TIDMBGFD

RNS Number : 5925B

Baillie Gifford Japan Trust PLC

08 October 2015

RNS Announcement: Preliminary Results

-------------------------------------

The Baillie Gifford Japan Trust PLC

===================================

Results for the year to 31 August 2015

--------------------------------------

The Baillie Gifford Japan Trust PLC outperformed its benchmark

index* over the year to 31 August 2015 by 7 percentage points. Net

asset value per share, after deducting borrowings at fair value,

rose 20.4%, while the benchmark index gained 13.4%. In this period

the Company's share price increased by 26.3%.

3/4 The positive absolute and relative outperformance came from

investment in a variety of sectors and stocks as a broad spectrum

of stocks performed well. There were thirteen individual stock

contributors of more than 0.5% to outperformance and five which

detracted at the same level.

3/4 Gearing was also beneficial to returns, with gearing

standing at 14% of shareholders' funds as at year end (31 August

2014 - 15%). Additional borrowings of Yen3bn were drawn during the

course of the year to reflect growth in the asset base.

3/4 Portfolio turnover over the period was 7.5% (11% for the

year to 31 August 2014) reflecting conviction in the current

portfolio. Eight new holdings were purchased and six holdings sold

in entirety.

3/4 During the year the Company issued 5.79m shares, 8.35% of

its pre-existing issued share capital, at a premium to net asset

value, raising GBP26.47m.

3/4 There are three new forces driving economic change in Japan:

the development of corporate governance, the tight labour market

and the surge in inbound tourism.

* The benchmark index is the TOPIX total return (in sterling terms)

The Baillie Gifford Japan Trust PLC aims to achieve long term

capital growth principally through investment in medium to smaller

sized Japanese companies which are believed to have above average

prospects for growth. At 31 August 2015, the Company had total

assets of GBP377.9m (before deduction of bank loans of

GBP54.7m).

The Company is managed by Baillie Gifford, an Edinburgh based

fund management group with around GBP115bn under management and

advice as at 7 October 2015.

Past performance is not a guide to future performance. The value

of an investment and any income from it is not guaranteed and may

go down as well as up and investors may not get back the amount

invested. This is because the share price is determined by the

changing conditions in the relevant stock markets in which the

Company invests and by the supply and demand for the Company's

shares. The Trust has borrowed money to make further investments

(sometimes known as 'gearing or leverage'). The risk is that when

this money is repaid by the Trust, the value of the investments may

not be enough to cover the borrowing and interest costs, and the

Company will make a loss. If the Trust's investments fall in value,

any invested borrowings will increase the amount of this loss. You

should view your investment as long term. You can find up to date

performance information about The Baillie Gifford Japan Trust PLC

on the Company website at www.japantrustplc.co.uk.

7 October 2015

For further information please contact:

Alex Blake - Client Liaison

The Baillie Gifford Japan Trust PLC

Tel: 0131 275 2859

Roland Cross, Director

Four Broadgate

Tel: 0203 761 4440

Chairman's Statement

====================

It has been a good year for Japanese investments and another

good year for your Company with the net asset value (after

deducting borrowings at fair value) rising by 20.4%, compared to a

13.4% rise in the benchmark TOPIX index total return (in sterling

terms). The share price increased by 26.3% and the Company's shares

are sitting at a premium to NAV (after deducting borrowings at fair

value) of 4.6%, having traded at a premium for most of the year

unlike the rest of our sector. This builds on an excellent five and

ten year record for the Japan Trust.

As with last year, both stock selection and gearing contributed

positively to the returns; further performance details are to be

found in the Managers' Report.

Investment income increased 15% over the year, reflecting higher

dividends, while expenses also increased due mainly to higher

management fees in line with the substantial increase in net asset

value.

Overall revenue gain per share was 0.28p (down from 0.47p last

year) and, as in prior years, no dividend will be paid as the

revenue reserve remains in deficit. Ongoing charges for the year

were 0.9%, the same as in 2014.

Gearing

Gearing amounted to 15% of shareholders' funds at the start of

the year and ended the year at 14%. The Company entered into two

new revolving loan facilities with Scotiabank Europe plc, details

of which can be found in note 7. Gross borrowings increased to

Y10.2bn from Y7.2bn and with the low cost of yen loans we continue

to believe that borrowing to invest in Japanese equities is a

sensible strategy.

