UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED): JANUARY 14, 2015

Commission File Number: 0-24260

AMEDISYS, INC.

(Exact

Name of Registrant as specified in its Charter)

|

|

|

| Delaware |

|

11-3131700 |

| (State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

5959 S. Sherwood Forest Blvd., Baton Rouge, LA 70816

(Address of principal executive offices, including zip code)

(225) 292-2031 or (800) 467-2662

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

SECTION 7 – REGULATION FD

ITEM 7.01. REGULATION FD DISCLOSURE

As of

January 14, 2015, representatives of Amedisys, Inc. (the “Company”) will begin making presentations at investor conferences using slides containing the information attached to this Current Report on Form 8-K as Exhibit 99.1. The

Company expects to use these slides, in whole or in part, and possibly with modifications, in connection with presentations to investors, analysts and others during 2015.

By filing this report on Form 8-K and furnishing this information, the Company makes no admission as to the materiality of any information in this report that

is required to be disclosed solely by reason of Regulation FD.

The information contained in the slides is summary information that is intended to be

considered in the context of the Company’s Securities and Exchange Commission (“SEC”) filings and other public announcements that it may make, by press release or otherwise, from time to time. The Company undertakes no duty or

obligation to publicly update or revise the information contained in this report, although it may do so from time to time as its management believes is warranted. Any such updating may be made through the filing of other reports or documents with

the SEC, through press releases or through other public disclosure.

In accordance with General Instruction B.2 of this Current Report on Form 8-K, the

information presented herein shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933,

as amended, except as previously set forth by specific reference in such a filing.

Use of our Website to Distribute Material Company Information

Our company website address is www.amedisys.com. We use our website as a channel of distribution for important company information. Important

information, including press releases, analyst presentations and financial information regarding our company, is routinely posted on and accessible on the Investor Relations subpage of our website, which is accessible by clicking on the tab labeled

“Investors” on our website home page. We also use our website to expedite public access to time-critical information regarding our company in advance of or in lieu of distributing a press release or a filing with the SEC disclosing the

same information. Therefore, investors should look to the Investor Relations subpage of our website for important and time-critical information. Visitors to our website can also register to receive automatic e-mail and other notifications alerting

them when new information is made available on the Investor Relations subpage of our website.

Certain Forward-Looking Statements

When included in this press release, words like “believes,” “belief,” “expects,” “plans,” “anticipates,”

“intends,” “projects,” “estimates,” “may,” “might,” “would,” “should” and similar expressions are intended to identify forward-looking statements as defined by the Private

Securities Litigation Reform Act of 1995. These forward-looking statements involve a variety of risks and uncertainties that could cause actual results to differ materially from those described therein. These risks and uncertainties include, but are

not limited to the following: changes in Medicare and other medical payment levels, our ability to open care centers, acquire additional care centers and integrate and operate these care centers effectively, changes in or our failure to comply with

existing Federal and State laws or regulations or the inability to comply with new government regulations on a timely basis, competition in the home health industry, changes in the case mix of patients and payment methodologies, changes in estimates

and judgments associated with critical accounting policies, our ability to maintain or establish new patient referral sources, our ability to attract and retain qualified personnel, changes in payments and covered services due to the economic

downturn and deficit spending by Federal and State governments, future cost containment initiatives undertaken by third-party payors, our access to financing due to the volatility and disruption of the capital and credit markets, our ability to meet

debt service requirements and comply with covenants in debt agreements, business disruptions due to natural disasters or acts of terrorism, our ability to integrate and manage our information systems, our ability to comply with requirements

stipulated in our corporate integrity agreement and changes in law or developments with respect to any litigation relating to the Company, including various other matters, many of which are beyond our control.

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on

any forward-looking statement as a prediction of future events. We expressly disclaim any obligation or undertaking and we do not intend to release publicly any updates or changes in our expectations concerning the forward-looking statements or any

changes in events, conditions or circumstances upon which any forward-looking statement may be based, except as required by law.

2

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits.

|

|

|

| 99.1 |

|

Investor Relations Slide Show in use beginning January 14, 2015 (furnished only) |

3

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

| AMEDISYS, INC.

(Registrant) |

|

|

| By: |

|

/s/ Scott G. Ginn |

|

|

Scott G. Ginn |

|

|

Senior Vice President of Accounting and Controller (Principal Accounting Officer) |

DATE: January 14, 2015

4

Exhibit Index

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Investor Relations Slide Show in use beginning January 14, 2015 (furnished only) |

5

|

|

| Amedisys

Investor Presentation January 2015

Exhibit 99.1 |

|

|

|

Forward-looking Statements

www.amedisys.com

NASDAQ: AMED

We encourage everyone to visit the

Investors Section of our website at

www.amedisys.com, where we have

posted additional important

information such as press releases,

profiles concerning our business and

clinical operations and control

processes, and SEC filings.

