Bank of Ireland(Governor&Co) Acquisition of Performing Commercial Loans (5537U)

July 30 2015 - 4:28AM

UK Regulatory

TIDMBKIR

RNS Number : 5537U

Bank of Ireland(Governor&Co)

30 July 2015

The Governor and Company of the Bank of Ireland ('Bank of

Ireland')

Acquisition of Performing Commercial Loan Portfolio

30 July 2015

___________________________________________________________________________

Bank of Ireland, together with Ennis Property Finance Limited,

an entity affiliated to Goldman Sachs and Feniton Property Finance

Limited, an entity affiliated to CarVal, have agreed terms to

acquire a commercial loan portfolio from Lloyds Banking Group plc.

As part of the transaction, Bank of Ireland will acquire a

portfolio of approximately EUR200 million performing commercial

loans, comprising over 650 customers in the SME and CRE sectors.

Ennis Property Finance Limited and Feniton Property Finance Limited

will acquire the balance of the portfolio.

Mr Mark Cunningham, Director of Bank of Ireland Business Banking

commented "Bank of Ireland is pleased to have been able to avail of

this opportunity to demonstrate our ongoing focus on further

growing and developing our strong position in serving the business

banking sector in Ireland. We look forward to welcoming these new

customers to Bank of Ireland and working with them as they seek to

develop and grow their own businesses and enterprises".

Ends.

For further information please contact:

Bank of Ireland

Andrew Keating, Group Chief Financial Officer +353 (0)766 23

5141

Mark Spain, Director of Group Investor Relations +353 (0)766 23

4850

Pat Farrell, Head of Group Communications +353 (0)766 23

4770

Forward Looking Statement

This document contains certain forward-looking statements within

the meaning of Section 21E of the US Securities Exchange Act of

1934 and Section 27A of the US Securities Act of 1933 with respect

to certain of the Bank of Ireland Group's (the 'Group') plans and

its current goals and expectations relating to its future financial

condition and performance and the markets in which it operates.

These forward-looking statements often can be identified by the

fact that they do not relate only to historical or current facts.

Generally, but not always, words such as 'may,' 'could,' 'should,'

'will,' 'expect,' 'intend,' 'estimate,' 'anticipate,' 'assume,'

'believe, ' 'plan,' 'seek,' 'continue,' 'target,' 'goal', 'would,'

or their negative variations or similar expressions identify

forward-looking statements, but their absence does not mean that a

statement is not forward looking. Examples of forward-looking

statements include among others, statements regarding the Group's

financial position, future income, business strategy and plans and

objectives for future operations.

Such forward-looking statements are inherently subject to risks

and uncertainties, and hence actual results may differ materially

from those expressed or implied by such forward-looking statements.

Such risks and uncertainties include, but are not limited to, the

following: concerns on sovereign debt and financial uncertainties

in the EU and in member countries such as Greece and the potential

effects of those uncertainties on the Group; general and sector

specific economic conditions in Ireland, the United Kingdom and the

other markets in which the Group operates; the ability of the Group

to generate additional liquidity and capital as required; the

impact on lending and other activity arising from emerging macro

prudential policies; the performance and volatility of

international capital markets; the impact of downgrades in the

Group's or the Irish Government's credit ratings or outlook; the

stability of the eurozone; changes in the Irish and United Kingdom

banking systems; changes in applicable laws, regulations and taxes

in jurisdictions in which the Group operates particularly banking

regulation by the Irish and United Kingdom Governments together

with the operation of the Single Supervisory Mechanism and the

establishment of the Single Resolution Mechanism; the exercise by

regulators of powers of regulation and oversight in Ireland and the

United Kingdom; the introduction of new government policies or the

amendment of existing policies in Ireland or the United Kingdom;

the development and implementation of the Group's strategy,

including the Group's ability to achieve net interest margin

increases and cost targets; the Group's ability to address

weaknesses or failures in its internal processes and procedures

including information technology issues and equipment failures and

other operational risks; the impact of the continuing

implementation of significant regulatory developments such as Basel

III, Capital Requirements Directive (CRD) IV, Solvency II and the

Recovery and Resolution Directive.

Nothing in this document should be considered to be a forecast

of future profitability or financial position and none of the

information in this document is or is intended to be a profit

forecast or profit estimate. Any forward-looking statement speaks

only as at the date it is made. The Group does not undertake to

release publicly any revision to these forward-looking statements

to reflect events, circumstances or unanticipated events occurring

after the date hereof. The reader should however, consult any

additional disclosures that the Group has made or may make in

documents filed or submitted or may file or submit to the US

Securities and Exchange Commission.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCPKKDBFBKKPON

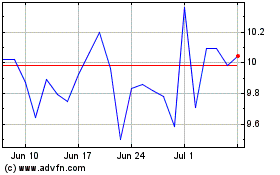

Bank Of Ireland (LSE:BIRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

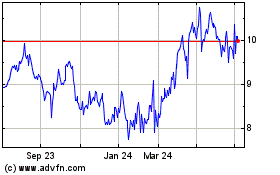

Bank Of Ireland (LSE:BIRG)

Historical Stock Chart

From Apr 2023 to Apr 2024