TIDMCWR

RNS Number : 5327W

Ceres Power Holdings plc

10 November 2014

10 November 2014

Ceres Power Holdings plc

Final Results 2014

and

Notice of Annual General Meeting

Ceres Power Holdings plc ("Ceres", "Ceres Power" or "the Group")

today announces its final results for the year ended 30 June

2014.

Highlights:

During the reporting period:

-- Joint Development Agreement signed with Cummins Power

Generation to explore the development and commercialisation of the

Steel Cell technology for products in Cummins' core markets of

prime and backup power

-- Evaluation of the Ceres Steel Cell with KD Navien, South

Korea's largest boiler manufacturer, as part of Technology

Assessment Agreement

-- Increase of underlying revenue from near zero in 2013 to

GBP0.5 million in 2014 (total revenue increasing from GBP0.5

million to GBP1.2 million) and reduction of loss for the financial

year by approximately 1 3 from GBP11.4 million to GBP7.4

million

After the period end:

-- Successful fundraising of GBP20 million from leading

institutional investors provides the balance sheet strength to

engage with commercial partners for the next stages of joint

development and commercialisation of the technology

-- Deepening relationship with global Japanese power system

company as Joint Development Agreement signed following successful

testing in Japan and the UK over the past year

Financial Highlights:

Year Ended

Year Ended 30 June

30 June 2014 2013

GBP'000 GBP'000

-------------- -----------

Revenue 1,224 523

Recurring operating costs (10,128) (10,187)

Operating costs (10,128) (13,255)

Operating loss (8,588) (12,741)

Loss for the financial year (7,393) (11,375)

Loss per share (1.38)p (3.88)p

Net cash and short-term investments 7,699 15,437

Notice of Annual General Meeting and posting of Annual Report

and Accounts:

Notice of the Company's Annual General Meeting is hereby given

for 11:00 am on Wednesday 3 December 2014 at its offices at Viking

House, Foundry Lane, Horsham, RH13 5PX. The Company also announces

that it has posted to shareholders its Annual Report and Accounts

for the year ended 30 June 2014. The documents are also available

from the Company's website www.cerespower.com.

Alan Aubrey, Chairman, commented:

"I am delighted with the tremendous progress the Company has

made both technically and commercially. With the expected rapid

growth in the fuel cell market over the next few years, I am

particularly pleased that we have set Ceres Power on a strong

financial footing through the recent GBP20 million

fundraising."

Phil Caldwell, CEO added:

"We are now seeing the benefits of our internal developments

coming through into our customer engagements with some of the most

experienced power system companies in the world. We are building

our global profile and we have a healthy commercial pipeline for

the coming year."

For further information contact:

Ceres Power Holdings plc Tel. +44 (0)1403

273463

Phil Caldwell, Chief Executive

Richard Preston, Finance Director

Nplus1 Singer Advisory LLP Tel. +44 (0) 20

7496 3000

Ben Wright

Tavistock Communications Tel. +44 (0) 20 7920 3150

Mike Bartlett / James Collins

www.cerespower.com

Chairman's Statement

This is an exciting time in the fuel cell industry. Following a

prolonged development period we are now seeing the rapid emergence

of an industry with the commercialisation of first generation

products from leading global companies.

Growth of the sector has been particularly significant in Asia

and the US, as favourable energy policies and subsidies, combined

with a renewed interest in natural gas and billions of dollars of

investment by private companies, support this initial

commercialisation.

As with any emerging industry we are also seeing a period of

consolidation. Many of the less well-financed independent fuel cell

providers have exited the business or been acquired by larger

OEM's, and significant partnerships have been made as companies

form strategic alliances. This shows an increasing need for global

engineering companies to access capability in fuel cell

technology.

By focusing on our technology and partnering with these leading

companies we are confident that we have the right strategy to take

our technology through to product.

With the global market for fuel cells forecast to reach US$8.5

billion by 2020, this represents a significant opportunity for

those companies that can emerge as winners over the next few years.

Therefore I am particularly pleased that we have set Ceres Power on

a strong financial footing with the addition of several high

quality institutional investors through the recent GBP20 million

fundraising.

