Current Report Filing (8-k)

December 05 2014 - 4:15PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 1, 2014

Huntsman Corporation

(Exact name of registrant as specified in its charter)

|

Delaware |

|

001-32427 |

|

42-1648585 |

|

(State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

|

of incorporation) |

|

File Number) |

|

Identification No.) |

|

500 Huntsman Way |

|

|

|

Salt Lake City, Utah |

|

84108 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code:

(801) 584-5700

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.05 Costs Associated With Exit or Disposal Activities.

On December 1, 2014, Huntsman Corporation (the “Company”), announced its plans to implement a comprehensive restructuring program in its Pigments and Additives segment aimed at improving its long-term global competitiveness. The Company estimates that the planned restructuring will be implemented by the middle of 2016 and could result in approximately 900 job losses. The Company is also evaluating titanium dioxide capacity reduction options within the Pigments and Additives segment.

In connection with the restructuring, the Company anticipates that it will incur costs in the fourth quarter of 2014 of approximately $80 million related to severance and other termination benefits. The Company expects that it will incur additional costs related to the restructuring, but is unable in good faith to make a determination of such costs at this time. The Company will file an amended report on Form 8-K after it makes a determination of an estimate of such costs as required by paragraphs (b), (c) and (d) of Item 2.05.

The foregoing contains statements that are not historical and are forward-looking statements. These statements are based on management’s current beliefs and expectations. The forward-looking statements are subject to uncertainty and changes in circumstances and involve risks and uncertainties that may affect the Company’s operations, markets, products, services, prices and other factors. Significant risks and uncertainties may relate to, but are not limited to, financial, economic, competitive, environmental, political, legal, regulatory and technological factors. For information regarding other factors that could cause the Company’s results to vary from expectations, please see the “Risk Factors” section of the Company’s filings with the Securities and Exchange Commission. The Company undertakes no obligation to revise or update publicly any forward-looking statement, except as otherwise required by applicable laws.

On December 1, 2014, the Company issued a press release regarding the planned restructuring. A copy of the press release is furnished herewith as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit Number |

|

Description |

|

99.1 |

|

Press Release, dated December 1, 2014. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

HUNTSMAN CORPORATION |

|

|

|

|

|

/s/ KURT OGDEN |

|

|

Kurt Ogden |

|

|

Vice President, Investor Relations |

Dated: December 5, 2014

3

INDEX TO EXHIBITS

|

Exhibit Number |

|

Description |

|

99.1 |

|

Press Release, dated December 1, 2014. |

4

Exhibit 99.1

|

News Release |

|

|

FOR IMMEDIATE RELEASE |

Investor Relations: |

Media: |

|

December 1, 2014 |

Kurt Ogden |

Gary Chapman |

|

The Woodlands, TX |

(801) 584-5959 |

(281) 719-4324 |

|

NYSE: HUN |

|

|

HUNTSMAN INITIATES SIGNIFICANT ACTION TO BUILD A GLOBAL MARKET LEADING PIGMENTS AND ADDITIVES BUSINESS

The Woodlands, TX — Huntsman Corporation (NYSE: HUN) announced today that it is taking significant action to improve the global competitiveness of its pigments and additives business. As part of a comprehensive restructuring program, Huntsman plans to reduce its workforce by approximately 900 positions. Annual cost savings are expected to be approximately $130 million and will be achieved by the middle of 2016.

Separately, Huntsman is evaluating titanium dioxide (TiO2) capacity reduction options within its pigments and additives business.

Peter R. Huntsman, President and CEO of Huntsman Corporation, commented:

“We are in the process of creating a global market leading pigments and additives business with superior technology and cost competitive manufacturing. With the inclusion of the recently acquired Rockwood pigments and additives businesses we have the broadest product offering of specialized pigments in the industry. This restructuring will improve the competitiveness of our global pigments and additives business and allow us to compete more aggressively.

This is not the first time we’ve made significant efforts to restructure. Recently, we successfully completed major restructuring in our Advanced Materials and Textile Effects divisions, the annual benefits of which were approximately $150 million. We will leverage the learning and know-how from these efforts to deliver approximately $130 million of cost savings in our Pigments and Additives division. We will carry out these efforts in-line with local procedures and by working with relevant associate representative groups.

We are also taking steps that will lead to a successful future initial public offering of our Pigments and Additives division.”

About Huntsman:

Huntsman Corporation is a publicly traded global manufacturer and marketer of differentiated chemicals with 2013 revenues of approximately $13 billion including the acquisition of Rockwood’s performance additives and TiO2 businesses. Our chemical products number in the thousands and are sold worldwide to manufacturers serving a broad and diverse range of consumer and industrial end markets. We operate more than 100 manufacturing and R&D facilities in more than 30 countries and employ approximately 15,000 associates within our 5 distinct business divisions. For more information about Huntsman, please visit the company’s website at www.huntsman.com .

Social Media:

Twitter: twitter.com/Huntsman_Corp

Facebook: www.facebook.com/huntsmancorp

LinkedIn: www.linkedin.com/company/huntsman

Forward-Looking Statements:

Statements in this release that are not historical are forward-looking statements. These statements are based on management’s current beliefs and expectations. The forward-looking statements in this release are subject to uncertainty and changes in circumstances and involve risks and uncertainties that may affect the company’s operations, markets, products, services, prices and other factors as discussed in the Huntsman companies’ filings with the U.S. Securities and Exchange Commission. Significant risks and uncertainties may relate to, but are not limited to, financial, economic, competitive, environmental, political, legal, regulatory and technological factors. The company assumes no obligation to provide revisions to any forward-looking statements should circumstances change, except as otherwise required by applicable laws.

2

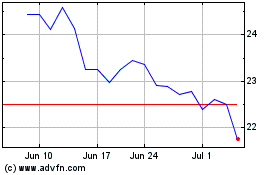

Huntsman (NYSE:HUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

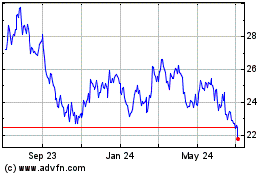

Huntsman (NYSE:HUN)

Historical Stock Chart

From Apr 2023 to Apr 2024