

|

|

Adjusted EBITDA |

|

$ |

3,740 |

|

$ |

6,781 |

|

$ |

(4,754 |

) |

$ |

2,969 |

|

(a) consists of amortization of intangibles - developed technology, distributor licenses and backlog

(b) consists of depreciation, primarily on property and equipment

(c) consists of stock-based compensation in accordance with ASC 718

(d) consists primarily of interest income from available-for-sale securities and interest expense associated with our convertible notes

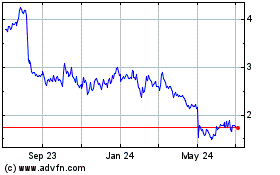

Accuray (NASDAQ:ARAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

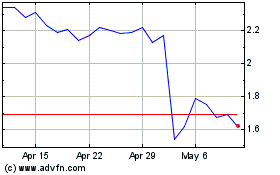

Accuray (NASDAQ:ARAY)

Historical Stock Chart

From Apr 2023 to Apr 2024