BAT Posts Stronger 2016 Profit, Helped by Currency Moves -- 2nd Update

February 23 2017 - 4:12AM

Dow Jones News

By Saabira Chaudhuri

LONDON--British American Tobacco PLC reported stronger net

profit for 2016, helped by the weak pound, as cigarette volumes

fell but the owner of Dunhill and Lucky Strike pushed through price

increases.

London-headquartered BAT reported annual net profit of 4.65

billion pounds ($5.8 billion), compared with GBP4.29 billion pounds

a year earlier, on revenue that was 13% higher at GBP14 billion. On

a constant-currency basis, revenue rose 6.9%.

The company said the volume of cigarettes sold declined 0.8% on

an organic basis, compared with a decline of 0.5% a year earlier

and against an estimated industry decline of 3%.

In January, BAT agreed to take full control of Reynolds American

Inc. in a $49.4 billion deal. Buying Reynolds will give the tobacco

giant direct access to the U.S., 13 years after it merged its U.S.

business Brown & Williamson with R.J. Reynolds Tobacco Holdings

Inc. to form Reynolds American. BAT has maintained a 42% stake in

Reynolds ever since, with a 10-year standstill agreement preventing

it from increasing this.

The company's move to take direct control comes after Reynolds

bought Lorillard Inc. in 2015, in a deal that combined the U.S.'s

second- and third-largest cigarette makers.

The U.S. is the world's largest profit pool for tobacco

companies outside of China and BAT has pointed to high disposable

incomes, relatively low pack prices and strong demand for

alternative products like vaping sticks as reasons behind its

decision to buy the rest of Reynolds. Litigation risks are also

seen to have broadly ebbed in the U.S.

"The litigation environment is more stable," BAT General Counsel

Jerry Ableman said. "Clearly the BAT board feels very positive

about the U.S. environment."

The company said operating margin for the year declined by 0.9

percentage points to 37.2%. Stripping out currency and acquisition

impacts, the margin would have improved by 1.6 percentage points,

according to BAT.

RBC analyst Mirco Badocco said the margin improvement

highlighted how cost control remained a key competence of the

company, describing its overall results as "solid."

BAT has been pushing hard to compete with rival Philip Morris on

next-generation products, spending $1 billion over the past five

years. The company in December launched a Vype-branded vaping

device called Pebble and has also launched a new heat-not-burn

product called Glo in Japan.

BAT said on Thursday that its vaping business was now the

world's largest outside the U.S., where it currently operates only

through its stake in Reynolds.

In the Asia-Pacific region, BAT's adjusted profit at constant

currency climbed 1.3%, as a strong performance in Pakistan,

Bangladesh and Vietnam was dampened by markets like New Zealand,

Malaysia and Japan. In the Americas, profit on this basis rose

2.8%, as weakness in Brazil was overshadowed by a good performance

in places like Canada, Peru and Venezuela. In Western Europe profit

rose 7.8%, while in Eastern Europe, the Middle East and Africa it

was up by 5.3%.

BAT results were helped by its stake in Reynolds and its Indian

business ITC Ltd. Income from associates and joint ventures jumped

80% to GBP2.23 billion. Factory closures hurt results, amounting to

a charge of GBP603 million, up from GBP367 million a year

earlier.

-Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

February 23, 2017 03:57 ET (08:57 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

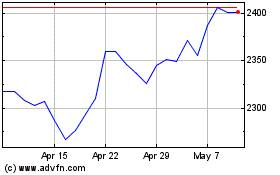

British American Tobacco (LSE:BATS)

Historical Stock Chart

From Mar 2024 to Apr 2024

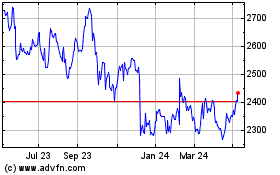

British American Tobacco (LSE:BATS)

Historical Stock Chart

From Apr 2023 to Apr 2024