Share Capital

The Company did not exercise its share buy back powers during

the year; however, your Board believes that it is important that

the Company retains this power and so, at the Annual General

Meeting, it is seeking to renew this facility. The Company also has

authority to issue new shares and to reissue any shares held in

treasury for cash on a non-pre-emptive basis. Shares are only

issued/reissued at a premium to net asset value, thereby enhancing

net asset value per share for existing shareholders.

During the year to 31 August 2015 5,790,000 shares were issued

at a premium to net asset value raising proceeds of GBP26,469,000,

continuing the trend of recent years. The Directors are, once

again, seeking 10% share issuance authority at the Annual General

Meeting and we will continue to issue shares only when at a premium

to net asset value. This authority will expire at the conclusion of

the Annual General Meeting in November 2016.

Continuance

Vote

Our shareholders have the right to vote annually on whether the

Company should continue in business, and will again have the

opportunity to do so at the Annual General Meeting to be held on 30

November 2015.

Last year the Company received support for its continuance from

99.9% of those voting. Your Directors are of the opinion that there

remain attractive opportunities in selected, well-run Japanese

companies.

Given the long-term favourable outlook, my fellow Directors and

I intend where possible to vote our own shareholdings in favour of

the resolution and hope that all shareholders will feel disposed to

do likewise.

Board

Your Board is committed to high standards of corporate

governance. In particular it recognises the need to have a balance

of skills, experience and length of service. It also believes that

membership of the Board should be refreshed over time and to that

end, after 14 years of excellent service, Martin Barrow is standing

down at the AGM. The process to identify a new Director with the

requisite skills has commenced using an external agency and we

expect to make an appointment before the end of 2015.

Outlook

The year to 2015 saw renewed strength in Japanese equities and

our Managers are continuing to find extremely interesting companies

in which to invest, with their bottom up approach of stock

selection adding significant value to the portfolio. The Board

visited Japan in May this year, meeting with a variety of companies

of interest to the Managers and we returned with a more positive

outlook on the investment opportunities within Japan as a

whole.

Prime Minister Abe strengthened his mandate for political and

economic reforms by calling and winning a snap election last

December.

We also saw much evidence of the encouraging improvements in

corporate governance across Japan which the Manager continues to

press for with all our holdings.

There has been significant volatility across world markets since

our August year end with Japan no exception; however, we continue

to believe there are significant opportunities for investment

growth amongst the companies in our portfolio and that the

Managers' approach of investing for medium to long term growth can

capitalise on these opportunities going forward.

Nick Bannerman

Chairman

7 October 2015

Past performance is not a guide to future performance.

Managers' Report

================

Performance

Over the past year the NAV per share with borrowings deducted at

fair value has increased by 20.4% compared to a rise of 13.4% in

the Company's benchmark. The share price also moved from a discount

at the end of last year to a premium and this helped the share

price increase by 26.3% over the period. This is the first time in

the past 10 years that there has been a premium at the year end. On

average over the year the shares traded at a premium of just over

1%.

The Japanese stock market rose in the first half of the

Company's year but has seen some volatility since the summer as

various global concerns have hit markets. The Company has continued

to use its gearing and over the year this has contributed to

roughly half the outperformance, with the rest coming from stock

selection. The yen weakened against sterling over the year by 7.5%,

but trends are really driven by the yen/dollar rate translated into

sterling. Overall Japan remains a competitive place for high

quality manufacture and services and an attractive country for

tourists.

(MORE TO FOLLOW) Dow Jones Newswires

October 08, 2015 02:00 ET (06:00 GMT)

The strongest returns within the portfolio came from the

Commerce and Services sector which includes several of the internet

related holdings, as well as companies involved in employment

services. In total there were 13 stocks which contributed more than

0.5% to outperformance and five which subtracted at the same level.

Notable amongst the winners were Cookpad, the recipe website which

has continued to gather paying members, new recipes and is moving

into advertising to its substantial subscriber base, Sysmex and

Shimadzu, both manufacturers of medical equipment, and Don Quijote,

the discount retailer benefiting from inbound tourism. Toyo Tire

and Rubber continues to do well selling truck tyres in the USA

whilst Temp Holding and Outsourcing both were helped by the labour

shortage in Japan and the increase in women in the workforce. Those

that detracted from performance included Iriso electronics, which

did very well last year and has had some pricing issues, along with

energy related holdings Modec and Inpex.

