Australia, NZ Dollars Fall After China Manufacturing PMI Data

July 23 2015 - 11:38PM

RTTF2

The Australia and the New Zealand dollars weakened against their

major currencies in the Asian session on Friday, after data showed

that China's manufacturing sector continued to contract in July and

at an accelerated pace.

Data from Caixin showed that China's manufacturing sector

continued to contract in July and at an accelerated pace, with a

flash PMI score of 48.2. That was well shy of forecasts for a score

of 49.7, and it was down sharply from 49.4 in June.

Among the individual components, the manufacturing output index

slipped to a 16-month low score of 47.3 - down from 49.7 in

June.

The Australian dollar fell to a 6-year low of 0.7268 against the

U.S. dollar and a 9-day low of 0.9482 against the Canadian dollar,

from yesterday's closing quotes of 0.7349 and 0.9581,

respectively.

Against the yen and the euro, the aussie dropped to more than a

2-week low of 90.09 and a 7-month low of 1.5087, from yesterday's

closing quotes of 91.09 and 1.4920, respectively.

The aussie slipped to a 10-day low of 1.1065 against the NZ

dollar, from yesterday's closing value of 1.1124.

If the aussie extends its downtrend, it is likely to find

support around 0.71 against the greenback, 0.94 against the loonie,

89.00 against the yen, 1.51 against the euro and 1.07 against the

kiwi.

While, the NZ dollar fell to an 8-day low of 1.6711 against the

euro and a 4-day low of 81.32 against the yen, from yesterday's

closing quotes of 1.6615 and 81.85, respectively.

Against the U.S. dollar, the kiwi dropped to 1.6562 from

yesterday's closing value of 1.6605.

If the kiwi extends its downtrend, it is likely to find support

around 1.68 against the euro, 80.00 against the yen and 1.64

against the greenback.

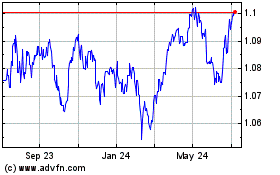

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Aug 2024 to Sep 2024

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Sep 2023 to Sep 2024