UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 12, 2014

AVALONBAY COMMUNITIES, INC.

(Exact name of registrant as specified in its charter)

Maryland

(State or Other Jurisdiction of Incorporation)

|

1-12672 |

|

77-0404318 |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

671 N. Glebe Road, Suite 800, Arlington, Virginia |

|

22203 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01. Other Events.

On November 12, 2014, AvalonBay Communities, Inc. (the “Company”) priced a public offering (the “Offering”) of an aggregate of $300,000,000 principal amount of its 3.50% Medium Term Notes due 2024 (the “Notes”). The offering was made pursuant to a Pricing Supplement dated November 12, 2014, a Prospectus Supplement dated December 16, 2013 and a prospectus dated February 27, 2012 relating to the Company’s Shelf Registration Statement on Form S-3 (File No. 333-179720). The Terms Agreement, dated November 12, 2014, by and among the Company and Morgan Stanley & Co. LLC and UBS Securities LLC, as representatives of the agents named therein, is filed herewith as Exhibit 1.1.

The Notes were issued under an Indenture between the Company and The Bank of New York Mellon, as trustee, dated as of January 16, 1998, as supplemented by a First Supplemental Indenture dated as of January 20, 1998, a Second Supplemental Indenture dated as of July 7, 1998, an Amended and Restated Third Supplemental Indenture dated as of July 10, 2000, a Fourth Supplemental Indenture dated as of September 18, 2006, and a Fifth Supplemental Indenture dated as of November 21, 2014. The Fifth Supplemental Indenture is filed herewith as Exhibit 4.1.

The Notes bear interest from November 21, 2014, with interest on the Notes payable semi-annually on May 15 and November 15, beginning on May 15, 2015. The Notes will mature on November 15, 2024. The Company will use the aggregate net proceeds, after underwriting discounts and other transaction-related costs, of approximately $295,353,000 from the sale of the Notes for working capital, capital expenditures and other general corporate purposes, which may include development, redevelopment and acquisition of apartment communities and repayment and refinancing of existing debt. Settlement occurred on November 21, 2014.

ITEM 9.01 Financial Statements and Exhibits

(d) Exhibits.

|

Exhibit No. |

|

Description |

|

|

|

|

|

1.1* |

|

Terms Agreement, dated November 12, 2014, among the Company and the agents named therein. |

|

4.1* |

|

Fifth Supplemental Indenture, dated November 21, 2014, between the Company and The Bank of New York Mellon, as trustee. |

|

5.1* |

|

Legal Opinion of Goodwin Procter LLP, dated November 21, 2014. |

|

23.1 |

|

Consent of Goodwin Procter LLP (included in Exhibit 5.1). |

* Filed herewith.

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be filed on its behalf by the undersigned hereunto duly authorized.

|

|

AVALONBAY COMMUNITIES, INC. |

|

|

|

|

|

|

|

Dated: November 21, 2014 |

|

By: |

/s/ Kevin P. O’Shea |

|

|

|

Kevin P. O’Shea |

|

|

|

Chief Financial Officer |

3

Exhibit 1.1

AVALONBAY COMMUNITIES, INC.

Medium-Term Notes

Due Nine Months or More From Date of Issue

TERMS AGREEMENT

November 12, 2014

AvalonBay Communities, Inc.

Ballston Tower

671 N. Glebe Rd, Suite 800

Arlington, Virginia 22203

Reference is made to that certain Amended and Restated Distribution Agreement dated as of December 16, 2013 (including any exhibits and schedules thereto, the “Distribution Agreement”), by and among AvalonBay Communities, Inc., a Maryland corporation (the “Company” or “AvalonBay”) and the agents named therein. The entities listed on Schedule 1 hereto are collectively referred to herein as the “Agents.” Morgan Stanley & Co. LLC and UBS Securities LLC have agreed to act as the representatives (the “Representatives”) of the Agents in connection with this Terms Agreement (this “Agreement”). Capitalized terms used, but not defined, in this Agreement are used in this Agreement as defined in the Distribution Agreement. This Agreement is one of the Written Terms Agreements referred to in Section 4(a) of the Distribution Agreement. The first offer of Notes for purposes of the term “Time of Sale Prospectus” under the Distribution Agreement shall be 2:56 p.m. Eastern Time.

