TIDMCPP

RNS Number : 6806W

CPPGroup Plc

21 August 2015

CPPGROUP PLC

21 AUGUST 2015

HALF YEAR REPORT

FOR THE SIX MONTHS ENDED 30 JUNE 2015

ROBUST FIRST HALF PERFORMANCE

CLEAR AND FOCUSED APPROACH FOR THE FUTURE

CPPGroup Plc (CPP or the Group) is an international assistance

business operating in the UK and overseas. CPP primarily operates a

business-to-business-to-consumer (B2B2C) business model providing

products and services to customers through Business Partners and

direct to consumer. The Group's core assistance products help to

provide security and are designed to make everyday life easier to

manage.

Financial highlights

-- Group revenue from continuing operations of GBP45.2 million (H1 2014: GBP58.7 million)

-- The Group's annual renewal rate has improved to 73.2% (31

December 2014: 71.4%), reflecting the value customers continue to

place on our products

-- Underlying operating profit of GBP2.2 million (H1 2014:

breakeven) partly reflecting the on-going control of the cost

base

-- Stable financial platform and stronger liquidity, following

successful equity raise and debt restructuring together with

improved trading

Operational highlights

-- Commenced work with SSP Limited on implementation of a new

core platform IT system for the Group

-- Decision to cease providing airport lounge access services (Airport Angel)

-- Reorganisation of management to a more nimble structure with greater accountability

-- Strategic initiatives defined to drive growth, enhance

digital and IT capability and manage costs

-- New executive team; appointment of Stephen Callaghan as Chief

Executive Officer, 30 July 2015; proposed appointment of Michael

Corcoran as Chief Financial Officer, with effect from 1 September

2015

Stephen Callaghan, Chief Executive Officer, commented:

"CPP has made significant progress in the first half of 2015.

Securing new equity funding and restructuring of the Group's debt

has provided the business with a stable financial platform, and the

business has delivered an improved profit performance underpinned

by our on-going focus on costs. There is much work to do for the

Group to realise its growth ambitions, however we are seeing

encouraging progress from the actions we are taking to improve our

financial performance. We expect to make further progress during

the remainder of 2015 and, looking to next year, our current view

is that the Group's underlying operating profit will be materially

higher than the previous expectations set for 2016.

CPP is going through a significant transition. We are in the

early stages of the Group's transformation plan and the team at CPP

has clarity of purpose, a focused approach, and well-defined

accountability. As the Group looks to the future, we know what we

have to do and understand the importance of maintaining momentum in

the delivery of our plans to ensure we achieve a strong,

sustainable and profitable future."

Highlights - continuing operations Six months ended 30 June 2015 Six months ended 30 June 2014

(Unaudited) (Unaudited)

---------------------------------------------- ------------------------------ ------------------------------

Revenue (GBP millions) 45.2 58.7

Operating profit/(loss) (GBP millions)

- Reported 20.7 (0.3)

- Underlying1 2.2 -

Profit/(loss) for the period (GBP millions)2 17.1 (2.7)

Basic earnings/(loss) per share (pence) 2.50 (1.12)

Cash used in operations (GBP millions)3 (4.0) (23.0)

Net funds (GBP millions)4 36.9 21.6

Live policies (millions) 4.4 6.1

Annual renewal rate (%)(5) 73.2 69.5

1. Underlying operating profit/(loss) excludes an exceptional

credit of GBP18.9 million (H1 2014: GBP0.3 million charge) and

Matching Share Plan charges of GBP0.3 million (H1 2014: GBPnil).

Further detail of the exceptional credit is provided in note 4 to

the condensed consolidated interim financial statements.

2. Profit/(loss) for the period includes profit/(loss) after tax

from continuing and discontinued operations.

3. Includes cash flows from continuing and discontinued operations.

4. Net funds comprise cash and cash equivalents of GBP38.0

million (H1 2014: GBP53.6 million) partially offset by borrowings

of GBP1.1 million (H1 2014: GBP32.0 million). Cash and cash

equivalents includes cash held for regulatory purposes of GBP15.8

million (H1 2014: GBP20.4 million) and cash restricted by the terms

of the VVOP within the UK's regulated entities of GBP17.5 million

(H1 2014: GBP24.4 million). Whilst not available to the wider

Group, the restricted cash is available to the regulated entity in

which it exists including for operational and residual redress

purposes.

5. The annual renewal rate does not include cancellations that

have occurred during the UK Scheme as they are not considered

available to renew in the normal course of business. If UK Scheme

of Arrangement cancellations were included the annual renewal rate

would be 8.0 percentage points lower at approximately 65.2% (H1

2014: 1.3 percentage points lower at 68.2%).

Enquiries

CPPGroup Plc

Stephen Callaghan, Chief Executive Officer

Craig Parsons, Chief Financial Officer

Tel: +44 (0)1904 544500

Nominated Adviser and Broker

Numis Securities Limited: Robert Bruce; Stuart Skinner; Charles

Farquhar

Tel: +44 (0)20 7260 1000

Media

Martin Robinson, Tulchan Communications +44 (0)20 7353 4200

For more information on CPP visit www.cppgroupplc.com

REGISTERED OFFICE

CPPGroup Plc

Holgate Park

York

YO26 4GA

Registered number: 07151159

CHAIRMAN'S STATEMENT

Introduction and first impressions

I joined the Board of CPP in May 2015 and was appointed Chairman

in July. During my career I have worked across many different

industries, developing a track record for overseeing successful

business transformations, most recently as Non-Executive Chairman

of Hornby PLC, the international models and collectibles group, and

more broadly in my capacity as Chairman of Phoenix Asset Management

Partners.

In my first months at CPP I have spent time with the leadership

team and developed a more in-depth knowledge of the Group. CPP has

come through a very challenging few years and there is more work to

do if we are to achieve the more focused, sustainable and

profitable future that we want for this business.

The process to secure new equity funding at the start of this

year, together with the concurrent restructuring of the Group's

liabilities and refinancing of its debts, was a critical milestone.

The successful completion of this process provided the Group with a

stronger and more stable footing and signalled the start of a new

era for CPP upon which we will build.