We intend to use our website to

expedite public access to time-critical

information regarding the Company in

advance of or in lieu of distributing a

press release or a filing with the SEC

disclosing the same information.

This presentation may include forward-looking statements as defined by the Private

Securities Litigation Reform Act of 1995. These forward-looking statements are

based upon current expectations and assumptions about our business that are subject to

a variety of risks and uncertainties that could cause actual results to differ

materially from those described in this presentation. You should not rely on

forward-looking statements as a prediction of future events.

Additional information regarding factors that could cause actual results to differ materially

from those discussed in any forward-looking statements are

described in reports and registration statements we file with the SEC, including our

Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q and

Current Reports on Form 8-K, copies of which are available on the Amedisys internet website

http://www.amedisys.com

or by contacting the Amedisys Investor Relations department at (225) 292-

2031.

We disclaim any obligation to update any forward-looking statements or any changes in

events, conditions or circumstances upon which any forward-looking statement may be

based except as required by law.

2 |

|

|

| 3

Amedisys Snapshot

Amedisys Home Health Care Centers (316 locations)

Amedisys Hospice Care Centers (80 locations)

•

Founded in 1982,

publicly listed 1994

•

396 care centers in 34

states

•

13,000 employees

•

55,000 patients

currently on census

•

LTM revenue of $1.2

billion

Overview |

|

|

| Business

Overview Business

$ (in

millions)

% of Total

Revenue

Revenue

per Visit /

Revenue

per Day

Gross

Margin (%)

Reimbursement Type

Home Health

Medicare

$185

62%

$156

45.1%

60-day episode of care

Non-Medicare Episodic

$18

6%

$154

44.4%

60-day episode of care

Non-Medicare Per Visit

$34

11%

$113

24.6%

Per visit

Total Home Health

$237

79%

Hospice

$63

21%

$149

48.1%

96% routine care; daily rate

Total

$300

100%

Based on 3Q14 financials. Gross margin computed by subtracting cost per visit from

revenue per visit in home health and cost per day from hospice revenue per day

4 |

|

|

| 5

($ in millions)

3Q13

4Q13

1Q14

2Q14

3Q14

Net Revenue

$237

$238

$237

$244

$237

Gross Margin %

40.5%

39.4%

39.2%

42.8%

42.1%

Same Store Volume

Medicare admissions

(1%)

(1%)

(2%)

0%

3%

Medicare recertifications

(21%)

(16%)

(6%)

2%

5%

Non-Medicare revenue

(28%)

(16%)

1%

21%

31%

Other operating statistics

Medicare revenue per episode

$2,822

$2,840

$2,778

$2,845

$2,834

Cost per visit

$87.31

$90.21

$90.28

$85.08

$85.47

Medicare recert rate

37.1%

37.1%

38.2%

37.4%

38.0%

Home Health Segment Financials

1

1.

The financial results for the three-month periods ending September 30, 2013,

December 31, 2013, March 31, 2014, June 30, 2014 and September 30, 2014 are adjusted for certain items and should be

considered non-GAAP financial measures. Reconciliation of these

non-GAAP financial measures are included as Exhibit 99.1 to our Forms 8-K filed with the Securities and Exchange Commission on

March 12, 2014, May 8, 2014, July 30, 2014 and October 29, 2014

|

|

|

| 6

($ in millions)

3Q13

4Q13

1Q14

2Q14

3Q14

Net Revenue

$64

$65

$62

$61

$63

Gross Margin %

46.5%

46.4%

46.8%

46.0%

48.0%

Operating Statistics

Same store revenue growth

(13%)

(8%)

(6%)

(3%)

3%

Average daily census

4,917

4,866

4,721

4,649

4,596

Admissions

4,352

4,371

4,595

4,350

4,002

Revenue per day

$142.52

$145.60

$145.95

$145.44

$149.16

Cost per day

$75.79

$77.63

$77.47

$78.24

$77.38

Hospice Segment Financials

1

1.