Progress

Since implementing our new strategy in 2013 Ceres has continued

to deliver against its plan.

I am especially pleased with the calibre of commercial interest

that Ceres has generated across different geographies and

applications.

This is particularly so with the signing of a Joint Development

Agreement and deepening of our relationship with one of the leading

global Japanese power systems companies and the significant

commercial progress made in a relatively short space of time with

our ongoing relationship with Cummins Power Systems in the US.

It is a huge endorsement of the technical team's capabilities

that they have been able to progress to the next stages with

customers as technically demanding as the Japanese OEMs.

By satisfying demanding customer test requirements in both the

UK and Asia, the Company has valuable third-party validation of the

Steel Cell technology's disruptive performance, particularly its

robustness.

We have made significant strides with the technology under the

leadership of Mark Selby, our Chief Technology Officer, and I am

pleased that this has been recognised by his promotion to the

board.

People

I am delighted with the tremendous progress the Company has

made, both technically and commercially, under the leadership of

our CEO Phil Caldwell in his first full year with the Company.

We have a strong dedicated team who have embraced the new

strategy and the increasing opportunities that this has generated.

This progress can be clearly seen in the Horsham facility, which

has never failed to impress the leading players from across the

industry that have visited in the past year.

We continue to invest both in adding to the team in key areas

and also the test and manufacturing infrastructure in Horsham. This

will accelerate our development and enable further customer

engagements.

I am confident that the Ceres Steel Cell technology can

transform the way that power is generated and distributed and look

forward to building on the significant progress made in the last

twelve months to further position Ceres as one of the leading

companies in the fuel cell industry in the year ahead.

Alan Aubrey

Chairman

Chief Executive's Statement

Introduction

I am positive that we have the right strategy to compete in the

rapidly growing fuel cell industry and, through the dedication of

the team working not just in the UK but also at customer sites in

Korea, Japan and the US, we have put in place a solid foundation

for our future commercial success.

Strategy

The fuel cell industry today is dominated by the large global

players who have the balance sheet strength to invest in technology

and bring first products to market in environments with favourable

energy policy and subsidies.

A partnering approach is being adopted with alliances of several

companies coming together to cover all aspects of the product

development cycle, from the design and manufacture of the core fuel

cell technology to system-level product development and the channel

to market, often through a utility or energy services company.

Our strategy of being a technology provider rather than a

product company allows us to play to our strengths and focus on our

next generation Steel Cell technology, while leveraging the

expertise of some of the world's largest power companies.

By using the same core Steel Cell technology for different

product applications across different geographies we are able to

access the growing markets of Asia and the US through strategic

partnerships and ultimately the licensing of our technology.

The licensing approach and outsourced manufacturing is often

used in the consumer electronics industry where a commercial

"eco-system" of technology designers, manufacturers and OEM's come

together to provide the products we are all reliant upon today. At

Ceres Power we are working on establishing our own eco-system of

partners.

This approach enables us to scale the business through

leveraging our partners' product development and manufacturing

capabilities in order to bring the Steel Cell technology to market

in the next generation of power products we all need for the home

and business.

The recent fundraise backed by leading institutional investors

endorses the Company strategy and gives Ceres the balance sheet

strength to engage with these leading companies at this key stage

of the Company's development.

Commercial

Over the past year we have made significant commercial progress

in building a pipeline of opportunities from the global power

sector and we have welcomed many of the leading players to our

facilities in Horsham. All of the companies we are dealing with are

leaders in their chosen markets and although not all can be

expected to go through to commercialisation, success with a

relatively small number of companies would give us a significant

market share.

One of the most satisfying aspects of the past year has been

seeing our technology successfully tested on several customer sites

in Korea and Japan. This confirms the confidence that we have in

the performance of the Steel Cell technology with third party

validation by some of the world's most experienced engineering

companies.

In January we shipped our first fuel cell power system to KD

Navien (KDN) under the terms of the Technology Assessment

Agreement, which has undergone extensive testing at an independent

Korean test house and then at KDN's own facility near Seoul. As a

first deployment outside of the UK we have made great progress and

learnt a tremendous amount about how our technology performs in

different environmental conditions.

