UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

Current Report Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 7, 2014

ART’S-WAY MANUFACTURING CO., INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

(State or other jurisdiction of incorporation) |

| |

|

|

|

000-05131 |

|

42-0920725 |

|

(Commission File Number) |

|

(IRS Employer |

| |

|

Identification No.) |

|

5556 Highway 9

Armstrong, Iowa 50514 |

|

(Address of principal executive offices) (Zip Code) |

| |

|

(712) 864-3131 |

|

(Registrant’s telephone number, including area code) |

| |

|

Not Applicable |

|

(Former name or former address, if changed since last report.) |

| |

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On October 7, 2014, Art’s-Way Manufacturing Co., Inc. (the “Company”) issued a press release announcing its financial results for the third quarter of fiscal year 2014, ended August 31, 2014. The full text of the press release is set forth in Exhibit 99.1 attached hereto and is incorporated by reference in this Current Report on Form 8-K as if fully set forth herein.

The information contained in this Current Report on Form 8-K, including Exhibit 99.1 attached hereto and incorporated herein, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section, and shall not be incorporated by reference into any registration statement pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(a) Financial statements: None

(b) Pro forma financial information: None

(c) Shell Company Transactions: None

(d) Exhibits:

99.1 Press Release dated October 7, 2014.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: October 7, 2014

|

|

ART’S-WAY MANUFACTURING CO., INC. |

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Carrie L. Majeski |

|

|

|

Carrie L. Majeski |

|

| |

President, Chief Executive Officer and Interim Chief Financial Officer |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

ART’S-WAY MANUFACTURING CO., INC.

EXHIBIT INDEX TO FORM 8-K

|

Date of Report: |

Commission File No.: |

|

October 7, 2014 |

000-05131 |

| Exhibit No. |

ITEM |

| |

|

|

99.1 |

Press Release dated October 7, 2014. |

Exhibit 99.1

ART’S WAY MANUFACTURING ANNOUNCES THIRD

QUARTER 2014 FINANCIAL RESULTS

Conference Call Scheduled For Thursday, October 9, 2014 at 10:00 AM CT

ARMSTRONG, IOWA, October 7, 2014 – Art’s Way Manufacturing Co., Inc. (NASDAQ: ARTW), a diversified, international manufacturer and distributor of equipment serving agricultural, research, water treatment and steel cutting needs, announces its financial results for the three and nine months ended August 31, 2014.

In conjunction with the release, the Company has scheduled a conference call for Thursday, October 9, 2014 at 10:00 AM CT. J. Ward McConnell, Jr., Chairman of the Board of Directors of Art’s Way Manufacturing, Marc H. McConnell, Vice Chairman of the Board of Directors of Art’s Way Manufacturing, and Carrie Majeski, President, Chief Executive Officer and interim Chief Financial Officer will be leading the call to discuss the third quarter financial results and will also provide an outlook for the balance of 2014.

What: Art’s Way Manufacturing Third Quarter and Year to Date 2014 Financial Results.

When: Thursday, October 9, 2014 10:00 AM CT.

How: Live via phone by dialing (800) 624-7038. Code: Art’s Way Manufacturing. Participants to the conference call should call in at least 5 minutes prior to the start time. A replay of the call will be archived on the Company’s website for 12 months. www.artsway-mfg.com.

