UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED): December 16, 2014 (December 11, 2014)

Commission File Number: 0-24260

Amedisys, Inc.

(Exact Name of Registrant as specified in its Charter)

|

|

|

| Delaware |

|

11-3131700 |

| (State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

5959 S. Sherwood Forest Blvd., Baton Rouge, LA 70816

(Address of principal executive offices, including zip code)

(225) 292-2031 or (800) 467-2662

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 5 – Corporate Governance and Management

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On December 16, 2014, Amedisys, Inc., a Delaware corporation (the “Company”), announced that it has appointed Paul B.

Kusserow, 53, as the Company’s new President and Chief Executive Officer effective as of December 16, 2014. Mr. Kusserow will also join the Company’s Board on that date.

Mr. Kusserow has more than seventeen years’ experience in the healthcare and healthcare technology industries. Most recently,

he served since June 2014 as Vice Chairman and President, Development of Alignment Healthcare, Inc., an integrated clinical care company. From December 2013 until June 2014, Mr. Kusserow provided executive advisory services to companies and

investors in the healthcare industry. Before that, he served as Senior Vice President, Chief Strategy, Innovations and Corporate Development Officer of Humana, Inc., a healthcare services and benefits company, from February 2009 through August 2013

and remained with Humana, Inc. through December 2013. Prior to joining Humana, Inc., he was Managing Director and Chief Investment Officer of the Ziegler HealthVest Fund, a venture capital fund focused on early to mid-stage investments in healthcare

services, healthcare technology and wellness; a co-founder and Managing Director of San Ysidro Capital Partners, L.L.C., an investment advisory and management firm specializing in healthcare services and technology; and Managing Partner of Roaring

Mountain, L.L.C., a strategy consulting firm with large clients in healthcare services and technology. Mr. Kusserow began his healthcare career with Tenet Healthcare Corporation, one of the nation’s largest investor-owned healthcare

service companies, where he spent seven years, the last four as Senior Vice President, Strategy and Tenet Ventures. He has served on many corporate and advisory boards, and currently serves on the Boards of Directors of Connecture, Inc., New Century

Health, Inc., AxelaCare Health Solutions, Inc. and Picwell, Inc. He previously served as the Chairman of the Board of Directors of Availity Inc.

In connection with his service on the Board, as of the effective date of his employment, the Company and Mr. Kusserow will enter into an

Indemnification Agreement, a form of which was previously filed as Exhibit 10.1 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2008.

During the period between December 2013 and June 2014, Mr. Kusserow served as an independent contractor to the Boston Consulting Group

(“BCG”) in connection with a consulting project BCG performed for the Company. Mr. Kusserow was paid approximately $400,000 by BCG in connection with his work on this project. There are no other transactions that would require

disclosure pursuant to Item 404(a) of Regulation S-K.

Mr. Kusserow succeeds Ronald A. LaBorde, who most recently served as the

Company’s President and Interim Chief Executive Officer since February 20, 2014 and previously served as the Company’s President and Chief Financial Officer from January 1, 2012 until February 20, 2014 and as the

Company’s President from November 1, 2011 until January 1, 2012. Mr. LaBorde, who has served as a member of the Company’s Board of Directors since 1997, will continue to serve on the Company’s Board and as an executive

officer, transitioning to the position of Vice Chairman effective December 16, 2014. The Company expects to enter into an Amended and Restated Employment Agreement with Mr. LaBorde shortly and intends to file a separate Form 8-K describing

the terms of this agreement.

Employment Agreement with Paul B. Kusserow

On December 11, 2014, Mr. Kusserow entered into an Employment Agreement (the “Agreement”) with the Company and

Amedisys Holding, L.L.C., a Louisiana limited liability company. The Agreement was approved by the Board upon the recommendation and approval of the Compensation Committee of the Board (the “Committee”). Pursuant to the Agreement,

Mr. Kusserow will commence employment on December 16, 2014 (the “Effective Date”).

The following is a

description of the terms and conditions of Mr. Kusserow’s Agreement and the amounts payable to him thereunder.

Mr. Kusserow has agreed to serve as the Company’s President and Chief Executive Officer. The term of the Agreement runs until

March 1, 2019, unless earlier terminated, and is not automatically renewable. Unless

2

mutually extended by the parties in writing, the Agreement shall terminate upon the expiration of the term, at which point Mr. Kusserow’s employment shall continue on an “at

will” basis unless such “at will” employment is terminated by the Company or Mr. Kusserow by notice in writing.

