Automated Hedge Funds Make Millions in January's Market Selloff

January 25 2016 - 7:50AM

Dow Jones News

Several hedge funds that use complicated computer programs to

guide how they trade have made hundreds of millions of dollars in

January's market selloff.

A tumbling oil price, sharp declines in global stocks and big

moves in currencies this month have provided near-ideal conditions

for commodity trading advisers, or CTAs, which run around $260

billion globally, providing the market trends and volatility they

can latch onto and profit from.

Among the winners this month are: Man Group's $4.4 billion AHL

Diversified fund, Aspect Capital's Diversified fund and Cantab

Capital' $2.6 billion CCP Quantitative fund.

While the S&P 500 has tumbled 6.7% and the euro Stoxx Europe

50 has lost 7.6% so far this month, computer-driven funds have

gained 5.3% this month through Thursday, according to early numbers

from Hedge Fund Research.

In contrast, hedge funds on average are down 3.2% this month,

after losing money last year.

"Trend-following CTAs are having a good month with short energy,

long bonds and a mix of currency positions strongly positive so

far," said Anthony Lawler, portfolio manager at GAM Holding.

Shorting means betting that the price of a security will fall in

the future.

He added that bets on the yen rising and sterling and emerging

market currencies falling had also helped.

Man Group's $4.4 billion AHL Diversified fund, which was one of

the world's best-performing hedge funds in 2014, was up 7.5% this

month through Thursday, according to data from the company,

equating to a profit of around $330 million. Its $3 billion AHL

Evolution fund has risen 4.7% over the same period.

Aspect Capital, which runs $5 billion in assets, has seen its

Diversified fund gain 5.5% this month through Thursday, said

another person who had seen the numbers, a profit of approximately

$275 million. Aspect Chief Executive Anthony Todd said in a comment

emailed to The Wall Street Journal that the fund "continues to

benefit from the downwards trends in energy prices, and more

recently the weakening of the Canadian dollar."

Another winner is Cantab Capital's $2.6 billion CCP Quantitative

fund, which has risen 10.8% this month through Jan. 15, according

to the latest numbers sent to investors, said a person who had seen

the numbers. That equates to a profit of around $280 million.

And recently-launched Florin Court Capital, which runs around

$370 million in assets and which was set up by former AHL managers,

was up 6% this month through Wednesday, having benefited from

trades in power, commodities and emerging market currencies, said

another person familiar with the fund's performance.

If CTAs hold on to this month's performance then it would mark

one of the biggest monthly returns since the credit crisis. Many of

these funds struggled over the past five years as central bank

money-printing reduced market volatility and many of the trends

that such funds like to latch onto disappeared, although the

tumbling oil price helped such funds return to profit in 2014.

Write to Laurence Fletcher at laurence.fletcher@wsj.com

(END) Dow Jones Newswires

January 25, 2016 07:35 ET (12:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

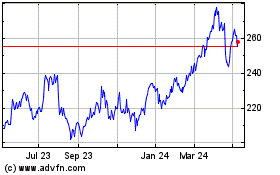

Man (LSE:EMG)

Historical Stock Chart

From Mar 2024 to Apr 2024

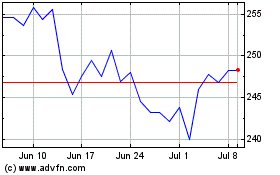

Man (LSE:EMG)

Historical Stock Chart

From Apr 2023 to Apr 2024