| |

|

For the Three Months Ended

(Consolidated) |

|

|

|

|

|

| |

|

August 31, 2014 |

|

|

August 31, 2013 |

|

|

Change |

|

|

Net Sales |

|

$ |

11,585,000 |

|

|

$ |

9,350,000 |

|

|

|

23.9 |

% |

|

Operating Income |

|

$ |

908,000 |

|

|

$ |

54,000 |

|

|

|

1581.5 |

% |

|

Net Income |

|

$ |

558,000 |

|

|

$ |

26,000 |

|

|

|

2046.2 |

% |

|

EPS (Basic) |

|

$ |

0.14 |

|

|

$ |

0.01 |

|

|

|

1300.0 |

% |

|

EPS (Diluted) |

|

$ |

0.14 |

|

|

$ |

0.01 |

|

|

|

1300.0 |

% |

|

Weighted Average Shares Outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

4,048,552 |

|

|

|

4,041,682 |

|

|

|

|

|

|

Diluted |

|

|

4,053,129 |

|

|

|

4,057,773 |

|

|

|

|

|

| |

|

For the Nine Months Ended

(Consolidated) |

|

|

|

|

|

| |

|

August 31, 2014 |

|

|

August 31, 2013 |

|

|

Change |

|

|

Net Sales |

|

$ |

27,291,000 |

|

|

$ |

27,016,000 |

|

|

|

1.0 |

% |

|

Operating Income |

|

$ |

1,057,000 |

|

|

$ |

1,566,000 |

|

|

|

-32.5 |

|

|

Net Income |

|

$ |

553,000 |

|

|

$ |

1,360,000 |

|

|

|

-59.3 |

% |

|

EPS (Basic) |

|

$ |

0.14 |

|

|

$ |

0.34 |

|

|

|

-58.8 |

% |

|

EPS (Diluted) |

|

$ |

0.14 |

|

|

$ |

0.34 |

|

|

|

-58.8 |

% |

|

Weighted Average Shares Outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

4,047,544 |

|

|

|

4,038,118 |

|

|

|

|

|

|

Diluted |

|

|

4,053,152 |

|

|

|

4,050,819 |

|

|

|

|

|

Net Sales:

Our consolidated corporate sales for the three- and nine-month periods ended August 31, 2014 were $11,585,000 and $27,291,000, respectively, compared to $9,350,000 and $27,016,000 during the same respective periods in 2013, a $2,234,000 or 23.9%, increase for the quarter and a $275,000 or 1.0% increase year-to-date. The increase in revenue for the three month period ended August 31, 2014 was primarily due to increases in revenue at Manufacturing and revenues generated from our new tools segment, formed following the acquisition of Ohio Metals in the fourth quarter of 2013. For the nine-month period ended August 31, 2014, Manufacturing, Vessels and Scientific each experienced a decline in revenue, which was offset by the addition of revenue generated from Metals. Consolidated gross profit margin for the three- and nine-month periods ending August 31, 2014 was 23.3% and 23.3% compared to 18.5% and 24.7% during the same periods of 2013.

Manufacturing:

Our third quarter sales at Manufacturing were $9,362,000, compared to $8,005,000 during the same period of 2013, an increase of $1,357,000, or 17.0%. The nine-month sales for 2014 at Manufacturing were $21,366,000, compared to $22,727,000 for the same period in 2013, a 6.0% decrease. The decrease in revenue year to date is primarily due to decreased demand for the Universal Harvester reels and reduced sugar beet harvester sales in fiscal 2014 as compared to 2013, but was offset somewhat by sales from our acquisition of certain Canadian assets from Agro Trend and increased demand for our grinder mixers. Manufacturing’s gross margin for the quarter ended August 31, 2014 was 25.0%, compared to 19.4% for the same period in 2013. For the year to date period ending August 31, 2014 gross margin was 24.8% as compared to 24.3% in the same period for 2013.

Vessels:

Our three- and nine-months sales at Vessels were $606,000 and $1,504,000, respectively, compared to $635,000 and $1,671,000 for the same periods in 2013, a decrease of $29,000, or 4.5% and $166,000, or 9.9%. Gross margin for the quarter ended August 31, 2014 was 6.8% compared to 16.4% for the same period in 2013. Gross margin for the nine-months ended August 31, 2014 was 6.4% as compared to 10.0% for the first nine-months of fiscal 2013.

Scientific:

Our third fiscal quarter and year-to-date sales at Scientific were $820,000 and $1,818,000, respectively, compared to $710,000 and $2,618,000 for the same periods in fiscal 2013, an increase of $111,000, or 15.6% and a decrease of $800,000, or 30.5%, respectively. The year to date decrease was primarily attributable to the 2013 first quarter finalization of an approximately $7 million fabrication and delivery contract executed in January 2012 and an approximately $1.7 million installation contract executed in April 2012. Scientific was hired to design, fabricate, and install twenty-four modular units over the course of approximately one year for one of the world’s leading research and teaching institutions. Scientific uses the percentage of completion accounting method to calculate revenue and gross margins for all contracts. Gross margin for the quarter ended August 31, 2014 was 20.2% compared to 10.1% for the same period in 2013, while gross margin for the nine-month period ended August 31, 2014 was 15.5% as compared to 37.3% for the same period in 2013. The margins reported in first two quarters of 2013 were a result of the finalization of costs as compared to estimates on the major projects described above and did not reflect normal operating margin for the business. The lower margin year to date for 2014 is primarily attributable to the lower revenue relative to steady overhead costs.