We have successfully demonstrated superior performance for

cycling and robustness compared to similar solid oxide fuel cell

(SOFC) technologies and have agreed to extend the testing period to

enable modification for localised conditions and ensure we

reproduce the same performance at KDN as in the UK. During this

time we have built a strong working relationship with the KDN team

and in parallel to the testing we are in discussions for the next

phases of the relationship to jointly develop a product for the

Korean and international markets based on the Steel Cell

technology.

I am extremely pleased with our progress in Japan this year,

since opening our office in Kyoto in April and culminating in the

recently signed next stage Joint Development Agreement with one of

the leading Japanese power system companies. This follows extensive

evaluation of the Steel Cell technology over the past year with

testing in the UK and at the customer's facility in Japan. There is

particular interest in the robustness and cycleability of the Steel

Cell for different applications such as conventional generators,

which has often been a problem for other SOFC technologies in the

past. Under this agreement the companies will jointly develop a

fuel cell stack using the Ceres Steel Cell technology combined with

the engineering and design expertise of the Japanese OEM, to be

built in the UK and then tested in Japan for its application for

both residential and generator systems. Japan is a key market for

us and we have developed a strong commercial pipeline and expect

several more companies to enter evaluation stages in the coming

months.

Recent advancements in the efficiency of the technology have

opened up the opportunity for us to explore other applications,

with a particular focus on the North American market. In March we

signed a strategic Joint Development Agreement with Cummins Power

Generation, a global provider of power systems, including those for

the data centre and back-up power markets. The purpose of the

collaboration is to explore the joint development and

commercialization of the Steel Cell technology for products in

Cummins' existing markets. There is significant interest in

distributed generation using fuel cells in the US and we are

exploring several commercial opportunities, which we expect to

progress to the next stages in the coming year.

As part of our business strategy we are also further developing

our relationships with energy companies and utilities in different

regions and are starting to explore strategic partnerships for

manufacturing scale-up in key markets such as Asia.

Technology

The Board has been very pleased with progress made this year

against our technology roadmap. In the last year the technology

team has continued to evaluate the ability of the technology to

compete in the most advanced markets in the world for fuel cell

power generation, namely the rapidly maturing Japanese consumer

scale CHP units and the emerging "power only", or prime power,

market in North America.

We have also supported our customers with their own technology

evaluation programmes, which have allowed them to validate our

technology's unrivalled ability to shutdown repetitively in planned

and unplanned scenarios.

I am most excited by the improvement in electrical efficiency

from 50% published this time last year to over 57%. Operation in an

unoptimised CHP prototype product showed 47% net efficiency, which

puts our technology firmly in the same high-efficiency category as

m-CHP products on sale today in Japan, but at a much lower overall

cost, improving potential savings for domestic micro-CHP customers.

Looking to the future, our roadmap for the next period includes

activities that aim to increase efficiency and power density still

further and will strengthen our cost USP against other

technologies.

With the support of a GBP1 million government grant from the

Department of Energy and Climate Change (DECC) to accelerate the

worldwide commercialisation of this technology, the team has made

great strides in improving the Fuel Cell Module design, including

improving emissions compliance at system level. This is key to

enable adoption in all our target markets and it offers our

partners an easier route to developing products around the

technology.

Across all areas of our technology we continue to generate and

protect our intellectual property. We file numerous patents where

they strengthen our position and protect our competitive advantage,

and since June 2013 we have increased the number of patent and

trade mark families we have filed for from 33 to 39.

Our focus on increasing efficiency of the core Steel Cell

technology combined with system development with our partners gives

us confidence that we can address larger scale prime power

applications where this is the main requirement.

Manufacturing and Operations

In manufacturing, the Company's operational focus has been

continuing the supply of quality fuel cells to the various internal

and customer programmes, as well as investing in improvements to

the manufacturing processes. For example, our recent partnership

with DEK (part of ASM Assembly Solutions), a global provider of

screen printing equipment, coupled with grant funding of GBP0.7

million from the Technology Strategy Board, which we announced in

August 2014, is a key enabler to scale up some of our key processes

more cost-effectively. The collaboration combines DEK's latest high

speed photovoltaic manufacturing processes with Ceres existing

manufacturing capability.

