TIDMAV.

FORM 8.5 (EPT/NON-RI)

AMENDMENT TO 2(1) Long and Purchases

PUBLIC OPENING POSITION DISCLOSURE/DEALING DISCLOSURE BY AN

EXEMPT PRINCIPAL TRADER WITHOUT RECOGNISED INTERMEDIARY ("RI")

STATUS (OR WHERE RI STATUS IS NOT APPLICABLE)

Rule 8.5 of the Takeover Code (the "Code")

1. KEY INFORMATION

(a) Name of exempt principal trader: BARCLAYS CAPITAL SECURITIES LTD

(b) Name of offeror/offeree AVIVA PLC

in relation to whose

relevant securities this form relates:

(c) Name of the party to the FRIENDS LIFE GROUP LIMITED

offer with which exempt

principal trader is connected

(d) Date position held/dealing undertaken: 28 January 2015

(e) In addition to the company in 1(b) YES:

above, is the exempt principal

trader making disclosures in respect FRIENDS LIFE GROUP LIMITED

of any other party to the offer?

2. POSITIONS OF THE EXEMPT PRINCIPAL TRADER

If there are positions or rights to subscribe to disclose in

more than one class of relevant securities of the offeror or

offeree named in 1(b), copy table 2(a) or (b) (as appropriate) for

each additional class of relevant security.

(a) Interests and short positions in the relevant securities of

the offeror or offeree to which the disclosure relates following

the dealing (if any)

Class of relevant ORD

security:

Interests Short Positions

Number (%) Number (%)

(1) Relevant

securities

owned

and/or 5,679,386 0.19% 4,452,124 0.15%

controlled:

(2) Cash-settled

derivatives:

3,493,667 0.12% 3,850,853 0.13%

(3) Stock-settled

derivatives

(including

options)

and agreements 0 0.00% 0 0.00%

to

purchase/DEALING:

TOTAL: 9,173,053 0.31% 8,302,977 0.28%

All interests and all short positions should be disclosed.

Details of any open stock-settled derivative positions

(including traded options), or agreements to purchase or sell

relevant securities, should be given on a Supplemental Form 8 (Open

Positions).

(b) Rights to subscribe for new securities (including directors'

and other employee options)

Class of relevant security in relation

to which subscription right exists:

Details, including nature of the rights

concerned and relevant percentages:

3. DEALINGS (IF ANY) BY THE EXEMPT PRINCIPAL TRADER

Where there have been dealings in more than one class of

relevant securities of the offeror or offeree named in 1(b), copy

table 3(a), (b), (c) or (d) (as appropriate) for each additional

class of relevant security dealt in.

The currency of all prices and other monetary amounts should be

stated.

(a) Purchases and sales

Class of Purchase/DEALING Total number of Highest price Lowest price

relevant per unit per unit

security securities paid/received paid/received

ORD Purchase 2,871,863 5.3650 GBP 5.25 GBP

ORD Sale 1,329,603 5.3650 GBP 5.25 GBP

ADR Purchase 2,706 16.0919 USD 16.0812 USD

ADR Sale 706 16.0812 USD 16.0812 USD

(b) Cash-settled derivative transactions

Class of Product Nature of dealing Number of Price per

relevant description reference unit

security securities

ORD SWAP Long 4,555 5.3004 GBP

ORD SWAP Long 4,986 5.3547 GBP

ORD SWAP Long 39,359 5.2994 GBP

ORD SWAP Short 136 5.2948 GBP

ORD SWAP Short 510 5.3050 GBP

ORD CFD Short 1,412 5.2582 GBP

ORD SWAP Short 4,640 5.2843 GBP

ORD SWAP Short 8,374 5.3586 GBP

ORD SWAP Short 8,700 5.2995 GBP

ORD CFD Short 21,879 5.2957 GBP

ORD SWAP Short 33,700 5.2844 GBP

ORD SWAP Short 40,349 5.2874 GBP

ORD SWAP Short 47,999 5.2840 GBP

ORD SWAP Short 392,137 5.2851 GBP

ORD CFD Short 412,868 5.2815 GBP

ORD CFD Short 475,347 5.2889 GBP

ORD SWAP Short 475,347 5.2889 GBP

(c) Stock-settled derivative transactions (including

options)

(i) Writing, selling, purchasing or varying

Class of Product Writing, Number Exercise Type Expiry date Option

relevant description purchasing, of price e.g. money

security e.g. selling, securities per unit American, paid/

call varying to European received

option etc. which etc. per

option unit

relates

(ii) Exercise

Class of relevant Product Exercising/ Number Exercise price

security description exercised of securities per unit

e.g. call against

option

(d) Other dealings (including subscribing for new

securities)

Class of relevant Nature of dealing Details Price per unit (if

security e.g. subscription, applicable)

conversion

4. OTHER INFORMATION

(a) Indemnity and other dealing arrangements

Details of any indemnity or option arrangement,

or any agreement or understanding, formal or

informal, relating to relevant securities which

may be an inducement to deal or refrain

from dealing entered into by the exempt principal

trader making the disclosure and any

party to the offer or any person acting in

concert with a party to the offer:

Irrevocable commitments and letters of intent

should not be included. If there

are no such agreements, arrangements or understandings, state "none"

(b) Agreements, arrangements or understandings relating to

options or derivatives

Details of any agreement, arrangement or understanding,

formal or informal, between the

exempt principal trader making the disclosure

and any other person relating to:

(i) the voting rights of any relevant securities under any option; or

(ii) the voting rights or future acquisition or disposal of any

relevant securities to which any derivative is referenced:

If there are no such agreements, arrangements

or understandings, state "none"

(c) Attachments

Is a Supplemental Form 8 (Open Positions) attached? NO

Date of disclosure: 30 Jan 2015

Contact name: Jay Supaya

Telephone number: 0207 773 0635

Public disclosures under Rule 8 of the Code must be made to a

Regulatory Information Service and must also be emailed to the

Takeover Panel at monitoring@disclosure.org.uk. The Panel's Market

Surveillance Unit is available for consultation in relation to the

Code's disclosure requirements on +44 (0)20 7638 0129.

The Code can be viewed on the Panel's website at

www.thetakeoverpanel.org.uk.

This information is provided by Business Wire

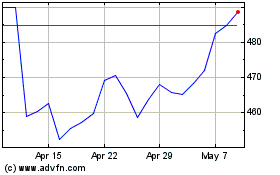

Aviva (LSE:AV.)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aviva (LSE:AV.)

Historical Stock Chart

From Apr 2023 to Apr 2024