Current Report Filing (8-k)

January 26 2015 - 4:09PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 24, 2015

Accretive Health, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

001-34746 |

|

02-0698101 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 401 North Michigan Avenue, Suite 2700, Chicago, Illinois |

|

60611 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (312) 324-7820

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers.

On January 24, 2015, Accretive Health, Inc. (the “Company”) appointed Richard B. Evans, Jr.,

age 47, as its Senior Vice President, Corporate Controller and Principal Accounting Officer. From July 2001 until September 2014, Mr. Evans was an audit partner at KPMG LLP with responsibility for financial statement and internal control

audits. Mr. Evans joined KPMG in 1990 and advanced through multiple management roles during his twenty-four years with that firm. From October 2014 through January 2015, Mr. Evans focused on family matters.

In connection with his appointment, Mr. Evans and the Company entered into an offer letter pursuant to which Mr. Evans is entitled to an annual base

salary of $300,000, and is eligible for a discretionary cash bonus with a target equal to 40% of his annual base salary (prorated for 2015). Pursuant to the offer letter, Mr. Evans will also be granted a nonqualified stock option to purchase up

to 50,000 shares of the Company’s common stock pursuant to the Company’s 2010 Stock Incentive Plan, with an exercise price equal to the closing price of the Company’s common stock reported through the facilities of the OTC Markets

Group Inc. on the grant date (the “Stock Option”). The Stock Option will vest and become exercisable over a four-year period based on continued service to the Company and will expire on the tenth anniversary of grant. In addition,

Mr. Evans will be eligible to receive discretionary annual long term incentive equity grants from the Company with a target equal to 30% of his base salary. Pursuant to the Company’s severance plan, in the event that Mr. Evans’s

employment with the Company is terminated other than for “cause,” in addition to any earned but unpaid salary and his accrued and vested benefits under the employee benefit programs of the Company, Mr. Evans also will be entitled to

receive a cash amount equal to his monthly base salary rate, paid monthly for a period of six months following the date of such termination.

Mr. Evans does not have any family relationships with any director or executive officer of the Company.

There are no transactions between Mr. Evans and the Company that are required to be reported under Item 404(a) of Regulation S-K.

(b)

On January 24, 2015, in connection with the

Company’s appointment of Mr. Evans as Corporate Controller and Principal Accounting Officer, Peter Csapo resigned as the Company’s Principal Accounting Officer, but remains the Company’s Chief Financial Officer and Treasurer.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

ACCRETIVE HEALTH, INC. |

|

|

|

|

| Date: January 26, 2015 |

|

|

|

By: |

|

/s/ Peter P. Csapo, CPA |

|

|

|

|

|

|

Peter P. Csapo, CPA |

|

|

|

|

|

|

Chief Financial Officer and Treasurer |

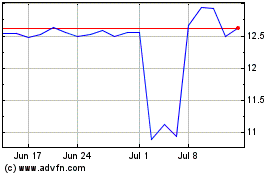

R1 RCM (NASDAQ:RCM)

Historical Stock Chart

From Mar 2024 to Apr 2024

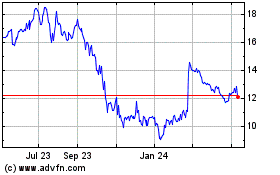

R1 RCM (NASDAQ:RCM)

Historical Stock Chart

From Apr 2023 to Apr 2024