In the coming year we will continue to develop our manufacturing

processes to enable further capacity, initially in the UK, and we

will explore further scale-up with global manufacturing partners in

line with our business strategy.

Financial

Apart from meeting commercial and technical milestones, we

measure success of the business through careful management of the

Company's resources and by measuring progress on our financial

milestones.

The Company's loss for the financial year decreased from GBP8.3

million in 2013 (excluding restructuring costs of GBP3.1 million)

to GBP7.4 million. As the weighted average number of shares in

issue increased from 293 million to 537 million, the loss per

ordinary share decreased from 3.88p to 1.38p.

Total revenue increased from GBP0.5 million in the year ending

30 June 2013 to GBP1.2 million in the current year. Excepting

releases of deferred revenue in both the prior year (Calor Gas

GBP0.5 million) and the current year (Bord Gais Eireann GBP0.7

million), the Group has increased its underlying revenue from

GBP13,000 in the year ending 30 June 2013 to GBP0.5 million in the

current year. This reflects the continued progress the Company has

made in developing new and deepening existing partner

relationships.

Control of the Company's cost base is vital to Ceres. We are in

a growth phase and we do expect our cost base to increase as we

service customers and rebase from our restructuring in 2013. The

Board is comfortable with the recurring operating costs of GBP10.1

million (2013: GBP10.2 million), which is necessary to continue the

development and productionisation of the technology.

At the year end the Company had GBP7.7 million in cash and cash

equivalents, having used GBP7.3 million net cash in operations in

the period (2013: GBP7.3 million), and with the addition of the

GBP20 million gross raised via an oversubscribed private placing in

July 2014, the Group is well financed to deliver the next phase of

its business plan.

During the year the Company began again to invest significantly

in capital equipment (GBP0.5 million based on cashflow during the

year, compared to GBP42,000 in 2013), which will be used to

accelerate the technology development cycle. The single largest

investment in 2014 is GBP1 million of new test facilities, which

was part complete at year end.

Ceres is also making excellent use of the available government

grants and is grateful for their availability, recognising GBP0.6

million in the year (2013: nil). Another important form of funding

to the business is receiving R&D tax credits. We received

GBP1.1 million of tax credit relating to the prior year and we

estimate to recover a similar amount for the current year.

People

I continue to be impressed with the whole team at Ceres. Their

commitment over the year has been excellent, and the Board

recognises the importance of everyone's contribution to achieving

the Company's goals. During the year we have recruited new

colleagues in order to deliver our internal and external

programmes, and we will continue to recruit the right resource to

help us deliver to our objectives.

As the Chairman has stated in his report, since the year end we

have promoted Mark Selby, Chief Technology Officer, to the main

Board of Directors of the Company. This reflects his leadership and

his active contribution to the development of our technology.

Risks

The Group faces a number of risks and uncertainties, which could

affect the execution of its strategic objectives. The key business

risks and the key financial risks are detailed in the Annual

Report.

Outlook, key objectives and KPI's

In the past year we have laid a solid technical foundation and

executed customer programmes to an extremely high standard of

performance. We are now seeing the benefits of our internal

developments coming through into our customer engagements with some

of the most experienced power system companies in the world. We are

building our global profile and we have a healthy commercial

pipeline for the coming year.

Ceres considers its financial key performance indicators to be

revenue from commercial activities, operating costs, and

maintaining a strong cash position.

In the coming year I expect further revenue growth through

advancement of partners to next stage Joint Development Agreements

and bringing on new partners at the evaluation stage.

We will manage operating costs to support commercial activity

and further investment will be made in the technical team and our

test and manufacturing capabilities at Horsham as we pursue our own

roadmap to produce a Steel Cell technology that is fit for real

world applications in all metrics of performance and cost.

The valuable third party validation we have received from our

OEM partners reinforces our confidence that our Steel Cell

technology has the potential to become the standard next generation

fuel cell technology.

This is a very exciting time in this rapidly growing industry

and at Ceres Power we are well positioned to become one of the

leading companies in this sector.