My early engagement with the business has provided me with

confidence. The Group has continued to show resilience through

challenging times, and it is clear that it has potential. The

business has an extensive international footprint, real product

development ambition, and good customer service capabilities. At

the heart of all this is CPP's colleagues - they have the passion

to go the extra mile for end-customers, and they are committed to

making this business a success. Ensuring that we continue to

provide opportunity for our people by both developing existing

colleagues and attracting new talent to the business are key

priorities and by so doing the Group will be better placed to

capitalise on the opportunities that lie ahead. As Chairman I will

be providing my full support to the executive team in this regard.

It is only by having the right people, doing the right things by

customers, that we will deliver sustainable value to our

shareholders and other stakeholders.

Board changes

There have been a number of Board changes during the first half

of the year, not least my own appointment to the Board in May

before taking over the Chairmanship in July. The Board thanks Eric

Anstee, my predecessor, for his contribution to the Group and

wishes him well for the future.

CPP also has a new executive team. We were delighted to have

secured the services of Stephen Callaghan as Chief Executive

Officer (CEO). Stephen has a proven track record of driving

improved business performance on an international scale, with

extensive relevant experience in growing technology-enabled

customer service businesses. He is a highly experienced executive

and has already made a significant impact on the business. The

Board looks forward to supporting Stephen as he continues to lead

the Group forward.

At the end of June, Craig Parsons announced his decision to step

down from his role as Chief Financial Officer after 13 years with

the Group, which will take effect on 31 August 2015. Craig has

given a huge amount to CPP during his time with the business and

leaves with our very best wishes for continued career success.

Today we are pleased to announce the Board's intention to appoint

Michael Corcoran as CPP's new Chief Financial Officer (subject to

regulatory approval) with effect from 1 September 2015. Michael has

extensive international and regulated business experience and

expertise in managing strong financial, operational, governance and

compliance frameworks. On behalf of the Board I would like to

welcome Michael to CPP and we look forward to the new and valuable

perspective he brings.

(MORE TO FOLLOW) Dow Jones Newswires

August 21, 2015 02:00 ET (06:00 GMT)

An important priority for me and the leadership team will be to

ensure that an appropriate business culture exists in the Group

underpinned by the necessary governance structure to support the

business, and that CPP has effective leadership supported by a

strong Board. I believe the Group's new executive team will bring

considerable energy to CPP as we embark on the next stage of our

journey. We will also add depth to the Group Board this year and my

focus will be on ensuring that the appointments we make bring both

relevant experience and complementary skills.

Dividend

The Directors have decided not to recommend the payment of a

dividend and the Board continues to believe it is not appropriate

to pay a dividend until cash generated by operating activities is

more than adequate to cover the Group's future investment

plans.

Roger Canham

Chairman

CHIEF EXECUTIVE'S STATEMENT

Introduction and first impressions

On 17 March 2015, I was engaged to support the Executive

Chairman as a contractor to CPP and subsequently, in April 2015,

the Board announced its intention to appoint me as Interim CEO

subject to regulatory approval. On 30 July 2015, my position as the

permanent CEO was announced following completion of my Approved

Persons application and following a process that resulted in the

Board approving my permanent appointment. My appointment therefore

followed the completion of the equity raise and debt restructure in

February and my tenure as CEO commences as the business embarks on

a new beginning.

In the 150 or so days that have elapsed since my initial

appointment I have gained a thorough understanding of the business

and turned my attention to the activities required to best position

the Group for recovery and growth. This is an international

business with operations in established markets such as the UK,

Spain, Germany, Italy and Portugal as well as emerging markets in

India, Mexico, Malaysia, Turkey and China. I have spent time with

colleagues across the business to understand how our operations are

run and how they interact, what's working and what's not, and which

areas need improvement or to be stopped.

CPP is a business that has endured a number of challenging

years, particularly in the UK. It is clear to me that the Group has

many strengths and my role is to build upon these whilst

eliminating activities and behaviours that detract from our core

purpose. For CPP to succeed - to become the 'international

assistance business of choice' - then it must do so as a committed,

trusted organisation that provides a valuable service to its

customers.

In this regard CPP is going through a significant transition.

The business has been focused on resolving legacy issues which have

been so damaging to our reputation. The conduct and practices that

led to these issues in the past are entirely inconsistent with the

values we hold ourselves to today. As part of our culture change we

have been embedding our core values of Commit, Collaborate, and

Perform across the organisation through training courses and

through our management processes supported by regular internal

communications. We are committed to creating a values-driven

culture in CPP, which will enhance the customer experience. These

core values will also determine how we measure and reward

performance. We also continue to focus on governance and

leadership, controls (including enhanced resources in Risk and

Compliance), and ensuring that our product offerings are designed

to meet the needs of our customers. We have a lot of work to do,

however we now have a good financial basis on which to build, and

it is by rising to these challenges that we will create our own

opportunities. Our focus on culture change will continue through

2015 and beyond, will demonstrate our commitment to doing business

in the right way, and will support long-term, sustainable business

growth.

I wish to build an organisation designed to execute against both

tactical and strategic plans that position the Group to become a

sustainable, growing and profitable business. Clinical focus on key

activities designed to create both the cash runway and the

execution time required to deliver customer led product and

proposition developments are central to this plan. The reporting

and management structure has been reorganised to eradicate cost and

improve operational control, such as taking decisive action to

cease provision of the historically loss making airport lounge

access services marketed under the Airport Angel brand.

We have three clear priorities in the short term: revenue

generation, business transformation, and cost reduction. Internally

we refer to these as 'swim lanes' and each has an executive owner

with accountability and a reporting line directly to me. Included

within these deliverables will be our Regulatory Business Plan; a

pre-requisite for applying to remove the restrictions of the

Voluntary Variation of Permissions (VVOP) and recommencing 'new

business' commercial activities in the UK, which remains a key

strategic market for the Group. Concurrently with these initiatives

we will set a clear strategic direction for the business and this

will require a strong and committed team. We have the core of that

team in place now but by the close of this financial year I intend

to strengthen the executive team further, specifically in the areas

of technology and marketing.

Group performance - a stronger, profitable platform

During the first half of 2015 CPP secured new equity funding,

restructured the Group's liabilities and refinanced its debts. This

was an essential and significant step that has provided the Group

with a stable financial platform upon which to build.