The financial results for the three-month periods ending September 30, 2013,

December 31, 2013, March 31, 2014, June 30, 2014 and September 30, 2014 are adjusted for certain items and should be

considered non-GAAP financial measures. Reconciliation of these

non-GAAP financial measures are included as Exhibit 99.1 to our Forms 8-K filed with the Securities and Exchange Commission on

March 12, 2014, May 8, 2014, July 30, 2014 and October 29, 2014

|

|

|

| Amedisys

Turnaround Portfolio Rationalization

-

G&A reduced 11% y/y

-

$14MM y/y reduction

40.5%

39.4%

39.5%

42.8%

42.1%

37.0%

38.0%

39.0%

40.0%

41.0%

42.0%

43.0%

44.0%

$76.00

$84.00

$88.00

$92.00

Q313

Q413

Q114

Q214

Q314

$80.00

2.9%

2.5%

1.8%

7.3%

7.9%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

275

280

285

290

295

300

305

310

315

320

325

Q313

Q413

Q114

Q214

Q314

110

115

120

125

130

127

126

126

117

113

Q313

Q413

Q114

Q214

Q314

Home Health Gross Margin Improvements

Consolidated G&A Expense Reductions

Revenue and EBITDA Margin

7

105

Summary of Exit

Activity

3Q13

3Q14

# of

Locations

Annual

Revenue per

Care Center

($MM)

# of

Locations

Annual

Revenue per

Care Center

($MM)

Home Health

377

2.5

316

3.0

Hospice

94

2.7

80

3.2

Total

471

2.6

396

3.0 |

|

|

| 8

Adjusted Summary Financials

1

–

Quarterly

($ in millions, except per share data)

3Q13

4Q13

1Q14

2Q14

3Q14

Net Revenue

$301

$303

$299

$305

$300

Gross Margin %

41.8%

40.9%

41.0%

43.4%

43.3%

Consolidated G&A Expenses

127

126

126

117

113

EBITDA

$9

$8

$5

$22

$24

EBITDA Margin

2.9%

2.5%

1.8%

7.3%

7.9%

EPS

($0.01)

($0.07)

($0.07)

$0.25

$0.28

EPS –

GAAP

($2.89)

($0.30)

($0.39)

$0.24

$0.26

1.

The financial results for the three-month periods ending September 30, 2013,

December 31, 2013, March 31, 2014, June 30, 2014 and September 30, 2014 are adjusted for certain items and should be

considered non-GAAP financial measures. Reconciliation of these

non-GAAP financial measures are included as Exhibit 99.1 to our Forms 8-K filed with the Securities and Exchange Commission on

March 12, 2014, May 8, 2014, July 30, 2014 and October 29, 2014

|

|

|

| 9

Summary Balance Sheet

Assets ($ in MM)

12/31/13

9/30/14

Cash

$17

$6

Accounts Receivable, net

111

103

Property and Equipment

159

141

Goodwill

209

206

Other

230

226

Total Assets

726

682

Liabilities and Equity

Other Liabilities

$157

$148

Senior Debt

47

46

2

nd

Lien Term Loan

--

70

DOJ Settlement Reserve

150

35

Equity

372

383

Total Liabilities and Equity

726

682

Total Leverage Ratio

2.9x

2.1x

Days Sales Outstanding (Net)

32

31 |

|

|

| 2015

Focus 10

Clinical excellence

•

•

Organic growth

•

•

Incremental operating efficiency

•

Disciplined capital allocation strategy

•

First priority is to provide the best quality care for our patients

Focused on measured outcomes, including patient / family satisfaction and likelihood

to recommend

Continue to target market share capture in home health for organic growth

Hospice growth will be key as we seek to reverse ADC declines

Incremental efficiencies in cost of revenue and field and corporate G&A

Continue to emphasize delevering the balance sheet |

|

|

| 11

Contact Information

Dale Redman

Interim Chief Financial Officer

dale.redman@amedisys.com

David Castille

Managing Director, Finance

david.castille@amedisys.com

Amedisys, Inc.

5959 S. Sherwood Forest Blvd.

Baton Rouge, LA 70816

Office: 225.292.2031 |

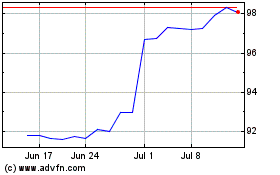

Amedisys (NASDAQ:AMED)

Historical Stock Chart

From Mar 2024 to Apr 2024

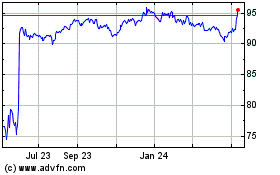

Amedisys (NASDAQ:AMED)

Historical Stock Chart

From Apr 2023 to Apr 2024