Metals:

Metals had sales of $797,000 and $2,603,000 for the three- and nine-months ended August 31, 2014, respectively. Gross margin at Metals was 19.8% for the third fiscal quarter, and 26.9% for the nine months ended August 31, 2014.

Income: Consolidated net income was $558,000 for the three-month period ended August 31, 2014, compared to a net income of $26,000 for the same respective period in 2013. This increase is due to increased operating income of $889,000 at our Manufacturing segment, but was offset by operating losses at our Vessels and Metals divisions. Our consolidated net income for the nine-month period ended August 31, 2014 was $553,000 as compared to $1,360,000 for the same period in 2013. The sale of land described previously and the 2014 year-to-date decrease in revenue at Scientific and Vessels account for the majority of this reduction, but were partially offset by incremental revenues at our new Metals entity.

Earnings per Share:

Earnings per basic and diluted share during the third fiscal quarter ended August 31, 2014 were $0.14 compared to $0.01for the same period during 2013. Earnings per basic and diluted share during the nine months ended August 31, 2014 were $0.14 compared to $0.34 for the same period in 2013. These changes were attributable to the changes in net income discussed above.

Chairman of the Art’s Way Board of Directors, J. Ward McConnell Jr., reports, “After a challenging first two quarters in fiscal 2014, we are pleased to show an increase in revenues on both a quarterly and year to date basis over the prior year. Our agricultural sales are strong, and we’ve seen an increase in backlog over last year in every segment. Our products serving the livestock and dairy sectors have been very strong and are providing the counter-cyclical strength and stability we seek during times of weak row-crop commodity prices.”

About Art’s Way Manufacturing, Inc.

Art's Way manufactures and distributes farm machinery niche products including animal feed processing equipment, sugar beet defoliators and harvesters, land maintenance equipment, crop shredding equipment, round hay balers, plows, hay and forage equipment, manure spreaders, reels for combines and swathers, and top and bottom drive augers, as well as pressurized tanks and vessels, modular animal confinement buildings and laboratories and specialty tools and inserts. Aftermarket service parts are also an important part of the Company's business. The Company has four reporting segments: agricultural products; pressurized tanks and vessels; modular buildings; and tools.

For more information, including an archived version of the conference call, contact: Carrie Majeski, Chief Executive Officer

712-864-3131

investorrelations@artsway-mfg.com

Or visit the Company's website at www.artsway-mfg.com

Cautionary Statements

This news release includes "forward looking statements" within the meaning of the federal securities laws. Statements made in this release that are not strictly statements of historical facts, including: (i) our expectations regarding the benefits of our recent acquisitions; (ii) our beliefs regarding the strength of our agricultural sales and benefits of our product mix; and (iii) expectations regarding the fulfillment of backlog orders and future results are forward looking statements. Statements of anticipated future results are based on current expectations and are subject to a number of risks and uncertainties, including, but not limited to: quarterly fluctuations in results; customer demand for our products; domestic and international economic conditions; factors affecting the strength of the agricultural sector; the cost of raw materials; the management of growth and integration of acquired assets; the availability of investment opportunities; unexpected changes to performance by our operating segments; and other factors detailed from time to time in our Securities and Exchange Commission filings. Actual results may differ markedly from management's expectations. The Company cautions readers not to place undue reliance upon any such forward looking statements. We do not intend to update forward looking statements other than as required by law.

-END-

- 4 -

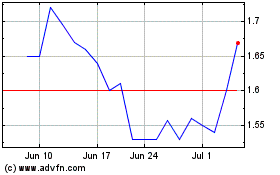

Arts Way Manufacturing (NASDAQ:ARTW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arts Way Manufacturing (NASDAQ:ARTW)

Historical Stock Chart

From Apr 2023 to Apr 2024