Portfolio

There have been relatively few changes within the portfolio in

the past year as our growth orientated companies have continued to

look appealing. Turnover fell to 7.5% over the year even after

buying eight new holdings and selling six.

Three of the new purchases were new listings and the IPO market

in Japan has been quite active, although the advent of sizeable

companies is still rare. The largest new listing we invested in was

Recruit, a large service sector company involved in recruitment as

well as property marketing and advertising. We have admired their

corporate culture for some time, as many key individuals in the

internet sector in Japan have spent some of their careers at

Recruit. The other two are much smaller companies and both

illustrate interesting points about current developments in Japan.

Nippon Ski Resort, a subsidiary of a parking company, was set up to

buy underperforming ski operations and improve their facilities.

This has been successful and there are many further opportunities

to expand, particularly as foreign tourists ski more in Japan.

SanBio, a research oriented bio tech company founded by Japanese

scientists, moved its headquarters from California to Japan after

legislation was passed in November 2014 as part of the Prime

Minister's third Arrow to speed up the approval processes for

regenerative medicine. Although at an early stage its technology

could represent a significant breakthrough in stroke treatment.

We sold six companies including Kyocera, Nomura, Sanrio and

Industrial & Infrastructure Fund. In the main these were sold

because the prospects no longer looked appealing owing to a variety

of reasons: intensified competition from the Frozen franchise in

the case of Sanrio, to the unsuccessful move from feature phone to

smart phones for Gree. None of these were a significant portion of

the portfolio and funds were used to invest in the more promising

opportunities.

Economy and Corporate Developments

Usually Japan is regarded as a pro-cyclical market with

corporate profits driven by the health of the economy and the speed

of growth. What has been interesting in the past year or so is the

lack of correlation. The economy in Japan has not recorded strong

growth since the rise in the consumption tax in April 2014. For the

current fiscal year ending in March 2016 the consensus view is that

the expansion is only going to be around 1.6% whilst profit growth

is likely to be over 10% despite recent weakness. Corporate

profitability in aggregate and margins are also at record levels.

This is partly due to the ongoing internationalisation of corporate

Japan, with more than half of profits now coming from overseas, and

partly to the drivers of change within the economy, along with a

greater focus on shareholder returns. There is also a thesis that

as the importance of the digital economy is mis-described by

economic statistics first compiled more than a century ago.

The Managers believe that there are three key forces driving

changes in Japan at the moment. The first is the fundamental

sea-change in corporate governance, encouraged by the advent of

Abenomics but also by the demographic changes and the increase in

international competition. Last year Japan introduced a new

stewardship code encouraging institutional investors to

constructively engage with the companies they invest in and this

year a new Corporate Governance code was introduced in June. This

encourages companies to change their boards and already the number

of independent Directors has risen further and now 94% of companies

have outsiders on the board. Companies also have to issue a

statement about their attitude to issues like cross-shareholdings

by the end of this year. This push is also coming at a time when

the importance of some other stakeholder groups is lessening. We

believe that there will be fundamental change over a five year

period and that this will lead to lower cash holdings on balance

sheets and increasing dividends along with investment for

growth.

The retirement of the baby-boomer generation, with their

corporate pensions and the increasing labour shortage, means that

managements no longer have to run companies to maintain employment

in Japan. The second development driving change is therefore the

tightening labour shortage. Again related to the aims of the Abe

government more women have been working in Japan but the

unemployment rate is now extremely low and surveys show employment

conditions extremely tight. There are suggestions that most new

jobs in Japan in the past few years have been created by companies

younger than five years, whilst the older companies are reducing

employment. This is a very welcome rebalancing and one that has

very positive implications for productivity. It goes alongside the

change in corporate governance and the rise in entrepreneurship in

Japan. In 1992, after the bubble burst, the major cause of

bankruptcy in Japan was a labour shortage for small companies

artificially created by large corporations continuing to recruit

whilst the economy turned down. Now the situation is different and

the very strong confidence being reported by the non-manufacturing

sector, which is the majority of employment in the economy. In

terms of significant formal immigration that remains some years

away, although the number of foreign residents of Japan continues

to rise and there are many anecdotal reports of informal

employment.