Results for the first half of 2015 show the business returning

to profitability but they also continue to exhibit some of the

underlying challenges and trends faced by the business. Group

revenue has declined to GBP45.2 million (H1 2014: GBP58.7 million),

continuing to reflect the natural decline in the UK renewal book as

new business sales remain restricted. The underlying operating

profit in the first half of the year is GBP2.2 million (H1 2014:

breakeven). This improved underlying operating profit performance

is partly the result of the actions taken in 2014 to reduce the

cost base, alongside on-going cost control scrutiny and

initiatives. The Group's liquidity is stronger following the equity

raise and improved trading performance.

The Group's annual renewal rate has improved to 73.2% (31

December 2014: 71.4%), reflecting the value customers continue to

place on our products, albeit the live policy base has reduced to

4.4 million (31 December 2014: 5.1 million) principally due to an

expected decline in UK wholesale policies.

Group performance in the first half of 2015 is discussed further

in the operational and financial reviews below.

Revenue generation

The Chief Revenue Officer (CRO) owns the Group's growth agenda

which is underpinned by three drivers: products, channels and

geographies. Current products and propositions will continue to be

sold, reviewed and updated to become relevant for new geographies

and channels to market, including digital. New products will be

conceived and designed in response to consumer demand for

deployment on an international basis through new and existing sales

channels.

-- Maximising existing capability

Short-term revenue generation will be driven almost exclusively

by looking after our existing customers and by augmenting the

Group's existing capabilities by making relatively simple product

changes to facilitate geographic revenue growth in response to

consumer demand. This extends the reach of the Group's existing

product portfolio. Country Managers now report to the CRO and we

have created forums for the dissemination of product, channel and

marketing initiatives so that we can leverage activity across the

business.

-- Accelerating the development of new growth initiatives

Innovation is central to the Group's future plans, and this

applies to products, customer propositions and channels. Work is

underway to develop new products and propositions that will be

increasingly digital-led, enabled by the Group's transition to a

new core platform IT system and the appointment of a Chief

Technical Officer who will report directly to me and work alongside

the Product team. The development of new business channels to

market outside of CPP's traditional banking channels will create

growth potential.

Business transformation

This swim lane is the direct responsibility of the Group's Chief

Operating Officer and is focused on ensuring a successful migration

to a new Group-wide core IT operating infrastructure to deliver

cost, compliance and control benefits. This is a key activity to

support our Regulatory Business Plan focused initially around

relaunching the UK business to better serve customer needs, as well

as creating an international business enabler.

The new system will provide the core IT platform to support the

Group's increasing focus on digital technology whilst improving

operational efficiency and improving customer experience. During

the first half of the year we announced that SSP Limited, the

leading specialist in general insurance technology solutions, had

been selected as our systems partner. Work is well underway with

the implementation process, which will be rolled out in the UK

initially during 2016 and then be extended across the Group's

international operations. This is a significant focus for the

business and we are working to an intensive timetable, with a high

level of commitment and motivation to achieving a successful

Group-wide implementation but not before the end of 2016.

(MORE TO FOLLOW) Dow Jones Newswires

August 21, 2015 02:00 ET (06:00 GMT)

When fully embedded, the system will simplify and standardise

processes across the business; provide compliant, robust governance

controls and secure customer data storage; and support our

increasingly digital aspirations in new product development. By

adopting a proven platform chosen by leading insurers, CPP will

have a stronger competitive position in an increasingly digital

world.

Cost reduction

The cost control swim lane is owned by the Group's Chief

Financial Officer and tight control of costs remains a core focus

for CPP. Administrative costs have reduced by GBP4.6 million

compared to the same period last year and we have a clear line of

sight on additional savings within the existing cost base. During

the first half of the year we have taken some big steps, by

completing the closure of the underperforming Brazilian operation,

for example. In addition, effective cost control is becoming

embedded as a core part of CPP's culture and values. We are

challenging all aspects of the business to ensure we are maximising

the value we get from our expenditure.

Moving towards an efficient and effective organisation

The management structure has been reorganised to provide clarity

and greater accountability. The Regional Director management layer

has been removed to create a structure more appropriate for a

business of our size. This ensures a more effective structure,

brings the Group executive team closer to operations across the

Group's geographies and will allow me to have my hands more

directly on the levers and work closely with small teams to get

things done. This will allow us to gain pace with our initiatives

and accelerate the Group's progress.

By bringing the executive team closer to the Group's operations

we have been more readily able to recognise talent within the Group

and identify gaps, such as leadership roles in technology and

marketing that we are seeking to fill. The culture and values we

seek to adopt require us to have engaged, enthusiastic and

committed people from the front line to the very top of the

organisation. Confident and empowered colleagues are essential to

making a difference at CPP whilst we build their careers in the

process. This work has been initiated in the first half and

continues apace.

Operational review

During the period the Group operated internationally in three

regions; UK and Ireland which accounts for 63% of Group revenue,

Europe and Latin America which accounts for 29% of Group revenue

and Asia Pacific which accounts for 8% of Group revenue. Further

detail of regional financial performance is provided in note 3 to

the condensed consolidated interim financial statements. As part of

the Group's organisational restructure the intention is to shift

the focus of management away from the current regional basis to an

individual country level.

Group revenue has continued to decline, principally due to the

restrictions on new retail sales in the UK from the VVOP, and the

continued difficult economic conditions in southern Europe.

However, we are encouraged by the increase in the Group's annual

renewal rate, which is driven by an improving rate in the Group's

largest renewal markets, the UK and Spain. The loyalty of the

existing customer base is pleasing and demonstrates that customers

value our products. However we recognise there is more that can be

done to further enhance the customer experience and during the

period the Group has continued to develop its product and channel

propositions which have led to a number of new opportunities.