Phil Caldwell

Chief Executive Officer

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year ended 30 June 2014

Year ended Year ended

30 June 30 June

2014 2013

Note GBP'000 GBP'000

Revenue 1,224 523

Cost of Sales (265) (10)

Gross Profit 959 513

Operating costs 2 (10,128) (13,255)

Other operating income 581 1

Operating loss (8,588) (12,741)

Finance income 73 55

Loss before income tax (8,515) (12,686)

Income tax credit 1,122 1,311

Loss for the financial year and total

comprehensive loss (7,393) (11,375)

=========== ===========

Loss per GBP0.01 ordinary share expressed

in pence per share:

Basic and diluted loss per share 3 (1.38)p (3.88)p

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 June 2014

30 June 30 June

2014 2013

Note GBP'000 GBP'000

------------------------------------------------ ---- -------- --------

Assets

Non-current assets

Property, plant and equipment 1,657 2,181

Other receivables 58 53

------------------------------------------------ ---- -------- --------

Total non-current assets 1,715 2,234

------------------------------------------------ ---- -------- --------

Current assets

Trade and other receivables 1,219 454

Current tax receivable 1,166 1,044

Short-term investments 6 - 6,207

Cash and cash equivalents 6 7,699 9,230

------------------------------------------------ ---- -------- --------

Total current assets 10,084 16,935

Liabilities

Current liabilities

Trade and other payables (1,143) (1,089)

Provisions for other liabilities and charges (242) (261)

Total current liabilities (1,385) (1,350)

------------------------------------------------ ---- -------- --------

Net current assets 8,699 15,585

------------------------------------------------ ---- -------- --------

Non-current liabilities

Accruals and deferred income (1,175) (1,918)

Provisions for other liabilities and charges (1,166) (1,293)

------------------------------------------------ ---- -------- --------

Total non-current liabilities (2,341) (3,211)

------------------------------------------------ ---- -------- --------

Net assets 8,073 14,608

------------------------------------------------ ---- -------- --------

Equity attributable to the owners of the Parent

Share capital 4 5,369 8,817

Share premium account 72,907 72,906

Capital redemption reserve 3,449 -

Other reserve 7,463 7,463

Accumulated losses (81,115) (74,578)

------------------------------------------------ ---- -------- --------

Total equity 8,073 14,608

------------------------------------------------ ---- -------- --------

CONSOLIDATED CASH FLOW STATEMENT

For the year ended 30 June 2014

Year ended Year ended

30 June 30 June

2014 2013

Note GBP'000 GBP'000

------------------------------------------------------- ---- ---------- ----------

Cash flows from operating activities

Cash used in operations 5 (8,252) (10,016)

Income tax received 1,000 2,667

------------------------------------------------------- ---- ---------- ----------

Net cash used in operating activities (7,252) (7,349)

------------------------------------------------------- ---- ---------- ----------

Cash flows from investing activities

Purchase of property, plant and equipment (520) (42)

Movement in short-term investments 6,207 (6,207)

Finance income received 75 57

------------------------------------------------------- ---- ---------- ----------

Net cash generated from/(used in) investing

activities 5,762 (6,192)

Cash flows from financing activities

Proceeds from issuance of ordinary shares 2 12,591

Net cash generated from financing activities 2 12,591

------------------------------------------------------- ---- ---------- ----------

Net decrease in cash and cash equivalents (1,488) (950)

Exchange (losses)/gains on cash and cash equivalents (43) 2

------------------------------------------------------- ---- ---------- ----------

(1,531) (948)

Cash and cash equivalents at beginning of year 9,230 10,178

------------------------------------------------------- ---- ---------- ----------

Cash and cash equivalents at end of year 6 7,699 9,230

------------------------------------------------------- ---- ---------- ----------

Reconciliation to net funds

Opening net funds 15,437 10,178

Net decrease in cash and cash equivalents (1,531) (948)

(Decrease)/increase in short-term investments (6,207) 6,207

------------------------------------------------------- ---- ---------- ----------

Closing net funds (note 6) 7,699 15,437

------------------------------------------------------- ---- ---------- ----------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 30 June 2014

Share Capital

Share premium redemption Other Accumu-lated

capital account reserve reserve losses Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- -------- -------- ----------- ---------------- ------------ --------