Thirdly, increased inbound tourism is arguably one of the most

successful outcomes of the original aims of Abenomics. The easing

of visa restrictions alongside the improvement in access provided

by more low cost airlines flying into Japan, mainly from Asia have

contributed to inbound tourism. For example, there is now a new

terminal at Narita, Tokyo's main international airport, dedicated

to such airlines offering cheaper landing fees as historically the

punitive rates for the main airport have been a deterrent to

travel. Last year the total number of foreign tourists reached

13.4m and the likely outcome for 2015 is now very likely to exceed

18m. Originally the target had been 20m in 2020, when Japan is

hosting the summer Olympics in Tokyo, but this is likely to be

comfortably exceeded. This new source of demand is helping certain

retailers and manufacturers as well as increasing the occupancy

rates of hotels, but it is also beginning to have social impacts.

As travellers come on return trips they are travelling outside the

main cities and many traditional Japanese attractions, from temples

to ryokan, are adapting and becoming more welcoming. Made in Japan

is viewed increasingly as a badge of quality, particularly by

Chinese tourists.

Outlook

Whilst global stock markets have been experiencing turbulence in

recent weeks we think that the long term positive changes for

Japanese companies outlined already will be more important over the

next year. This is not to deny that weakness in the Chinese economy

will see demand fall for some products but rather that the longer

term shifts in behaviour driven by the changes mentioned above will

outweigh shorter term difficulties. This is also not to claim that

all the many aims of Abenomics will be a success, but that there is

enough forward progress to be encouraged. Prime Minister Abe was

re-elected with a strong majority in December 2014, and having

achieved his aims of changing the security laws in Japan is now

refocused on improving the economy. There is much negative

commentary on Japan's outstanding levels of debt and very little on

the overall level of assets, which makes Japan the world's largest

ever net creditor nation. In November Japan Post Holdings, Bank and

Insurance will all be privatised which will move very significant

businesses from the public to the private sector. Against this

background and with the belief that valuations are not too high the

trust has increased its levels of gearing after the year end. There

is a further tranche of borrowing to be invested as

appropriate.

Past performance is not a guide to future performance.

Portfolio Performance Attribution for the Year to 31 August 2015(*) (unaudited)

(MORE TO FOLLOW) Dow Jones Newswires

October 08, 2015 02:00 ET (06:00 GMT)

Computed relative to the benchmark (TOPIX total return (in

sterling terms)) with net income reinvested

Benchmark Baillie Gifford

asset allocation Japan asset

allocation Performance Contribution attributable to:

=====================

01.09.14 31.08.15 01.09.14 31.08.15 BG Japan TOPIX total return Contribution to relative return Stock selection Asset allocation Gearing

Portfolio breakdown % % % % % % % % % %

===================== ======== ======== ======== ========== ======== ================== =============================== =============== ================ =======

Commerce and services 12.5 12.6 24.9 27.9 26.8 12.6 3.1 3.1 - -

Manufacturing and

machinery 21.0 19.8 20.6 19.6 20.4 8.8 2.2 2.2 - -

Retail 4.1 4.8 5.5 5.3 52.3 34.0 0.9 0.7 0.2 -

Electricals and

electronics 12.8 11.7 14.2 12.9 5.7 4.9 - 0.1 (0.1) -

Real estate and

construction 6.1 5.8 5.7 5.4 2.1 5.7 (0.1) (0.2) 0.1 -

Information,

communication and

utilities 9.2 9.7 9.1 9.8 12.4 18.3 (0.5) (0.5) - -

Chemicals and other

materials 11.6 10.9 7.3 5.6 (5.0) 7.1 (0.5) (0.8) 0.3 -

Financials 13.9 14.9 10.0 10.3 15.6 20.0 (0.7) (0.4) (0.3) -

Pharmaceuticals and

food 8.8 9.8 2.7 3.2 6.2 26.0 (1.1) (0.5) (0.6) -

Total assets 100.0 100.0 100.0 100.0 17.2 13.4 3.3 3.7 (0.4) -

===================== ======== ======== ======== ========== ======== ================== =============================== =============== ================ =======

Impact of gearing 3.0 - 3.0 - - 3.0

===================== ======== ======== ======== ========== ======== ================== =============================== =============== ================ =======

Total (including

gearing)# 20.6 13.4 6.3 3.7 (0.4) 3.0

===================== ======== ======== ======== ========== ======== ================== =============================== =============== ================ =======

Past performance is not a guide to future performance.