The key commercial operational developments during the period

include:

-- Spain - a contract to provide a new automotive insurance

product has been signed and sales will commence in H2 2015

-- India - positive progress has been made in the mobile phone

protection sector, with one major contract signed and sales have

now commenced. The Card Protection portfolio continues to grow with

new opportunities in several retail banks, some of which are linked

to new channel development

-- Turkey - new channel development has contributed to revenue growth in the period

-- Italy - there are a number of exciting pilot campaigns

planned which will help to drive new revenue in the country

-- China - we have worked hard with existing partners to develop

new sales channels that show potential, whilst at the same time

reviewing the financial viability of existing campaigns and making

closures where necessary

-- UK - detailed market analysis has been undertaken to

influence and inform our strategic product development

direction

The decision to cease providing airport lounge access services

(Airport Angel), as announced on 27 May 2015, is a further step

towards CPP becoming a more focused, sustainable and profitable

business. We are working towards Airport Angel being operationally

closed by the end of the year. The regional office closure in Hong

Kong is also complete and plans to exit the market are well

advanced. The market exit of Brazil has been completed in the first

half of the year.

We continue to work on enhancing our digital capability which

will enable more interactive, efficient ways of engaging with our

customers.

Financial review

Summary

The Group completed the equity raise and debt restructure in

February 2015 which represented an essential and significant

milestone in restoring the Group's financial stability and

providing a platform from which it can progress in its development.

The cost base remains a key priority and is an area of continued

focus across the Group.

On a constant currency basis, Group revenue has declined by 21%

for the half year to GBP45.2 million, continuing to reflect the

natural decline in the UK renewal book as new sales remain

restricted through the terms of the VVOP. The Group's annual

renewal rate has improved in the period to 73.2% from 71.4% at 31

December 2014. This improvement is largely driven by the UK,

reflecting the value the remaining book places in our products and

the approved change in late 2014, to revert to an industry standard

'cooling off' period for renewing policies.

The underlying operating profit in the first half of the year is

GBP2.2 million (H1 2014: breakeven). Underlying operating profit,

which excludes exceptional items and Matching Share Plan (MSP)

charges, has improved largely as a result of the actions taken in

2014 to reduce the cost base and one-off benefits relating to

Airport Angel, which offset the profit impact of declining revenue.

The underlying operating profit margin has therefore increased to

4.8% (H1 2014: breakeven).

Exceptional items are a credit of GBP18.9 million (H1 2014:

charge GBP0.3 million) which comprises; a gain from the compromise

of the commission deferral agreement, net of associated costs, of

GBP19.4 million; and restructuring activities, mainly in Spain, of

GBP0.5 million.

The exceptional items, along with the MSP charges of GBP0.3

million contribute to a reported operating profit of GBP20.7

million (H1 2014: loss GBP0.3 million).

Profit after tax from continuing operations is GBP17.1 million

(H1 2014: loss GBP1.9 million) and underlying profit after tax,

which excludes exceptional items and MSP charges, is GBP0.4 million

(H1 2014: loss GBP1.7 million).

There are no discontinued operations in the current period (H1

2014: loss GBP0.8 million). The Group's reported profit for the

period is therefore GBP17.1 million (H1 2014: loss GBP2.7 million).

In accordance with accounting standards, the results of Airport

Angel will be disclosed as discontinued when its closure is

complete.

Redress

The Group has a remaining customer redress and associated cost

provision at 30 June 2015 of GBP3.7 million, which reflects the

Group's current estimate of the cost to complete residual customer

redress activity. There has been no additional provision made in

the first half of the year. The provision does not include an

amount for the outstanding element of the regulatory fine of GBP8.5

million, which is disclosed within current and non-current

payables.

Balance sheet, financing and cash flow

The equity raise and debt restructure has had a fundamental

impact on the Group's balance sheet position, returning it to net

assets of GBP5.3 million at 30 June 2015 from net liabilities of

GBP30.9 million at 31 December 2014.

The Group's borrowing arrangements comprise a GBP5.0 million

debt facility which is available until February 2018, and a

commission deferral balance of GBP1.3 million which is due for

repayment in January 2017. These arrangements are much reduced,

following the debt restructure in February 2015, from the previous

GBP13.0 million debt facility and GBP20.9 million commission

deferral balance. The debt facility, whilst committed, is not

currently being utilised by the Group.

As expected, the Group's net funds position has increased to

GBP36.9 million at 30 June 2015 (31 December 2014: GBP7.9 million)

as a result of the equity raise and commission deferral compromise.

The working capital outflow of GBP6.2 million in the period

reflects continued cash settlement of residual redress and a

reduction in Airport Angel and southern European trading balances.

Capital expenditure in the period is GBP2.5 million (H1 2014:

GBP0.1 million) as the Group develops its new core policy IT

system, with planned implementation being H1 2016 in the UK. The

net funds figure includes GBP33.3 million cash held in the UK's

regulated entities. These cash balances cannot be distributed to

the wider Group as they are either held for regulatory purposes or

are restricted by the terms of the VVOP. The restricted cash is,

however, available to use in the regulated entity in which it

exists.

Summary and outlook

(MORE TO FOLLOW) Dow Jones Newswires

August 21, 2015 02:00 ET (06:00 GMT)

CPP has made significant progress in the first half of 2015.

Securing new equity funding and restructuring of the Group's debt

has provided the business with a stable financial platform, and the

initial focus on swim lanes will ensure that we generate the

necessary momentum and cash runway upon which to build a future.

This is a new beginning for CPP. Under a new and motivated

leadership team the business has started to take actions that will

shape the long-term future development of the Group.

Challenges remain and there is much work to do for the Group to

realise its growth ambitions. Consequently, there continues to be

uncertainty from strategic risk whilst the Group's plans are

developed. However, the team at CPP has clarity of purpose, a

focused approach, and well-defined accountability. Therefore, as

the Group looks to the future, we know what we have to do and

understand the importance of maintaining momentum in the delivery

of our plans.

Efforts to improve the Group's financial performance in the

short-term will continue and we are seeing encouraging progress

from the actions we are taking. Whilst we expect to make further

progress during the remainder of 2015, looking to next year,

following a strengthening of renewal rates, other commercial

initiatives and further cost control, our current view is that the

Group's underlying operating profit will be materially higher than

the previous expectations set for 2016, albeit 2016 revenue is

expected to be materially lower following the closure of Airport

Angel.