At 1 July 2012 4,311 64,821 - 7,463 (63,617) 12,978

--------------------------------- -------- -------- ----------- ---------------- ------------ --------

Comprehensive income

Loss for the financial year - - - - (11,375) (11,375)

--------------------------------- -------- -------- ----------- ---------------- ------------ --------

Total comprehensive loss - - - - (11,375) (11,375)

--------------------------------- -------- -------- ----------- ---------------- ------------ --------

Transactions with owners

Issue of shares, net of costs 4,506 8,085 - - - 12,591

Share-based payments charge - - - - 414 414

--------------------------------- -------- -------- ----------- ---------------- ------------ --------

Total transactions with owners 4,506 8,085 - - 414 13,005

--------------------------------- -------- -------- ----------- ---------------- ------------ --------

At 30 June 2013 8,817 72,906 - 7,463 (74,578) 14,608

--------------------------------- -------- -------- ----------- ---------------- ------------ --------

Comprehensive income

Loss for the financial year - - - - (7,393) (7,393)

--------------------------------- -------- -------- ----------- ---------------- ------------ --------

Total comprehensive loss - - - - (7,393) (7,393)

--------------------------------- -------- -------- ----------- ---------------- ------------ --------

Transactions with owners

Issue of shares, net of costs 1 1 - - - 2

Cancellation of deferred shares,

net of costs (3,449) - 3,449 - - -

Share-based payments charge - - - - 856 856

--------------------------------- -------- -------- ----------- ---------------- ------------ --------

Total transactions with owners (3,448) 1 3,449 - 856 858

--------------------------------- -------- -------- ----------- ---------------- ------------ --------

At 30 June 2014 5,369 72,907 3,449 7,463 (81,115) 8,073

--------------------------------- -------- -------- ----------- ---------------- ------------ --------

Notes to the final announcement

1. Basis of preparation

The final announcement for the year ended 30 June 2014 has been

prepared in accordance with International Financial Reporting

Standards (IFRS) as adopted by the European Union, the IFRS

Interpretations Committee (IFRS-IC) interpretations and those parts

of the Companies Act 2006 applicable to companies reporting under

IFRS. The financial information contained in this final

announcement does not constitute statutory accounts as defined in

Section 434 of the Companies Act 2006. The financial information

has been extracted from the financial statements for the year ended

30 June 2014, which have been approved by the Board of Directors

and the comparative figures for the year ended 30 June 2013 are

based on the financial statements for that year. The accounts for

2013 have been delivered to the Registrar of Companies and the 2014

accounts will be delivered after the Annual General Meeting. The

auditors have reported on both sets of accounts without

qualification, did not draw attention to any matters by way of

emphasis without qualifying their report and did not contain a

statement under Section 498(2) or 498(3) of the Companies Act

2006.

2. Operating costs

Operating costs are split as follows:

Year ended Year ended

30 June 2014 30 June 2013

GBP'000 GBP'000

------------------------------------------------------ ------------- -------------

Operating costs are split as follows:

Research and development costs 7,138 7,190

Administrative expenses - recurring 2,990 2,997

------------------------------------------------------ ------------- -------------

10,128 10,187

Administrative expenses - non-recurring restructuring

related - 3,068

------------------------------------------------------ ------------- -------------

10,128 13,255

------------------------------------------------------ ------------- -------------

Non-recurring costs incurred in 2013 relate to the disposal of

property, plant and equipment (GBP759,000) and termination payments

and provisions for onerous leases (GBP2,309,000).

3. Loss per share

Basic and diluted loss per GBP0.01 ordinary share are calculated

by dividing the loss for the financial year attributable to

ordinary shareholders by the weighted average number of ordinary

shares in issue during the year. Given the losses during the year,

there is no dilution of losses per share in the year ended 30 June

2014 or in the previous year.

The loss for the financial year ended 30 June 2014 was

GBP7,393,000 (2013: GBP11,375,000) and the weighted average number

of GBP0.01 ordinary shares in issue during the year ended 30 June

2014 was 536,831,883 (2013: 292,793,498).