In accordance with and subject to the terms and conditions stated in this Agreement, the Distribution Agreement and those certain Appointment Agreements dated as of the date hereof (the “Appointment Agreements”), by and between the Company and each of BB&T Capital Markets, a division of BB&T Securities, LLC, Mitsubishi UFJ Securities (USA) Inc. and PNC Capital Markets LLC, which agreements are incorporated herein in their entirety and made a part hereof, the Company agrees to sell to the Agents, and each of the Agents severally agrees to purchase, as principal, from the Company the aggregate principal amount set forth opposite its name in Schedule 1 hereto of the Company’s Notes identified on Schedule 2 hereto. If one or more of the Agents shall fail at the Settlement Date to purchase the Notes which it or they are obligated to purchase under this Agreement, the procedures set forth in Section 4(a) of the Distribution Agreement shall apply.

The obligations of the Agents to purchase Notes shall be subject, in addition to the conditions precedent listed in the Distribution Agreement, to the delivery of the following documents to the Representatives, on or before the Settlement Date:

1. the opinions and letters referred to in Sections 6(a), 6(b) and 6(c) of the Distribution Agreement, each dated the Settlement Date and otherwise in substantially the same form as was delivered in connection with the Company’s December 5, 2013 public offering of medium-term notes (the “Prior Offering”);

2. the letters of Ernst & Young LLP referred to in Section 6(d) of the Distribution Agreement, dated the date hereof and the Settlement Date and otherwise in substantially the same forms as were delivered in connection with the Prior Offering; and

3. the officers’ certificate referred to in Section 6(e) of the Distribution Agreement, dated the Settlement Date and otherwise in substantially the same form as was delivered in connection with the Prior Offering.

All such opinions, certificates, letters and other documents will be in compliance with the provisions hereof only if they are reasonably satisfactory in form and substance to the Representatives of the Agents and their counsel. The Company will furnish the Agents with such conformed copies of such opinions, certificates, letters and other documents as the Agents shall reasonably request.

This Agreement shall be governed by the laws of the State of New York. This Agreement, the Distribution Agreement and the Appointment Agreements constitute the entire agreement of the parties regarding the offering of Notes contemplated by this Agreement and supersede all prior written or oral and all contemporaneous oral agreements, understandings and negotiations with respect to the subject matter hereof. This Agreement may be executed in one or more counterparts and, if executed in more than one counterpart, the executed counterparts shall each be deemed to be an original but all such counterparts shall together constitute one and the same instrument.

[Signature page follows.]

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

|

|

AVALONBAY COMMUNITIES, INC. |

|

|

|

|

|

|

|

|

By: |

/s/ Kevin P. O’Shea |

|

|

Name: Kevin P. O’Shea |

|

|

Title: EVP & CFO |

MORGAN STANLEY & CO. LLC

UBS SECURITIES LLC

For themselves and as Representatives of the Agents named on Schedule 1 hereto

|

MORGAN STANLEY & CO. LLC |

|

|

|

|

|

|

|

|

By: |

/s/ Russell Lindberg |

|

|

Name: Russell Lindberg |

|

|

Title: Vice President |

|

|

|

|

|

|

|

|

UBS SECURITIES LLC |

|

|

|

|

|

|

|

|

By: |

/s/ Christian Stewart |

|

|

Name: Christian Stewart |

|

|

Title: Managing Director |

|

|

|

|

|

|

|

|

By: |

/s/ Chelseay Boulos |

|

|

Name:Chelseay Boulos |

|

|

Title: Associate Director |

|

[Signature Page to Terms Agreement]

