By Simon Zekaria

LONDON-- BT Group PLC on Thursday said it is spending billions

of dollars on upgrading the U.K.'s high-speed Internet broadband

and wireless networks as well as slashing costs of its recently

relaunched mobile business, as the telecommunications firm's

quarterly profit rose.

The U.K. telecoms incumbent said it is spending GBP6 billion

($8.7 billion) over the next three years on superfast fiber-optic

broadband and fourth-generation wireless coverage. One key measure

is increasing fiber running to premises directly, which offer

higher speeds than lines routed through older copper telecoms

networks. BT previously said it considered the technology too

expensive to roll out on a mass scale.

The plan comes amid pressure from industry regulators and the

U.K. government on the London-based firm to dial up telecoms

investment and sustain the country's economic recovery.

And BT's spending follows wider criticism over the reach of its

operations as the U.K.'s largest fixed telecoms firm, which

resulted in calls from rivals for BT's lucrative infrastructure arm

to be separated from the main company. Rival operators lease the

network, which covers large parts of the country.

Sky PLC, Europe's biggest pay-television group by customer

numbers, called BT's plans "limited" and said they had been

"dragged out" of the company by the threat of regulatory

action.

"We are happy to accept criticism. We are happy to step up, " BT

Chief Executive Gavin Patterson told reporters following the

results.

To partially fund its spending ramp-up, BT is taking out

costs.

BT expects savings of around GBP400 million a year in the fourth

year of integration of mobile business EE, up from a previous

target of GBP360 million. It also expects the cost of integrating

the mobile company-- which it acquired last year--to be lower than

previously planned, at around GBP550 million.

Over the next two years, across the group, it said it expects

overall to take out over GBP1 billion in gross costs.

BT said net profit in the final fiscal quarter ended March 31

rose to GBP756 million from GBP690 million for the same period a

year earlier, boosted by demand for broadband and television

services. Revenue before exceptional items rose 22% to GBP5.66

billion.

Fiscal-year earnings before interest, taxes, depreciation and

amortization, adjusted for exceptional items, was GBP6.58 billion,

up 5%. The company expected "modest growth" in adjusted Ebitda in

fiscal 2016.

In the year, sales for its consumer division increased 7% and

the number of customers for its TV service jumped by 28%.

BT shares rose near 3% in midmorning trade. "The significant

investment in networks will go somewhere to appease regulators,"

said CCS Insight analyst Paolo Pescatore.

Earlier this week, The Wall Street Journal reported that the

European Commission is set to block CK Hutchison Holdings Ltd.'s

planned deal to buy British mobile operator O2 for around $14

billion.

EU competition commissioner Margrethe Vestager has taken a tough

stance against telecoms mergers in the region, particularly in

cases where deals reduce the number of mobile-telecom operators in

a given country to three from four, as would be the case in the

U.K. deal.

And in the U.K., both the antitrust body, U.K.'s Competition and

Markets Authority, and communications regulator U.K.'s Office of

Communications, or Ofcom, have voiced concerns about the deal,

saying it would hurt competition and lead to higher consumer

prices.

Thursday, Mr. Patterson said: "It is clearly a factor in the

market," on the merger.

But he said regulatory resistance wouldn't deter fixed-operators

from seeking deals in the U.K.

"Even if there isn't a four-to-three consolidation, I think the

opportunities for other fixed players to combine with one or other

of the two mobile operators, [Three] and O2--those exist.

Consolidation within a convergence landscape I think it going to

continue."

In the U.K, as elsewhere in Europe's consolidating telecoms and

cable markets, operators are battling for subscribers in an

intensified media services fight as they bundle together fixed

telephony, mobile, broadband Internet and pay-TV.

BT has spent heavily on a range of sports channels and sports

rights, including high-profile domestic and European soccer, to

develop its TV service and in February 2015 moved to acquire mobile

operator EE in a multibillion-dollar deal, which has raised the

stakes in the industry.

BT recommended a full-year dividend of 14 pence, up 13%.

Write to Simon Zekaria at simon.zekaria@wsj.com

(END) Dow Jones Newswires

May 05, 2016 07:09 ET (11:09 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

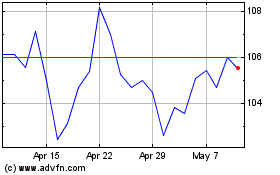

Bt (LSE:BT.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

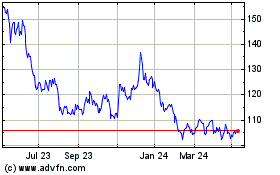

Bt (LSE:BT.A)

Historical Stock Chart

From Apr 2023 to Apr 2024