4. Share capital

2014 2013

-------------------- --------------------

Number GBP'000 Number GBP'000

--------------------------------------- ----------- ------- ----------- -------

Allotted and fully paid

At 1 July 536,799,123 8,817 86,215,662 4,311

Allotted under share option schemes 32,850 1 2,235,838 22

Allotted on cash placing & open offer - - 448,347,623 4,484

Transfer to capital redemption reserve -(1) (3,449) - -

Ordinary shares of GBP0.01 each at

30 June 536,831,973 5,369 536,799,123 8,817

--------------------------------------- ----------- ------- ----------- -------

(1) 86,215,662 GBP0.04 deferred shares were cancelled in the

year. These deferred shares were not included in the number of

ordinary shares disclosed in this table.

During the period the deferred shares of GBP0.04 each were

cancelled with GBP3,448,626 being transferred to a capital

redemption reserve and 32,850 ordinary shares of GBP0.01 each were

issued on the exercise of employee share options for cash

consideration of GBP1,642. (2013: On 18 December 2012 each existing

ordinary share of GBP0.05 was sub-divided into one new ordinary

share of GBP0.01 and one deferred share of GBP0.04. On that date

the Company issued 330,000,000 ordinary shares of GBP0.01 each in a

placing and open offer for cash consideration of GBP3,300,000. On 2

April 2013 the Company issued 118,347,623 ordinary shares of

GBP0.01 each in a placing and open offer for cash consideration of

GBP9,467,810 (before deducting issue costs of GBP208,050). Also

2,235,838 ordinary shares of GBP0.01 each were issued on the

exercise of employee share options for cash consideration of

GBP31,792).

5. Cash used in operations

Year ended Year ended

30 June 2014 30 June 2013

GBP'000 GBP'000

--------------------------------------------------- ------------- -------------

Loss before income tax (8,515) (12,686)

Adjustments for:

Other finance income (73) (55)

Depreciation of property, plant and equipment

(net of amortised grant contributions) 1,069 1,322

Disposal of property, plant and equipment - 759

Share-based payments charge 856 414

--------------------------------------------------- ------------- -------------

Operating cash flows before movements in working

capital (6,663) (10,246)

(Increase)/decrease in trade and other receivables (773) 163

Decrease in trade and other payables (670) (861)

(Decrease)/increase in provisions (146) 928

--------------------------------------------------- ------------- -------------

(Increase)/decrease in working capital (1,589) 230

--------------------------------------------------- ------------- -------------

Cash used in operations (8,252) (10,016)

--------------------------------------------------- ------------- -------------

6. Net cash, short-term investments and financial assets

30 June

2014 30 June 2013

GBP'000 GBP'000

-------------------------------------------- -------- ------------

Cash at bank and in hand 982 576

Money market funds 6,717 8,654

Cash and cash equivalents 7,699 9,230

Short-term bank deposits greater than three

months - 6,207

-------------------------------------------- -------- ------------

7,699 15,437

-------------------------------------------- -------- ------------

The Group typically places surplus funds into pooled money

market funds and bank deposits with durations of up to twelve

months. The Group's treasury policy restricts investments in

short-term sterling money market funds to those which carry

short-term credit ratings of at least two of AAAm (Standard &

Poor's), Aaa/MR1+ (Moody's) and AAA V1+ (Fitch) and deposits with

banks with minimum long-term rating of A/A-/A3 and short-term

rating of F-1/A-2/P-2 for banks which the UK Government holds less

than 25% ordinary equity.

7. Post balance sheet event

During July 2014 the Company completed a private placing which

raised GBP20 million gross through the issue of 235,705,868

ordinary shares.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UKSARSBAARUA

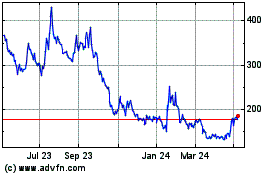

Ceres Power (LSE:CWR)

Historical Stock Chart

From Mar 2024 to Apr 2024

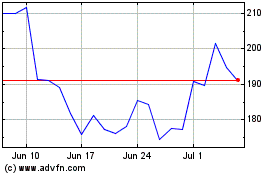

Ceres Power (LSE:CWR)

Historical Stock Chart

From Apr 2023 to Apr 2024