CIBC Revenue and Earnings Jump, Topping Expectations

February 23 2017 - 8:08AM

Dow Jones News

By Austen Hufford

Canadian Imperial Bank of Commerce on Thursday posted revenue

and profit gains across all its divisions during its first quarter

as higher trading volumes boosted results.

Last year, the bank agreed to buy Chicago-based PrivateBancorp

Inc . for about $3.8 billion in cash and stock, but in December, a

PrivateBancorp shareholder vote was postponed as shares of U.S.

banks surged following the election of Donald Trump as president.

Last month, PrivateBancorp said it still believes in the long-term

benefits of the deal.

Toronto-based CIBC, one of Canada's largest lenders by assets,

earned 1.39 billion Canadian dollars ($1.06 billion), or C$3.50 a

share, in its latest quarter, up from C$968 million, or C$2.43 a

share, the year before.

The bank said results were boosted by a C$299 million gain from

the sale and lease-back of certain retail properties.

Adjusted to exclude that and other items, CIBC earned C$2.89 a

share.

Revenue rose 17% to C$4.21 billion.

Analysts polled by Thomson Reuters were expecting C$2.59 in

adjusted earnings per share on C$3.83 billion in revenue.

Loan-loss provisions, or the funds set aside to cover bad loans,

decreased to C$212 million from C$262 million a year earlier and

C$222 million in the previous quarter.

Net interest income rose 1.7% to C$2.14 billion, and fee-based

income increased 40% to C$2.07 billion.

In the latest period, earnings from retail and business banking

rose 39% on volume growth and higher fees that were partially

offset by narrower spreads, a higher provision for credit losses

and higher spending. Wealth management profit was up 12% on higher

average assets under management and increased transactions. Capital

markets earnings rose 52% on higher equity derivatives, interest

rate and commodities trading, as well as increases in equity and

debt issuance activity an corporate banking revenue.

CIBC raised its quarterly dividend by 3 Canadian cents a share,

to C$1.27 a share. The company also said it was seeking approval to

repurchase up to 8 million shares, or about 2% of those

outstanding, in the next 12 months.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

February 23, 2017 07:53 ET (12:53 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

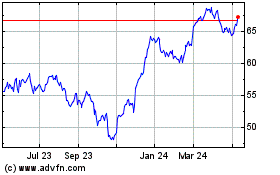

Canadian Imperial Bank o... (TSX:CM)

Historical Stock Chart

From Mar 2024 to Apr 2024

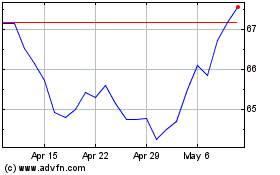

Canadian Imperial Bank o... (TSX:CM)

Historical Stock Chart

From Apr 2023 to Apr 2024