Under

the terms of the Agreement, Mr. Kusserow, among other things, is entitled to:

| |

(1) |

An annual base salary of not less than $875,000, subject to annual review for increase (but not decrease) by the Committee; |

| |

(2) |

Participate in the Company’s annual (cash bonus) incentive plan, with target and maximum award opportunities approved from year to year by the Committee (the amount of target annual incentive approved by the

Committee for any given year shall not be less than 25% of Mr. Kusserow’s current base salary; however, entitlement to and payment of an annual incentive bonus is subject to the approval of the Committee); |

| |

(3) |

Equity awards, as follows: |

| |

a. |

Subject to the approval of the Committee, on the Effective Date, Mr. Kusserow will be granted (i) 75,000 time-based restricted shares of the Company’s common stock and (ii) time-based non-qualified

stock options to purchase 250,000 shares of the Company’s common stock (collectively, the “2014 Equity Awards”). Both the time-based restricted shares and the time-based non-qualified stock options will vest in one-fourth

increments on the first through fourth anniversaries of the grant date, provided that Mr. Kusserow remains employed by the Company on each such vesting date (subject to certain accelerated and pro-rated vesting provisions as provided in the

Agreement). The exercise price of the stock options will be the closing price of the Company’s common stock on the date of grant, and the options will have a ten-year term. |

| |

b. |

Subject to the approval of the Committee, during the first quarter of calendar year 2015, Mr. Kusserow will be granted (i) 75,000 performance-based restricted shares of the Company’s common stock and

(ii) performance-based non-qualified stock options to purchase 250,000 shares of the Company’s common stock (collectively, the “2015 Equity Awards”). Both the performance-based restricted shares and the performance-based

stock options shall vest, if at all, based on the certification by the Committee of the achievement of identified EBITDA goals for fiscal years 2015 through 2018, respectively (subject to certain accelerated and pro-rated vesting provisions as

provided in the Agreement). The exercise price of the stock options will be the closing price of the Company’s common stock on the date of grant, and the options will have a ten-year term. |

| |

c. |

Unless Mr. Kusserow’s employment is terminated for “Cause” (as defined in the Agreement), he shall have until the earlier of (A) the expiration date of any option granted pursuant to the

Agreement or (B) 90 days following termination of his employment in which to exercise any of such options that were vested as of the termination date. If his employment is terminated for Cause, there shall be no post-termination exercise

period, and all vested and unvested options shall terminate immediately upon termination of employment. |

| |

d. |

Upon a “Change in Control” (as defined in the Agreement), the 2014 Equity Awards and the 2015 Equity Awards shall vest immediately in full. |

It is the intention of the parties that the 2014 Equity Awards and the 2015 Equity Awards shall be the sole equity awards

granted to Mr. Kusserow during the term of the Agreement. In other words, there is no expectation that Mr. Kusserow will receive or be entitled to additional equity awards during the term of the Agreement.

| |

(4) |

Participate, consistent with his rank and position, in the Company’s other compensation (other than equity), pension, welfare and benefit plans

and programs as are made available to the Company’s |

3

| |

senior level executives or to its employees in general, including deferral, health, medical, dental, long-term disability, travel, accident and life insurance plans, subject to eligibility

(provided, that there is no entitlement to any equity awards outside of the 2014 Equity Awards and the 2015 Equity Awards without the prior approval of the Committee); and |

| |

(5) |

Reimbursement for relocation and travel expenses, as follows: (i) reasonable relocation expenses in an amount not to exceed $20,000, (ii) $10,000 per month for housing and travel expenses for the first

eighteen months of the employment term and (iii) reimbursement of reasonable legal fees incurred by Mr. Kusserow in connection with negotiating the Agreement up to a maximum of $15,000. |

In the event Mr. Kusserow’s employment is terminated due to his death or disability, Mr. Kusserow or his surviving spouse or

estate (as the case may be) will be entitled to any benefits due or earned in accordance with the applicable plans of the Company and the following amounts (paid in accordance with Federal tax rules and regulations and within the deadlines described

in the Agreement): (a) unpaid base salary through the date of termination; and (b) incentive awards earned in the prior year, but not yet paid. Additionally, all unvested equity awards held by Mr. Kusserow as of the date of death or

disability shall vest immediately in full.