Stephen Callaghan

Chief Executive Officer

CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

CONSOLIDATED INCOME STATEMENT

6 months ended 6 months ended Year ended

30 June 2015 30 June 2014 31 December 2014

GBP'000 GBP'000 GBP'000

Note (Unaudited) (Unaudited) (Audited)

Continuing operations

Revenue 45,185 58,667 108,806

Cost of sales (22,739) (33,746) (60,774)

Gross profit 22,446 24,921 48,032

Administrative expenses

--------------- --------------- ------------------

Exceptional items 4 18,902 (262) (6,323)

Matching Share Plan charges 13 (348) - -

Other administrative expenses (20,283) (24,924) (47,507)

Total administrative expenses (1,729) (25,186) (53,830)

Operating profit/(loss)

--------------- --------------- ------------------

Operating profit/(loss) before exceptional items and

Matching Share Plan charges 2,163 (3) 525

--------------- --------------- ------------------

Operating profit/(loss) after exceptional items and

Matching Share Plan charges 20,717 (265) (5,798)

Investment revenues 131 287 432

Finance costs (1,416) (1,164) (2,296)

Profit/(loss) before taxation 19,432 (1,142) (7,662)

Taxation 5 (2,351) (780) 1,698

Profit/(loss) for the period from continuing

operations 17,081 (1,922) (5,964)

Discontinued operations

Loss for the period from discontinued operations - (785) (785)

--------------- --------------- ------------------

Profit/(loss) for the period attributable to equity

holders of the Company 17,081 (2,707) (6,749)

--------------- --------------- ------------------

Basic earnings/(loss) per share:

Continuing operations 7 2.50 (1.12) (3.48)

Discontinued operations 7 - (0.46) (0.46)

--------------- --------------- ------------------

2.50 (1.58) (3.94)

--------------- --------------- ------------------

Diluted earnings/(loss) per share:

Continuing operations 7 2.48 (1.12) (3.48)

Discontinued operations 7 - (0.46) (0.46)

----- ------- -------

2.48 (1.58) (3.94)

----- ------- -------

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Year ended

6 months ended 30 June 2015 6 months ended 30 June 2014 31 December 2014

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Profit/(loss) for the period 17,081 (2,707) (6,749)

Items that may be reclassified

subsequently to profit or loss:

Exchange differences on

translation of foreign

operations 296 146 111

Other comprehensive income for

the period net of taxation 296 146 111

---------------------------- ---------------------------- ------------------

Total comprehensive

income/(expense) for the period

attributable to equity holders

of the

Company 17,377 (2,561) (6,638)

---------------------------- ---------------------------- ------------------

CONSOLIDATED BALANCE SHEET

30 June 2015 30 June 2014 31 December 2014

GBP'000 GBP'000 GBP'000

Note (Unaudited) (Unaudited) (Audited)

Non-current assets

Other intangible assets 8 2,810 1,915 808

Property, plant and equipment 8 3,657 4,621 3,820

Deferred tax asset 489 2 2,248

------------- ------------- -----------------

6,956 6,538 6,876

------------- ------------- -----------------

Current assets

Insurance assets 451 376 593

Inventories 89 121 93

Trade and other receivables 14,048 18,803 15,709

Cash and cash equivalents 9 38,019 53,613 40,599

------------- ------------- -----------------

52,607 72,913 56,994

Total assets 59,563 79,451 63,870

------------- ------------- -----------------

Current liabilities

Insurance liabilities (1,651) (2,612) (2,019)

Income tax liabilities (2,923) (2,983) (2,231)

Trade and other payables (41,398) (44,502) (40,631)

Provisions 11 (4,437) (14,034) (7,041)

------------- -----------------

(50,409) (64,131) (51,922)

(MORE TO FOLLOW) Dow Jones Newswires

August 21, 2015 02:00 ET (06:00 GMT)

------------- ------------- -----------------

Net current assets 2,198 8,782 5,072

------------- ------------- -----------------

Non-current liabilities

Borrowings 10 (1,130) (32,016) (32,733)

Deferred tax liabilities (13) (529) (126)

Trade and other payables (2,125) (9,505) (8,991)

Provisions 11 (606) - (973)

------------- ------------- -----------------

(3,874) (42,050) (42,823)

------------- ------------- -----------------

Total liabilities (54,283) (106,181) (94,745)

------------- ------------- -----------------

Net assets/(liabilities) 5,280 (26,730) (30,875)

============= ============= =================

Equity

Share capital 12 23,879 17,123 17,126

Share premium account 45,109 33,290 33,291

Merger reserve (100,399) (100,399) (100,399)

Translation reserve 1,016 755 720

Equalisation reserve 6,870 7,834 7,487

ESOP reserve 12,223 11,886 11,891

Retained earnings/(accumulated losses) 16,582 2,781 (991)

------------- ------------- -----------------

Total equity attributable to equity holders of the

Company 5,280 (26,730) (30,875)

============= ============= =================

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share

Share premium Merger Translation Equalisation ESOP Retained earnings /

capital account reserve reserve reserve reserve (accumulated losses) Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

6 months ended

30 June 2015

(Unaudited)

At 1 January 2015 17,126 33,291 (100,399) 720 7,487 11,891 (991) (30,875)

Total

comprehensive

income - - - 296 - - 17,081 17,377

Movement on

equalisation

reserve - - - - (617) - 617 -

Current tax charge

on equalisation

reserve movement - - - - - - (125) (125)

Equity settled

share based

payment charge - - - - - 332 - 332

Other ordinary

share issues

(note 12) 6,753 11,818 - - - - - 18,571

At 30 June 2015 23,879 45,109 (100,399) 1,016 6,870 12,223 16,582 5,280

======== ======== ========== ============ ============= ======== ===================== =========

6 months ended

30 June 2014

(Unaudited)

At 1 January 2014 17,120 33,292 (100,399) 609 8,129 11,688 5,259 (24,302)

Total

comprehensive

expense - - - 146 - - (2,707) (2,561)

Movement on

equalisation

reserve - - - - (295) - 295 -

Current tax charge

on equalisation

reserve movement - - - - - - (63) (63)

Equity settled

share based

payment - - - - - 198 - 198

Exercise of share

options 3 (2) - - - - (3) (2)

At 30 June 2014 17,123 33,290 (100,399) 755 7,834 11,886 2,781 (26,730)

