Current Report Filing (8-k)

December 16 2014 - 4:35PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 15, 2014

ARCHER-DANIELS-MIDLAND COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-44 |

|

41-0129150 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 77 West Wacker Dr.

Chicago, Illinois |

|

60614 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (217) 424-5200

N/A

(Former name or

former address, if changed since last report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 8.01. Other Events.

On December 15, 2014, Archer-Daniels-Midland Company (“ADM”) issued a press release announcing that it had reached an agreement to sell its

global cocoa business to Olam International Limited for $1.3 billion, subject to customary adjustments. The proposed sale is contingent on customary regulatory approvals.

A copy of the press release is attached hereto as Exhibit 99.1.

Item 9.01. Financial Statements And Exhibits

(d)

The following exhibits are filed herewith:

99.1 Press release dated December 15, 2014, issued by Archer-Daniels-Midland Company.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

| |

|

ARCHER-DANIELS-MIDLAND COMPANY |

| Date: December 16, 2014 |

|

|

|

|

By: |

|

/s/ D. Cameron Findlay |

|

|

Name: |

|

D. Cameron Findlay |

|

|

Title: |

|

Senior Vice President, General Counsel, and Secretary |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Press Release dated December 15, 2014. |

Exhibit 99.1

|

|

|

|

|

|

|

|

|

|

|

|

|

Archer Daniels Midland Company

77 West Wacker Drive Chicago, Illinois 60601 |

ADM to Sell Global Cocoa Business to Olam

$1.3 billion transaction frees capital for higher-return, less-volatile investments

CHICAGO, Dec. 15, 2014 – Archer Daniels Midland Company (NYSE: ADM) today announced that it has reached an agreement to sell its global cocoa business to

Olam International Limited (SGX: O32) for $1.3 billion, subject to customary adjustments.

“We are continuing to actively manage our portfolio to

create shareholder value by improving returns and dampening the volatility of our earnings,” said ADM Chairman and CEO Patricia Woertz. “This transaction will allow us to redeploy capital to investments that offer improved returns

potential and less volatility than the cocoa business, or distribute excess capital to shareholders, or a combination of both.”

The sale encompasses

ADM’s entire global cocoa business, including processing facilities in Mississauga, Canada; Koog aan de Zaan and Wormer, Netherlands; Mannheim, Germany; Ilhéus, Brazil; Abidjan, Côte d’Ivoire; Kumasi, Ghana; and Singapore.

Also included are ADM’s buying stations in Brazil, Cameroon, Côte d’Ivoire, and Indonesia, as well as the company’s deZaan and UNICAO brands.

The majority of the approximately 1,550 colleagues in ADM’s cocoa business will transfer to Olam with the sale.

The proposed sale, which is contingent on customary regulatory approvals, is expected to close during the second quarter of 2015.

This transaction does not impact the sale of ADM’s chocolate business to Cargill, which is progressing as planned.

Forward-Looking Statements

Some of the above statements

constitute forward-looking statements. ADM’s filings with the SEC provide detailed information on such statements and risks, and should be consulted along with this release. To the extent permitted under applicable law, ADM assumes no

obligation to update any forward-looking statements.

About ADM

For more than a century, the people of Archer Daniels Midland Company (NYSE: ADM) have transformed crops into products that serve the vital needs of a growing

world. Today, we’re one of the world’s largest agricultural processors and food ingredient providers, with more than 33,000 employees serving customers in more than 140 countries. With a global value chain that includes more than 470 crop

procurement locations, 285 ingredient manufacturing facilities, 40 innovation centers and the world’s premier crop transportation network, we connect the harvest to the home, making products for food, animal feed, chemical and energy uses.

Learn more at www.adm.com.

Archer Daniels Midland Company

Media Relations

Jackie Anderson

media@adm.com

217-424-5413

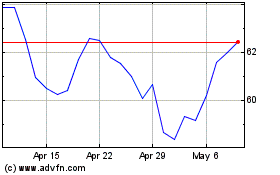

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Mar 2024 to Apr 2024

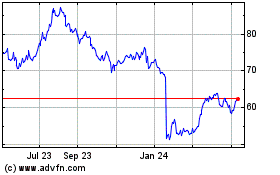

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Apr 2023 to Apr 2024