If Mr. Kusserow is terminated for Cause or if Mr. Kusserow voluntarily resigns

without “Good Reason,” (as defined in the Agreement) he will be entitled to any benefits earned in accordance with the applicable plans of the Company and the following amounts (paid in accordance with Federal tax rules and

regulations and within the deadlines described in the Agreement): (a) unpaid base salary through the date of termination, and (b) incentive awards earned in the prior year, but not yet paid.

If Mr. Kusserow is terminated without Cause or resigns with Good Reason, in both cases prior to a Change in Control, Mr. Kusserow

will be entitled to any benefits earned in accordance with the applicable plans of the Company and the following:

| |

(1) |

unpaid base salary through the date of termination, paid in accordance with Federal tax rules and regulations and within the deadlines described in the Agreement; |

| |

(2) |

an amount equal to two (2) times the sum of (A) his base salary, at the annualized rate in effect on the date of termination (or in the event a reduction in base salary is a basis for termination with Good

Reason, then the base salary in effect immediately prior to such reduction), and (B) the greater of (x) an amount equal to his prior year cash bonus or (y) $218,750, which amount will be paid in substantially equal monthly

installments in accordance with the Company’s payroll practices for a period of 24 months beginning with the calendar month that immediately follows the earliest payment date (as described in the Agreement); |

| |

(3) |

unpaid incentive awards earned in the prior year, paid in accordance with Federal tax rules and regulations and within the deadlines described in the Agreement; |

| |

(4) |

should he elect continuance of group health insurance coverage under the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended (“COBRA”) and/or similar state or federal law or regulation,

the Company will pay the full cost of such continued health insurance coverage for Mr. Kusserow and his eligible dependents until the first to occur of (x) his attainment of alternative employment if such employment includes health

insurance benefits or (y) the expiration of a 24-month period beginning with the calendar month that immediately follows the earliest payment date (as described in the Agreement) (such period, the “Coverage Period”). Should

Mr. Kusserow’s entitlement to health insurance continuation coverage under COBRA expire prior to the end of the Coverage Period, the Company will arrange to provide, at the Company’s expense, Mr. Kusserow and his eligible

dependents with continued health insurance benefits substantially similar to those which he and his eligible dependents received under COBRA until the end of the Coverage Period; |

| |

(5) |

pro-rated vesting of a number of the non-qualified stock options and restricted shares that comprise the 2014 Equity Awards and the 2015 Equity Awards

according to a formula as stated in the Agreement, provided that with respect to any shares of performance-based restricted stock for which there are |

4

performance periods that have not been completed, such pro-rated vesting shall occur only to the extent the Company achieves the performance measures for the not-yet completed performance

periods.

In the event that Mr. Kusserow’s employment is terminated without Cause or he resigns with Good Reason within one year

following a Change in Control (or he is terminated without Cause within 90 days prior to a Change in Control), Mr. Kusserow shall be entitled to any benefits earned in accordance with the applicable plans of the Company and the following:

| |

(1) |

unpaid base salary through the date of termination paid in accordance with Federal tax rules and regulations and within the deadlines described in the Agreement; |

| |

(2) |

an amount equal to three times the sum of (A) his base salary, at the annualized rate in effect on the date of termination (or in the event a reduction in base salary is a basis for termination with Good Reason,

then the base salary in effect immediately prior to such reduction), and (B) the greater of (x) an amount equal to his prior year cash bonus or (y) $218,750, which amount will be paid in a lump sum on the earliest payment date (as

described in the Agreement); |

| |

(3) |

unpaid incentive awards earned in the prior year, paid in accordance with Federal tax rules and regulations and within the deadlines described in the Agreement; and |

| |

(4) |

should he elect continuance of group health insurance coverage under COBRA and/or similar state or federal law or regulation, the Company will pay the full cost of such continued health insurance coverage for

Mr. Kusserow and his eligible dependents until the end of the Coverage Period. Should Mr. Kusserow’s entitlement to health insurance continuation coverage under COBRA expire prior to the end of the Coverage Period, the Company will

arrange to provide, at the Company’s expense, Mr. Kusserow and his eligible dependents with continued health insurance benefits substantially similar to those which he and his eligible dependents received under COBRA until the end of the

Coverage Period. |

As noted above, upon a Change in Control, the 2014 Equity Awards and 2015 Equity Awards shall vest

immediately in full.