======== ======== ========== ============ ============= ======== ===================== =========

Year ended

31 December 2014

(Audited)

At 1 January 2014 17,120 33,292 (100,399) 609 8,129 11,688 5,259 (24,302)

Total

comprehensive

expense - - - 111 - - (6,749) (6,638)

Movement on

equalisation

reserve - - - - (642) - 642 -

Current tax charge

on equalisation

reserve movement - - - - - - (138) (138)

Equity settled

share based

payment charge - - - - - 203 - 203

Deferred tax on

share based

payment charge - - - - - - 1 1

Exercise of share

options 6 (1) - - - - (6) (1)

At 31 December

2014 17,126 33,291 (100,399) 720 7,487 11,891 (991) (30,875)

======== ======== ========== ============ ============= ======== ===================== =========

CONSOLIDATED CASH FLOW STATEMENT

6 months ended 6 months ended Year ended

Note 30 June 2015 30 June 2014 31 December 2014

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Net cash used in operating activities 14 (4,167) (21,125) (32,906)

Investing activities

Interest received 131 287 432

Purchases of property, plant and equipment (140) (37) (190)

Purchases of intangible assets (2,327) (58) (406)

Cash consideration in respect of sale of

discontinued operations - 275 275

Credit associated with disposal of discontinued

operations - 28 28

Investment in joint venture - (1,096) (1,000)

Net cash used in investing activities (2,336) (601) (861)

--------------- --------------- ------------------

Financing activities

Repayment of bank loans (13,000) - -

Repayment of borrowings (1,304) - -

Proceeds from new borrowings 1,304 8,831 8,831

Interest paid (882) (239) (514)

(MORE TO FOLLOW) Dow Jones Newswires

August 21, 2015 02:00 ET (06:00 GMT)

Cost of refinancing (220) - -

Cost of compromising the Commission Deferral

Agreement (743) - (193)

Issue of ordinary share capital and associated

costs 19,069 (2) (499)

Net cash generated by financing activities 4,224 8,590 7,625

--------------- --------------- ------------------

Net decrease in cash and cash equivalents (2,279) (13,136) (26,142)

Effect of foreign exchange rate changes (301) (151) (159)

Cash and cash equivalents at start of period 40,599 66,900 66,900

Cash and cash equivalents at end of period 38,019 53,613 40,599

=============== =============== ==================

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

1 General information

The condensed consolidated interim financial statements for the

six months ended 30 June 2015 do not constitute statutory accounts

as defined under Section 434 of the Companies Act 2006. The

Financial Statements for the year ended 31 December 2014 were

approved by the Board on 30 March 2015 and have been delivered to

the Registrar of Companies. The Auditor, Deloitte LLP, reported on

these financial statements; their report was unqualified, did not

contain an emphasis of matter paragraph and did not contain

statements under s498 (2) or (3) of the Companies Act 2006.

2 Accounting policies

Basis of preparation

The unaudited condensed consolidated interim financial

statements for the six months ended 30 June 2015 have been prepared

in accordance with IAS 34 'Interim Financial Reporting' as adopted

by the European Union.

The condensed consolidated interim financial statements should

be read in conjunction with the Annual Report and Financial

Statements ("the Financial Statements") for the year ended 31

December 2014, which have been prepared in accordance with

International Financial Reporting Standards (IFRSs) as adopted by

the European Union.

The condensed consolidated interim financial statements were

approved for release on 20 August 2015.

New and amended standards and interpretations need to be adopted

in the interim financial statements issued after their effective

date (or date of early adoption). There are no new IFRSs or IFRICs

that are effective for the first time for the six months ended 30

June 2015 which have a material impact on the Group.

Going concern

The Group is in a stable financial position following the

completion of the UK Scheme of Arrangement and the successful

equity raise, restructure of liabilities and refinancing in

February 2015. Whilst there continues to be uncertainty from medium

term trading and strategic risk, the Group's forecasts show that

the Group should have the necessary resources to trade and operate

within the level of its borrowing facilities.

After making enquiries, the Directors have a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future. Accordingly, they

continue to adopt the going concern basis in preparing the

condensed consolidated interim financial statements.

3 Segmental analysis

Segment revenue and performance for the current and comparative

periods have been as follows:

Europe

UK and and Latin Asia

Ireland America Pacific Total

Six months ended 30 June 2015 GBP'000 GBP'000 GBP'000 GBP'000

(Unaudited)

Continuing operations

Revenue - external sales 28,436 12,926 3,823 45,185

--------- ------------ --------- --------

Regional operating profit/(loss)

before exceptional items and

Matching Share Plan charges 156 2,102 (95) 2,163

--------- ------------ ---------

Exceptional items (note 4) 18,902

Matching Share Plan charges (348)

Operating profit after exceptional

items and Matching Share Plan

charges 20,717

Investment revenues 131

Finance costs (1,416)

--------

Profit before taxation 19,432

Taxation (2,351)

--------

Profit for the period from

continuing operations 17,081

Discontinued operations

Loss for the period from discontinued -

operations

--------

Profit for the period 17,081

========

UK and Europe and Asia

Ireland Latin America Pacific Total

Six months ended 30 June 2014 GBP'000 GBP'000 GBP'000 GBP'000

(Unaudited)

Continuing operations

Revenue - external sales 38,490 17,034 3,143 58,667

--------- ---------------- --------- --------

Regional operating (loss)/profit

before exceptional items (3,298) 3,271 24 (3)

--------- ---------------- ---------

Exceptional items (note 4) (262)

Operating loss after exceptional

items (265)

Investment revenues 287

Finance costs (1,164)

--------

Loss before taxation (1,142)

Taxation (780)

--------

Loss for the period from continuing

operations (1,922)

Discontinued operations

Loss for the period from discontinued

operations (785)

--------

Loss for the period (2,707)

========

Europe

UK and and Latin Asia

Ireland America Pacific Total

Year ended 31 December 2014 GBP'000 GBP'000 GBP'000 GBP'000

(Audited)

Continuing operations

Revenue - external sales 69,690 32,463 6,653 108,806

--------- ------------ --------- --------

Regional operating (loss)/profit

before exceptional items (4,404) 5,162 (233) 525

--------- ------------ ---------

Exceptional items (note 4) (6,323)

Operating loss after exceptional

items (5,798)

Investment revenues 432

Finance costs (2,296)

Loss before taxation (7,662)

Taxation 1,698

--------

Loss for the year from continuing

operations (5,964)

Discontinued operations

Loss for the year from discontinued

operations (785)

--------

Loss for the year (6,749)

========

(MORE TO FOLLOW) Dow Jones Newswires

August 21, 2015 02:00 ET (06:00 GMT)

For the purposes of resource allocation and assessing

performance, operating costs and revenues are allocated to the

regions in which they are earned or incurred. The above does not

reflect additional annual net charges of central costs of

GBP1,845,000 presented within UK and Ireland in the tables above

which has been charged to other regions for statutory purposes.