Schedule 1

AGENTS’ ALLOCATIONS

2024 Notes

|

Agent |

|

Aggregate

Principal Amount

of 2024 Notes |

|

|

|

|

|

|

|

|

Morgan Stanley & Co. LLC |

|

$ |

127,500,000 |

|

|

|

|

|

|

|

|

UBS Securities LLC |

|

$ |

127,500,000 |

|

|

|

|

|

|

|

|

BB&T Capital Markets, a division of BB&T Securities, LLC |

|

$ |

15,000,000 |

|

|

|

|

|

|

|

|

Mitsubishi UFJ Securities (USA), Inc. |

|

$ |

15,000,000 |

|

|

|

|

|

|

|

|

PNC Capital Markets LLC |

|

$ |

15,000,000 |

|

|

|

|

$ |

300,000,000 |

|

Schedule 2

AVALONBAY COMMUNITIES, INC.

TERMS OF THE NOTES

(See Attached.)

Exhibit 4.1

AVALONBAY COMMUNITIES, INC.

Issuer

to

THE BANK OF NEW YORK MELLON

Trustee

Fifth Supplemental Indenture

Dated as of November 21, 2014

FIFTH SUPPLEMENTAL INDENTURE, dated as of November 21, 2014 (the “Supplemental Indenture”), between AVALONBAY COMMUNITIES, INC., a corporation organized under the laws of the State of Maryland (herein called the “Company”), and The Bank of New York Mellon, a corporation organized and existing under the laws of the State of New York, as Trustee (herein called the “Trustee”).

RECITALS OF THE COMPANY

The Company has heretofore delivered to the Trustee an Indenture dated as of January 16, 1998 (the “Senior Indenture”), a First Supplemental Indenture dated as of January 20, 1998, a Second Supplemental Indenture dated as of July 7, 1998, a Third Supplemental Indenture dated as of December 21, 1998, an Amended and Restated Supplemental Indenture dated as of July 10, 2000 and a Fourth Supplemental Indenture dated as of September 18, 2006, the forms of which have been filed with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended, and incorporated by reference as exhibits to the Company’s Registration Statement on Form S-3 (Registration No. 333-179720), providing for the issuance from time to time of Senior Debt Securities of the Company (the “Securities”) in an unlimited aggregate principal amount, including a series of debt securities entitled “Medium-Term Notes Due Nine Months or More from Date of Issue” currently limited to $500,000,000 in aggregate initial principal amount.

The Company wishes to amend and restate Section 507 of the Senior Indenture, as provided in this Fifth Supplemental Indenture.

Section 901, including without limitation Sections 901(5) and 901(9), of the Senior Indenture provides that the Company and the Trustee may enter into an indenture supplemental to the Senior Indenture to change or eliminate any of the provisions of the Senior Indenture, and may also enter into an indenture supplemental to the Senior Indenture to make any other provision with respect to matters or questions arising under the Senior Indenture, subject in both cases to certain limitations with respect to outstanding Securities. This Fifth Supplemental Indenture does not affect any outstanding Securities, and applies only to Securities issued after the date of this Fifth Supplemental Indenture. The amendments herein do not and shall not adversely affect the interests of the Holders of Securities of any series in any material respect.

The Trustee is willing to enter into this Fifth Third Supplemental Indenture at the Company’s request, subject to compliance with Section 901 of the Senior Indenture, as applicable.

The Board of Directors of the Company has previously duly adopted resolutions authorizing the Company to execute and deliver this Supplemental Indenture.

All the conditions and requirements necessary to make this Fifth Supplemental Indenture, when duly executed and delivered, a valid and binding agreement in accordance with its terms and for the purposes herein expressed, have been performed and fulfilled.

NOW, THEREFORE, THIS FIFTH SUPPLEMENTAL INDENTURE WITNESSETH:

For and in consideration of the premises and the purchase of each of the series of Securities provided for herein by the Holders thereof and for other good and valuable consideration, the receipt of which is hereby acknowledged, it is mutually covenanted and agreed, for the equal and proportionate benefit of all Holders of the Notes (as herein defined) or of any series thereof, as follows:

ARTICLE ONE

RELATION TO SENIOR INDENTURE; DEFINITIONS

SECTION 1.1. Relation to Senior Indenture. This Supplemental Indenture constitutes an integral part of the Senior Indenture.

