Credit Agricole CIB Appoints Gerard R. Vincitore, Former New York Power Authority (NYPA) Senior Vice President, Managing Dire...

June 28 2016 - 10:51AM

Business Wire

Vincitore Will Head Advisory in North

America

Crédit Agricole Corporate & Investment Bank -- the corporate

and investment banking arm of the Crédit Agricole Group, the

world’s ninth largest bank by total assets – announced today the

appointment of Gerard R. Vincitore as a Managing Director in its

Structured Finance Advisory Group for Americas, where he will head

up advisory activities in the North American Power & Utilities

Sector and in addition be involved in specific energy related

transactions in the Americas. He will be based in New York

City.

Credit Agricole CIB is a long-standing market leader in project

finance both globally and in the US & Canada providing

structured finance solutions through its Energy &

Infrastructure business line. Regionally, the bank has been an

innovative financier for a broad range of energy projects,

including renewable and conventional power, distributed generation,

gas transportation infrastructure, LNG export, petrochemicals, and

other infrastructure projects.

Prior to joining Crédit Agricole CIB, Mr. Vincitore was a

financial executive with the New York Power Authority (NYPA), the

nation’s largest public utility, most recently as Senior Vice

President of Corporate Finance. His responsibilities, in addition

to corporate financial management, included identifying,

evaluating, structuring, and supporting the implementation of

Authority initiatives including new generation and transmission

projects (both as owner or off-taker), customer financial

offerings, energy policy projects, and mergers, acquisitions, and

divestitures. He has successfully structured over 1500 MW ($2.0

billion) of new generation projects and 1100 MW ($1.0 billion) of

transmission projects, including the negotiation of two major

transmission development partnerships and advised on several key

Authority energy policy initiatives (New York Energy Highway,

k-Solar, etc.).

“The Power and Utilities sector is a key vertical within the

Global Energy & Infrastructure Practice and a dominant part of

our activity for more than 15 years. With Jerry’s appointment we

will expand into advising on debt and equity capital raising and

other strategic advisory services in this sector in North America,

reflecting the evolution of our advisory practice globally. With

over 18 years of experience, Jerry brings an extraordinarily deep

understanding of the power sector with differentiating perspectives

of the various stakeholders that will enrich our client

engagement,” said Jaya Viswanadha, who heads the Structured Finance

Advisory Group in Americas and to whom Mr. Vincitore will

report.

Upon graduating college in 1998, Mr. Vincitore joined ABB Lummus

Global, Inc. (now part of Chicago Bridge & Iron Company) as a

Process Engineer in the Refining Technology Business Group, where

he spent four years before moving to his first stint with the New

York Power Authority (NYPA) as a Senior Investment Analyst and

Portfolio Manager. He left the utility after two years for Natixis,

an investment bank, before rejoining NYPA in 2009, rising

successively in responsibility to his most recent position.

Mr. Vincitore holds a BS in Chemical Engineering from Manhattan

College, a MBA from Fordham University and is a Chartered Financial

Analyst.

Crédit Agricole CIB, a Global Player in

Energy and Infrastructure Financing

Crédit Agricole CIB, a leading global player in Energy and

Infrastructure financing, has the distinction of being the only

bank to receive Project Finance Bond House of the Year, Global Bank

of the Year and Global Adviser of the Year awards from Project

Finance International, in addition to being named its 2015 Americas

Bank of the Year for Project Financing. Crédit Agricole CIB ranked

in the top 5 financial Mandated Lead Arrangers for North America in

2015 (Source: Dealogic)

As a leading advisor globally, Crédit Agricole CIB has been

actively involved in several recent transactions, including, among

others, a $20 billion debt financing for the Ichthys LNG project

offshore Australia, the world’s largest project financing;

refinancing of the $1.1 billion Singapore SportsHub, the largest

public private partnership to date in South East Asia; and the 765

million Euro refinancing of Copenhagen Airport in the U.S. and Euro

private placement and bank markets, together with associated cross

currency swaps. In the Americas, Crédit Agricole CIB has high

profile diverse mandates to its credit such as a debt advisory for

$ 5bn Cobre Panama Copper Mine for FQM (Ongoing), the Covioriente

Toll Road financing in Colombia (Ongoing), 500kV Charrua Ancoa

196.5km transmission line financing, owned by Grupo Elecnor S.A.

and APG (Closed); and on the debt and equity financing of the Tres

Mesas’ 148.5 MW wind farm in Mexico (Closed).

About Crédit Agricole Corporate and

Investment Bank

Crédit Agricole CIB is the Corporate and Investment Banking arm

of the Crédit Agricole Group, the world’s 9th largest bank by total

assets (The Banker, July 2015). The Bank offers its clients a

comprehensive range of products and services structured around six

major divisions:

- Client Coverage & International

Network

- Global Investment Banking

- Structured Finance

- Global Markets

- Debt Optimization &

Distribution

- International Trade and Transaction

Banking.

The Bank provides support to clients in large international

markets through its network with a presence in major countries in

Europe, Americas, Asia Pacific and the Middle East North

Africa.

For more information, please visit its website at

www.ca-cib.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160628006054/en/

Media Inquiries:Crédit Agricole CIB AmericasMs. Mary Guzman, +1

212 261-7129mary.guzman@ca-cib.comorAnreder & CompanySteven S.

AnrederMichael WichmanTel:

+1-212-532-3232steven.anreder@anreder.commichael.wichman@anreder.com

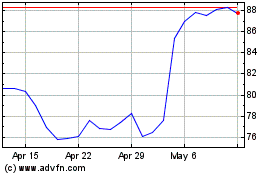

Arcosa (NYSE:ACA)

Historical Stock Chart

From Mar 2024 to Apr 2024

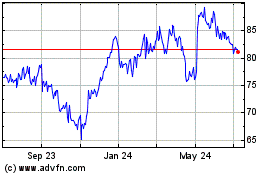

Arcosa (NYSE:ACA)

Historical Stock Chart

From Apr 2023 to Apr 2024