Segmental assets

30 June 2015 30 June 2014 31 December 2014

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

UK and Ireland 50,525 68,254 51,673

Europe and Latin America 5,720 8,455 7,012

Asia Pacific 2,829 2,740 2,937

Total segment assets 59,074 79,449 61,622

Unallocated assets 489 2 2,248

Consolidated total assets 59,563 79,451 63,870

Deferred tax is not allocated to segments.

Revenue from major products

6 months ended 30 6 months ended 30 Year ended

June 2015 June 2014 31 December 2014

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Continuing operations

Retail assistance policies 34,229 43,546 82,652

Retail insurance policies 3,156 6,092 10,229

Packaged and wholesale policies 7,320 8,655 15,080

Non-policy revenue 480 374 845

-------------------- --------------------- ------------------

Revenue from continuing operations 45,185 58,667 108,806

==================== ===================== ==================

Major product streams are disclosed on the basis monitored by

the Board of Directors. For the purpose of this product analysis,

"retail assistance policies" are those which may be insurance

backed but contain a bundle of assistance and other benefits;

"retail insurance policies" are those which protect against a

single insurance risk; "packaged and wholesale policies" are those

which are provided by Business Partners to their customers in

relation to an on-going product or service which is provided for a

specified period of time; "non-policy revenue" is that which is not

in connection with providing an on-going service to policyholders

for a specified period of time.

Geographical information

The Group operates across a wide number of territories, of which

the UK and Spain are considered individually material. Revenue from

external customers and non-current assets (excluding deferred tax)

by geographical location are detailed below.

External revenues Non-current assets

----------------------------------------- ------------------------------------------

6 months 6 months

ended ended Year ended

30 June 30 June 31 December 30 June 30 June 31 December

2015 2014 2014 2015 2014 2014

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited) (Unaudited) (Unaudited) (Audited)

Continuing

operations

UK 27,969 37,751 68,412 6,145 5,415 4,100

Spain 6,231 8,079 15,215 131 358 176

Other 10,985 12,837 25,179 191 763 352

Total continuing

operations 45,185 58,667 108,806 6,467 6,536 4,628

============ ============ ============= ============ ============ ============

4 Exceptional items

Year ended

6 months ended 30 June 2015 6 months ended 30 June 2014 31 December 2014

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Commission deferral compromise

and associated costs (19,388) - 744

Restructuring costs 486 262 2,579

Customer redress and associated

costs - - 3,000

Exceptional (credit)/charge

included in operating profit or

loss (18,902) 262 6,323

Tax on exceptional items 1,910 (54) (646)

---------------------------- ---------------------------- -------------------

Total exceptional

(credit)/charge after tax (16,992) 208 5,677

============================ ============================ ===================

The gain from the commission deferral compromise and associated

costs in the six month period of GBP19,388,000 (H1 2014: GBPnil,

year ended 31 December 2014: GBP744,000 charge) relates to the gain

from the settlement in full of the Commission Deferral Agreement

for a payment of GBP1,304,000, net of costs associated with

finalising the agreement to compromise.

The restructuring costs in the six month period of GBP486,000

(H1 2014: GBP262,000, year ended 31 December 2014: GBP2,579,000)

relate to redundancy programmes and associated costs across the

Group.

5 Taxation

The effective tax rate at the half year is 12.1% (H1 2014:

negative 68.3%, year ended 31 December 2014: 22.2%). The effective

rate is lower than the standard rate of corporation tax in the UK

due to capital allowances and other tax deductions, for which

deferred tax assets were not previously recognised, that are now

available for offset against UK taxable profits. The UK impact on

the effective rate is partly offset by higher rates of tax on

overseas profits. The 2015 full year rate may vary from this due to

the territory mix of future 2015 profits.

6 Dividends

The Directors have not proposed an interim dividend for

2015.

7 Earnings/(loss) per share

Basic and diluted earnings/(loss) per share have been calculated

in accordance with IAS 33 "Earnings per Share". Underlying

earnings/(loss) per share have also been presented in order to give

a better understanding of the performance of the business.

Six months ended 30 June 2015

(Unaudited) Continuing operations Discontinued operations Total

Earnings GBP'000 GBP'000 GBP'000

Profit for the purposes of basic and

diluted earnings per share 17,081 - 17,081

Exceptional items (net of tax) (16,992) - (16,992)

Matching Share Plan charges (net

of tax) 283 - 283

Earnings for the purposes of underlying

basic and diluted earnings per share 372 - 372

====================== ======================== =============

Number

Number of shares (thousands)

Weighted average number of ordinary

shares for the purposes of basic

earnings per share 683,863

Effect of dilutive potential ordinary

shares: share options 4,228

-------------

Weighted average number of ordinary

shares for the purposes of diluted

earnings per share 688,091

Earnings per share Continuing operations Discontinued operations Total

Pence Pence Pence

Basic earnings per share 2.50 - 2.50

Diluted earnings per share 2.48 - 2.48

Basic and diluted underlying loss

per share 0.05 - 0.05

Six months ended 30 June 2014

(MORE TO FOLLOW) Dow Jones Newswires

August 21, 2015 02:00 ET (06:00 GMT)

(Unaudited) Continuing operations Discontinued operations Total

Loss GBP'000 GBP'000 GBP'000

Loss for the purposes of basic and

diluted loss per share (1,922) (785) (2,707)

