Burberry Sales Remain Under Pressure

July 13 2016 - 4:20AM

Dow Jones News

LONDON—Burberry Group PLC said its comparable sales declined in

the first quarter as the British fashion house was hit by

broad-based weakness in all its major regions.

The continued declines—coming after a difficult year in which

Burberry reeled from the impact of a spending slowdown in Greater

China—follow a major management shake-up announced Monday in which

the company named luxury veteran Marco Gobbetti to replace

Christopher Bailey as chief executive and said it was replacing

chief financial officer Carol Fairweather with Julie Brown, the CFO

of medical technology business Smith and Nephew PLC.

On Wednesday, Burberry reported that underlying retail revenue

was flat at £ 423 million ($563 million) in the fiscal first

quarter ended June 30 compared with a year earlier. Same-store

sales declined 3% in the fiscal first quarter, a marked slowdown

from the 6% growth reported for the same period last year but ahead

of consensus analyst estimates for a 5% decline.

Burberry now expects wholesale revenue in the six months ending

Sept. 30 to be down by over 10% from last year, a deterioration

from May guidance in which Burberry said it expected a decline of

around 10%.

The company described the external environment as "challenging,"

saying cost inflation pressures had persisted.

But Burberry's results are expected to see a boost following

Britain's vote to leave the European Union since the company makes

90% of its sales outside the U.K., in currencies such as the dollar

and the yuan against which the pound has slumped.

Burberry on Wednesday said it now expects a higher benefit from

exchange rates for fiscal 2017, with an adjusted retail and

wholesale profit boost of £ 90 million, which is higher than the

expected benefit outlined in May.

Mr. Bailey said the recent management changes, along with steps

Burberry has taken since concluding a strategic review of its

business in May, "gives us real confidence for the future."

Burberry in May said it would work to save at least £ 100

million a year by fiscal 2019 by reducing complexity, simplifying

processes and eliminating duplication in its operations. Burberry's

operating expenses are close to 500 basis points higher than its

peers according to UBS, with the company hiring about 15% more

sales staff.

Mr. Bailey will become Burberry's president and chief creative

officer sometime next year, reporting to Chairman John Peace and

working with Mr. Gobbetti on strategy alongside his regular design

duties. Ms. Fairweather will step down from Burberry's board by the

end of January and will leave the company by March to make way for

Ms. Brown.

Burberry said it now plans to start the £ 150 million share

buyback it announced in May.

The Asia Pacific region, Burberry's largest by revenue, has

suffered a slowdown over the past year as the Chinese government

has continued to crack down on corruption while unrest in Hong

Kong—previously a popular destination for Chinese shoppers—has led

to a slump in tourist spending there and in Macau.

The company on Wednesday reported a double-digit percentage

decline in comparable sales in Hong Kong and said comparable sales

in mainland China were roughly flat.

Analysts expect the company to see spending pick up in the key

market of mainland China after the Chinese government in April

raised taxes on overseas purchases, implemented stricture customs

controls and hiked taxes for the postal items used by so-called

"Daigous"—professional overseas shoppers.

Meanwhile until the luxury brand hikes prices, the weak pound

should make Burberry's home market, Britain, an attractive

destination for overseas shoppers.

Burberry said its sales in the U.K. improved in the final weeks

of the quarter to log mid-single-digit percentage comparable growth

but the company was hit by double-digit declines in sales to

traveling luxury customers in places like France and Italy.

In the U.S., Burberry said it continued to see "uneven demand,"

and that spending from tourists remained down by a double-digit

percentage.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

July 13, 2016 04:05 ET (08:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

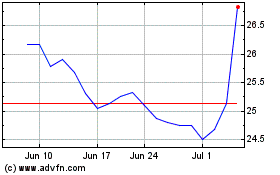

Smith and Nephew (NYSE:SNN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Smith and Nephew (NYSE:SNN)

Historical Stock Chart

From Apr 2023 to Apr 2024