SECTION 1.2. Definitions. For all purposes of this Supplemental Indenture, except as otherwise expressly provided for or unless the context otherwise requires:

(1) Capitalized terms used but not defined herein shall have the respective meanings assigned to them in the Senior Indenture; and

(2) All references herein to Articles and Sections, unless otherwise specified, refer to the corresponding Articles and Sections of this Supplemental Indenture.

ARTICLE TWO

AMENDMENT AND RESTATEMENT OF SECTION 507

SECTION 2.1. Amendment and Restatement of Section 507. Section 507 of the Senior Indenture is hereby amended and restated to provide as follows:

SECTION 507. Limitation on Suits. No Holder of any Security of any series or any related coupon shall have any right to institute any proceeding, judicial or otherwise, with respect to this Indenture or the Securities, or for the appointment of a receiver or trustee, or for any other remedy hereunder, unless:

(1) such Holder has previously given written notice to the Trustee of a continuing Event of Default with respect to the Securities of that series;

(2) the Holders of not less than 25% in principal amount of the Outstanding Securities of that series shall have made written request to the Trustee to institute proceedings in respect of such Event of Default in its own name as Trustee hereunder;

(3) such Holder or Holders have offered to the Trustee indemnity reasonably satisfactory to the Trustee against the costs, expenses and liabilities to be incurred in compliance with such request;

(4) the Trustee for 60 days after its receipt of such notice, request and offer of indemnity has failed to institute any such proceeding; and

(5) no direction inconsistent with such written request has been given to the Trustee during such 60-day period by the Holders of a majority in principal amount of the Outstanding Securities of that series;

it being understood and intended that no one or more of such Holders shall have any right in any manner whatever by virtue of, or by availing of, any provision of this Indenture to affect, disturb or prejudice the rights of any other of such Holders, or to obtain or to seek to obtain priority or preference over any other of such Holders or to enforce any right under this Indenture, except in the manner herein provided and for the equal and ratable benefit of all such Holders.

ARTICLE THREE

MISCELLANEOUS PROVISIONS

SECTION 3.1. Ratification of Senior Indenture. Except as expressly modified or amended hereby, the Senior Indenture continues in full force and effect and is in all respects confirmed and preserved.

SECTION 3.2. Governing Law. This Supplemental Indenture and each Note shall be governed by and construed in accordance with the laws of the State of New York. This Supplemental Indenture is subject to the provisions of the Trust Indenture Act of 1939, as amended, and shall, to the extent applicable, be governed by such provisions.

SECTION 3.3. Counterparts. This Supplemental Indenture may be executed in any number of counterparts, each of which so executed shall be deemed to be an original, but all such counterparts shall together constitute but one and the same instrument.

SECTION 3.4. Trustee. The Trustee makes no representation as to the validity or sufficiency of this Fifth Supplemental Indenture. The recitals and statements herein are deemed to be those of the Company and not of the Trustee.

[Signature page follows.]

IN WITNESS WHEREOF, the parties hereto have caused this Fifth Supplemental Indenture to be duly executed by their respective officers hereunto duly authorized, all as of the day and year first written above.

|

|

AVALONBAY COMMUNITIES, INC. |

|

|

|

|

|

|

|

|

By: |

/s/ Kevin P. O’Shea |

|

|

|

Kevin P. O’Shea |

|

|

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|

Attest: |

/s/ Edward M. Schulman |

|

|

|

|

Edward M. Schulman |

|

|

|

Secretary |

|

|

|

|

|

|

|

|

|

|

|

THE BANK OF NEW YORK MELLON, |

|

|

as Trustee |

|

|

|

|

|

|

|

|

By: |

/s/ Raymond K. O’Neil |

|

|

|

Name: Raymond K. O’Neil |

|

|

|

Title: Authorized Signatory |

|

|

|

|

|

Exhibit 5.1

November 21, 2014

AvalonBay Communities, Inc.