Exceptional items (net of tax) 208 (311) (103)

Loss for the purposes of underlying

basic and diluted loss per share (1,714) (1,096) (2,810)

====================== ======================== =============

Number

Number of shares (thousands)

Weighted average number of ordinary

shares for the purposes of basic and

diluted loss per

share 171,605

Loss per share Continuing operations Discontinued operations Total

Pence Pence Pence

Basic and diluted loss per share (1.12) (0.46) (1.58)

Basic and diluted underlying loss

per share (1.00) (0.64) (1.64)

Continuing Discontinued

Year ended 31 December 2014 (Audited) operations operations Total

Loss GBP'000 GBP'000 GBP'000

Loss for the purposes of basic and diluted loss per share (5,964) (785) (6,749)

Exceptional items (net of tax) 5,677 (311) 5,366

Loss for the purposes of underlying basic and diluted loss per share (287) (1,096) (1,383)

Number of Number

shares (thousands)

Weighted average number of ordinary shares for the purposes of basic

and diluted loss per

share 171,622

Continuing Discontinued

Loss per share operations operations Total

Pence Pence Pence

Basic and diluted loss per share (3.48) (0.46) (3.94)

Basic and diluted underlying loss per share (0.17) (0.64) (0.81)

8 Tangible and intangible assets

Other intangible assets Property, plant and equipment Total

GBP'000 GBP'000 GBP'000

Six months ended 30 June 2015

(Unaudited)

Carrying amount at 1 January 2015 808 3,820 4,628

Additions 2,357 140 2,497

Disposals (1) (8) (9)

Amortisation/depreciation (325) (253) (578)

Exchange adjustments (8) (42) (50)

Impairment (21) - (21)

Carrying amount at 30 June 2015 2,810 3,657 6,467

Six months ended 30 June 2014

(Unaudited)

Carrying amount at 1 January 2014 3,299 5,061 8,360

Additions 58 37 95

Amortisation/depreciation (1,434) (442) (1,876)

Exchange adjustments (8) (35) (43)

Carrying amount at 30 June 2014 1,915 4,621 6,536

Year ended 31 December 2014

(Audited)

Carrying amount at 1 January 2014 3,299 5,061 8,360

Additions 406 190 596

Disposals (4) (39) (43)

Amortisation/depreciation (2,884) (1,271) (4,155)

Exchange adjustments (9) (35) (44)

Impairment - (86) (86)

Carrying amount at 31 December 2014 808 3,820 4,628

The carrying value of other intangible assets includes

GBP2,621,000 (H1 2014: GBPnil, 31 December 2014: GBP373,000)

relating to the development of the core IT policy platform, which

is an asset under construction and will not be amortised until it

becomes operational.

9 Cash and cash equivalents

Cash and cash equivalents of GBP38,019,000 (H1 2014:

GBP53,613,000; 31 December 2014: GBP40,599,000) comprises cash held

on demand by the Group and short term deposits.

Cash and cash equivalents includes the following:

i) GBP15,790,000 (H1 2014: GBP20,375,000; 31 December 2014:

GBP21,542,000) cash maintained by the Group's insurance business

for solvency purposes; and

ii) GBP17,475,000 (H1 2014: GBP24,441,000; 31 December 2014:

GBP13,380,000) cash held in the UK's regulated entities CPPL and

HIL which is restricted by the terms of the VVOP and cannot be

distributed to the wider Group without FCA approval. This

restricted cash whilst being unavailable to distribute to the wider

Group, is available to the regulated entity in which it exists

including for operational and residual customer redress

purposes.

10 Borrowings

30 June 2015 30 June 2014 31 December 2014

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Bank loans due outside of one year - 13,000 13,000

Less: unamortised issue costs (190) (1,333) (969)

Deferred commission 1,320 20,349 20,702

Borrowings due outside of one year 1,130 32,016 32,733

The Group's bank debt is in the form of a revolving credit

facility (RCF). The current RCF became effective on 11 February

2015 and has a commitment of GBP5,000,000. The Group is entitled to

roll over repayment of amounts drawn down, subject to all amounts

outstanding falling due for repayment on expiry of the facility on

28 February 2018.

On 11 February 2015, the Group also agreed to settle all the

liabilities of the Commission Deferral Agreement with certain

Business Partners for a compromise payment of GBP1,304,000 and

further deferral of commission of up to GBP1,304,000. On conclusion

of the deferral period, commission deferred within the Second

Commission Deferral Agreement has totalled GBP1,304,000, which has

a repayment date of 31 January 2017.

The borrowing facilities are secured by fixed and floating

charges on certain assets of the Group.

At 30 June 2015, the Group has undrawn committed borrowing

facilities of GBP5,000,000 (H1 2014: GBPnil; 31 December 2014:

GBPnil).

11 Provisions

Customer redress and associated

costs Onerous leases Total

GBP'000 GBP'000 GBP'000

Six months ended 30 June 2015

(Unaudited)

At 1 January 2015 6,356 1,658 8,014

Customer redress and associated costs

paid in the period (1,829) - (1,829)

Utilisation of onerous lease provision in

the period - (318) (318)

Transfer to trade and other payables (824) - (824)

At 30 June 2015 3,703 1,340 5,043

Six months ended 30 June 2014

(Unaudited)

At 1 January 2014 37,398 - 37,398

Customer redress and associated costs

paid in the period (23,364) - (23,364)

At 30 June 2014 14,034 - 14,034

Year ended 31 December 2014 (Audited)

At 1 January 2014 37,398 - 37,398

Charged to the income statement 3,000 1,658 4,658

Customer redress and associated costs

(MORE TO FOLLOW) Dow Jones Newswires

August 21, 2015 02:00 ET (06:00 GMT)

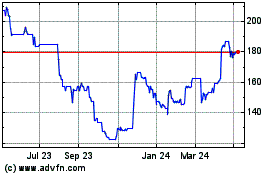

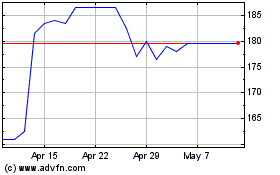

Cppgroup (LSE:CPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cppgroup (LSE:CPP)

Historical Stock Chart

From Apr 2023 to Apr 2024