Source: StatPro/Baillie Gifford

Contributions cannot be added together, as they are geometric;

for example, to calculate how a return of 20.6% against a benchmark

return of 13.4% translates into a relative return of 6.3%, divide

the portfolio return of 120.6 by the benchmark return of 113.4,

subtract one and multiply by 100. In addition, the total

contribution figures include a residual element that relates to

changes in weightings mid-month, which cannot be attributed to

individual sectors. Consequently, the contributions for the

individual sectors do not sum to the total contribution

figures.

* The performance attribution table is based on total assets.

The returns are total returns (net income reinvested),

calculated on a monthly linked method.

# The total return performance of 20.6% excludes expenses and,

therefore, differs from the NAV return (after deducting borrowings

at par value) of 19.9% as a result.

Income Statement (unaudited)

============================

The following is the unaudited preliminary statement for the

year to 31 August 2015 which was approved by the Board on 7 October

2015. No dividend is payable.

For the year ended 31 August 2015 For the year ended 31 August 2014

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

======================================== =========== =========== =========== =========== =========== ===========

Gains on investments - 45,071 45,071 - 18,801 18,801

Currency gains (note 2) - 2,700 2,700 - 3,927 3,927

Income (note 3) 4,316 - 4,316 3,746 - 3,746

Investment management fee (note 4) (2,141) - (2,141) (1,693) - (1,693)

Other administrative expenses (502) - (502) (386) - (386)

======================================== =========== =========== =========== =========== =========== ===========

Net return before finance costs and

taxation 1,673 47,771 49,444 1,667 22,728 24,395

======================================== =========== =========== =========== =========== =========== ===========

Finance costs of borrowings (1,042) - (1,042) (1,004) - (1,004)

======================================== =========== =========== =========== =========== =========== ===========

Net return on ordinary activities before

taxation 631 47,771 48,402 663 22,728 23,391

======================================== =========== =========== =========== =========== =========== ===========

Tax on ordinary activities (432) - (432) (341) - (341)

======================================== =========== =========== =========== =========== =========== ===========

Net return on ordinary activities after

taxation 199 47,771 47,970 322 22,728 23,050

======================================== =========== =========== =========== =========== =========== ===========

Net return per ordinary share (note 6) 0.28p 67.17p 67.45p 0.47p 33.45p 33.92p

======================================== =========== =========== =========== =========== =========== ===========

All revenue and capital items in this statement derive from

continuing operations.

A Statement of Total Recognised Gains and Losses is not required

as all gains and losses of the Company have been reflected in the

above statement.

Balance Sheet (unaudited)

=========================

At 31 August 2015 At 31 August 2014

GBP'000 GBP'000 GBP'000 GBP'000

======================================== ================ =================== =============== ====================

Fixed assets

Investments held at fair value through

profit or loss 369,568 286,275

======================================== ================ =================== =============== ====================

Current assets

Debtors 345 369

Cash and cash equivalents 8,742 5,231

======================================== ================ =================== =============== ====================

9,087 5,600

======================================== ================ =================== =============== ====================

Creditors

Amounts falling due within one year

(note 7) (16,872) (1,428)

======================================== ================ =================== =============== ====================

Net current (liabilities)/assets (7,785) 4,172

======================================== ================ =================== =============== ====================

Total assets less current liabilities 361,783 290,447

======================================== ================ =================== =============== ====================

Creditors

Amounts falling due after more than one

year (note 7) (38,630) (41,733)

(MORE TO FOLLOW) Dow Jones Newswires

October 08, 2015 02:00 ET (06:00 GMT)

======================================== ================ =================== =============== ====================

Net assets 323,153 248,714

======================================== ================ =================== =============== ====================

Capital and reserves

Called up share capital 3,756 3,467

Share premium 73,272 47,092

Capital redemption reserve 203 203

Capital reserve 251,739 203,968

Revenue reserve (5,817) (6,016)

======================================== ================ =================== =============== ====================

Shareholders' funds 323,153 248,714

======================================== ================ =================== =============== ====================

Net asset value per ordinary share

(after deducting borrowings at fair

value) 425.4p 353.3p

======================================== ================ =================== =============== ====================

Net asset value per ordinary share

(after deducting borrowings at par

value) 430.2p 358.7p

======================================== ================ =================== =============== ====================

Ordinary shares in issue (note 9) 75,121,750 69,331,750

======================================== ================ =================== =============== ====================

Reconciliation of Movements in Shareholders' Funds

(unaudited)

==================================================

For the year ended 31 August 2015

Called up Share Share Capital redemption Shareholders'

capital premium reserve Capital* reserve Revenue reserve funds

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

==================== =============== ======== =================== ================ =============== =============