Mr. Kusserow is subject to certain restrictive covenants, including (i) prohibitions against competition

for 24 months following his termination prior to the expiration of the employment term and (ii) prohibitions against soliciting company employees and customers for 24 months following his termination. He is also subject to a standstill

provision, which prevents him from acquiring any Company securities or seeking to effect a Change in Control of the Company (or assisting or working with others to effect a Change in Control of the Company) for a period of 24 months following his

termination.

Both Mr. Kusserow and the Company are subject to arbitration for resolution of disputes arising out of the Agreement,

which is governed by Louisiana law.

Section 7 – Regulation FD

| Item 7.01 |

Regulation FD Disclosure. |

On December 16, 2014, the Company issued a press release

titled “Amedisys Board Names Paul B. Kusserow as New CEO,” a copy of which is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K.

The information presented in Item 7.01 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, unless the Company specifically states that the information

is to be considered “filed” under the Exchange Act or specifically incorporates it by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

5

Section 9 – Financial Statements and Exhibits

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

|

|

| 99.1 |

|

Press Release dated December 16, 2014 titled “Amedisys Board Names Paul B. Kusserow as New CEO” (furnished only) |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

| AMEDISYS, INC. |

|

|

| By: |

|

/s/ Dale E. Redman |

|

|

Dale E. Redman |

|

|

Interim Chief Financial Officer and |

|

|

Duly Authorized Officer |

|

| DATE: December 16, 2014 |

6

Exhibit Index

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press Release dated December 16, 2014 titled “Amedisys Board Names Paul B. Kusserow as New CEO” (furnished only) |

7

Exhibit 99.1

Amedisys Board Names Paul B. Kusserow as New CEO

Former Humana Executive Chosen to Lead Resurgent Post-Acute Company

BATON ROUGE, La.—(BUSINESS WIRE)—Tuesday, Dec. 16, 2014— Amedisys, Inc. (NASDAQ:AMED), a leading home health and hospice company, today

announced that its Board of Directors has named Paul B. Kusserow as President and Chief Executive Officer and member of the Board of Directors. Kusserow will assume the role on December 16, 2014 from President and Interim CEO, Ronald LaBorde,

who will remain a member of the senior management team in the role of Vice Chairman reporting directly to the CEO. LaBorde will also continue to serve as a member of the Board of Directors.

“Paul is an exceptional and proven leader with a broad and deep understanding of the business of healthcare, a track record of delivering on long-term

growth strategies, and fiscal competency that will surely help guide our company to be a national leader,” said Don Washburn, Amedisys Board Chairman and Director. “His relationships and deep knowledge of integrated health services, IT,

payors, hospitals, and post-acute providers will be instrumental as he guides our management team in offering solutions that drive value across the entire healthcare continuum. After six months working closely with Paul as he developed the strategic

turnaround plan we’ve adopted, and seeing him in action during that period moving us forward in a meaningful way, the entire Board is confident that Paul is the right person to lead Amedisys during this period of important transition for the

post-acute care sector.”

“I am honored to have the opportunity to help lead Amedisys as we mobilize to strengthen our leadership position as

the home care and hospice provider of choice throughout the United States,” said Kusserow. “Under the leadership of the Board and management team led by Ronnie LaBorde, the company has demonstrated strong growth in the past 10 months, and

there is much more we can and will accomplish. I am committed to helping Amedisys deliver clinical excellence, enhance operational efficiencies, and build value for everyone we serve, including our shareholders.”

Kusserow, a highly respected healthcare industry veteran with deep expertise in driving growth and innovation, was most recently Vice Chairman of Alignment

Healthcare, Inc., an integrated clinical care company focused on providing care to the Medicare population. Before that, he served as Senior Vice President, Chief Strategy, Innovations and Corporate Development Officer of Humana, Inc., a Fortune 75

healthcare services and benefits company. Prior to joining Humana, he was Managing Director and Chief Investment Officer of the Ziegler HealthVest Fund; Managing Director of San Ysidro Capital Partners, L.L.C.; and Managing Partner of Roaring

Mountain, L.L.C.