Ballston Tower

671 N. Glebe Road, Suite 800

Arlington, VA 22203

Re: Legality of Securities to be Registered Under Registration Statement on Form S-3

Ladies and Gentlemen:

We have acted as counsel to you in connection with your filing of a Registration Statement on Form S-3 (File No. 333-179720) (as amended or supplemented, the “Registration Statement”) filed on February 27, 2012 with the Securities and Exchange Commission (the “Commission”) pursuant to the Securities Act of 1933, as amended (the “Securities Act”), relating to the registration of the offer by AvalonBay Communities, Inc., a Maryland corporation (the “Company”) of an unlimited amount of any combination of securities of the types specified therein. The Registration Statement became effective pursuant to the rules of the Commission upon filing on February 27, 2012. Reference is made to our opinion letter dated February 27, 2012 and included as Exhibit 5.1 to the Registration Statement. We are delivering this supplemental opinion letter in connection with the pricing supplement dated November 12, 2014 (the “Pricing Supplement”) filed on November 12, 2014 by the Company with the Commission pursuant to Rule 424 under the Securities Act. The Pricing Supplement relates to the offering by the Company of $300 principal amount of the Company’s 3.50% Notes due 2024 (the “Notes”) covered by the Registration Statement. We understand that the Notes are to be offered and sold in the manner described in the Pricing Supplement.

We have reviewed such documents and made such examination of law as we have deemed appropriate to give the opinions set forth below. We have relied, without independent verification, on certificates of public officials and, as to matters of fact material to the opinions set forth below, on certificates of officers of the Company.

We refer to (a) the Indenture, dated as of January 16, 1998, between the Company and The Bank of New York Mellon (as successor to State Street Bank and Trust Company) (the “Trustee”), (b) the First Supplemental Indenture, dated as of January 20, 1998, between the Company and the Trustee, (c) the Second Supplemental Indenture, dated as of July 7, 1998, between the Company and the Trustee, (d) the Amended and Restated Third Supplemental Indenture, dated as of July 10, 2000, between the Company and the Trustee, (e) the Fourth Supplemental Indenture, dated as of September 18, 2006, between the Company and the Trustee and (f) the Fifth Supplemental Indenture, dated as of November 21, 2014, between the Company and the Trustee, collectively as the “Indenture.”

The opinion expressed below is limited to the law of New York and the Maryland General Corporation Law.

Based on the foregoing, and subject to the additional qualifications set forth below, we are of the opinion that, upon the execution, authentication and issuance of the Notes in accordance with the terms of the Indenture, the Notes will be valid and binding obligations of the Company, enforceable against the Company in accordance with their terms.

The opinion expressed above is subject to bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and other similar laws of general application affecting the rights and remedies of creditors and to general principles of equity. We express no opinion as to the validity, binding effect or enforceability of provisions in the Notes or the Indenture relating to the choice of forum for resolving disputes.

This opinion letter and the opinion it contains shall be interpreted in accordance with the Legal Opinion Principles issued by the Committee on Legal Opinions of the American Bar Association’s Business Law Section as published in 53 Business Lawyer 831 (May 1998).

We hereby consent to the inclusion of this opinion as Exhibit 5.1 to the Registration Statement and to the references to our firm under the caption “Legal Matters” in the Registration Statement. In giving our consent, we do not admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations thereunder.

|

Sincerely, |

|

|

|

|

|

|

|

|

/s/ Goodwin Procter LLP |

|

|

GOODWIN PROCTER LLP |

|

2

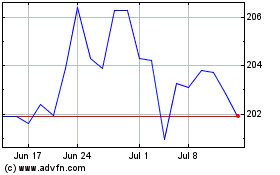

Avalonbay Communities (NYSE:AVB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Avalonbay Communities (NYSE:AVB)

Historical Stock Chart

From Apr 2023 to Apr 2024