Shareholders' funds

at 1 September 2014 3,467 47,092 203 203,968 (6,016) 248,714

Shares issued 289 26,180 - - - 26,469

Net return on

ordinary activities

after taxation - - - 47,771 199 47,970

Shareholders' funds

at 31 August 2015 3,756 73,272 203 251,739 (5,817) 323,153

==================== =============== ======== =================== ================ =============== =============

For the year ended 31 August 2014

Called up Share Share Capital redemption Shareholders'

capital premium reserve Capital* reserve Revenue reserve funds

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

==================== ======== ==================== ================ =============== ================

Shareholders' funds

at 1 September 2013 3,251 32,019 203 181,240 (6,338) 210,375

Shares issued 216 15,073 - - - 15,289

Net return on

ordinary activities

after taxation - - - 22,728 322 23,050

Shareholders' funds

at 31 August 2014 3,467 47,092 203 203,968 (6,016) 248,714

===================== ======== ==================== ================ =============== ======= =======

* The capital reserve balance as at 31 August 2015 includes

investment holding gains of GBP140,216,000 (2014 -

GBP103,632,000)

Cash Flow Statement (unaudited)

===============================

At 31 August 2015 At 31 August 2014

GBP'000 GBP'000 GBP'000 GBP'000

============================================================== ========= ======== ========= ========

Net cash inflow from operating activities 1,327 1,322

============================================================== ========= ======== ========= ========

Servicing of finance

Interest paid (1,030) (884)

============================================================== ========= ======== ========= ========

Net cash outflow from servicing of finance (1,030) (884)

============================================================== ========= ======== ========= ========

Financial investment

Acquisitions of investments (62,854) (52,638)

Disposals of investments 23,906 30,201

Exchange differences on settlement of investment transactions (117) (54)

============================================================== ========= ======== ========= ========

Net cash outflow from financial investment (39,065) (22,491)

============================================================== ========= ======== ========= ========

Net cash outflow before financing (38,768) (22,053)

============================================================== ========= ======== ========= ========

Financing

Shares issued 26,469 15,289

Bank loans drawn down 24,075 27,410

Bank loans repaid (7,921) (16,387)

============================================================== ========= ======== ========= ========

Net cash inflow from financing 42,623 26,312

============================================================== ========= ======== ========= ========

Increase in cash 3,855 4,259

============================================================== ========= ======== ========= ========

2015 2014

Reconciliation of net cash flow to movement in net debt GBP'000 GBP'000

======================================================== ======== =========

Increase in cash in the year 3,855 4,259

Net cash inflow from bank loans (16,154) (11,023)

Exchange differences on bank loans 3,161 4,869

Exchange differences on cash (344) (888)

--------------------------------------------------------- -------- ---------

Movement in net debt in the year (9,482) (2,783)

Opening net debt (36,502) (33,719)

========================================================= ======== =========

Closing net debt (45,984) (36,502)

========================================================= ======== =========

Twenty Largest Holdings at 31 August 2015 (unaudited)

=====================================================

2015 2014

====================== ========================================

Value % of Value

Name Business GBP'000 total assets GBP'000

====================== ======================================== ======== ============= ========

SoftBank Telecom operator and internet investor 12,058 3.2 6,966

Sysmex Medical equipment 11,183 3.0 6,607

Toyo Tire & Rubber Tyre manufacturer 10,833 2.9 7,327

Temp Holdings Employment and outsourcing services 10,568 2.8 6,236

Rakuten Internet retail and financial services 9,676 2.6 6,664

Japan Exchange Group Stock Exchange operator 9,329 2.5 6,580

Fuji Heavy Industries Subaru cars 8,858 2.3 8,747

Itochu Trading conglomerate 8,785 2.3 8,028

Cookpad Recipe website 8,731 2.3 4,309

M3 Online medical database 8,690 2.3 6,073

(MORE TO FOLLOW) Dow Jones Newswires

October 08, 2015 02:00 ET (06:00 GMT)

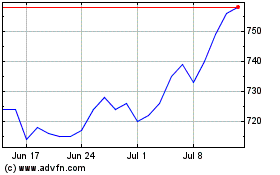

Baillie Gifford Japan (LSE:BGFD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Baillie Gifford Japan (LSE:BGFD)

Historical Stock Chart

From Apr 2023 to Apr 2024