Kusserow began his healthcare career with Tenet Healthcare Corporation, one of the nation’s largest investor-owned hospital and

healthcare service companies, where he spent seven years, the last four as Senior Vice President, Corporate Strategy and Ventures. Kusserow started his

career as a management consultant at McKinsey & Company, Inc. He has served on many corporate and advisory boards, including his role as Chairman of the Advisory Board of Care

Innovations™, an Intel-GE joint venture focused on aging-in-place technologies, and member of the advisory board of Interpreta. He also serves on the corporate boards of AxelaCare Health Solutions, Connecture, Inc. (NASDAQ:CXNR), New Century

Health, Inc., and Picwell Inc. Kusserow graduated Phi Beta Kappa from Wesleyan University, and as a Rhodes Scholar from Oxford University.

“Paul has

the unanimous support of our Board to lead Amedisys into the future,” said Nathaniel M. Zilkha, Amedisys Board Member and Co-Head of Credit and Special Situations at KKR & Co. L.P. “His focused approach will create stockholder

value and position the company for strong future performance, building on many positive business shifts we’ve seen since our strategic plan was implemented at the beginning of this year.”

“I am delighted to pass the baton of leadership to Paul and look forward to teaming with him to advance the vital mission of Amedisys,” said Ronnie

LaBorde, President and Interim CEO and Board Member since 1997. “It has been a privilege to lead this company, and I am extremely proud of the progress we have made over the last 10 months as well as the progress we will make in the

future.”

About Amedisys:

Amedisys, Inc.

(NASDAQ: AMED) is a leading health care at home company delivering personalized home health and hospice care to more than 360,000 patients each year. More than 2,200 hospitals and 61,900 physicians nationwide have chosen Amedisys as a partner in

post-acute care. Amedisys is focused on delivering the care that is best for our patients, whether that is home-based recovery and rehabilitation after an operation or injury, care focused on empowering them to manage a chronic disease, palliative

care for those with a terminal illness, or hospice care at the end of life. For more information about the company, please visit: www.amedisys.com.

Forward-Looking Statements:

When included in this press

release, words like “believes,” “belief,” “expects,” “plans,” “anticipates,” “intends,” “projects,” “estimates,” “may,” “might,” “would,”

“should” and similar expressions are intended to identify forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve a variety of risks and uncertainties that

could cause actual results to differ materially from those described therein. These risks and uncertainties include, but are not limited to the following: changes in Medicare and other medical payment levels, our ability to open care centers,

acquire additional care centers and integrate and operate these care centers effectively, changes in or our failure to comply with existing Federal and State laws or regulations or the inability to comply with new government regulations on a timely

basis, competition in the home health industry, changes in the case mix of patients and payment methodologies, changes in estimates and judgments associated with critical accounting policies, our ability to maintain or establish new

patient referral sources, our ability to attract and retain qualified personnel, changes in payments and covered services due to the economic downturn and deficit spending by Federal and State

governments, future cost containment initiatives undertaken by third-party payors, our access to financing due to the volatility and disruption of the capital and credit markets, our ability to meet debt service requirements and comply with

covenants in debt agreements, business disruptions due to natural disasters or acts of terrorism, our ability to integrate and manage our information systems, our ability to comply with requirements stipulated in our corporate integrity agreement

and changes in law or developments with respect to any litigation relating to the Company, including various other matters, many of which are beyond our control.

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on

any forward-looking statement as a prediction of future events. We expressly disclaim any obligation or undertaking and we do not intend to release publicly any updates or changes in our expectations concerning the forward-looking statements or any

changes in events, conditions or circumstances upon which any forward-looking statement may be based, except as required by law.

|

|

|

|

|

| Media Contact: |

|

Investor Contact: |

|

|

|

|

|

| Shannon Hooper (615) 577-1124

smh@thinkrevivehealth.com |

|

David Castille (225) 299-3665

david.castille@amedisys.com |

|

|

|

|

|

| Kendra Kimmons (225) 299-3720

kendra.kimmons@amedisys.com |

|

Tripp Sullivan (615) 760-1104

TSullivan@SCR-ir.com |

|

|

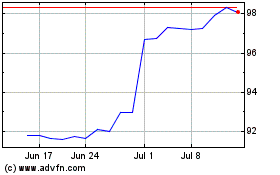

Amedisys (NASDAQ:AMED)

Historical Stock Chart

From Mar 2024 to Apr 2024

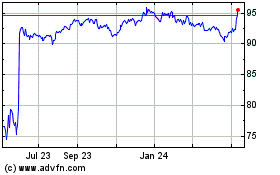

Amedisys (NASDAQ:AMED)

Historical Stock Chart

From Apr 2023 to Apr 2024